phase one - Villanova University

advertisement

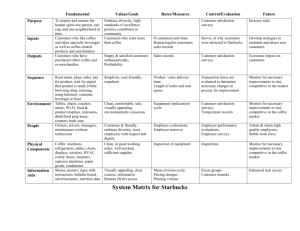

THE BIG IDEA YUBAN amanda lauren elaine jeff lily YUBAN PHASE I 7.13.2007 AGENDA WHAT’S GOING ON? Market Analysis WHAT’S GREEN? Sustainability Overview WHO’S GEN-Y? Target Analysis THE BIG IDEA 360 TASK BRIEF VISUAL MANIFESTO “Conscience keeps more people awake than coffee.” Unknown what’s going on? Market Analysis MARKET ANALYSIS IN HOME COMPETITION Chock Full O Nuts Eight O’Clock Folgers Maxwell House Nescafe/Taster’s Choice Millstone Green Mountain Newman’s Own ON-THE-GO COMPETITION Starbucks Seattle’s Best Dunkin’ Donuts Caribou Coffee STRENGTHS MARKET ANALYSIS WEAKNESSES • Certifications • Limited Awareness • Low Price • Few Flavor Options • Quality • Unavailable On-The-Go • Rich Taste • Not Fair Trade Certified OPPORTUNITIES THREATS • Green Movement Trends • Other Sustainable Coffee Brands • Potential Brand Loyalty • Peer Influence On Target • Consistent Price In Rising Market • “Starbucks Syndrome” • Ground Coffee For Gen-Y • Flavor Coffee Trends • Future Partnerships • Increasing Number of Certifications EXPENSIVE $11 MARKET ANALYSIS NOT-SUSTAINABLE SUSTAINABLE INEXPENSIVE $3 MARKET ANALYSIS WHAT’S MISSING? Ground Coffee for Gen-Y Inexpensive AND Green Brand Awareness “We have more degrees but less sense; more knowledge but less judgments; more experts but more problems…” Dalai Lama what’s green? Sustainability Overview SUSTAINABILITY SIZE Large Corporations Small Private Labels SUSTAINABILITY IS… Corporate social responsibility, a resume builder, many initiatives A selling point, a core value, focused initiatives EXAMPLES Starbucks, Caribou Coffee, Nescafe, Trader Joe’s Rock Solid, Alterra, Newhall, CityKid Java, Millstone, Green Mountain “Commoditization of Sustainability” Rainforest Alliance, Fair Trade, recycled, organic biodegradable, eco-friendly, all-natural… Introduction of additional social, environmental, or economic cause primarily with smaller brands SUSTAINABILITY INTENTION AND ACTION DISCONNECT SIMMONS DATABASE OF 24,617 ADULTS • “I make a conscious effort to recycle” (57%) • “I’m worried about pollution caused by cars” (47%) • “The government should ban products that pollute” (36%) • “I would pay more for environmentally-friendly products” (35%) •Yet only 12% of Mintel’s 3,000 respondents answered “regularly” to the question: “How often do you buy green products?” SUSTAINABILITY-CONSUMER SUSTAINABILITY All 18-24 25-34 35-44 45-54 55-64 65+ % % % % % % % I would buy green products if they were less expensive 66 61 67 67 72 63 61 Green living is too expensive for the average consumer 57 52 58 59 58 58 57 64 54 63 65 68 69 62 I am concerned about the impact cleaning products have on the environment 60 46 54 61 66 67 64 Cost Beliefs I believe that my choices as a consumer impact the environment Availability There are not enough products available to live completely green 49 39 44 51 53 56 51 I’m not sure if the grocery store(s) I shop at carries/carry green products 41 45 38 41 41 41 44 Practices I consider to be a recycler 52 products 45 46 more 51 54 55 60 The mostmyself common reasons stated for not buying green frequently I look for recycled products with a high percentage of post -consumer waste 30 23 29 28 32 30 34 were cost (66%) and availability (49%) I usually choose green products over traditional products 21 20 22 20 22 19 20 SUSTAINABILITY WHAT’S MISSING? Value in Certifications Tangible and Visible Impact Differentiating Factor (≠ Certification) “An inconvenient truth has become an obnoxious one.” New York Times, 2007 who is gen-y? Target Analysis CORE NEEDS OF GEN-Y TARGET ANALYSIS IMAGE The “badge value” of the coffee matters to the consumer COSTS The consumer is price-sensitive CONVENIENCE Efficiency is key for the consumer FLAVOR / VARIABILITY The variability of coffee flavors appeals to