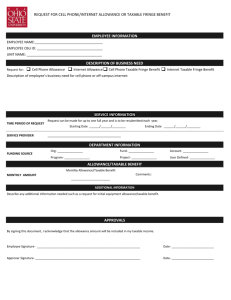

PAYE

advertisement

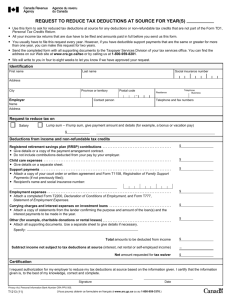

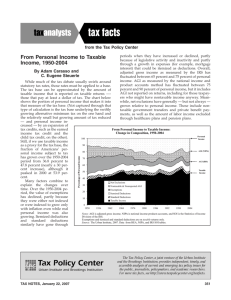

Summary of Taxation Rebates, Exemptions, Deductions, Credits and Allowances 1. Rebates: 1.1. Primary R 12 726 1.2. Secondary R 7 110 1.3. Tertiary R 2 367 Everyone receives this rebate Persons 65 and older (in addition to primary rebate) Persons 75 and older (in addition to primary and secondary) 2. Interest Exemption: Interest from a South African source, person under 65 years old, up to R 23 800. 3. Deductions (allowable tax deductions): 3.1. Pension Fund: The greater of 7,5% of remuneration of retirement fund employment OR R 1 750. 3.2. Retirement Annuity: the greater of 15% of taxable income other than from retirement funding employment, R3 500 less current deductions to a pension fund, or R1 750. 3.3. Medical and Disability Expenses: Medical Scheme Fees Tax Credit: Monthly contributions to medical schemes (a tax rebate referred to as a Medical Scheme Fees Tax Credit) up to R257 for the main member as well as the 1st dependent on the medical scheme; plus R 172 for each additional dependant. Disability Expenses: If a person 65 years or older, or a spouse or a child is disabled then 33,3% of qualifying medical expenses that have been paid and an amount by which medical scheme contributions paid by the individual exceeds 3 x the medical scheme fees tax credits for the tax year. Medical expenses: 25% of an amount equal to qualifying medical expenses and an amount by which medical scheme contributions paid by the individual exceeds 4 x the medical scheme fees tax credits for the tax year, limited to the amount which exceeds 7,5% of taxable income 3.4. Donations: to certain public benefit organisations and limited to 10% of the taxable income. 4. Allowances: A taxable benefit is a benefit provided to an employee by an employer that has to be added to the employee’s income. 4.1. Subsistence Allowance/ Advances: Where the recipient is obliged to spend at least one night away from his or her usual place of residence on business and the accommodation to which that allowance or advance relates is in the Republic and the allowance or advance is granted to pay for: meals and incidental costs, an amount of R335 per day is deemed to have been expended; incidental costs only, an amount of R103 for each day which falls within the period is deemed to have been expended 4.2. Travel Allowance The full allowance remains taxable on assessment, then you claim using the rates etc. below as allowable tax deductions when working out the Taxable Income (see rates below). Rates per kilometre, which may be used in determining the allowable deduction for business travel where no records of actual costs are kept, are determined by using the table provided in the SARS Guide. 80% of the travelling allowance must be included in the employee’s remuneration for the purposes of calculating PAYE. The percentage is reduced to 20% if the employer is satisfied that at least 80% of the use of the motor vehicle for the tax year will be for business purposes Actual distance travelled during a tax year and the distance travelled for business purposes substantiated by a log book are used to determine the costs which may be claimed against a travelling allowance Alternately: Where the distance travelled for business purposes does not exceed 8 000 kilometres per annum, no tax is payable on an allowance paid by an employer to an employee up to the rate of 330 cents per kilometre, regardless of the value of the vehicle. 5. Fringe Benefit: (these are taxable benefits) Definition: A taxable benefit is a benefit provided to an employee by an employer that has to be added to the employee’s income. o Employer-owned vehicles o Residential accommodation Summary of Taxation Rebates, Exemptions, Deductions, Credits and Allowances Rebates (Primary, Secondary and Tertiary) Exemptions (e.g. Interest) Deductions: o Pension Fund o Retirement Annuity o Medical Scheme Credits o Disability Expenses o Medical Expenses (NOT medical scheme contributions) o Donations Allowances o Subsistence Allowance (meals and incidental costs) o Travel Allowance (use rates per km and a tax table) Fringe Benefit: (these are taxable benefits) o Employer-owned vehicles o Residential accommodation Difference between: tax deductions, exemptions, rebates and credits Deductions and exemptions reduce taxable income. Credits (and rebates) reduce tax. PAYE Calculation Summary Gross Income (including allowances and Fringe benefits) – Exempt (non-taxable) income, e.g. interest] Less Deductions (e.g. Pension, Retirement Annuity + Donations) Taxable Income: Tax payable on Look up tax threshold tax table (tax rate) Less Taxable Income = Rebate + Medical credits = Tax payable (÷ 12 months = monthly PAYE)