GIFT IN & IR Revenue Codes Webinar Presentation

advertisement

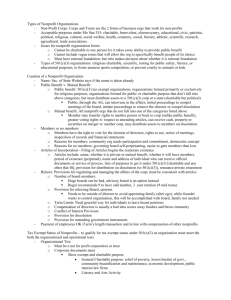

A SIGNATURE PROGRAM OF INDIANA PHILANTHROPY ALLIANCE COMMUNITY FOUNDATIONS: WHAT DOES THE INDIANA CODE AND THE INTERNAL REVENUE CODE REALLY SAY ABOUT THEM? Phil Purcell, JD GIFT Consultant Vice President, Ball State University Foundation Indiana State Law 3 Indiana State Law • Indiana Nonprofit Corporation Law • Uniform (Prudent) Management of Institutional Funds Act (UPMIFA) • Donations - Government Units • Donations - School Corporations • Donations – Libraries • Donations – Cemetery Perpetual Care Funds • Sales and Property Tax Exemption • Other States 4 Indiana Nonprofit Corporation Law 5 Nonprofit Corporation Defined IC 23-17-2-7: (a) "Corporation" means a public benefit, mutual benefit, or religious corporation incorporated under or subject to this article. (b) The term does not include a foreign corporation. (c) For purposes of IC 23-17-24, the term does not include a homeowners association (as defined in IC 34-6-2-58). 6 Federal Tax Exemption Tests 7 Organizational Test • The organizing documents (bylaws and articles of incorporation) must limit the organization's purposes to exempt purposes set forth in section 501(c)(3). • Must not expressly empower it to engage, other than as an insubstantial part of its activities, in activities that are not in furtherance of one or more of those purposes. • Met if the purposes stated in the organizing documents are limited in some way by reference to section 501(c)(3). 8 Organizational Test • Assets must be permanently dedicated to an exempt purpose. • If an organization dissolves, its assets must be distributed for an exempt purpose. • Organizing documents should contain a provision ensuring their distribution for an exempt purpose in the event of dissolution. 9 Operational Test • An organization will be regarded as operated exclusively for one or more exempt purposes only if it engages primarily in activities that accomplish exempt purposes specified in section 501(c)(3). • An organization will not be so regarded if more than an insubstantial part of its activities does not further an exempt purpose. 10 Taking Action! 11 Means of Participating in a Meeting IC 23-17-15-1(c) Unless articles of incorporation or bylaws provide otherwise, a board of directors may permit a director to: (1) participate in a regular or special meeting by; or (2) conduct the meeting through the use of; any means of communication by which all directors participating may simultaneously hear each other during the meeting. A director participating in a meeting by this means is considered to be present in person at the meeting. 12 Action Taken Without A Meeting IC 23-17-15-2(a) Unless articles of incorporation or bylaws provide otherwise, action required or permitted by this article to be taken at a meeting of a board of directors may be taken without a meeting if the action is taken by all members of the board of directors. The action must be evidenced by at least one (1) written consent: (1) describing the action taken; (2) signed by each director; and (3) included in the minutes or filed with the corporate records reflecting the action taken. (b) Action taken under this section is effective when the last director signs the consent, unless the consent specifies a prior or subsequent effective date. (c) A consent signed under this section has the effect of a meeting vote and may be described as such in any document. 13 U(P)MIFA: Endowment Law 15 What’s in a Name? • Uniform Management of Institutional Funds Act - former and current name of the Indiana law of charitable endowments. • Indiana adopted most of the provisions of the Uniform Prudent Management of Institutional Funds Act (UPMIFA) recommended by the Uniform Law Commission, replacing the former UMIFA statute in 2007-08. 16 Endowment Fund IC 30-2-12-2: "Endowment fund" means an institutional fund, or any part of the fund, not wholly expendable by the institution on a current basis under the terms of the applicable gift instrument. The term does not include assets that an institution designates as an endowment fund for the institution's use (i.e., quasi-endowment or board designated endowment). 