4361_samplefinalsm12

advertisement

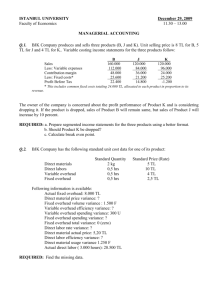

Page 1 of 21 ACG 4361 FINAL EXAM REVIEW PROBLEMS draft 1. Which of the following best describes one impact of undercosting? A. It is a common goal of all companies that allows a company to show larger profit margins. B. Undercosting some products will lead to overcosting other products, which is acceptable because total costs and profits are the same. C. Undercosting may cause a company to price it products less than what is necessary to make a profit. D. It can cause activity levels to fluctuate. 2. Which one of the following is an appropriate cost driver? A. A product such as Monopoly games B. The dollar amount of delivery costs incurred in shipping goods to customers C. The number of purchase orders prepared by an ordering department D. A production department 3. As volume decreases, A. variable cost per unit decreases. B. fixed cost in total decreases. C. variable cost in total remains the same. D. fixed cost per unit increases. 4. Sam Company makes 2 products, buckets and shovels. Additional information follows: Buckets Shovels Units 2,000 3,000 Sales $60,000 $25,000 Variable costs 24,000 13,750 Fixed costs 10,000 5,250 Net income $26,000 $6,000 Pounds of plastic per unit 2.00 0.40 Profit per unit $13.00 $2.00 Contribution margin per unit $18.00 $3.75 The company can sell as many buckets and shovels as it can manufacture and can eliminate one or the other without an effect on demand of the other. Suppose that plastic is in limited supply and only 1,500 pounds are available. Which products and how many should the company manufacture? 5. The sales-volume variance is due to A. using a different selling price from that budgeted. B. inaccurate forecasting of units sold. C. poor production performance. D. both (a) and (b). 6. The number of units in the sales budget and the production budget may differ because of a change in A. finished goods inventory levels. B. overhead charges. C. direct material inventory levels. D. sales returns and allowances. 7. Activity-based budgeting Page 2 of 21 A. B. C. D. uses one cost driver such as direct labor-hours. uses only output-based cost drivers such as units sold. focuses on activities necessary to produce and sell products and services. classifies costs by functional area within the value chain. 8. A maintenance manager is MOST likely responsible for A. a revenue center. B. an investment center. C. a cost center. D. a profit center. 9. The flexible-budget variance for direct costs can be subdivided into A. a static-budget variance and a sales-volume variance. B. a sales-volume variance and an efficiency variance. C. a price variance and an efficiency variance. D. a static-budget variance and a price variance. 10. The following information was taken from the cost records of the Solom Corporation: Estimated manufacturing overhead $84,000 Actual manufacturing overhead $89,000 Estimated direct labor hours 12,000 @ $11.00 Actual direct labor hours 12,500 @ $11.20 Solom applies manufacturing overhead based on direct labor hours. How much is overapplied or underapplied manufacturing overhead? 11. A favorable price variance for direct materials indicates that a. a lower price than planned was paid for materials. b. a higher price than planned was paid for materials. c. less material was used during production than planned for actual output. d. more material was used during production than planned for actual output. 12. A favorable efficiency variance for direct manufacturing labor indicates that a. a lower wage rate than planned was paid for direct labor. b. a higher wage rate than planned was paid for direct labor. c. less direct manufacturing labor-hours were used during production than planned for actual output. d. more direct manufacturing labor-hours were used during production than planned for actual output. e. less direct manufacturing labor-hours were used during production than planned for budgeted output. f. more direct manufacturing labor-hours were used during production than planned for budgeted output. 13. The delivery trucks of Slavin Transport Company incurred $3,600 of maintenance costs during the busiest month of 2004, in which 12,000 miles were driven collectively. During the slowest month, $2,800 in maintenance costs were incurred, and 8,000 miles were driven. Using the high-low method, what maintenance cost would the company expect to incur if 15,000 miles were driven? Page 3 of 21 14. An unfavorable variable overhead efficiency variance indicates that a. variable overhead items were used efficiently. b. the price of variable overhead items was less than budgeted. c. the variable overhead cost-allocation base was not used efficiently. d. the activity level was not accurately determined. 15. The amount reported for fixed overhead on the static budget is also reported a. as actual fixed costs. b. as allocated fixed overhead. c. on the flexible budget. d. as both (b) and (c). THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 16 THROUGH 19. Jenny’s Corporation manufactured 25,000 grooming kits for horses during March. The fixed-overhead costallocation rate is $20.00 per machine-hour. The following fixed overhead data pertain to March. Actual Static Budget Production 25,000 units 24,000 units Machine-hours 6,100 hours 6,000 hours Fixed overhead costs for March $123,000 $120,000 16. What is the fixed overhead flexible-budget amount? 17. What is the amount of fixed overhead allocated to production? 18. 