The Price of Civilization

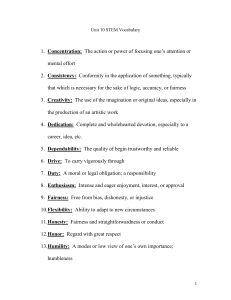

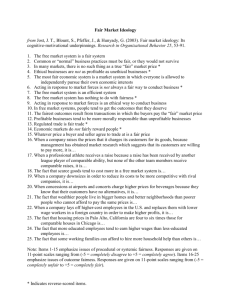

advertisement

The Price of Civilization Chapter 2 Prosperity Lost America’s Approval • Wary, pessimistic, and cynical • 2/3 of Americans are dissatisfied; US is “off track” • 71% say federal government looks out only for its own interests • 70% say government and big business work together to hurt consumers America’s Lack of Confidence • Institutions closer to home > national/global institutions • Loss of confidence in each other – Robert Putnam: “bowling alone” – High in ethnically diverse communities – “hunkering down” Richard Easterlin’s Subjective Well-Being • Self-reported happiness • Between 1972 and 2006, between 2.1 and 2.3 (scale of 1 to 3) – GDP doubled during this time, yet no sign of change in happiness as a result – Declined among women • Gallup Poll: 19th • Hedonic Treadmill – US running very hard to pursue happiness, but are staying in the same place Jobs Crisis • 9% • Peak 2007 - Trough 2009: 8.6 million jobs lost • 2000s = lowest job growth since WW2 • Highest for lower-skilled – 15% for no diploma – 10% for diploma/some college • 1975 – Bachelor’s degree = 60% more income than HS diploma • 2008 – 100% • Housing crisis Savings Crisis • National savings rate • 1980s-2008 sharp fall • As individuals lost financial prudence, Congress did too – 1955-1974: below 2% GDP – 1974-1995: above 3% • Caused retirement crisis • Center for Retirement Research at Boston College; “National Retirement Risk Index” – 43% unready 2004 – 51-60% in 2009 Investment Squeeze • China: 54% of national income • American Society of Civil Engineers (ASCE) – Report card 5-year investment needs to correct major problems – D, “poor”, $2.2 trillion = 2-3% GDP • Intellectual capital – the pride of America – diminishing • Most serious threat to human capital – quality of work force – Most important factor of US future prosperity Education • Human capital • Program for International Student Assessment (PISA) • 2009: 15th reading, 23rd science, 31st math • Shanghai #1 in all three • 12th in the world for portion of 25-34 year-olds with at least an associate’s degree • More people attending college, but same rate of graduation New Gilded Age • Income gap/inequality – Highest since Great Depression • 1/8 Americans on food stamps • Top 1% > 99% in net worth • Dishonesty = contagious social disease • Social Immune System • Something goes wrong – lie • Almost nobody at the top pays for the lies, even with the truth surfaces Government and Big Business • Dick Cheney: CEO of Halliburton to VP • Goldman Sachs, Citigroup, JPMorgan Chase: central part of financial crisis 2008 to Obama administration • Goldman Sachs: SEC charged $550 million for fraud; company made $13.4 billion • Countrywide CEO Angelo Mozilo: fraud with $67.5 million fine; made $470 million The Price of Civilization Chapter 3 The Free-Market Fallacy Age of Paul Samuelson • 1940s to 1970s • First American winner of Nobel Prize in Economic Sciences • 5 core ideas of modern mixed capitalism: – Markets are reasonably efficient – Efficiency ≠ fairness – Fairness = share the wealth; government redistribution of income – Markets underprovide certain “public goods” – Markets prone to financial instability; solved by government policies “Great Stagflation” • Bretton Woods dollarexchange collapse • US abandons link to gold on August 15, 1971 • Surge of oil prices 73-74 • Economic stagnation and inflation • Reaganomics and Margaret Thatcher – Decrease rich tax rates to unleash entrepreneurial zeal – New disdain for the poor who depend on the government for support Adam Smith’s Invisible Hand • “Market equilibrium” – When the balance of supply and demand is reached for each good/service • ME is reached without a central planner • If everyone aims for selfinterest, well-being for all • “self-organizing system” • Competitive ME is efficient – no waste of resources Why Free Markets Need Government 1. Provide public goods • Private markets work with many suppliers and consumers, but fail because only need “single supplier” for some goods – Causes adverse spillovers; too much of a good thing is bad (pollution) – Need “corrective pricing”; taxes to get rid of pollution 2. Regulate markets when info between buyers and sellers is “asymmetric” – Sellers have inside info buyers don’t leads to fraud, insider trading, etc. Economic Fairness • 63% of Americans believe it is the responsibility of government to take care of citizens who can’t take care of themselves • Rule of law – treat everyone equally; redistribution should follow due process • Distribution of income and well-being – both at a point in time and also across generations: “sustainability” (fairness to future) • “Stewardship”: living generation must be stewards of earth’s resources for the next generations; only have one Earth Libertarianism • Liberty: the right of each individual to be left alone by others and the government • Individuals have no responsibility to society other than to respect the liberty and property of others • Tax = government extortion • Most Americans accept legitimacy of taxes – 61% Libertarian arguments • Moral assertion: everyone has the overriding right to liberty • Political/pragmatic: only free markets protect democracy from government despotism • Economic: free markets ensure prosperity Triple Bottom Line • Efficiency (prosperity), fairness (opportunity for all), and sustainability (future) • Joseph Schumpeter’s “Creative destruction”: new technology wipes out way of life • Free markets do not guarantee sustainability – Natural capital is property of everyone and very vulnerable – Market interest rates • Interest rates are positive because people are impatient Efficiency and Fairness • 10-20% say market outcome is fair • Rich should be taxes, poor should be helped • Trade off – Rich are taxed and poor are helped through transfers = hard work of rich is punished while idleness of poor is rewarded • Scandinavian opposite • Promoting fairness also promotes efficiency The Price of Civilization Chapter 4 Washington’s Retreat from Public Purpose New Deal to War on Poverty • Federal government steered national economy as an instrument of democratic power • S&T initiatives: nuclear power, satellites, computers, Internet • 1960s Medicare, rights for women and disabled New Deal Programs • Extended during 40s-60s – Construction of physical infrastructure (roads, etc) – Regional development – Increased provision of public services (education) – Social Security – Support for science and technology – Public administration – Income security (unemployment insurance) – Food stamp and welfare programs FDR, Reagan, and Clinton • FDR: “Government is the instrument of our united purpose to sole for the individual the ever-rising problems of a complex civilization.” • Reagan: “In this present crisis, government is not the solution to our problem; government is the problem… It is my intention to curb the size and influence of the Federal establishment.” • Clinton: “The era of big government is over.” Rise of Public Spending • Government’s economic role: civilian (nondefense) federal spending relative to national income • Rose to 16% of GDP by 1980; unchanged until 2008 • Everywhere in the world; more in Europe • Reflects need for a mixed economy Complacency with Big Government • 1940s to 1960s • Nation had gone through “near-death” experiences and emerged as an increasingly united society: Great Depression and WW2 • 1924 Immigration Act slowed flow of immigrants; 15% in 1924 to 5% in 1970 • Government was competent and representative of national interests; NATO, EU • JFK and LBJ; War on Poverty The Great Reversal and Jimmy Carter • 1977-1981 • Big Labor lost its political influence; rise of Sunbelt power; 1978 Revenue Act; Japan exports increase • Deregulation • “Big government” constituted the major barrier to prosperity • Government lost its aura of competency Reagan Revolution