17 Institution IC 30-2-12-5: "Institution" means any of the following: (1) A person, other than an individual, that is organized and operated exclusively for charitable purposes. (2) The state, including any agency or instrumentality of the state, or a unit of local government to the extent that the state or unit holds funds exclusively for charitable purposes. (3) A trust that has only charitable interests … Person IC 30-2-12-6.4: "Person" means an individual, a corporation, a business trust, an estate, a trust, a partnership, a limited liability company, an association, a joint venture, a public corporation, the state of Indiana, a state agency or instrumentality, a unit of local government, or any other legal or commercial entity. 19 Institutional Fund IC 30-2-12-6: "Institutional fund" means a fund held by an institution exclusively for charitable purposes. The term does not include the following: (1) A fund held for an institution by a trustee that is not an institution. (2) A fund in which a beneficiary that is not an institution has an interest, other than possible rights that could arise upon violation or failure of the purposes of the fund. (3) Assets held by an institution primarily for charitable purposes and not primarily for investment purposes. Difference: UPMIFA – FASB/990 • FASB definition of endowment is broader. • FASB encompasses all funds established to provide income for the support of an institution, including unrestricted funds set aside by the board. • FASB Statement 117 requires both identification of funds as endowment and the allocation of each such fund to one of three categories: permanently restricted, temporarily restricted or unrestricted. • See: FASB Statement 117, Glossary 21 FASB 117 Definition of Endowment An established fund of cash, securities, or other assets to provide income for the maintenance of a nonprofit organization. The use of the assets may be permanently restricted, temporarily restricted or unrestricted. Endowment funds generally are established by donor restricted gifts and bequests to provide a permanent endowment, which is to a permanent source of income, or a term endowment, which to provide income for a specified period. 22 FASB 117 Definition The portion of a permanent endowment that must be maintained permanently – not used up, expended or otherwise exhausted – is classified as permanently restricted net assets. The portion of a term endowment that must be maintained for a specified term is classified as temporarily restricted net assets. An organization’s governing board may earmark a portion of its unrestricted net assets as a board-designated endowment (sometimes called funds functioning as endowment or quasiendowment funds) to be invested to provide income for long but unspecified period. A board-designated endowment …is not donor restricted and is classified as unrestricted net assets. 23 Need for Guidance In 2008, the Financial Accounting Standards Board (FASB) issued staff Position 117-1 to provide guidance on the net asset classification of endowments in states that have adopted UPMIFA. 24 FASB 117-1: Disclosures in Financial Statements • Board’s interpretation of law (UPMIFA) that underlies net asset classification • Inclusion of adherence to UPMIFA in bylaws • Description of spending policy • Description of investment policy • End of period net asset class totals and by type of fund, showing donor vis-à-vis board restricted endowment funds • Reconciliation of beginning and ending balance of endowment in total and by asset class 25 Gift Instrument IC 30-2-12-3: "Gift instrument" means a record, including any institutional solicitations, under which property is granted or transferred to or held by an institution as an institutional fund. IC 30-2-12-6.7: "Record“ means information that is: (1) inscribed on a tangible medium; or (2) stored in an electronic or other medium; and is retrievable in a perceivable form. 26 UPMIFA – A “Default” Statute Current agreements that reference or promise the provisions of the former UMIFA statute – such as observing “historic dollar value” as a “shut off” valve for a fund - remain valid unless expressly revoked 27 UPMIFA – A “Default” Statute If an agreement does not reference any applicable law, UPMIFA will apply 28 Spending/Investing Authority IC 30-2-12-9 (a) Subject to the terms of a gift instrument, an institution may appropriate for expenditure or accumulate so much of an endowment fund that the institution determines is prudent for the uses, benefits, purposes, and duration of the endowment fund. Except as provided in a gift instrument, the assets in an endowment fund are donor restricted until appropriated by the institution. Prudence Defined (b) In determining to