the consumer QUALITY The consumer has a specific standard for the quality of coffee “GREEN” The consumer would prefer to or only drink coffee that is environmentally responsible and green CAFFEINE BOOST The consumer drinks coffee for the caffeine effects FAMILIARITY The consumer is often loyal to the coffee brands that he/she is familiar with (reputation or experience) About Me Segment The Socialites Name: Sidney Hilton Age: 19 Education: BA in American Studies, UC Santa Barbara Career Aspiration: Fashion PR Executive Description: Image-conscious What am I like? “I like haute couture items. I care about my image and what other people think of me. I only want the best coffee and I don’t have time to brew my own at home. Who has coffee makers these days anyway? I love socializing and I will never be caught dead drinking Dunkin’ Donuts or anything of the like!” Lesser Greater Core Values Attitudes Caffeine Boost Flavor / Variability • Image Quality “I want my coffee brand to say something about my status.” Image Familiarity • Quality Costs Convenience “Green” • To “Fit In” -1 -0.5 0 0.5 Importance of Segment Values 1 “I believe high prices = quality, and I’m willing to pay the costs.” “Keeping up with current trends and my crowd is important to me.” Segment On-The-Go Entrepreneurs About Me Name: Bradley Thompson Age: 24 Education: Bachelor’s in Management, Georgetown University Career Aspiration: Future CEO Description: Practical What am I like? “I am still in the early stages of my career. I am busy every day of the week and I am often in and out of meetings. I need the caffeine to get me through the day. Efficiency is key but it’s not feasible for me to buy a cup of Starbucks coffee every day.” Lesser Greater Core Values Convenience Costs Caffeine Boost • Convenience Attitudes “I prefer efficient, on-the-go options. Time is money to me.” Flavor / Variability Familiarity “Green” • Costs “I drink coffee everyday, so it has to be affordable for me.” Image Quality • Caffeine Boost -1 -0.5 0 0.5 Importance of Segment Values 1 “No hype. Just give me some caffeine.” About Me Segment Straight Shooters Name: Josh Lordman Age: 21 Education: BA in Philosophy, NYU Career Aspiration: Undecided / Graduate Degree Description: Experimental, No-Nonsense What am I like? “I can come off as being stingy sometimes…but hey, I’m pretty tight on cash so my purchases are price-sensitive. I drink coffee to get me through studying or other schoolrelated activities. Variety in flavor appeals to me but again, I’m price-sensitive.” Lesser Greater Core Values Attitudes Costs Caffeine Boost Flavor / Variability Convenience Quality “Green” • Costs • Caffeine Boost Image Familiarity • Flavor -1 -0.5 0 0.5 Importance of Segment Values 1 “My parents don’t give me money for coffee so I prefer cheaper options.” “With all the late night studying and early classes, I need caffeine to get by. “I like coffee that tastes good. Period.” About Me Segment Content Traditionalists Name: Sara Enriquez Age: 23 Education: High School Diploma Career Aspiration: Kindergarten Teacher Description: Conservative What am I like? “I prefer to stay in my comfort zone, in terms of my lifestyle. I am loyal to the brands that my family, my friends, and I are familiar with. I love my hometown and I’m happy that I am surrounded by things and people that I grew up with. I am also pretty domestic.” Lesser Greater Core Values Attitudes Familiarity Quality • Familiarity Costs Convenience Flavor / Variability Image Caffeine Boost “Green” • Quality • Costs -1 -0.5 0 0.5 Importance of Segment Values 1 “I tend to stick with the brands I trust.” “I want a good cup of coffee when I brew it at home in the morning.” “When scanning the aisles, I prefer options that are decently priced.” About Me Segment Tree-Huggers Name: Lucky Birkenstock Age: 18 Education: BS in Environmental