19. What is the fixed overhead spending variance? What is the fixed overhead production-volume variance? Page 4 of 21 20. Activity-based costing A. calculates a more accurate product cost and is less expensive than the traditional method of costing. B. categorizes direct costs by activity and traces the direct costs to those activities using a cost driver. C. is used to allocate indirect and direct costs to products. D. allocates indirect costs based on the activity that causes costs to increase. USE THIS INFORMATION FOR QUESTIONS 21 through 23. Grant’s Kitchens is approached by Ms. Tammy Wang, a new customer, to fulfill a large one-time-only special order for a product similar to one offered to regular customers. The following per unit data apply for sales to regular customers: Direct materials $455 Direct labor 300 Variable manufacturing overhead 45 Fixed manufacturing overhead 100 Total manufacturing costs 900 Markup (60%) 540 Targeted selling price $1440 Grant’s Kitchens is operating at capacity. Ms. Wang wants the cabinets in cherry rather than oak, so direct material costs will increase by $30 per unit. 21. For Grant’s Kitchens, what is the minimum acceptable price of this one-time-only special order? 22. Other than price, what other items should Grant’s Kitchens consider before accepting this one-time-only special order? a. Reaction of shareholders b. Reaction of existing customers to the lower price offered to Ms. Wang c. Demand for cherry cabinets d. Price is the only consideration. 23. If there was unlimited capacity at Grant’s kitchen, all of the following amounts would change EXCEPT a. opportunity costs. b. differential costs. c. variable costs. d. the minimum acceptable price. 24. When evaluating a make-or-buy decision, which of the following does NOT need to be considered? a. Alternative uses of the production capacity b. The original cost of the production equipment c. The quality of the supplier's product d. The reliability of the supplier's delivery schedule 25. Which of the following will NOT be considered in a make-or-buy decision? a. Fixed costs that will no longer be incurred b. Incremental revenue c. Potential rental income from space occupied by the production area d. Variable selling costs 26. If the anticipated contribution margin on a new product line is $12, fixed costs are $200,000, and the total market for the product is 20,000 units, then the CVP analysis would recommend that the company A. abandon the potential new product line. B. decrease the sales price per unit. C. increase fixed costs (such as advertising) to lower the breakeven units. D. adopt the new product line. Page 5 of 21 27. In graph form, the breakeven point is at the intersection of the A. total-revenue and variable-cost lines. B. total-cost line and vertical axis. C. variable-cost and fixed-cost lines. D. total-cost and total-revenue lines. 28. During May, actual costs for a company that produced 28,000 widgets were direct materials, $20,000; direct labor, $30,000; indirect materials, $3,000, indirect labor, $2,000, factory supplies, $1,000, factory supervisor salary, $4,000, selling expenses; $10,000, and costs to delivery products to customers, $2,000. How much is the unit cost of manufacturing widgets? 29. Gregory Enterprises has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year: Cost Pool Overhead Costs Cost driver Activity level Supervision of direct labor $320,000 Direct labor-hours 800,000 Machine maintenance $120,000 Machine-hours 960,000 Facility rent $200,000 Square feet of area 100,000 Total overhead costs $640,000 The accounting records show the Mossman Job consumed the following resources: Cost driver Actual level Direct labor-hours 200 Machine-hours 1,600 Square feet of area 50 If direct labor-hours are considered the only overhead cost driver, what is the single cost driver rate for Gregory Enterprises? 30. Use the information in question 29. How much is the overhead cost assigned to the Mossman job using ABC? 31. When direct materials are requisitioned by the production supervisor in actual costing, A. Work in Process Inventory decreases. B. Finished Goods Inventory increases. C. Raw Materials Inventory decreases. D. Finished Goods Inventory decreases. 32. The CEO of RV USA is trying to estimate sales based on a budgeted net income before taxes of $47000. The income tax rate is 30%. If the unit contribution margin is $5,000, total sales in June are estimated at $900,000 and fixed costs are $500,000, how many RVs must be sold to attain the target profit after taxes? Page 6 of 21 33. At the point that indirect materials are used in production, what transaction occurs in normal costing? A. Raw Materials Inventory increases B. Work in Process Inventory increases C. Manufacturing overhead increases D. Cost of goods sold increases 34. Wright Company's Work in Process account showed a balance of $20,780 on July 1, 2012. During July, direct materials costing $58,300 were requested for production and $96,400 was incurred for total factory payroll. Wright applies manufacturing overhead at a rate of 125% of direct labor costs. Costs of $200,000 were transferred to the Finished Goods Inventory account during July. How much should Wright report as its July 31, 2012 balance in Work in Process Inventory? 35. Overcosting of a product is MOST likely to result from a. misallocating direct labor costs. b. overpricing the product. c. allocating overhead costs. d. understating total product costs in budgets. 36. Activity-based costing (ABC) can eliminate cost distortions because ABC a. develops cost drivers that have a cause-and-effect relationship with the activities performed. b. establishes multiple cost pools. c. eliminates product variations. d. recognizes interactions between different departments in assigning support costs. 37. Each of the following statements is true EXCEPT a. traditional product costing systems are easier to apply than ABC. b. ABC is a method of allocating indirect costs to products. c. traditional product costing systems are more accurate than an ABC system. d. cost distortions occur when a mismatch (incorrect association) occurs between the way indirect costs are incurred and the basis for their assignment to individual products. 