appropriate or accumulate endowment funds, an institution shall: (1) act in good faith and with the care a prudent person acting in a like position would use under similar circumstances; and (2) consider the following factors: (A) The duration and preservation of the endowment fund. (B) The purposes of the institution and the endowment fund. (C) General economic conditions. (D) The possible effects of inflation or deflation. (E) The expected total return from income and the appreciation of investments. (F) Other resources of the institution. (G) The investment policy of the institution. UPMIFA IC 30-2-12-14 Duties of Person or Institution Managing or Investing Institutional Funds 32 Managing or Investing Duties IC 30-2-12-14 (a) An institution that manages or invests an institutional fund shall consider the following: (1) The intent of a donor expressed in a gift instrument. (2) The charitable purposes of the institution. (3) The purposes of the institutional fund. Duties of Loyalty and Prudent Care (b) A person who is responsible for managing or investing an institutional fund shall: (1) comply with the duty of loyalty imposed by any law; and (2) manage or invest the fund in good faith and with the care a prudent person acting in a like position would use under similar circumstances. 34 Costs/Verify Facts/Pooling (c) An institution that manages or invests an institutional fund: (1) may only incur costs that are appropriate and reasonable in relation to: (A) the assets of; (B) the purposes of; and (C) the skills available to … the institution; and (2) shall make a reasonable effort to verify facts relevant to the management and investment of the fund. (d) An institution may pool two (2) or more institutional funds for purposes of management or investment. 35 Factors to Consider in Investing and Managing (e)(1)… (A) General economic conditions. (B) The possible effects of inflation or deflation. (C) The possible tax consequences of investment decisions or strategies. (D) The role of each investment or course of action in relation to the overall investment portfolio of the institutional fund. (E) The expected total return from income and the appreciation of investments. (F) Other resources of the institution. (G) The needs of the institution and institutional fund to make distributions and to preserve capital. (H) The relationship or value of an asset to the charitable purposes of the institution. 36 Individual Assets (e)(2) An institution shall make management and investment decisions about an individual asset: (A) in the context of an institutional fund's portfolio of investments as a whole and not in isolation; and (B) as part of an overall investment strategy that has risk and return objectives reasonably suited to the institutional fund and to the institution. 37 Diversification (e)(3) Except as otherwise provided in law, an institution may invest in any kind of property or type of investment. (4) An institution shall diversify the investments of an institutional fund unless the institution reasonably determines that, due to special circumstances, the purposes of the institutional fund are better served without diversification. 38 Disposition of Gifts (e)(5) Within a reasonable time after receiving property, an institution shall: (A) retain or dispose of the property; or (B) otherwise rebalance the investment portfolio; to bring the institutional fund into compliance with the purposes, terms, and distribution requirements of the institution. 39 Use of Skills/Retain Assets (e)(6) A person that has, or represents to have, special skills or expertise shall use the skills or expertise to manage or invest institutional funds. (7) Notwithstanding any other provision in this chapter, an institution may retain property contributed by a donor to an institutional fund as long as the governing board of the institution considers it advisable. 40 Delegation - IC 30-2-12-15 (a) Subject to the terms of a gift instrument … an institution may delegate to an agent the management or investment of an institutional fund. The institution shall act in good faith and with the care a prudent person acting in a like position would use under similar circumstances in doing the following: (1) Selecting an agent. (2) Establishing the scope and terms of the delegation, subject to the purposes of the institution and the institutional fund. (3) Periodically reviewing the agent's actions to monitor the agent's performance of and compliance with the scope and terms of the delegation. An institution that complies with this subsection is not liable for the decisions or actions of an agent to whom the management or investment of an institutional fund is delegated. 