chapter ii

advertisement

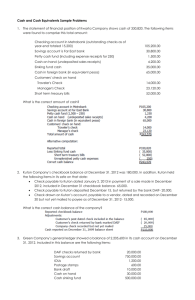

CHAPTER II Accounts Cash Definition of Terms Initial Measurement Subsequent Measurement All financial instruments are initially measured at fair value except for certain related party transactions. The definition of fair value contains a presumption of dealing at arm’s length, so Section 3840 contains provisions for measuring transactions when that presumption is not met. all current instruments are measured at undiscounted cash or consideration to be received Is acceptable by bank or other financial institution fir deposit or face value. Cash on Hand Undeposited cash collection and cash items awaiting deposit. Undeposited Cash Collection Cash receipts that has been added to the company’s cash balance but has not been added to the balance reported on the bank statement. Customer's Check Traveler's Check Manager's Check Cash in Bank Bank Drafts Are written order addressed to the bank to pay an amount of money to the order of the maker. Money Order A demand credit instrument issued and payable by a post office. unrestricted funds deposited in a bank that can be withdrawn upon Demand Deposit Funds deposited in a bank that can be withdrawn upon demand. Petty Cash Fund intended to pay minor expenses. Working Funds Imprest System Is characterized by daily deposit of all cash receipts intact to the bank and making disbursements through issuance of checks. Fluctuating System Is handling petty cash fund wherein every expenses/voucher is debited directly with petty cash fund as a credit. Change Fund Payroll Fund Bank account used solely for paying employee’s salaries. Dividend Fund Tax Fund Interest Fund Cash Equivalent Short-term, investments assets that are readily convertible into a known cash amount or sufficiency close to their maturity date (usually within 90 days) so that the market value is not sensitive to interest rate exchange. Consideration in reporting Cash Foreign Currency Cash in Closed Bank Post-dated Checks Checks, which at the date of issuance, bears a future date; will be honored by the bank only on or after the date indicated on the face of the check. NSF Checks “not sufficient fund”, those that cannot be covered by funds in the debtor’s DAIF Checks “Drawn against insufficient funds”, check drawn by a depositor but is subsequently returned by the bank to the payee because the amount of the deposit is not enough to cover the amount of the check. DAUD Checks “drawn against unclear deposit” Expense Advances Bank Overdraft Are written checks of depositor greater than its depositor’s bank account. Undelivered or Unreleased Check Are the company’s check drawn and recorded but are not actually issued or delivered to the payees as of the reporting date. Compensating Balances Are minimum amounts that a company agrees to maintain in a bank checking account as support or collateral for a loan by the depositor. Cash Set Aside for Long term Specific Date Cash Management Segregation of Duties Voucher System A system to control cash disbursements. Internal Audits at Irregular Intervals All policies and procedures used to protect assets, ensure reliable accounting, promote efficient operations, and urge adherence to company policies. Periodic Reconciliation of Bank Statement Bank Reconciliation Report that explains the differences between the book (company) balance of cash and the cash balance reported on the bank statement. Bank and Book Balances Reconciled to a Correct Cash Balance Bank Balances Reconciled with Book Balance Book Balance Reconciled with Bank Balance Proof of Cash Setting Petty Cash Fund Petty Cash Cash in Bank Replenishment of Petty Cash Fund Expenses xx xx xx A four-column bank reconciliation of beginning and ending balances of cash as well as of cash receipts and disbursements during the period. Cash in Bank Accounting for Cash Shortage Cash Short or Over Cash in Bank Due from Cashier Cash Short or Over or Loss from Cash Shortage Cash Short or Over xx xx xx xx xx xx xx Accounting for Cash Overage Cash in Bank xx Cash Short or Over Cash Short or Over xx Miscellaneous Expense or Cash Short or Over xx Payable to Cashier xx xx xx Bank Reconciliation Balance per bank statement Add: Deposit in transit Receipts not yet deposited Total Deduct: Outstanding check Adjusted cash balance xx xx xx xx _______ xx _______ xx Balance per books Add: Note collected by bank Interest on note collected Total Deduct: Bank service charge NSF check returned by bank Adjusted cash balance xx xx xx _______ xx xx xx _______ xx Adjustments Cash in Bank Notes Receivable Interest Revenue Miscellaneous Expense (or Bank Service Charge) Cash in Bank Accounts Receivable Cash in Bank Accounts Payable Cash in Bank xx xx xx xx xx xx xx xx xx Proof of Cash Nov. 30 Unadjusted bank balances Deposit in transit November 30 Receipts December Disbursement xx xx xx (xx) xx Dec. 31 Xx December 31 Outstanding checks November 30 December 31 Adjusted balance per bank xx (xx) xx (xx) xx (xx) xx Xx December Receipts Disbursement Nov. 30 Unadjusted book balances Bank service charges November December Bank credit memo in November for customer’s note collected by bank Bank credit memo in December for proceeds of bank loan granted on Dec. 31 Customer’s DAIF checks returned by bank November xx Xx xx xx xx xx xx Xx (xx) xx (xx) (xx) xx (xx) Dec. 31 xx (xx) December Adjusted balances, per books xx Statement Presentation Cash on hand xx Cash in bank xx Petty cash fund xx Treasury bill xx Total cash and cash equivalent xx xx xx (xx) xx Xx