38. Which of the following units of Target Corporation would most likely not be a support department? A. An assembly department B. The corporate accounting department C. The marketing department D. Investor Relations 39. Bill’s Tires produces specialty tires for the lawn mower industry. Bill is trying to evaluate his current month’s profit for his 6-inch tire. The tire’s unit selling price is $5.00, the variable cost per unit is $3, sales volume is 260 units, and fixed costs are $120 for the period. How much is the contribution margin ratio of the tires? 40. The fixed overhead production volume variance is favorable when A. more units are produced than were originally planned. B. actual overhead costs are less than the flexible budget. C. the static budget is greater than the amount of fixed overhead applied. D. there are units remaining in ending inventory. Page 7 of 21 Use the Nelson Manufacturing information for questions 41 through 44. Nelson Manufacturing produces baseball equipment. The standard cost of producing one unit of model XHR is: Material (3.50 ounces at $1.30 per ounce) $4.55 Labor (0.30 hour at $12.00 per hour) 3.60 Overhead 2.20 Total $10.35 At the start of 2008, Nelson’s planned to produce 80,000 units during the year. Annual fixed overhead is budgeted at $56,000 and the standard for variable overhead is $1.50 per unit. The following information summarizes the results for 2011: Actual production was 75,000 units. Purchased 275,000 ounces of material at a total cost of $343,750. Used 266,250 ounces of material in production. Employees worked 22,000 hours and were paid $275,000. 41. 42. What is the material price variance? What is the material quantity variance? 43. 44. What is the labor rate variance? What is the labor efficiency variance? 45. The standard price for materials is often determined by A. a financial analyst who is following the company. B. a union labor contract. C. price lists provided by suppliers. D. multiplying the number of units needed by the actual cost. 46 The difference between standard costs and budgeted costs is that standard costs A. refer to a single unit while budgeted costs refer to the cost, at standard, for the total number of budgeted units. B. are calculated under ideal conditions, while budgeted costs are calculated for attainable conditions. C. are calculated for material while budgeted costs are calculated for labor. D. are part of the management accounting system, while budgets are part of the financial accounting system. Page 8 of 21 47. Budgeted sales (in units) for the Randstar Company are as follows: September 45,000 units October 60,000 units November 40,000 units December 75,000 units The company wishes to have 10% of the next month’s sales on hand at the end of each month. How much is budgeted production for November? 48. Standard costs would be most useful for A. A canning factory B. A tax preparation firm C. A software company D. A custom home builder 49. In general, unfavorable labor efficiency variances arise from A. using more labor hours than planned. B. paying a higher rate to employees than planned. C. Both A and B are correct. D. Producing less units of product than budgeted. 50. Which of the following is a reasonable order in which to prepare the following budgets? A. Budgeted income statement, sales budget, cash receipts and disbursements budget B. Cash receipts and disbursements budget, production budget, labor budget C. Sales budget, production budget, material purchases budget D. Labor budget, budgeted income statement, sales budget 51. If the number of units in finished goods beginning inventory is more than the number of units in finished goods ending inventory, the number of units sold is A. less than the number of units produced. B. greater than the number of units produced. C. less than the number of units in beginning inventory. D. less than the number of units in ending inventory. 52. A significant difference between the direct material purchases budget and the direct labor budget is that the direct material purchases budget A. is based on units sold, while the direct labor budget is based on units produced. B. considers beginning and ending inventory amounts, which are not part of a direct labor budget. C. is constructed for each quarter, while the direct labor budget is constructed for each month. D. is constructed from budgeted amounts, while the direct labor budget uses actual amounts. 53. What is one reason the amount of cash paid out for overhead each period does not equal the total overhead incurred? A. Depreciation is an overhead expense that does not require the use of cash. B. Overhead expenses are only estimates, they do not require cash. C. Cash is only paid out for fixed manufacturing overhead expenses. D. The amount of cash paid out is adjusted for the number of units sold. 54. Which of the following does not appear on the cash budget? A. ending cash balance B. cash needed for capital acquisitions C. cost of goods sold D. dividend payments Page 9 of 21 55. Billings Rail Company’s sales for the next five months are as follows: February $175,000 March $160,000 April $145,000 May $135,000 June $130,000 Collection history for the company indicates that 50% of sales are collected in the month of the sale, 48% is collected in the following month, and 2% of sales are uncollectible. How much are total budgeted cash receipts for April? 56. Jefferson Company’s sales are 55% cash and 45% credit. 50% of credit sales are collected in the month of sale, 30% in the month following the sale, and 20% is collected two months after the sales month. Budgeted sales data is as follows: June $100,000 July $90,000 August $100,000 How much is total ‘Accounts Receivable’ at the end of July? 57. The main difference between a static budget and a flexible budget is that the static budget is A. the total fixed overhead for the period. B. for units produced while a flexible budget is for units sold. C. for a single level of activity while a flexible budget is adjusted for the actual activity level. D. used only for selling and administrative costs while the flexible budget is used for manufacturing costs. 