41 Delegation (b) An agent shall exercise reasonable care to perform a delegated function in compliance with the scope and terms of the delegation. (c) An agent that accepts the delegation of a management or investment function from an institution submits to the jurisdiction of Indiana courts in all proceedings concerning the delegation or the performance of a delegated function. (d) An institution may delegate management or investment functions to its committees, officers, or employees as otherwise provided by law. 42 Donations: Government Units 44 Governmental Unit IC 36-1-2-23: "Unit" means county, municipality, or township. 45 Gaming Revenue IC 36-1-14-1(b) As used in this section, "gaming revenue" means either of the following: (1) Tax revenue received by a unit under IC 4-33-12-6, IC 4-33-13, or an agreement to share a city's or county's part of the tax revenue. (2) Revenue received by a unit under IC 4-35-8.5 or an agreement to share revenue received by another unit under IC 4-35-8.5. Donations to Community Foundations IC 36-1-14-1 (c). Notwithstanding IC 8-1.5-2-6(d), a unit may donate the proceeds from the sale of a utility or facility or from a grant, a gift, a donation, an endowment, a bequest, a trust, or gaming revenue to a foundation under the following conditions: (1) The foundation is a charitable nonprofit community foundation. (2) The foundation retains all rights to the donation, including investment powers. 47 Community Foundation Terms (3) The foundation agrees to do the following: (A) Hold the donation as a permanent endowment. (B) Distribute the income from the donation only to the unit as directed by resolution of the fiscal body of the unit. (C) Return the donation to the general fund of the unit if the foundation: (i) loses the foundation's status as a public charitable organization; (ii) is liquidated; or (iii) violates any condition of the endowment set by the fiscal body of the unit. 48 Use of Income • IC 36-1-14-2: A unit may use income received under this chapter from a community foundation only for purposes of the unit. 49 Donations: School Corporations 50 Donations from School Corporations • IC 20-47-1-5(a) The governing body of a school corporation may donate the proceeds of a grant, a gift, a donation, an endowment, a bequest, a trust, an agreement to share tax revenue received by a city or county under IC 4-33-12-6 or IC 4-33-13, or an agreement to share revenue received by a political subdivision under IC 4-358.5, or other funds not generated from taxes levied by the school corporation, to a foundation under the following conditions: 51 Riverboat Gaming Revenue Included • IC 20-47-1-1 "Proceeds from riverboat gaming“ means tax revenue received by a political subdivision under IC 4-33-12-6, IC 433-13, or an agreement to share a city's or county's part of the tax revenue. 52 Conditions of Donations from School Corporations IC 20-47-1-5(a) The governing body of a school corporation may donate … to a foundation under the following conditions: (1) The foundation is a charitable nonprofit community foundation. (2) The foundation retains all rights to the donation, including investment powers, except as provided in subdivision (3). 53 Conditions of Donations from School Corporations (3) The foundation agrees to do the following: (A) Hold the donation as a permanent endowment. (B) Distribute the income from the donation only to the school corporation as directed by resolution of the governing body of the school corporation. (C) Return the donation to the general fund of the school corporation if the foundation: (i) loses the foundation's status as a public charitable organization; (ii) is liquidated; or (iii) violates any condition of the endowment set by the governing body of the school corporation. 54 Use by School Corporation (b) A school corporation may use income received under this section from a community foundation only for purposes of the school corporation. 55 Donations: Libraries 56 Library Funds IC 36-12-3-11: (5) Money or securities accepted and received by the library board as a grant, a gift, a donation, an endowment, a bequest, or a trust may be: …. (B) set aside in an account with a nonprofit corporation established for the sole purpose of building permanent endowments within a community (referred to as a "community foundation"). 