Taiwan 50 Index Futures Contract Specifications 6 Contract

advertisement

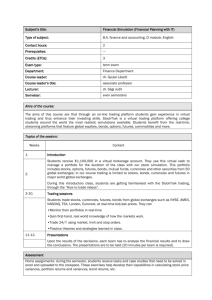

TSEC Taiwan 50 Index Futures June 2003 Background The current TAIEX index and sector indices deviate measurably from most cash portfolio held by stock investors, adding to the difficulty of utilizing hedging and arbitrage strategies, and affects the price discovery function of futures market; the market mechanism to maintain effective prices; and the precision and efficiency of futures trading strategies Most renown stock index futures contracts use the index composed by a fixed number of component stocks as underlying to facilitate hedging purpose and, thereafter, the development of futures markets. 2 Background TAIFEX Products at a Glance TAIEX Futures (07/98) Electronic Sector Index Futures (07/99) Finance Sector Index Futures (07/99) Mini-TAIEX Futures (04/01) Daily average (contracts) TAIEX Option (12/01) Equity Option (01/03) Total 98 2,233 99 3,653 714 155 4,522 00 4,944 1,512 654 7,100 01 11,659 2,807 1,596 2,334 856 19,252 02 16,661 3,367 1,479 4,210 6,316 32,033 03 19,217 3,357 3,410 4,451 45,508 1,512 77,455 2003 data up to May 30 3 Contract Specifications Underlying: the TSEC Taiwan 50 Index Abbreviation :Taiwan 50 Futures Ticker symbol:T5F Trading hours:8:45 AM~1:45PM Taiwan time on trading days of Taiwan Stock Exchange Contract size:NT$500 × Index 4 Taiwan 50 Index Futures Contract Specifications Delivery months: Five delivery months, including spot month, the next calendar month plus next three quarter months of the March, June, September, and December cycle. Daily price limit:±7% of previous day's settlement price. Last trading day:The third Wednesday of the delivery month. Final settlement day:The first business day following the last trading day. Settlement:On net cash basis. 5 Contract Multiplier- 500 Contract size=TSEC Taiwan 50 Futures Index × NT$500 The medium contract size accommodates the features of the index and encourages participation of institutional investors by meeting their needs Establishing market segregation from TAIEX futures reduces crowding out between the two products, while taking into account both the needs of institutional and individual investors Reducing trading cost Larger contract size (than TAIEX future) is more in tune with international trend 6 Contract Multiplier- 500 In reference to international practice and based on contract size, a proper integer multiple is set for the conversion between futures contract and the ETF to facilitate hedging, arbitrage and regular trading. 50 ETF shares 1 futures contract 20 futures contracts 1 ETF basket 7 Trading System Order Order placement:limit order or market order. Orders are accepted starting at 8:30AM. Matching 8:45 (market open):competitive auction. 8:45 ~13:40 :Match order by order. 13:40 ~13:45 (market closing): competitive auction. 8 Settlement System Position Management Opposite positions of the same delivery month for the same product in the same account are automatically offset. Margin Calculation Margin calculation will be the same as that for stock index futures of TAIFEX, that is risk coefficient is used to estimate the greatest possible variation in the price of underlying to cover single-day index volatility risk. Cash settlement 9 Market Participants Futures market participant Securities dealers Mutual fund companies Market participants QFII Futures dealers Banks and insurance companies CPO Other juristic persons Individuals ETF market participants Primary Secondary market market Participating securities firms, Institutional investors Institutional investors, Small traders 10 Needs of ETF Market for Futures Products Hedging needs—ETF issuing market (creation and redemption) ETF participating firms that create or redeem ETF shares can use futures products for hedging when they face price risk arising from time difference. When ETF participating firms intend to engage in arbitrage trading, they can resort to futures trading when buying or selling a basket of stocks is hard to execute. 11 Needs of ETF Market for Futures Products Needs of hedging —ETF trading market After the TSEC Taiwan 50 Index ETF is listed on the TSEC, its fluctuation will reflect the fluctuation of all component stocks. Institutional or individual investors can use futures products to hedge the risk of ETF price volatility. Needs of arbitrage Price imbalance in the spot market, EFT market and futures market may be corrected using futures products. 12