58. Jericho Company’s budgeted income statement for 2011 follows: Sales (8,000 units) $128,000 Direct materials 27,600 Direct labor 6,000 Variable overhead 16,800 Fixed overhead 15,000 Fixed selling & administrative expenses 30,000 Operating income $32,600 How much operating income would appear on a flexible budget for 9,000 units? 59. Management by exception refers to the practice of only investigating variances A. that are unfavorable. B. where the actual amount exceeds the budget. C. that are large in amount relative to budgeted amounts. D. that are large in amount relative to actual amounts incurred. 60. Stanton Company had sales of 15,000 units of its only product in the first quarter of 2011. In the first quarter of 2012, Stanton anticipates selling 20% more units than it sold in the first quarter of 2011, with a selling price of $68 per unit. What is the amount of sales revenue that will appear in the budgeted income statement for the first quarter of 2012? Page 10 of 21 61. Freesome Enterprises planned to sell 18,000 surfboards, however the actual number sold totaled 19,000. Which one of the following provides the best comparison of the cost data associated with the sales? a. A budget based on the original planned level of activity b. A budget of 18,000 units of activity c. A budget of 19,000 units of activity d. The master budget level of activity 62. Brink Company planned to make 500,000 cans of pasta sauce and spending $250,000 on tomatoes during November. However, demand was weak due to increased competition, and only 450,000 cans of pasta sauce were produced. The actual cost incurred was $230,000. Tomato prices were as expected during the period. Which of the following statements would be a fair statement regarding Brink’s performance on tomato usage? A. Brink’s was under flexible budget by $20,000 and did well controlling costs. B. Brink’s was over budget by $5,000 and did a poor job of controlling costs. C. Brink’s flexible budget for tomatoes for performance evaluation should have been $250,000. D. Both a and c are correct 63. Which one of the following is a suitable way to evaluate cost centers? a. Compare the actual profit generated with expected profit b. Compare actual total costs with flexible budget data c. Compare actual controllable costs with static budget data d. Compare actual controllable costs with flexible budget data 64. Given below is a portion of Dance, Inc.’s management performance report: Budget Actual Contribution margin $1,040,000 $1,020,000 Controllable fixed costs 430,000 420,000 Difference $20,000 10,000 Which statement is true about the manager’s overall performance? a. His performance is good. b. His performance is bad. c. The manager was under budget on all controllable amounts. d. The manager's overall performance cannot be determined from information given. 65. Which statement below describes the budgeted balance sheet? a. It is a projection of financial position of the company at the end of the budget period. b. It is developed from the budgeted balance sheet for the preceding year. c. It is the last operational budget prepared. d. It shows the costs incurred by the company for the current year. 66. Zappa, Inc. makes and sells a single product, balloons. 30 grams of latex are needed to make one balloon. Budgeted production of balloons for the next three months is as follows: August 88,000 units, September 60,000 units, October 50,000 units. The company wants to maintain monthly ending inventories of latex equal to 5% of the following month's production needs, and 10% of the number of balloons to be sold in the following month. The cost of latex is $.01 per 30 grams. How many grams of latex will Zappa use for production during September? 67 Ceradyne manufactures lawn ornaments. Three types, the P1, P2 and P3, have contribution margin ratios of 30%, 42%, and 36%, respectively, and profit margin ratios of 12%, 16%, and 19%, respectively. Product demand is high. Which product should the company push to its customers? Page 11 of 21 68. Which of the following allocations will never occur when the direct method of allocating service costs is used in a manufacturing company? A. B. C. D. Payroll department costs are allocated to the baking department. HR department costs are allocated to the maintenance department. Personnel department costs are allocated to the assembly department. All of the above allocations could occur when the direct method is used. 69. Under which costing method are fixed operating costs considered a product cost? A. Absorption costing and variable costing B. Absorption costing only C. Variable costing only D. Neither variable or absorption costing 70. A cost that includes direct labor, direct materials, and manufacturing overhead is called A. a discretionary cost B. a direct cost C. a variable cost D. a product cost E. a period cost 71. Beginning finished goods inventory for Alves Inc. was $12,000. Goods completed during the year were costed at $800,000. Purchases of raw materials totaled $400,000. The ending finished goods inventory was $16,000. How much was cost of goods sold for the year? 72. Hunley Company’s sales revenue for 2012 was $120,000. Hunley has one product that has a 40 percent contribution margin. Fixed costs total $25,000 and the income tax rate is 30%.What is Hunley Company’s breakeven point in sales dollars? 