strategic analysis - Cal State LA

advertisement

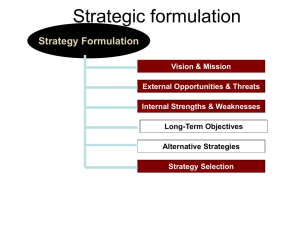

Business Strategies or How to Analyze a Case Dr. K. Kwong MGMT 497 How to Analyze a Case Mission/Vision & Objectives Industry Analysis S.W.O.T. Analysis Current Strategy Recommendations MISSION Defined Answers the question: “What business are we in?” or “Why do we exist?” --Customer Needs: What is being satisfied? --Customer Groups: Who is being satisfied? Vision Statements Future-oriented; transformative Mission = what is; vision = what will be Companies may have mission or vision or both MISSION Defined Costco: “To continually provide our members with quality goods and services at the lowest possible prices” OBJECTIVES = a desired future state that a company attempts to realize. Should be: - precise & measurable - addressing important issues - challenging but realistic - set for a specific time period - consistent with each other Types of Objectives Financial Profitability Revenue growth Long-term shareholder value Customer Product/service attributes; relationship; image Internal Process Operations, customers, innovation Corporate social responsibility Learning & growth Human, information, & organization resources EXTERNAL ENVIRONMENT ANALYSIS A. Macro Environment and Trends (Actual and Perceived) B. Industry Environment Analysis B1. Generic Analysis Main Economic and Business Characteristics of the Industry Identify Factors that are Crucial to Competitive Success in the Industry Major Issues and Conditions Facing the Industry B2. Michael Porter’s Five Forces Analysis Evaluate External Opportunities and Threats to the Company’s Growth: Macroeconomic Factors Product sales depend on the general demand and cost conditions. Adverse changes in macroeconomic conditions (e.g., interest rates, unemployment rates, currency rates, and fuel and commodity prices) can threaten the profitability of an industry. Demographic Factors Changing customer demographics (e.g., aging population, changing gender composition, changing racial and ethnic composition, and higher education levels) can spur new growth opportunities for some businesses but present threats to other businesses. Social Factors Social changes (e.g., growing health consciousness, increasing environmental awareness, rising number of single-parent or two-working adult families with kids, and rapid growth in internet users) can also create opportunities and threats. Evaluate External Opportunities and Threats to the Company’s Growth: Technological Factors Technology changes (e.g., advances in materials engineering, information technology, and wireless communications) can present opportunities and create threats. They can make established products obsolescent overnight, but they can also create new products and processes. Political and Legal Factors Changes in political and legal factors (e.g., deregulation, antitrust, tort reform, and government regulation changes) can open up new opportunities and create threats as well. Global Environment Changes in international markets (e.g., exchange rates, free trade agreements and globalization of businesses) can create new growth opportunities for some industries but also open up other industries to greater international competition. Changes in geopolitics can also have significant economic and business implications for an industry. Industry Analysis: Porter’s 5 Competitive Forces Purpose: understand why some industries have higher profit margins & what factors can change long-run industry profitability. Risk of New Entry Rivalry Among Established Firms Bargaining Power of Buyers Bargaining Power of Suppliers Threat of Substitute Products ENTRY Barriers Brand Loyalty Absolute Cost Advantages patents access to raw materials superior production techniques Economies of Scale Government Regulation Factors Affecting Intensity of RIVALRY Competitive Structure number of firms relative market share Demand conditions growth decline Exit barriers Factors Affecting BARGAINING POWER Number of firms in buyer vs. supplier industries Quantity or % of total orders Switching costs Standardization vs. specialization of input Threat of vertical integration SUBSTITUTES = products from OTHER industries that serve consumers’ needs in a way that is similar to those being served by your industry. Example: coffee vs. tea vs. soft drinks NOTE: Substitutes are very difficult to monitor, because they can involve technological changes in industries that did not pose any threat in the past. INTERNAL ENVIRONMENT ANALYSIS A. Identify the Key Elements of the Corporate Culture B.Assess Strengths and Weaknesses (within specific areas of operations): Marketing Operations Management Research and Development (R&D) Human Resource Management (HRM) Finance/Accounting C. Financial Ratio Analysis: Liquidity Ratios, Activity/Efficiency Ratios, Leverage Ratios, and Profitability Ratios Corporate Culture = Collection of beliefs, expectations, and values learned and shared by members and transmitted from one generation of employees to another. = Collective mental programming. Functions of Corporate Culture Conveys a sense of identity Generates employee commitment Adds to organizational stability Serves as a frame of reference Identifying Resource Strengths and Competitive Capabilities A strength is something a firm does well or an attribute that enhances its competitiveness Valuable skills, competencies, or capabilities Valuable physical assets Valuable human assets Valuable organizational assets Valuable intangible assets Important competitive capabilities Resource strengths and competitive capabilities are competitive assets! Identifying Resource Weaknesses and Competitive Deficiencies A weakness is something a firm lacks, does poorly, or a condition placing it at a