Budapesti Gazdasági Főiskola

advertisement

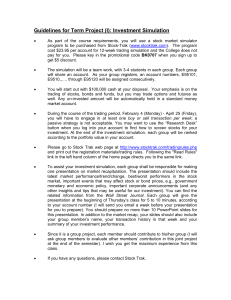

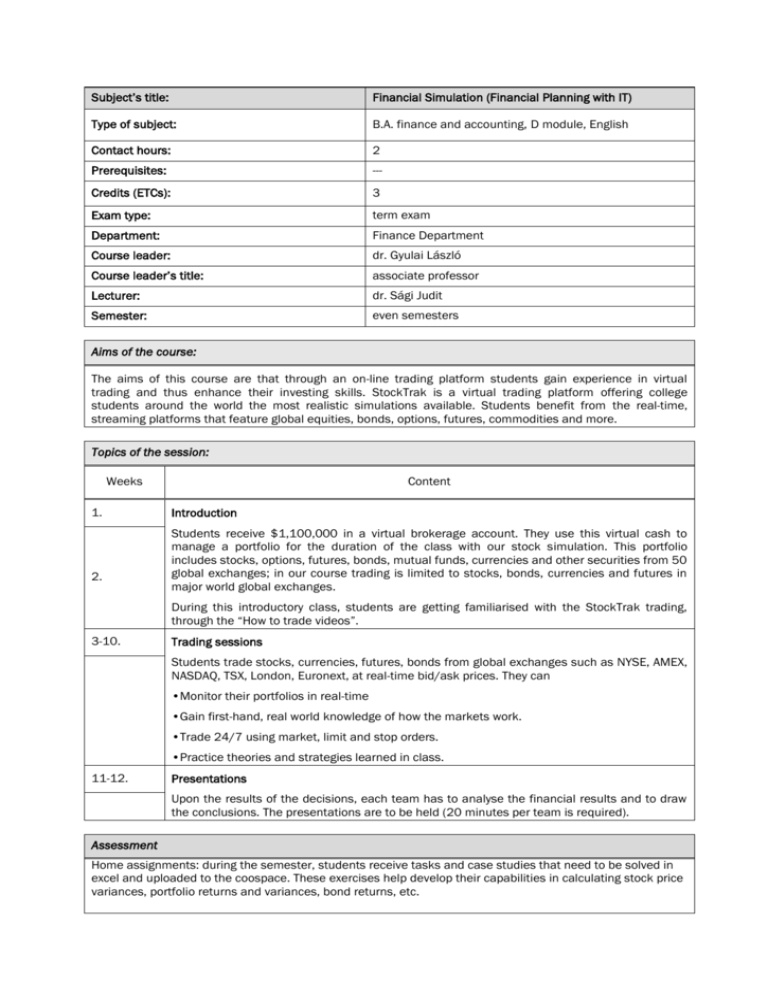

Subject’s title: Financial Simulation (Financial Planning with IT) Type of subject: B.A. finance and accounting, D module, English Contact hours: 2 Prerequisites: --- Credits (ETCs): 3 Exam type: term exam Department: Finance Department Course leader: dr. Gyulai László Course leader’s title: associate professor Lecturer: dr. Sági Judit Semester: even semesters Aims of the course: The aims of this course are that through an on-line trading platform students gain experience in virtual trading and thus enhance their investing skills. StockTrak is a virtual trading platform offering college students around the world the most realistic simulations available. Students benefit from the real-time, streaming platforms that feature global equities, bonds, options, futures, commodities and more. Topics of the session: Weeks 1. 2. Content Introduction Students receive $1,100,000 in a virtual brokerage account. They use this virtual cash to manage a portfolio for the duration of the class with our stock simulation. This portfolio includes stocks, options, futures, bonds, mutual funds, currencies and other securities from 50 global exchanges; in our course trading is limited to stocks, bonds, currencies and futures in major world global exchanges. During this introductory class, students are getting familiarised with the StockTrak trading, through the “How to trade videos”. 3-10. Trading sessions Students trade stocks, currencies, futures, bonds from global exchanges such as NYSE, AMEX, NASDAQ, TSX, London, Euronext, at real-time bid/ask prices. They can •Monitor their portfolios in real-time •Gain first-hand, real world knowledge of how the markets work. •Trade 24/7 using market, limit and stop orders. •Practice theories and strategies learned in class. 11-12. Presentations Upon the results of the decisions, each team has to analyse the financial results and to draw the conclusions. The presentations are to be held (20 minutes per team is required). Assessment Home assignments: during the semester, students receive tasks and case studies that need to be solved in excel and uploaded to the coospace. These exercises help develop their capabilities in calculating stock price variances, portfolio returns and variances, bond returns, etc. Form of assessment: practical exam. When the final round of the simulation is completed, each team has to make a presentation about the specific strategy that has been formulated throughout the game, referring to the changes in the strategy, and also to the interim result. However, most emphasis must be laid on the final results in the presentation, including the net market value of all positions, and the students’ team place in ranking. Grading The final mark will be composed of: - the team’s ranking in the simulation game, up to 40%; - and the presentations about the team’s strategy and the results achieved, up to 60%. Note: The personal assessment may differ from the one of the team. Compulsory and recommended readings Compulsory reading: The Research sites of StockTrak, with external links like: http://www.unitedfutures.com/futures101.htm http://technitrader.com/new-investors-training-video/?gclid=CIfr3oXq98MCFcXLtAoduRgAjQ etc. Recommended reading: The teaching materials of the previous semesters in Finance, Accounting, Economics and Management. 2015. 02. 09. dr. Sági Judit 2