57 Library Funds The earnings on the funds in the account, either: (i) deposited by the library; or (ii) accepted by the community foundation on behalf of the library; may be distributed back to the library for expenditure, without appropriation, in accordance with the conditions and purposes specified by the donor. A community foundation that distributes earnings under this clause is not required to make more than one (1) distribution of earnings in a calendar year. 58 Cemetery Perpetual Care Funds 59 Applies to … IC 23-14-48-10. (a) This section applies to a corporation that: (1) is organized under Indiana law for the purpose of establishing and maintaining a cemetery; or (2) is organized for another purpose but has established and maintains a cemetery. 60 Not Applicable IC 23-14-48-1 (a) Except as provided in subsection (b), this chapter does not apply to: (1) a cemetery owned by a municipal corporation or other governmental unit; (2) a religious cemetery; or (3) a cemetery: (A) that is ten (10) acres or less in size; (B) that is owned and operated entirely and exclusively by a nonprofit mutual association in existence on June 14, 1939; and (C) in which burials have taken place before June 14, 1939. 61 Duties of Owner/Name of Fund IC 23-14-48-2(a) The owner of each cemetery shall provide for the creation and establishment of an irrevocable perpetual care fund. (b) The principal of a perpetual care fund established under this section shall permanently remain intact, except as provided in this chapter. The principal shall be known as the "perpetual care fund" or "endowment care fund" of the cemetery. 62 Terms of the Fund (c) Fifty percent (50%) of any appreciation of the principal of the fund may be withdrawn annually not more than forty-five (45) days after the end of the fund's fiscal year. (d) Any income earned by the fund during the fiscal year may be withdrawn quarterly during the fund's fiscal year. (e) The income from a fund established under this section and any withdrawal of the appreciation of the principal under subsection (c) shall be devoted to the perpetual care of the cemetery. 63 Special Requirements • IC 23-14-48-3: Required Payment Terms • IC 23-14-48-4: Duties of cemetery organized after March 6, 1953, and before July 1, 1997 • IC 23-14-48-5: Duties of cemetery organized after June 30, 1997 • IC 23-14-48-7: Accounting, report and audit by the “custodian or trustee” (community foundation) 64 Talk of Taxes 66 State Sales Tax IC 6-2.5-5-21 (b) Sales of food and food ingredients are exempt from the state gross retail tax if: the seller meets the filing requirements under subsection (d) and is any of the following: 67 Qualifying Organizations (1)(B) Any: (i) institution; (ii) trust; (iii) group; (iv) united fund; (v) affiliated agency of a united fund; (vi) nonprofit corporation; (vii) cemetery association; or (viii) organization; that is organized and operated exclusively for religious, charitable, scientific, literary, educational, or civic purposes if no part of its income is used for the private benefit or gain of any member, trustee, shareholder, employee, or associate. 68 Purchases Exempt from Sales Tax IC 6-2.5-5-25(a) Transactions involving tangible personal property or service are exempt from the state gross retail tax, if the person acquiring the property or service: (1) is an organization described in section 21(b)(1) of this chapter; (2) primarily uses the property or service to carry on or to raise money to carry on its not-for-profit purpose; and (3) is not an organization operated predominantly for social purposes. Sales Exempt from Collection of Sales Tax IC 6-2.5-5-26(a) Sales of tangible personal property are exempt from the state gross retail tax, if: (1) the seller is an organization that is described in section 21(b)(1) of this chapter; (2) the organization makes the sale to make money to carry on a not-for-profit purpose; and (3) the organization does not make those sales during more than thirty (30) days in a calendar year. 70 Sales Exempt from Collection of Sales Tax IC 6-2.5-5-26(b) Sales of tangible personal property are exempt from the state gross retail tax, if: (1) the seller is an organization described in section 21(b)(1) of this chapter; (2) the seller is not operated predominantly for social purposes; (3) the property sold is designed and intended primarily either for the organization's educational, cultural, or religious purposes, or for improvement of the work skills or professional qualifications of the organization's members; and (4) the property sold is not designed or intended primarily for use in carrying on a private or proprietary business. 