73. Manufacturing overhead during the year was underapplied. If the amount is immaterial, which one of the following is a part of the transaction that should occur to dispose of the underapplied amount? A. Increase Cost of Goods Sold B. Decrease Cost of Goods Sold C. Increase Finished Goods Inventory, Work in process, and Cost of goods sold D. Decrease Finished Goods Inventory, Work in process, and Cost of goods sold 74. A disadvantage of dropping a product line is that A. the supplier may be able to produce a component at a lower cost. B. there is a loss of control over the production process. C. there may be an opportunity to expand other parts of the company. D. allocated costs must absorbed by other product lines. 75. Harper Dating Services is trying to determine the variable and fixed elements of its service overhead. The following data have been collected from recent activity: Total Service Overhead Cases Worked June $60,000 188 July 59,000 190 August 56,500 182 September 56,000 184 Which data points will be chosen to use the high low method? Page 12 of 21 76. Which of the following is not true about the step-down method? a) It is also known as the sequential method. b) Costs are allocated from each support department to all other support and production departments. c) Support cost pools ranking is a key step in step-down allocation. d) This is considered to be a one–way allocation method. 77. Budgets are useful in planning because they enhance A. relevance and reliability of information. B. communication and coordination. C. understanding of costs. D. elimination of costs. 78. Sudo Enterprises budgeted 2012 sales to be 390,000 gallons and production to be 400,000 gallons of window cleaner. Material cost in the 2012 production plan amounted to $800,000. During 2012, the company actually produced 450,000 gallons and material costs totaled $910,000. How much is the flexible budget variance for materials on a level 2 analysis? 79. Robin Company currently produces 8,000 units of part B13. Current costs for part B13 are as follows: Direct materials $12 Direct labor 9 Fixed factory costs 7 Fixed administrative costs 10 Variable factory overhead 7 Total $45 If the company decides to buy part B13, 50% of the administrative costs would be avoided. All of the Robin Company items, including part B13, are manufactured in the same rented production facility. The company has an offer from a wholesaler that wishes to sell the part to Robin for $31 per unit. What effect will occur if the company decides to accept the offer from the wholesaler? 80. Walter Jewelry Company produces a bracelet which normally sells for $79.95. The company produces 1,500 units annually but has the capacity to produce 2,000 units. A special order for manufacturing and selling 200 bracelets at $49.95 has been received which would not disrupt current operations. Current costs for the bracelet are as follows: Direct materials $17.00 Direct labor 14.50 Variable overhead 4.00 Fixed overhead 5.00 Total $40.50 In addition, the customer would like to add a monogram to each bracelet which would require an additional $2 per unit in additional labor costs and Walter Company would also have to purchase a piece of equipment to create the monogram which would cost $1,600. This equipment would not have any other uses. With regard to this special order, what effect will occur is it is accepted? Page 13 of 21 81. BigByte Company has 12 obsolete computers that are carried in inventory at a cost of $13,200. If these computers are upgraded at a cost of $7,500, they could be sold for $15,300. Alternatively, the calculators could be sold “as is” for $9,000. What is the net advantage or disadvantage of re-working the computers? 82. Companies which use only one or two cost pools rather than several cost pools A. may have seriously distorted product costs. B. will have higher record-keeping costs. C. will be able to more accurately price products to cover the cost and generate a profit. D. are likely to be using ABC. 83. Central Apparel Company owns two stores and management is considering eliminating the East store due to declining sales. Contribution income statements are as follows and common fixed costs are allocated on the basis of sales. West East Total Sales $420,000 $90,000 $510,000 Variable costs 210,000 45,000 255,000 Direct fixed costs 50,000 25,000 75,000 Allocated fixed costs 110,000 35,000 145,000 Net Income $ 50,000 ($15,000) $35,000 Central’s management feels that if they eliminate the East store, that sales in the West store will increase by 20%. If the East store is closed, what effect will occur to the overall company net income? 84. Which of the following is not generally true when a company compares ABC and traditional costing? A. ABC uses more cost drivers. B. ABC allocates costs based solely on production volume. C. ABC is more expensive. D. ABC is less likely to undercost complex, low-volume products. 85. Jarme Company makes two products and is budgeting for an Activity Based Costing (ABC) system. Previously, all overhead had been applied on the basis of machine hours. The company produces 100,000 units of product D and 5,000 units of product F annually. Overhead is applied based on machine hours. Actual Activity Estimated Cost Pool Estimated Activity Cost in Pool Product D Product F Equipment Setup 500 setups $1,000,000 350 setups 160 setups Materials Ordering 10,000 orders $2,000,000 7,000 orders 3,100 orders Quality Control 4,000 inspections $500,000 2,000 inspections 1,980 inspections 50,000 machine 40,000 machine 12,000 machine Machining $5,000,000 hours hours hours What is the total overhead cost allocated to Product D using traditional allocation? 86. Use the information in question 85. What is the overhead cost per unit for Product D using ABC? Page 14 of 21 87. Offshore Company makes 2 different types of boats, commercial fishing and sail boats both for recreation and competition. The company consists of two different departments, design & engineering, and production. The company has decided to allocate overhead costs in each of the two cost pools. Data on estimated overhead follows: Estimated Sailboat Fishing Activity Driver Overhead Cost Estimate Estimate Product Design # of designs $180,000 22 designs 23 designs Production Labor hours $994,000 4,500 hours 2,500 hours What overhead rates will be used in each department to assign costs to the sailboats? 