Budgetary Control and Responsibility Accounting

advertisement

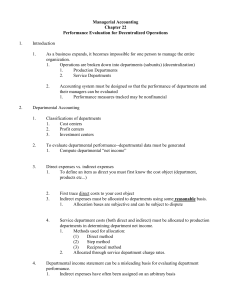

Budgetary Control and Responsibility Accounting Chapter 10 Richard E. McDermott, Ph.D. Presentation Approach As much of the material is self-explanatory, this presentation will only focus on conceptual concepts that need additional explanation. As always, students are responsible for all material in the chapter. Static Budgets Static budgets are budgets that do not vary with changes in production or sales volume. Static budgets are of limited use for cost control or performance evaluation. The only reason Professor McDermott can see for using a static budget (versus a flexible budget) is: If the company can forecast volume with certainty, or If the company cannot identify variable costs Flexible Budget Formula A formula that Professor McDermott has found to be useful to students in working flexible budgeting problems is: Y = a + bX Where Y = total flexible budget a = total fixed costs b = variable costs per unit X = production or sales volume Example Problem The controller of XYZ Company has provided you with the following cost information on the company’s product line. Total fixed costs equals $200,000 Variable cost per unit is $10 Next year the company anticipates manufacturing 25,000 units What should be the flexible budget for the year? Y = 200,000 + 10(25,000) Y = $450,000 Responsibility Accounting Involves accumulating and reporting costs (and revenues where relevant) on the basis of the manager who has authority to make day-to-day decisions about the items. Is based on the concept that managers should not be held accountable for revenues and costs over which they have no control. Types of Responsibility Centers Cost Center. Incurs costs but does not generate revenue. Profit Center. Incurs both costs and revenues. Investment Center. Incurs both costs and revenues. In addition has responsibility for assets used in generating revenues. Investment center managers are evaluated on both the profitability of the center and the rate of return earned on the funds invested. Responsibility Report Prepared using the cost volume profit income statement explained in chapter 5. Steps: Contribution margin is calculated by subtracting variable costs from revenues. Controllable fixed costs are subtracted from contribution margin. The resulting balance is known as the controllable margin. Let’s see an example! Responsibility Report Format Everything here is under control of one manager! Budget Actual Variance Sales $xxx $xxx $xxx Less variable costs Contribution margin Less controllable fixed costs Controllable margin $xxx $xxx $xxx $xxx $xxx $xxx $xxx $xxx $xxx $xxx $xxx $xxx Return on Investment (ROI) ROI is used in evaluating managers of investment centers because it measures the effectiveness of the manager and utilizing the assets at his or her disposal. Formula: When using responsibility accounting, we divide the controllable margin (instead of operating income) by average operating assets to calculate return on investments (ROI). Controllable margin ÷ average operating assets = ROI Exercise 10-1 Identify each of the statements on the following slide as true or false. If false, indicate how to correct the statement. Exercise 10-1 1.Budget reports compare actual results with planned objectives. True. 2. All budget reports are prepared on a weekly basis. False. Budget reports are prepared as frequently as needed. 3. Management uses budget reports to analyze differences between actual and planned results and determine their causes True. Exercise 10-1 4. As a result of analyzing budget reports, management may either take corrective action or modify future plans. True. 5. Budgetary control works best when the company has an informal reporting system. False. Budgetary control works best when a company has a formalized reporting system. Exercise 10-1 6. The primary recipients of the sales reporter the sales manager and the vice president of production. False. The primary recipients of the sales report are the sales manager and top management. 