Chapter 22

1.

2.

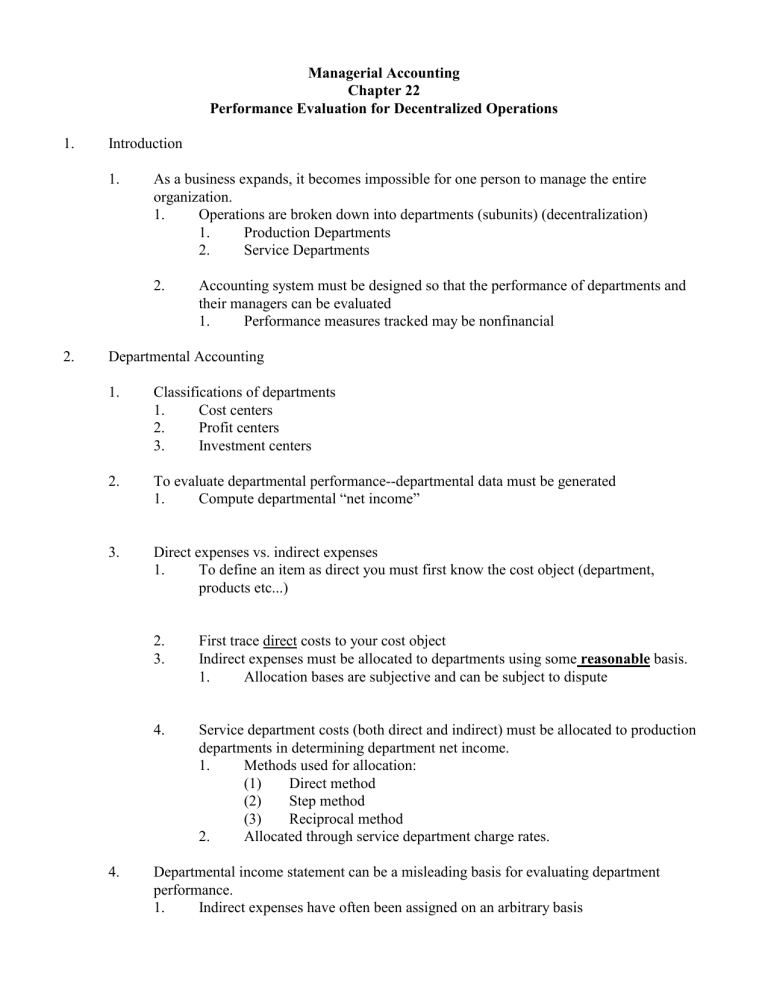

Introduction

1.

As a business expands, it becomes impossible for one person to manage the entire organization.

1.

Operations are broken down into departments (subunits) (decentralization)

1.

2.

Production Departments

Service Departments

2.

Managerial Accounting

Chapter 22

Performance Evaluation for Decentralized Operations

Accounting system must be designed so that the performance of departments and their managers can be evaluated

1.

Performance measures tracked may be nonfinancial

Departmental Accounting

1.

Classifications of departments

1.

Cost centers

2.

Profit centers

3.

Investment centers

2.

To evaluate departmental performance--departmental data must be generated

1.

Compute departmental “net income”

3.

Direct expenses vs. indirect expenses

1.

To define an item as direct you must first know the cost object (department, products etc...)

2.

3.

First trace direct costs to your cost object

Indirect expenses must be allocated to departments using some reasonable basis.

1.

Allocation bases are subjective and can be subject to dispute

4.

4.

Service department costs (both direct and indirect) must be allocated to production departments in determining department net income.

1.

Methods used for allocation:

2.

(1) Direct method

(2) Step method

(3) Reciprocal method

Allocated through service department charge rates.

Departmental income statement can be a misleading basis for evaluating department performance.

1.

Indirect expenses have often been assigned on an arbitrary basis

3.

2.

Might want to consider escapable (avoidable) and inescapable (unavoidable) expenses.

1.

If department was eliminated, would cost be eliminated?

2.

If revenues exceed escapable costs, generally the division should be kept open unless a better alternative use for such assets exist.

3.

Must also consider affect on other department revenues if the department is closed.

Responsibility Accounting

1.

Involves accumulation and reporting of costs on the basis of the individual manager who has the authority to make day-to-day decisions about the items.

1.

It is best if evaluation of performance is based on the items directly under that manager’s control.

2.

Cost is controllable if at a given level of managerial responsibility, that manager has the power to authorize the incurrence of the cost within a given period of time.

2.

3.

Noncontrollable costs are common costs that are allocated to a responsibility level.

Responsibility reporting involves the preparation of a report for each level of responsibility shown in the company’s organization chart.

1.

Cost center manager--performance evaluation based on ability to meet budgeted goals for controllable costs.

2.

Profit center manager--performance evaluated on controllable profit (margin)

Revenues

- Operating expenses

Income from operations before service department charges

-Service department charges

Income from operations.

3.

Investment center manager--primary methods for evaluation are rate of return on investment (ROI) and residual income

1.

ROI

(1) Basic formula:

Income from operations

------------------------------

Invested assets

(2) Expanded formula:

Income from operations Sales

-------------------------- X ---------------------------

Sales Invested assets

2.

Residual income

(1) Income from operations less desired minimum amount of return

(1) Minimum amount of return = invested assets times minimum rate of return desired.

4.

3.

Reporting principles for responsibility accounting performance evaluations.

1.

2.

3.

Only contain data controllable by manager of responsibility center

Provide accurate and reliable budget data to measure performance

Highlight significant differences between actual results and budget goals

4.

Be prepared at reasonable intervals

Transfer Pricing

Determination of prices for goods/services provided by one division to another 1.

2.

Common approaches:

1.

Based on “costs”

2.

3.

Market prices

Negotiated price