Studies, University of West Virginia Career Aspiration: Environmental Lobbyist Description: Environmentally conscious What am I like? “I eat, drink, live, and breathe green. I will only purchase products that are environmentally and socially responsible. I do research to make sure that the claims companies make are legitimate. Organic and ‘green’ products are of better quality anyway.” Lesser Greater Core Values Attitudes “Green” Quality • “Green” Image “I investigate the credibility of brands’ social responsibility claims.” Flavor / Variability Caffeine Boost • Quality Familiarity Convenience Costs • Image -1 -0.5 0 0.5 Importance of Segment Values 1 “Organic = quality.” “I want people to recognize that I live a ‘green’ lifestyle.” The Socialites On-The-Go Entrepreneurs Image Convenience Quality Straight Shooters Content Traditionalists Tree-Huggers Costs Familiarity “Green” Costs Caffeine Boost Quality Quality Fitting in Caffeine Boost Flavor Costs Image Flavor Flavor Convenience Convenience Flavor Minor Major Major Minor TARGET ANALYSIS Core Needs / Values Campaign Focus Common Values Across Segments Costs Convenienc e Major Flavor Quality PSYCHOGRAPHICS TARGET ANALYSIS DUAL CONSCIOUSNESS Live For Today On Brink Of Tomorrow Idealistic Realistic Nurtured Independent Image-Conscious “Rat Pack” Treat Yourself Irresponsible Spending Socially-Conscious Trendsetters Save For Future Smarter Consumption “I can accomplish anything I put my mind to” (91%) “WHAT’S HOT” PACKAGING TARGET ANALYSIS FAMILY the green movement MYSPACE LABELS E-MAIL FRIENDS FACEBOOK BLOGS GEN-Y CONVENIENCE CONSUMER YOUTUBE ONLINE SHOPPING PURCHASING DECISION TARGET ANALYSIS WHAT’S MISSING? simplicity US COFFEE MARKET ANALYSIS WHAT IS MISSING? Ground Coffee for Gen-Y I Inexpensive AND Green SUSTAINABILITY OVERVIEW WHAT IS MISSING? Value in Certifications I Visible & Tangible Impact THE BIG IDEA TARGET ANALYSIS WHAT IS NEEDED? simplicity CREATIVE STRATEGY the BIG idea. It’s e a s i e r to be g r e e n than you t h i n k. MARKETING & COMMUNICATION GOAL GENERATE AWARENESS INNER-DIALOGUE EXTERNAL DISCUSSION CONSUMPTION HABITS YUBAN SALES 360 TASK BRIEF WHAT IS OUR TASK? Generate awareness of Yuban. HOW WILL WE ACCOMPLISH THIS? Tap into the “dual consciousness” of the target audience by providing them with an appealing product (inexpensive, tasty, caffeine fix) that is also good for the environment. Simplify information relating to sustainability to allow consumers to make a small difference every day. WHAT ARE THE CHALLENGES? Communicate the benefits of brewing coffee Combat “Starbucks Syndrome” ( image-conscious, convenient consumption) Establish brand image WHO ARE WE TALKING TO? 18-24 year olds who have a dual consciousness: they live for today but are worrisome about the future. Price, convenience, taste, and trends are key in their food choices. They love to treat themselves in every aspect. They are consumed with technology, gathering information, multitasking, and pop culture. Largely image-conscious and self-centered, with a rat-pack mentality, they want to fit in. Despite this, they are searching for a change and for a sense of integrity. Although their actions are not always sensible, these consumers are smarter than what they do. They believe in themselves and their capabilities, but until now being active in the green movement seems too overwhelming. IF WE COULD CONVINCE THEM OF ONE THING, WHAT WOULD IT BE? It’s easier to be green than you think. This big idea incorporates: simplicity, sustainability, and thought. It speaks to our primary goal: generating internal and external dialogue surrounding how generation y consumes. WHAT IS OUR TONE? “Start to change the world every morning” We are an honest, simple, and refreshing voice in an overwhelmed world. We are a call to consumers to question their actions. We are about simple language, not buzz