7. The primary recipient of the scrap report is production manager. True. 8. A static budget is a projection of budget data at one level of activity. True. Exercise 10-1 9. Top management’s reaction to unfavorable differences is not influenced by the materiality of the difference False. Top management’s reaction to unfavorable differences is often influenced by the materiality of the difference. 10.A static budget is not appropriate in evaluating a manager’s effectiveness in controlling costs unlessthe actual activity level approximates the static budget level or the behavior of the cost is fixed. True. Exercise 10-3 XYZ company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows: indirect labor $1.00 indirect material $0.50 utilities $0.40 Exercise 10-3 Fixed overhead costs per month are: Supervision $4000 Depreciation the $1500 Property taxes $800 The company believes it will normally operate in a range of 7,000 to 10,000 direct labor hours per month. Prepare a monthly manufacturing overhead flexible budget for 2008 for the expected range of activity, using increments of 1,000 direct labor hours. Exercise 10-3 Since we are working with a flexible budget, we must first identify the activity level. The activity level is the cost driver – the activity that drives variable costs. In this problem it is direct labor hours. Activity level Direct labor hours 7,000 8,000 9,000 10,000 Exercise 10-3 Now multiply in the variable costs per activity level by the budgeted number of activities to get total variable costs. Activity level Direct labor hours Variable costs Indirect labor ($1) Indirect materials ($.50) Utilities ($.40) Total variable costs ($1.90) 7,000 8,000 9,000 10,000 $ 7,000 3,500 2,800 13,300 $ 8,000 4,000 3,200 15,200 $ 9,000 4,500 3,600 17,100 $10,000 5,000 4,000 19,000 Exercise 10-3 Now insert fixed costs.Then total variable and fixed costs to give a total budget at each level of activity. Activity level Direct labor hours Variable costs Indirect labor ($1) Indirect materials ($.50) Utilities ($.40) Total variable costs ($1.90) Fixed costs Supervision Depreciation Property taxes Total fixed costs Total costs 7,000 8,000 9,000 10,000 $ 7,000 3,500 2,800 13,300 $ 8,000 4,000 3,200 15,200 $ 9,000 4,500 3,600 17,100 $10,000 5,000 4,000 19,000 4,000 1,500 800 6,300 $19,600 4,000 1,500 800 6,300 $21,500 4,000 1,500 800 6,300 $23,400 4,000 1,500 800 6,300 $25,300 Exercise 10-4 Using the information from exercise 10-3, assume that in 2008, the company incurs the following manufacturing overhead costs. Variable costs Indirect labor Fixed costs $8,700 Supervision Indirect materials 4,300 Depreciation Utilities 3,200 Property taxes $4,000 1,500 800 RANEY COMPANY Manufacturing Overhead Flexible Budget Report For the Month Ended July 31, 2008 Prepare a flexible budget at 9,000 hours. Direct labor hours (DLH) Variable costs Indirect labor Indirect materials Utilities Total variable costs Fixed costs Supervision Depreciation Property taxes Total fixed costs Total costs Budget at 9,000 DLH $ 9,000 4,500 3,600 17,100 Actual Costs 9,000 DLH $ 8,700 4,300 3,200 16,200 4,000 1,500 800 6,300 $23,400 4,000 1,500 800 6,300 $22,500 Difference $300 F 200 F 400 F 900 F $900 F RANEY COMPANY Manufacturing Overhead Flexible Budget Report For the Month Ended July 31, 2008 Prepare a flexible budget at 8,500 hours. Direct labor hours (DLH) Variable costs Indirect labor Indirect materials Utilities Total variable costs Fixed costs Supervision Depreciation Property taxes Total fixed costs Total costs Budget at 8,500 DLH $ 8,500 4,250 3,400 16,150 Actual Costs 8,500 DLH $ 8,700 4,300 3,200 16,200 4,000 1,500 800 6,300 $22,450 4,000 1,500 800 6,300 $22,500 Difference $200 U 50 U 200 F 50 U $ 50 U Exercise 10-4 Comment on your findings. In case (a) the performance for the month was satisfactory. In case (b) management may need to determine the causes of the unfavorable differences for indirect labor and indirect materials, or since the differences are small, 2.4% of budgeted cost for indirect labor and 1.2% for indirect materials, they might be considered immaterial. Exercise 10-8 As sales manager, Terry DeWitt was given the following static budget report for selling expenses in the clothing department of XYZ Company for the month of October. As a result of this budget report, he was called in and congratulated on his fine sales performance. He was reprimanded, however ,for allowing his cost to get out of control. Terry was sure that something was wrong with the performance report that he had been given. However he was not sure what to do and comes to you for advice. Prepare a budget report based on flexible budget data to help Terry. Original Report Garber Company Budget Report for October 31, 2008 Sales in units Variable expenses Sales commissions Advertising expenses Travel expense Free samples give amount Total variable Fixed expenses Rent Sales salaries Office salaries Depreciation Total fixed Total expenses Budget 8000 Actual 10,000 Difference -2,000 2000 800 3600 1600 8000 2600 850 4000 1300 8750 -600 -50 -400 300 -750 1500 1200 800 500 4000 12000 1500 1200 800 500 4000 12750 0 0 0 0 0 -750 Corrected Variable Cost Report Then we Garber Company Budget Report for October 31, 2008 multiply per unit cost by actual Variable activity Cost per Budget unit Actual Difference Sales in units 10,000 10,000 -2,000 Variable expenses Sales commissions 2,500 0.25 2,600 -100 Advertising expenses 1,000 0.10 850 150 Travel expense 4,500 0.45 4,000 500 Free samples give amount 2,000 0.20 1,300 700 Total variable 10,000 1.00 8,750 1,250 Fixed expenses Rent Sales salaries Office salaries Depreciation Total fixed Total expenses 1500 1200 800 500 4000 14000 We calculate per unit cost first by 1500 dividing budget 1200 by units of 800 activity. 500 4000 12,750 0 0 0 0 0 1,250 Exercise 10-8 Terry should not have been reprimanded. As shown in the flexible budget report, variable costs were $1,250 below budget. Exercise 10-9 XYZ Plumbing company is a newly formed company specializing in plumbing service for home and business. The owner has divided the company into two segments: home plumbing services and business plumbing services. Each segment is run by its own supervisor, all basic selling and administrative services are shared by both segments. The president has asked you to help him create a performance reporting system that will allow them to measure each segments performance in terms of its profitability. To that end following information has been collected on the home services segment for the first quarter of 2008. Exercise 10-9 Service revenue Allocated portion of: Building depreciation Advertising Billing Property taxes Material and supplies Supervisory salaries Insurance Wages Gas and oil Equipment depreciation Budgeted 25,000 Actual 26,000 11,000 5000 3500 1200 1500 9000 4000 3000 2700 1600 11,000 4200 3000 1000 1200 9400 3500 3300 3400 1300 Exercise 10-9 Prepare a responsibility report for the first quarter of 2008 for the home plumbing service segment. Remember the formula: Revenue – variable expenses – controllable fixed expenses = controllable margin Responsibility Report For the Quarter Ended March 31, 2008 Calculate the contribution margin first: Service revenue Variable costs: Material and supplies Wages Gas and oil Total variable costs Contribution margin Budget $25,000 Actual $26,000 Difference Favorable F Unfavorable U $1,000 F 1,500 3,000 2,700 7,200 17,800 1,200 3,300 3,400 7,900 18,100 300 F 300 U 700 U 700 U 300 F Responsibility Report For the Quarter Ended March 31, 2008 Then subtract controllable fixed expenses: Service revenue Variable costs: Material and supplies Wages Gas and oil Total variable costs Contribution margin Controllable fixed costs: Supervisory salaries Insurance Equipment depreciation Total controllable fixed costs Controllable margin Budget $25,000 Actual $26,000 Difference Favorable F Unfavorable U $1,000 F 1,500 3,000 2,700 7,200 17,800 1,200 3,300 3,400 7,900 18,100 300 F 300 U 700 U 700 U 300 F 9,000 4,000 1,600 14,600 $ 3,200 9,400 3,500 1,300 14,200 $ 3,900 400 U 500 F 300 F 400 F $ 700 F Exercise 10-9 Write a memo to the president discussing the principles that should be used when preparing a performance report. Exercise 10-9 Points to be covered: When evaluating the performance of a company’s segments, the performance reports should: Contain only data that are controllable by the segment’s manager. Provide accurate and reliable budget data to measure performance. Highlight significant differences between actual results and budget goals. Be tailor-made for the intended evaluation. Be prepared at reasonable intervals. The End