88. West Company’s manufacturing costs for 2010 are as follows: Direct materials $100,000 Direct labor $250,000 Variable factory overhead $72,000 Depreciation of factory equipment $30,000 Other fixed manufacturing overhead $50,000 What amount should be considered cost of goods sold for external reporting purposes if 10,000 units were produced and 9,800 were sold? USE THIS INFORMATION FOR QUESTIONS 89 through 92. Closeout Deals manufactures gizmos and employs a normal costing system. During June, Closeout’s transactions and accounts included the following Raw materials acquired $148,000 Total manufacturing overhead allocated 27,900 Total manufacturing overhead incurred 28,800 Finished goods, beginning 15,400 Finished goods, ending 18,000 Raw materials inventory, beginning $3,900 Raw materials inventory, ending 3,200 Work in process inventory, beginning 11,600 Work in process inventory, ending 12,500 Direct labor cost incurred 44,000 89. How much is the cost of direct materials requisitioned for production during June? 90. How much is the total manufacturing costs for June? 91. How much is cost of goods manufactured for June? 92. How much is cost of goods sold for June? Page 15 of 21 93. Which of the following items on a variable costing income statement will change in direct proportion to a change in sales? A. Contribution margin and operating income B. Variable costs and contribution margin C. Variable costs, contribution margin, fixed costs and operating income D. Variable costs and fixed costs 94. Washington Supply Company experienced the following costs in 2010: Direct materials $3.50/unit Direct labor $2.55/unit Manufacturing Overhead Costs Variable $1.50/unit Fixed $20,000 Selling & Administrative Costs Variable selling $2.15/unit Fixed selling $8,000 Fixed administrative $7,000 During the year, the company manufactured 19,000 units and sold 20,000 units. If the average selling price per unit was $12, how much was the company’s contribution margin for 2010? 95. Use the information in question 94. How much is gross profit for 2010? 96. Use the information in question 94. Assume that variable costing income is $22,000. By what amount will variable costing income be adjusted to determine absorption income? 97. Macus Production uses a process costing system with one cost pool. There were 65,000 units transferred out of a department and 12,000 units still in process at the end of a period. There were 8,000 in process at the beginning of the period. How many units were started into production during the period? 98. Gable Corporation is allocating costs under weighted average process costing system during May for its vacuum products. There were 1,500 units in beginning inventory and 21,000 were started during May. At May 31, its work in process inventory has 5,000 units that are 20% complete as it relates to labor and overhead costs with all other units complete. Materials are added at the start of production. The total conversion costs to account for are $135,000. How much is the conversion cost allocated to Work in Process at May 31? Page 16 of 21 99. Williams Manufacturing Company is evaluating its weighted average process costing process. In the manufacturing of a complex medical device that monitors vital signs, two types of polymers are added in a mixture of other compounds. Work in process consists of 5,000 units that are 40% complete as it relates to conversion costs, 80% complete as it relates to Polymer A and 20% complete as it relates to Polymer B. There were 22,000 units completed during the period. Polymer A costs totaled $43,160 for the period. What is the equivalent cost per unit for conversion costs? Use the following information for questions 100 through 101: Bjorni Inc. makes a single product, the Bjorn, and has 20,000 units in inventory as of January 1, 2010. Information for 2010 appears below: Sales in units 198,000 Production in units 200,000 Variable production cost per unit $1.50 Variable selling cost per unit $0.30 Fixed production cost per year $100,000 Fixed selling and administrative cost per year $50,000 Selling price per unit $3.00 100. How much is the ending inventory cost using variable costing? 101. How much is the full cost of inventory to be reported on the December 31 balance sheet? 102. A significant weakness of the high-low method is that A. a significant amount of management expertise is necessary to break out the variable and fixed costs. B. the two data points that are used may not be representative of the general relation between cost and activity. C. the calculations are so complex that a computer is usually necessary in order to get accurate results. D. monthly data must be collected for at least three years before the method can be used. 103. Duradyne, Inc. has total costs of $18,000 when 2,000 units are produced and $26,000 when 5,200 units are produced. During March, 4,000 units were produced and sold for $10 each. What is the contribution margin per unit? 104. Holding all other factors constant, the break-even point will be decreased by A. increasing the fixed costs. B. decreasing the contribution margin. C. increasing the selling price. D. increasing the variable cost per unit. 105. Werth Company produces tie racks. The estimated fixed costs for the year are $288,000, and the estimated variable costs per unit are $14. Werth expects to produce and sell 60,000 units at a price of $20 per unit. By how much can sales revenue drop before Werth incurs a loss? Page 17 of 21 106. A regression analysis yields the following information: Regression Statistics Multiple R 0.961386 R Square 0.924262 Adjusted R Square 0.916688 Standard Error 39.10106 Observations 12 ANOVA df Regression Residual Total Intercept X Variable 1 1 10 11 SS 186578 15288.9 201867 Coefficients 955.01 1.09 Standard Error 225.526 0.09912 MS 186578 1528.89 F 122.0345 Signifi.F 6.3E-07 t Stat 4.2349 11.0469 P-value 0.00173 0.00634 Lower 95% 452.579 0.87409 Upper 95% 1457.6 1.3158 Lower 95.0% 452.58 0.8741 Upper 95.0% 1457.6 1.3158 What is the estimated cost for a production level of 1,200 units? 