disadvantage Resource weaknesses relate to Inferior or unproven skills, expertise, or intellectual capital Missing capabilities in key areas Resource weaknesses and deficiencies are competitive liabilities! Identifying a Company’s Market Opportunities Opportunities most relevant to a company are those offering ◦ Good match with its financial and organizational resource capabilities ◦ Best prospects for profitable long-term growth ◦ Potential for competitive advantage Identifying External Threats Emergence of cheaper/better technologies Introduction of better products by rivals Entry of lower-cost foreign competitors Onerous regulations Rise in interest rates Potential of a hostile takeover Unfavorable demographic shifts Adverse shifts in foreign exchange rates Political upheaval in a country Strategy levels Corporate-level Top Management (define the overall scope & direction of the company) Business-level (secure competitive advantage for each business unit) Business Unit #1 Business Unit #2 Business Unit #3 R&D, Manufacturing, Marketing & Sales, Logistics, Human Resources Procurement, Marketing & Sales, Manufacturing, Information Systems, Human Resources R&D, Marketing & Sales, Finance, Information Systems, Human Resources Functional (secure effective & efficient operations in each area) Issues addressed by corporate strategies Scope of operations Which product or service markets should the company compete in? Which geographic markets should the company serve? Extent and type of diversification How broad should the corporate portfolio of businesses be? Should related or unrelated diversification be pursued? Are there new businesses the company should enter? Are there existing businesses the company should terminate or divest? Organizational structure and integration How should the company be structured? How much should the company integrate its various lines or units of business? Deployment of resources How should the company allocate resources among business units? Which business units will be stressed? Corporate portfolio strategy Boston Consulting Group (BCG) Matrix: Market Growth Market Share High Low High STARS QUESTION MARKS Low CASH COWS DOGS This guides decisions on which business to expand, maintain or exit: STARS are businesses with a high market share in a fast-growing market. They can generate significant cash flows but may also need a lot of resources to sustain their growth. QUESTION MARKS are businesses with little market share but a high growth potential. These businesses are cash users and can be risky. CASH COWS are businesses that have a high market share in a slow-growth market. They generate dependable cash flows to fund business units with better growth. Invest just to maintain their market positions. DOGS are businesses with a low market share in a slow-growth market. Such businesses can still be profitable but the company will not invest in them any further and may even consider selling them. Corporate directional (grand) strategies Growth strategies Type: Concentration vs. diversification Level: Vertical integration vs. horizontal integration Geographic Location: International growth vs. domestic growth Stability strategies Pause, digest, and consolidate after rapid growth or some turbulent events Retrenchment strategies Turnaround through cost cutting, downsizing, divestment, or spin-off Bankruptcy and restructuring Liquidation (last resort) Corporate growth strategies Vertical Integration Horizontal Integration Concentration Forward or Backward Corporate Growth International Global or Multi-domestic Diversification Related or Unrelated Concentration strategy Focusing on expanding the company’s primary lines of business Examples: Merck, Walgreen, Cisco, Starbucks, UPS Potential benefits of concentration Allows the company to specialize in and master one business No dilution of management’s attention – the management can focus on what the company knows and does best Drawbacks of concentration The current industry may become mature and even decline The industry conditions can be too unstable Too much dependence on a single industry makes the company vulnerable to risks of product obsolescence (due to changes in, e.g., technology or consumer preferences) Miss the opportunity to leverage resources and capabilities to other businesses Horizontal integration strategy Seeking ownership or increased control over competitors Examples: Oracle, Unitedhealth Potential benefits of horizontal integration Gain scale economies in production Cost savings from economics of scope by combining similar operations (e.g., production, sales and marketing, and distribution) of different companies and reducing duplication of resources Create value through product bundling, total solution and cross selling Reduce the threat from substitutes Increase market power over suppliers and buyers May help increase market penetration and/or expand market coverage geographically Drawbacks of horizontal integration Not easy to integrate operations of companies with different cultures Synergies may fail to realize Reduction in competition can generate antitrust issues Vertical integration strategy Seeking ownership or increased control over distributors (forward integration) or over suppliers (backward integration) Examples: Exxon Mobil, General Motors Potential benefits of backward integration Lower transaction (purchasing) costs and capture additional profits from expanded operations Have better control over the supply of inputs Reduce the bargaining power of suppliers Potential benefits of forward integration Lower transaction (selling) costs and capture additional profits Have better control over the distribution of products and services Reduce the bargaining power of distributors/buyers Drawbacks of vertical integration