Lecture 16

advertisement

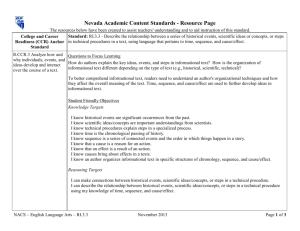

Risk, Return and Market Efficiency For 9.220, Term 1, 2002/03 02_Lecture16.ppt Student Version Outline 1. 2. 3. 4. Introduction Types of Efficiency Informational Efficiency Forms of Informational Efficiency and Empirical Evidence 5. Implications of Informational Efficiency on Security Price Changes 6. Implications for Investors and Managers 7. Summary and Conclusions Introduction People have various views of how efficient are financial markets – this is a hotly debated topic, especially between practitioners and researchers. Some argue that since prices change so much and so quickly, the markets are an irrational crap-shoot that is not efficient at all. They conclude that only with professional advice can an investor make wise investment decisions. Others argue that markets are somewhat efficient and that some professional advice is of low or even negative value. We will look at specific classifications of market efficiency and review the scientific evidence before making our judgments. Then we will consider the implications of our findings for security prices, investors, and managers. Types of Efficiency 1. Operational Efficiency – the processes of buying and selling securities is fast, accurate, and of low cost. Mechanisms for transactions are not wasteful. 2. Informational Efficiency – security prices reflect relevant information (we’ll come back to this in detail). 3. Allocational Efficiency – capital (money) is allocated to those users who can use it most efficiently. This depends on operational efficiency (so there is an easy flows of funds) and informational efficiency (so people know what is going on and what investments deserve their cash). Informational Efficiency – the hot topic! Concept: Info is cheaply and widely available to investors and ALL RELEVANT INFO AVAILABLE IS ALREADY REFLECTED IN SECURITY PRICES. Implication if true: If you know a piece of good info and you buy a stock because of it, you cannot expect to make an abnormally high return. Why? Because that info has already been reflected in the stock’s price. If it was good info, the stock’s price would have already risen to reflect the info. Therefore, you can only expect to make a normal return commensurate with the risk of the security. Info Efficiency – Illustration Let Rf = 10%, E[RM] = 16% Assume security i has i = 2 E[Ri] = If yesterday’s closing price of security i is $10, then the expected price in 1 year is … Suppose now you get reliable info that says the price in 1 year should rise to $20. When you go to buy that stock what happens? The price has already adjusted to reflect the information – i.e., you are too late! Price = ? = Ex ante Abnormal Returns A stock’s abnormal return is the difference between its actual return and the expected return given its risk level. Informational efficiency implies you can’t expect to make an abnormal return – i.e., the return you expect (in the probabilistic sense) to actually make is the same as the relevant expected return for an asset given its level of risk. Ex ante, expected abnormal returns are zero Ex post Abnormal Returns Look back at the example … what if you bought the stock yesterday and sold it today? Would you have made an abnormal return? 1-day return is … = = Obviously this is a high abnormal return! Unfortunately, this is after-the-fact (ex post), yesterday before you had the info, you didn’t expect to make the abnormal return. And, if you hadn’t bought the stock until you knew the information, you were too late. Understanding Informational Efficiency The key part of informational efficiency is this: Prices are not necessarily correct but they are not consistently wrong in one direction. So, even though we know prices will change as more information is revealed, we don’t know whether returns will be above or below expected risk-adjusted returns. For practitioners who make their money giving advice about when to buy which stocks, talk about informational efficiency obviously makes them nervous! What does Info Efficiency say about the NPV of buying Stocks or Bonds? It says NPV = 0. Why? Because the current price reflects expectations about future prices and when discounted at the relevant opportunity cost of capital (the rate adjusted for the security’s risk), the discounted expected future price equals the current price. Since NPV = PVinflows – PVoutflows = = What if T-bills have an expected return of 3.5% but NOVA Corp. shares have an expected return of 12%? Is the NPV of NOVA’s stock > 0? No! The higher expected return is due to the higher level of systematic risk; NPV = 0 for both. Forms of Informational Efficiency When discussing informational efficiency, it should not be taken for granted that markets are perfectly informationally efficient – they are not. Finance researchers have looked at what amount of information is usually reflected in security prices. By looking at subsets of information and examining if the subset of info is usually reflected in security prices, we can get a better idea of the degree to which markets are informationally efficient. The three forms of info efficiency are related to what subset of info is reflected in security prices. Weak form Semi-strong form Strong form Weak Form Informational Efficiency (WFIE) Concept: Current prices reflect all information contained in the record of past prices (past prices, volume of trades and dividends) Implications: Can’t expect to make abnormal profits (or returns) by using a stock picking strategy based solely on past prices or volumes. Tests: Look at trading rules to see if they are consistently profitable given the risk involved. filter rules (if stock rises by X% then buy because it will keep rising, if it falls by X% then sell and go short because it will keep falling) moving average rules these are types of Technical Analysis Result: Market does seem to be WFIE after accounting for transaction costs. Although some anomalies persist: January effect, day of weak effect, etc. Semi-Strong Form Informational Efficiency (SSFIE) Concept: Current prices reflect all information that is publicly available: past prices and volumes other public information (newspaper info, TV, internet, etc.) Implication: Can’t expect to make abnormal returns by trading based on publicly available information. Tests: Look at public announcements of info to see if abnormal returns could be made following the announcements. Announcements of earnings, stock splits, dividends, takeovers, etc. Results: Any change in stock prices seems to have anticipated the info release. no profits to be made after the info release. Market does seem to be SSFIE. Strong Form Informational Efficiency (SFIE) Concept: Current prices reflect all info: past prices, other public info, and all private info. Implication: Can’t expect to make abnormal returns by trading based on any info. Tests: Mutual Fund Performance Specialized managers should be able to get private info (through research etc.) and thus earn excess returns if market is not SFIE. Results: after adjusting for the relative riskiness of the funds - no consistent abnormal returns were found - sometimes lucky sometimes unlucky Would expect, given random chance, about 50% to outperform some passive portfolio like TSX 300 index (market proxy) and 50% to underperform. This is what happens in reality. What about insider trading profits? These high profits are proof that the market is not SFIE. Note, insider trading is illegal although the evidence suggests that this type of crime pays. Relationship among the Three Different Information Sets Conclusions on Informational Efficiency Market is generally regarded as being weak-form informationally efficient. Market is generally regarded as being semi-strong-form informationally efficient. Market is generally regarded as NOT being strong-form informationally efficient. Implications of Informational Efficiency Changes in stock prices will appear to be random. The Random Walk Hypothesis Why? Current price reflects all current info. Price changes must be due to new info arriving. New info must be unexpected otherwise it is not new info - you already knew it. Unexpected info is a chance event - random price changes away from expected values are also random. Prices follow a Random Walk (I.e., the difference between actual returns and expected returns is a random process.) Abnormal Returns in an Informationally Efficient Market Do abnormal returns exist? Yes, due to price changes caused by new info. Is this evidence against market efficiency? No, because abnormal returns were not expected. Remember, informational efficiency deals with EXPECTED returns. Implications for Investors Stock prices have no memory - only the current price matters - it contains all info about past prices. Trust market prices - they reflect all info (at least all public info) Don’t trust your broker, on average they will only be right due to luck! A buy and hold strategy is optimal because you can’t expect to get in and out of securities in a way that will boost your return – unless you have inside info. Implications for Managers If markets react negatively to a managerial decision, the decision may truly be bad Managers shouldn’t try to fool the market. Eventually they will be found out and then lose their credibility for the future. Often the market is able to see through the manipulations quickly; sometimes it takes time (Enron, Worldcom) but the end result is not good. The only time not to trust market prices is when you have better info, not public info. For managers this info may be info related to their own firm. It is not likely that managers have better information on macroeconomic variables like inflation, interest rates, unemployment, exchange rates, etc. Look out for violating insider trading laws if you are trading based on “better” information. What about wild market fluctuations? You can get wild fluctuations with market efficiency. If the public generally believes certain info means something good, they will bid up the prices of stocks. But if they change their minds, stock prices will fall. Sometimes the public becomes more confident as more good reports are generated thus bidding up stock prices to very high levels. When a bad report finally comes out, their bubble of over-confidence can burst – then prices plunge. This may be a partial explanation for market crashes. The problem is that it is often difficult to identify the crash-causing info. Wild Market Fluctuations and Informational Efficiency Is this evidence against market efficiency? Maybe … if people could predict the crash. If you follow analysts, though, you will see that at any one time there are some predicting a bear market (dropping prices) while others are predicting a bull market (prices rising). It is usually only after-the-fact that those who correctly predicted exclaim “The market is definitely not efficient because I predicted the crash!” The question that you should ask is whether they were just lucky in their predictions or can consistently predict what will happen in the future. Most evidence says the latter explanation is wrong! Summary and Conclusions With operational efficiency and informational efficiency, the conditions are right for the optimal allocation of resources in the economy (allocational efficiency). The three forms of informational efficiency (weak, semi-strong, strong) correspond to how much information is reflected in security prices. Most developed markets are generally considered semi-strong form informationally efficient (so past price info and other public info is generally assumed to be reflected in security prices). Insider trading profits are evidence markets are not strong form efficient. In addition, there are various anomalies that contradict weak and semi-strong form efficiency. New information is unpredictable and thus so are changes in stock prices. (Random Walk Hypothesis) Given the degree of informational efficiency that does exist in our financial markets, it is best to trust market prices (unless you have legal info nobody else has) and not to try to fool the market.