words. We are not the firefighter who saves the child from the burning building, but rather, we are the stranger who holds the door for a couple of extra seconds. We are that kid in class that raises a question that nobody wants to ask. We are the arm that brings you from indecision to action in the form of responsible consumption. WHY SHOULD THEY BELIEVE US? We lead by example. Yuban has a strong history of sustainable actions and is certified under Rainforest Alliance and Organic standards. WHAT IS THE DESIRED BEHAVIORAL RESPONSE? Generate consumer awareness and an internal dialogue regarding how they consume, in turn seeking to establish a positive association with the Yuban brand. APPENDIX YUBAN APPENDIX SURVEY BREAKDOWN 227 completed surveys • 60% female 40% male • 50% were 21 years old Respondents from 22 different states • 49 from west coast • 27 from mid west • 151 from east coast 6 different race categories 72% in college full time; 27% not in college; 1% part time OUR FINDINGS: COFFEE APPENDIX HOW OFTEN? Nearly 50% at least once a week 28% at least once a day WHY? Caffeine rush HOW MUCH? 20% two or three cups a day WHERE? 51% are drinking it at work or school 44% of us are buying it at specialty stores while Only 2% said they bought ground coffee 33% would buy a brand of coffee to brew at home if they liked it WHO IS OUR FAVORITE? 38% Starbucks 16% Dunkin Donuts 5% Folgers 15% had no preference WHY DO WE LOVE THEM? Variety of flavors, “experimental” products Taste “image, environment, taste, options” – the “whole package” “it’s everywhere!” – on the way/ at work “consistent quality” Employees are happy WHAT’S NOT SO GREAT? The cost: It is too expensive to drink these products daily OUR FINDINGS: YUBAN APPENDIX WHAT IS YUBAN? 79% are “very unfamiliar” with brand Of the familiar, only 28%, or 13 out of 227 had tried it Among those, very little opinion of the brand WHY DON’T WE KNOW YUBAN? No presence at school, work, or store Target assumes green products cost most WHAT IF WE KNEW? 71% said it sounded like an appealing product. “I have never seen it on the market, on TV, or heard anyone talk about it.” YUBAN’S ADVERTISING APPENDIX Advertising money: magazines and newspapers 65% of budget on newspaper Specific concentration in California markets. Regional Presence • • West Market: Denver, Fresno, Las Vegas, Los Angeles, Phoenix, Sacramento, Salt Lake City, San Diego, San Francisco, Northwest Market: Portland and Seattle APPENDIX NATIONAL PRESENCE APPENDIX ADVERTISING SPENDING Chock Full O Nuts, 0.8 Yuban, 7.7 Caribou, 0.3 Dunkin Donuts, 0.3 Eight O'Clock, 1.3 Nescafe, 13.6 Folgers, 33 Starbucks, 15.7 Seattle's Best, 7.7 Green Mtn, 0.05 Millstone, 5.45 Maxwell House, 14.1 Total budget: $122,912,000 in 2006 Caribou Chock Full O Nuts Dunkin Donuts Eight O'Clock Folgers Green Mtn Maxwell House Millstone Seattle's Best Starbucks Nescafe Yuban 0.03 9.4 APPENDIX 0.12 14.8 0.21 0.1 11.83 MAGAZINE SPENDING Total budget: $41,452,100 in 2006 22.31 29.2 12 2.7 0.11 Caribou Eight O Clock Folgers Green Mtn Maxwell House Millstone Seattle's Best Starbucks Nescafe Yuban 0.02 0.02 Caribou Folgers Green Mtn Millstone Starbucks Yuban NEWSPAPER SPENDING Total budget: $8,749,100 in 2006 38.55 58.6 APPENDIX CURRENT GOOGLE TRENDS Yuban Rainforest Alliance 2007 Reflecting Trend Toward Global Companies Embracing Sustainability, McDonald’s UK Puts Rainforest Alliance Certified Coffee On the Menu 2006 Rainforest Alliance creates pavilion of sustainable tourism at Washington ATE Ethiopian Farmers Embrace Sustainable Agriculture, Become First Growers of Rainforest Alliance Certified Coffee in Africa The Rainforest Alliance Gets On Board Sustainable Tourism Initiative to Conserve and Promote World Heritage Sites

![저기요[jeo-gi-yo] - WordPress.com](http://s2.studylib.net/store/data/005572742_1-676dcc06fe6d6aaa8f3ba5da35df9fe7-300x300.png)