107. Which of the following statements is correct? A. Total fixed costs are equal to revenue plus variable cost per unit times the quantity produced. B. Profit is equal to total fixed costs plus revenue. C. Total fixed costs are equal to profit minus revenue. D. Profit is equal to revenue minus total variable costs minus total fixed costs. 108. Randy Company produces a single product. The income tax rate is 30%. If the unit contribution margin is $59 and fixed costs total $47,500, how many units must Randy sell in order to earn net income of $100,000? 109. Rambles Toyland makes a product that has a 40% contribution margin rate and a per unit contributuion margin of $60. Annual fixed costs are $24,000. How much will profits increase if revenue increases by $2,000? 110. Verret, Inc. produces tacos and burritos with a stable sales mix. Its financial information follows for the month of June: Tacos Burritos 25,000 37,500 Units sold Sales revenue $50,000 $150,000 Fixed costs 6,000 38,000 Variable costs 12,000 78,000 Income $32,000 $34,000 How much is the breakeven point in total sales dollars for Verret? Page 18 of 21 111. Which of the following is not an assumption underlying CVP analysis? A. Costs can be accurately separated into their fixed and variable components. B. Fixed costs remain fixed over the relevant range. C. Variable costs per unit change over the relevant range. D. The sales mix remains constant. 112. Which of the following is not true for a firm with high operating leverage? A. It has a relatively high amount of fixed costs. B. It is generally thought to be riskier than a company with lower operating leverage. C. It has a larger contribution margin ratio than similar firms. D. If sales increase, its profits will increase slower than a company with lower operating leverage. 113. Ice Box Company manufactures refrigerators. Which of the following items is most likely to be an indirect material cost for Ice Box Company? A. Factory supervisor’s salary B. Lubricant for refrigerator door hinges C. Glass shelves for the refrigerators D. Refrigerator motors 114. Which of the following costs is not part of manufacturing overhead? A. Electricity for the factory B. Depreciation of factory equipment C. Salaries for the production supervisors D. Fringe benefits for sales staff 115. Work in Process Inventory includes the cost of A. goods which are only partially completed. B. all goods sold during the period. C. all materials purchased during the last period. D. all goods which are completed and ready to sell. E. both A and D F. 116. Burson, Inc. uses a job-order costing system. It reported the following amounts for March: Work in process, March 1 $35,000 Finished goods, March 1 $12,800 Work in process, March 31 31,000 Finished goods, March 31 15,200 Cost of goods manufactured 182,000 Raw materials, March 1 15,300 Direct labor used 56,000 Raw materials, March 31 17,800 Selling costs incurred 33,000 Direct materials used 66,000 How much of the above amounts will Burson report on its balance sheet at the end of March? 117. Which one of the following is a reason that standard costs are used in process costing? a) Record keeping is easier because the method attaches the same value to each completed unit. b) No benchmarks are developed in the process. c) It takes very little effort and resources to compute the standards. d) Management can use standards developed by other companies in the same industry. 118. Companies that use process costing systems A. generally produce large quantities of identical items. B. trace costs to specific items produced. C. accumulate costs by completed products rather than by departments. D. All of the above answers are correct. Page 19 of 21 119. Which of the following statements about job-order costing is not true? A. Materials are traced to jobs using materials requisition forms. B. Indirect labor is traced to jobs using time tickets. C. Manufacturing overhead cannot be traced directly to jobs, so it is assigned using the overhead allocation rate. D. All of the above statements are true. 120. Nations Shipping determined the rate to apply overhead based on direct labor hours would be $8.40, and based on machine hours would be $5.20. Job 43D used $12.40 of direct materials, 0.46 machine hours, and 18 minutes of direct labor at a cost of $13 per hour. How much is the cost of job 43D if Nations Shipping applies overhead based on machine hours? 121. Which of the following is not true in a job-order costing system? A. Cost of goods sold will include the costs of all jobs that are sold during the accounting period. B. Work in Process Inventory will include the cost of all jobs that are currently being worked on. C. Finished Goods Inventory will include the cost of all jobs that are completed but not yet sold. D. Raw Materials Inventory will include the cost of jobs that have been started but are not yet completed. 122. Clinton Ties began the month of July with jobs 80 and 83 completed and waiting to be shipped to customers. At the end of June, jobs 81, 84, and 85 were in production. During July, jobs 86, 87, 88, 89 and 90 were begun. The company completed Jobs 81, 85, 86, 88, and 89 during July. Jobs 80, 81, 83, 86, and 88 were shipped to customers during July. Which jobs are in finished goods at July 31? 