Product costs can actually rise if best-cost external suppliers are not used Business remains susceptible to industry fluctuations and cycles May face risks with growing maturity of the industry Increase bureaucratic costs Related (concentric) diversification strategy Diversify into related businesses under some coherent strategic theme Examples: Johnson & Johnson, Pepsico, JP Morgan Potential benefits of related diversification Cross-business sharing of expertise, capabilities and technology Exploit economics of scope and capture synergy benefits from combining similar operations (e.g., manufacturing, sales and marketing, distribution, R&D, information systems, and managerial support) of different businesses Enable collaboration to develop new strengths and create mew competitive capabilities (including new products and new services) Leverage use of a company’s brand name Increase market power Drawbacks of related diversification Possible difficulties in integrating the operations of businesses with different cultures Strategic fits may be overestimated Unrelated (conglomerate) diversification strategy Diversifying into unrelated businesses with no unifying strategic theme (this is more finance-driven and less strategy-driven) Examples: General Electric, 3M, Honeywell, United Technologies, Samsung Potential benefits of unrelated diversification Spreading business risks over a wider variety of industries Promote efficient allocation of internal capital by allowing capital to be allocated toward industries with best profit prospects Purchase any businesses with undervalued assets and turn them around Drawbacks of unrelated diversification Difficult to manage and excel in unrelated businesses Dilution of management’s attention often leads to underperformance of some lines of business Lack of strategic fits that can be leveraged into competitive advantage Implementation of growth strategies Options Pros Mergers & Acquisitions Quick to obtain proven Strategic Alliances & Partnerships Quick entry to a market Bypass barriers to entry Less capital investment Allow risk sharing Combine strengths & expertise & market positions Bypass barriers to entry Increase market power Economies of scale Cons Takeover premium Excessive borrowing Integration difficulties Overestimate synergy Possible antitrust problems Potential conflicts in cultures and management personalities No full management control capabilities of two companies Internal Development Capture all the value created Encourage innovation Full management control Can take a long time High development costs with uncertain outcomes Lack of needed technical expertise and know-how International growth strategy Ways to enter foreign markets Exporting Licensing or franchising Joint venture Direct investment These alternative options vary in their degree of speed, control, and risk, as well as the required level of investment and market knowledge. Types of cross-border market differences Differences in consumer tastes and preferences Differences in buying habits Differences in infrastructure and distribution channels Differences in government regulations Potential benefits from international growth Gain access to new markets with attractive growth Get access to valuable natural resources and raw materials Enable cost reduction Capitalize on resource strengths and competencies Diversify business risks across a wider market base Basic strategic alternatives for international growth High Global Strategy Transnational Strategy Cost Pressures Multi-domestic Strategy Low Low High Pressures for Local Responsiveness Global strategy for international growth (Think Global, Act Global) It deemphasizes national differences, having products standardized across national markets. This works best when buyer tastes and preferences are similar across countries or can be standardized through marketing efforts. Examples: Coca-Cola, MacDonald’s, Sony, Panasonic, Boeing Benefits of the Global strategy Standardization enables the company to exploit economies of scale in manufacturing and marketing, thus lowering product costs Allow transfers of the company’s competencies across national markets Permit resource sharing and coordinated strategic moves across countries Faster and less costly product development by focusing on global brands Successful global brands can enhance the company’s bargaining power over distributors Drawbacks of the Global strategy Highly centralized control and so low responsiveness to local markets Ignored the local needs can limit market penetration and may allow other locally responsive competitors to capture market share Developing new global brands can take a long time and a lot of capital Transnational strategy for international growth (Think global, Act local) It embraces national differences, with products mass-customized to address local preferences in an efficient, semi-standardized manner. This can be effective when there are relatively high needs for local responsiveness as well as appreciable benefits to be realized from standardization. Examples: KFC, Otis Elevator Benefits of the transnational strategy Offer Benefits of both local responsiveness and global integration Enables the transfer and sharing of resources and capabilities across borders Provides the benefits of flexible coordination Drawbacks of the transnational strategy More complex and harder to implement Conflicting goals may be difficult to reconcile and require trade-offs Implementation more costly and time-consuming Multi-domestic strategy for international growth (Think local, Act local) It embraces national differences, with products customized for local markets. This can be effective when buyer tastes and preferences differ vastly across countries. Examples: Toyota, Philips Electronics, Procter & Gamble Benefits of the multi-domestic strategy Less centralized control and so high local responsiveness Customization offers product differentiation Drawbacks of the multi-domestic strategy Poses problems of transferring competencies across borders Higher costs due to tailored products and duplication across countries Slower and more costly product development Generic business-level strategies (positioning) Sources of Competitive Advantage Competitive Scope Broad Narrow Low Cost Uniqueness Cost Leadership Differentiation Focus (Segmentation) Positioning the company based on strategic strength and strategic scope: Cost leadership Differentiation Focus (Segmentation) Cost leadership strategy This strategy underscores the company’s strength in efficiency Example: Wal-Mart To be successful, the cost leadership strategy requires: Relatively standardized products Products serve needs of buyers in the broadest market segment Strong price competition with highly price-sensitive buyers Constant tight control of production costs and overhead costs Mass production to achieve economies of scale Efficient manufacturing processes Superior operating efficiency that is hard for competitors to match Risks Loss of cost advantage due to, e.g., imitation or technological advances of competitors Too fixated on reducing costs and ignoring buyers’ needs Customer preferences change toward more differentiated products Differentiation strategy This strategy underlines the company’s strength in offering unique products Examples: Apple Inc., Harley-Davidson, Walt Disney To be successful, the differentiation strategy requires: Perceived uniqueness in product attributes Customers have low price sensitivity and are willing to pay a premium price Strong R&D and fast-paced product innovation Superior product engineering Strong marketing skills to sustain a distinct brand image and maintain customer loyalty Constant review of market trends Risks Prices are too high to be justified by the product’s differentiated features Over-differentiating such that product attributes exceed buyers’ needs Loss of differentiation due to imitation by competitors Customer tastes can change toward more standardized products May overlook cost control efforts, which can still be important Focus (segmentation) strategy To gain a competitive advantage by meeting the specialized needs of a narrow market segment Examples: Porsche AG (focused differentiation) Credit unions and community banks (focused cost) To be successful, the focus strategy requires: The industry has many market segments, creating focusing opportunities Ability to identify right niche markets that are less vulnerable to substitutes or where competition is weakest Few other rivals are focusing on the same target market High degree of product customization Strong customer loyalty Relevant factors that support a cost leadership or differentiation strategy Risks The broad-market leader may find effective ways to serve the target market The market segment may become appealing enough to attract other rivals, depressing the profitability in serving the already small market segment Generic Competitive Strategies Broad Low-Cost leadership Striving to be the overall low-cost provider in industry Broad Differentiation Striving to build customer loyalty by differentiating one’s product offerings from rivals’ products Focus Strategy Based on Low Cost Targeting on a narrow market segment, out-competing rivals on basis of lower cost Focus Strategy Based on Differentiation Pursuing a market niche (especially one that has been neglected by others in the industry) by offering a specific group of customers a product or service customized to their needs Best Cost Striving to build customer loyalty by incorporating upscale attributes at lower costs or under pricing rivals whose products have similar upscale features (Lexus) Functional strategies These aim to secure effective and efficient operations within specific functional areas so that they support business-level and corporate-level strategies: Marketing & Sales Decide on product choices, pricing, distribution, promotion, and customer service Financial management Deal with capital acquisition, capital allocation, dividend policy, investment, and cash flow management Production & operations management Address choices about where and how product will be manufactured, technology to be used, management of resources, purchasing, quality control, inventory control, and relations with suppliers R&D Process development and product development Information systems Deal with office automation, decision support, and operational support Human resources management Deal with work flow control, pay and incentives, recruiting, orientation, training, staffing, and labor relations What Strategic Issues Merit Managerial Attention? Based on results of both industry and competitive analysis and an evaluation of a company’s competitiveness, what items should be on a company’s “worry list”? A “good” strategy must address “what to do” about each and every strategic issue! Identifying the Strategic Issues: Some Possibilities How to stave off market challenges from new foreign competitors? How to combat price discounting of rivals? How to reduce a company’s high costs? How to sustain a company’s present growth in light of slowing buyer demand? Whether to expand a company’s product line? Whether to acquire a rival firm? Whether to expand into foreign markets rapidly or cautiously? What to do about aging demographics of a company’s customer base? RECOMMENDATIONS Shift from Analysis--->Synthesis Is a fundamental shift in strategy required or not? How do your recommendations line up with your SWOT analysis? Is this a feasible, creative solution that is supported by your analysis?