71 Tax Forms for Indiana Department of Revenue • NP – 20: Nonprofit Organization's Annual Report (Attach 990) • NP-20A: Nonprofit Application for Sales Tax Exemption • IT-20 NP: Current Year Nonprofit Organization Unrelated Business Income Tax Booklet with Forms and Schedules 72 Property Tax Exemption 6-1.1-10-16(a) All or part of a building is exempt from property taxation if it is owned, occupied, and used by a person for educational, literary, scientific, religious, or charitable purposes. IC 6-1.1-1-10 "Person" includes a sole proprietorship, partnership, association, corporation, limited liability company, fiduciary, or individual. 73 Property Tax Exemption Forms for Indiana Department of Local Government Finance • Form 136 - Application for Property Tax Exemption • Form 120 - Notice of Action on Exemption Application • Form 136 - Notice of Change of Ownership of Exempt Property 74 Loss of Exemption IC 6-1.1-10-36.5 (a) Tangible property is not exempt from property taxation under sections 16 through 28 of this chapter or under section 33 of this chapter if it is used by the exempt organization in a trade or business, not substantially related to the exercise or performance of the organization's exempt purpose. 75 Other States 76 Gift Annuity Registration • No registration in Indiana • Other states require registration and fulfillment of other requirements for reserve, contract terms, etc. • Register in states where donors reside • See website of American Council on Gift Annuities at www.acga-web.org for summary • Consultants for registration: Crescendo, PG Calc 77 Fundraising Registration • No need to register in Indiana • Must register in many other states if you solicit gifts in those states (mail, email, events, send staff, etc.) • See www.nasconet.org for links to various state registration laws • Consultants: Charitable Registry, LLC 78 Federal Law 80 OVERVIEW OF TAX EXEMPT ORGANIZATIONS Section 501(c) – Tax Exempt Organizations Mutual Benefit Orgs • 501(c)(4)-Civic leagues • 501(c)(6)-Business leagues, chambers of commerce, real estate boards • 501(c)(7)-Social & recreational clubs • 501(c)(8)-Fraternal benefit societies, associations. • 501(c)(13)-Credit unions • 501(c)(19)-Veterans organizations Traditional Charities 509(a)(1) No Public Support Test: • Hospitals • Schools • Churches • Government Public Support Test Required: • Community Foundations and Other Publicly Supported Charities Public Charities 501(c)(3) Private Foundations 501(c)(3) Other Publicly Supported Charities 509(a)(2) Supporting Organizations 509(a)(3) Public Safety Organizations 509(a)(4) Public Support Test required Type 1 Type 2 Functionally Integrated Type 3 Non-functionally Integrated TAX CODE NUMBERS MATTER! Your fund agreements reference grants to Internal Revenue Code section 170 and 509 organizations and purposes IRS determination letters for tax exempt organizations reference these same numbers The numbers indicate whether the organization and purpose is charitable. TWO TYPES OF TAX EXEMPT ORGANIZATIONS Mutual Benefit Organizations that require expenditure responsibility: 501(c)(4), etc. organizations Public Benefit Organizations/Charities that do not generally require expenditure responsibility: 501(c)(3), 170 and 509 organizations WHAT IS “CHARITABLE”? Definition of “charitable” expanded over time to evolve from care for the poor and needy to now include organizations (charities) that serve a “public benefit.” “Mutual benefit” organizations serve members – and do not generally provide public benefit qualifying as charitable. MUTUAL BENEFIT ORGANIZATIONS 501(c)(4) Civic leagues 501(c)(6) Business leagues, chambers of commerce, real estate boards 501(c)(7) Social and recreational clubs 501(c)(8) Fraternal benefit societies, associations 501(c)(13) Credit unions 501(c)(19) Veterans organizations MUTUAL BENEFIT ORGANIZATIONS Tax exempt No tax on income. Not “charitable” So no income tax charitable deduction for donors. Note: some exceptions. May perform charitable activities such as grants for scholarships or disaster relief aid. Expenditure responsibility required. May have related 501(c)(3) foundations for charitable activities Expenditure responsibility is not required for grants to such charitable foundations, assuming you confirm 501(c)(3) status by copy of IRS determination letter and recipients signs grant receipt confirming qualified use of grant funds. PUBLIC BENEFIT ORGANIZATIONS (CHARITIES): SECTION 501(C)(3) REQUIREMENTS 1. Organized and operated exclusively for an exempt purpose (i.e., religious, charitable, scientific, test for public safety, literary or educational…”) 2. No private inurement. 