123. Southeastern Spas produces custom portable spas. At the end of its accounting period, the account balances indicated the following: Raw Materials Inventory $ 18,000 Work in Process Inventory 74,000 Finished Goods Inventory 42,000 Cost of Goods Sold 384,000 Manufacturing Overhead (credit balance) 8,000 Determine the adjusted balance of Cost of Goods Sold, rounded to the nearest whole dollar, assuming the balance in Manufacturing Overhead is considered material in amount. 124. Uno Pizza produced and sold 800 pizzas last month and had total variable ingredients that cost $3,440. If production and sales are expected to increase by 10% next month, which of the following statements is true? A. Total variable materials costs are expected to be $3,784 B. Variable material cost per unit is expected to be $4.73 C. Total costs are expected to be $47,784 D. Total variable materials costs are expected to be $344 Page 20 of 21 125. Which of the following statements regarding fixed costs is true? A. When production increases, fixed cost per unit increases. B. When production decreases, total fixed costs decrease. C. When production increases, fixed cost per unit decreases. D. When production decreases, total fixed costs increase. 126. Samson Industries began June with no dining tables in its beginning inventory. On June 1, the company began work on 500 tables. By the end of June, Samson had completed work on 420 tables, and assessed ending work in process inventory to be 40% complete with respect to conversion costs, and 90% complete as to materials. Samson spent $24,600 on materials and $40,680 on conversion costs during June. What is the cost of dining tables that were completed during June using a weighted average process costing system? 127. Agnate Boutique provided the following budgeted sales information for 5 months in 2009: April May June July August $70,000 $74,000 $65,000 $62,000 $68,000 The cash balance on April 1 is $24,000. Agnate expects customers to pay 40% in the month of sale, 35% in the month that follows, and 25% in the next month. How much cash receipts does Agnate expect to collect during June? 128. Billings Company’s plant manager is trying to better understand his plant’s inventory workflow. He determined that $10 million was incurred to purchase raw materials, $2 million on direct labor and $3 million on manufacturing overhead. If raw materials beginning and ending inventories are $2 million and $1 million, respectively, and work-in-process beginning and ending inventories are $6 million and $4 million respectively, how much is cost of goods manufactured using an actual costing system? 129. Gecko Company is evaluating the use of a supplier versus making the wheels for its skateboards internally. The currently manufactured wheels have a variable unit cost of $2. Fixed costs are $16,000 per month, however, 25% can be eliminated if wheels are no longer produced. A supplier has offered to produce this part for $3 per wheel and can produce the 3,200 wheels for the 800 skateboards needed monthly. Should Gecko outsource wheels or make them internally? a) Outsource because the incremental cost savings is $12,800. b) Make the product because the incremental cost savings is $3,200. c) Outsource because the incremental cost savings is $800. d) Outsource because the incremental cost savings is $8,800. Page 21 of 21 130. Which amount would not be considered to be a period cost on an absorption costing income statement? a) Variable manufacturing overhead costs b) Fixed marketing and sales costs c) Administration costs d) Variable marketing and sales costs 131. Redplum Computers’ sales volume is below its production volume for the month. How will profit differ on an absorption costing income statement from profit on a variable costing income statement? a) Profit will be higher on a variable costing income statement. b) Profit will be higher on an absorption costing income statement. c) Both amounts will be the same. The costs are just located in different sections of the two statements. d) It depends on the number of cost pools the company uses to allocated capacity costs. 132. Geronimo Gym Equipment produces playground equipment with a selling price of $800 per set. The costs to produce each set include: direct materials, $300; direct labor, $125, variable manufacturing overhead, $100. The fixed manufacturing overhead per year is $12,000. Beginning inventory is 15 units.. If Geronimo produces 200 sets and sells 180 sets, and income under variable costing is $37,500, how much is operating income under absorption costing? 133. What is an activity-based costing system? a) An approach to determining product costs b) An approach that eliminates all non-value-adding costs c) An approach that allocates all costs that can be directly traced to products or services d) An approach that allocates indirect costs to products 134. Which one of the following is a key difference of the direct method as compared to other methods of allocating support activity costs? a) It partially accounts for the relationship among support activities. b) It fully accounts for the relationship among support activities. c) It employs two separate drivers to allocate fixed and variable costs in a cost pool. d) It ignores the relationship among support activities and focuses instead on the relationship between support and production activities. 135. Lawn Queen manufactures mowers. The firm has divided its two divisions—East Division, and West Division. It is contemplating the best way to allocate the support costs in the head office to the two divisions. The following data are available. Technology Traced Costs Consumption Pattern From Technology From Administration $128,000 10% Administration East Division West Division $156,000 $141,000 $120,000 15% 50% 35% 35% 55% How much is the total cost for the East Division after allocation using the direct method? 136. Use the information from question 135. How much is the total cost for the East Division after allocation using the step-down method?