3. No substantial amount of lobbying. 4. No political activities. PRIVATE FOUNDATIONS Qualify per 501(c)(3): Presumed to be a private foundation unless proven otherwise Must file 990-PF and fulfill private foundation rules: 1. 5% payout requirement 2. 2% excise tax 3. No lobbying or campaigning 4. No jeopardy investments 5. No self-dealing PUBLIC BENEFIT CHARITIES Organizations described in 501(c)(3) – except churches - are presumed private foundations unless proven otherwise. Six categories of public charities pursuant to 501(c)(3) are described in IRC Sec. 509(a)(1) which incorporates by reference IRC Sec. 170(b)(1)(A)(i) to (vi). Two categories of public charities pursuant to 501(c)(3) are described in 509(a)(2) and 509(a)(3). PUBLIC BENEFIT CHARITIES – NO PUBLIC SUPPORT TEST Section 509(a)(1): Organizations described in Section 170(b)(1)(A) other than subsections (vii) and (viii) that do not require passing a public support test: • Section 170(b)(1)(A)(i): Churches • Section 170(b)(1)(A)(ii): Schools • Section 170(b)(1)(A)(iii): Hospitals and Medication Research Organizations • Section 170(b)(1)(A)(iv): State University Foundations • Section 170(b)(1)(A)(v): Governmental Units PUBLIC BENEFIT CHARITIES – PUBLIC SUPPORT TEST (INCLUDING COMMUNITY FOUNDATIONS) Section 509(a)(1): Section 170(b)(1)(A)(vi)-Publicly Supported Charities – requires a public support test: oOne-third of the charity’s total support is from the general public. oNo one contributor’s donation can count toward public support more than 2% of total support. PUBLIC BENEFIT CHARITIES – PUBLIC SUPPORT TEST Section 509(a)(2): Other Public Benefit Charities that require a different public support test: o One-third of the charity’s total support is from the general public and from fees for services rendered. o Examples: Zoo, Museum, Symphony o No more than one-third of the charity’s total support is from investment income and UBIT (unrelated business income). PUBLIC BENEFIT CHARITIES 509(a)(3): Supporting organizations - not a private foundation by virtue of a close and continuing relationship with a public benefit charity – and not controlled by a disqualified person. TYPES OF SUPPORTING ORGANIZATIONS Type I: “operated, supervised or controlled by” the supported organization. Expenditure responsibility may be required. Type II: “supervised or controlled in connection with” the supported organization. Expenditure responsibility may be required. Type III: “operated in connection with” the supported organization. Expenditure responsibility is required depending on type of Type III SO. Community Foundation Defined Treasury Regulations Section 1.170A-9(e)(10)(14) create the six “single entity” requirements to combine multiple trusts, nonprofit corporations or unincorporated associations into a single entity known as a community foundation for tax purposes. 97 Single Entity Requirements 1. Commonly known as a “Community Foundation”, “Community Trust” or “Community Fund” 2. Common instrument – master trust or agency agreement – binding separate entities 3. Common governing body 4. Committed to a reasonable return on investments – balancing return of income with growth of principal 5. Financial reports required – showing all funds as components of the single entity 98 Variance Power 6. The power of the governing body to modify any restriction or condition on the distribution of funds for any specified charitable purpose or to any specified organization, if in the sole judgment of the governing body, such restriction becomes unnecessary, incapable of fulfillment, illegal or inconsistent with the needs of the community. Treas. Reg. Sec. 1.170A-9(e)(11)(v)(B)(1). 99 Limits on Variance Power • Exercised by the governing board • Must be done in good faith • Must be relative to charitable purpose or organizational recipient – beware of undesignating a restriction for endowment • While a federal requirement, there may be state law considerations pursuant to signed agreements or contracts – resulting in review by the Attorney General and local court of jurisdiction 100