Strategic Formulation: Vision, Objectives, & Strategies

advertisement

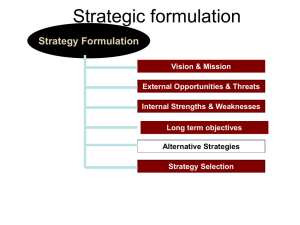

Strategic formulation Strategy Formulation Vision & Mission External Opportunities & Threats Internal Strengths & Weaknesses Long-Term Objectives Alternative Strategies Strategy Selection Strategies in Action Strategies for taking the hill won’t necessarily hold it. – Amar Bhide The early bird may get the worm, but the second mouse gets the cheese. – Unknown Strategies in Action Companies Embrace Strategic Planning -- Quest for higher revenues -- Quest for higher profits Long-Term Objectives • Results expected from pursuing certain strategies • Strategies represent actions to accomplish long-term objectives Objectives are commonly stated in terms such as growth in assets, growth in sales, profitability, market share, degree and nature of diversification. Long-term objectives are needed at the corporate, divisional, and functional levels in an organization. They are an important measure of managerial performance. Long-Term Objectives Objectives -Quantifiable Measurable Realistic Understandable Challenging Hierarchical Obtainable Congrugent (fit- together) Time-line Financial vs. Strategic Objectives Financial Objectives Strategic Objectives Growth in revenues Larger market share Growth in earnings Quicker on-time delivery than rivals Higher dividends Quicker design-to-market times than rivals Higher profit margins Higher earnings per share Improved cash flow Lower costs than rivals Higher product quality than rivals Wider geographic coverage than rivals Financial vs. Strategic Objectives Trade-Off Maximize short-term financial objectives – harm long-term strategic objectives Pursue increased market share at the expense of short-term profitability Tradeoffs related to risk of actions; concern for business ethics; need to preserve natural environment; social responsibility issues Types of Strategies • • • • Vertical Integration Strategies Intensive Strategies Diversification Strategies Defensive Strategies Types of Strategies Forward Integration Vertical Integration Strategies Backward Integration Horizontal Integration Forward Integration Strategies Attempts to gain control over: Distributors and Retailers Some guidelines: Current distributors – expensive or unreliable Availability of quality distributors – limited Firm competing in industry expected to grow markedly Firm has both capital & HR to manage new business of distribution Current distributors have high profit margins Backward Integration Strategies Control of Firm’s suppliers Guidelines: Current suppliers – expensive or unreliable # of suppliers is small; # of competitors is large High growth in industry sector Firm has both capital & HR to manage new business Stable prices are important Current suppliers have high profit margins Horizontal Integration Strategies Control of Firm’s Competitors Guidelines: Gain monopolistic characteristics w/o federal government challenge Competes in growing industry Increased economies of scale – major competitive advantages Faltering due to lack of managerial expertise or need for particular resource Types of Strategies Market Penetration Intensive Strategies Market Development Product Development Market Penetration Strategies: Increased Market Share of Present products/services or Present markets Strategy should be adopted when : Current markets not saturated Rate of present customers can be increased significantly Shares of competitors declining; industry sales increasing Increased economies of scale (increase units of production cause reduction in average cost to produce a unit) provide major competitive advantage Market Development Strategies: New Markets -- Present products/services to new geographic areas Strategy should be adopted when : New channels of distribution – reliable, inexpensive, good quality When Firm is successful at what it does Untapped/unsaturated markets Excess production capacity Basic industry rapidly becoming global Product Development Strategies: Increased Sales -- Improving present products/services or developing new products/services Products in maturity stage of life cycle Industry characterized by rapid technological development Competitors offer better-quality products @ comparable prices Strong R&D capabilities Types of Strategies Related Diversification Diversification Strategies Unrelated Diversification Diversification • Related – When their value chains posses competitively valuable cross-business strategic fits • Unrelated – When their value chains are so dissimilar that no competitively valuable cross-business relationships exist Related Diversification Preferred To Capitalize on: • Combining the related activities of separate businesses into a single operation to lower costs • Cross-business collaboration to create competitively valuable resource strengths and capabilities Related Diversification May be Effective When: • An organization competes in a no-growth or a slow growth industry • New, but related, products have seasonal sales levels that counterbalance an organization’s existing peaks and valleys • An organization’s products are currently in the declining stage of the product’s life cycle Unrelated Diversification • Favors capitalizing on a portfolio of businesses that are capable of delivering excellent financial performance • Entails hunting to acquire companies: – Whose assets are undervalued – That are financially distressed – With high growth potential but are short on investment capital Unrelated Diversification May be Effective When: • An organization’s current distribution channels can be used to market new products to existing customers • An organization has the capital and managerial talent to compete successfully in a new industry • An organization’s basic industry is experiencing declining annual sales and profits • An organization has the opportunity to purchase an unrelated business as an attractive investment opportunity Types of Strategies Retrenchment Defensive Strategies Divestiture Liquidation Defensive Strategies Retrenchment: reduce Costs & assets to reverse declining sales & profit Divesture: Selling a division or part of an organization Liquidation: Sell Company’s assets, in parts, for only their tangible worth; not for their copyrights … Retrenchment Strategies Guidelines -Failed to meet objectives & goals consistency; has distinctive competencies Firm is one of weaker competitors Inefficiency, low profitability, poor employee morale, pressure for stockholders Strategic managers have failed Rapid growth in size; major internal reorganization necessary Divestiture Strategies Guidelines -Retrenchment failed to attain improvements Division needs more resources than are available Division responsible for firm’s overall poor performance Division is a mis-fit with organization Large amount of cash is needed and cannot be raised through other sources Liquidation Strategies Guidelines -Retrenchment & divestiture failed Only alternative is bankruptcy Minimize stockholder loss by selling firm’s assets Michael Porter’s Generic Strategies Cost Leadership Strategies Differentiation Strategies Focus Strategies Generic Strategies Low Cost strategy: the basic idea underprice competitors or offer a better value thereby gain market share and sales driving some competitors out of the market entirely. Cost Leadership • Ways of ensuring total costs across value chain are lower than competitors’ total costs 1. Perform value chain activities more efficiently than rivals and control factors that drive costs 2. Revamp the firm’s overall value chain to eliminate or bypass some cost-producing activities Cost Leadership • Can be especially effective when: 1. Price competition among rivals is vigorous 2. Rival’s products are identical and supplies are readily available 3. There are few ways to achieve differentiation 4. Most buyers use the product in the same way 5. Buyers have low switching costs 6. Buyers are large and have significant power 7. Industry newcomers use low prices to attract buyers Generic Strategies Differentiation: (Type 3) producing products that are considered unique allows a firm to charge higher prices Or gain customer loyalty risk of differentiation strategy: unique product may not be valued highly enough by customers to justify the higher price. requirements for a successful differentiation strategy: strong coordination among the R&D and marketing functions and substantial amenities to attract scientists and creative people. Differentiation • Can be especially effective when: 1. There are many ways to differentiate and many buyers perceive the value of the differences 2. Buyer needs and uses are diverse 3. Few rival firms are following a similar differentiation approach 4. Technology change is fast paced and competition revolves around evolving product features Generic Strategies Focused Strategies (Type 4 & 5) producing products and services that fulfill the needs of small groups of consumers (niche market). two types: products or services to a small range (niche) of customers at the lowest price available on the market. products or services to a small range (niche) of customers at the lowest price available on the market. (focused differentiation) Focused Strategy • Can be especially effective when: 1. The target market niche is large, profitable, and growing 2. Industry leaders do not consider the niche crucial 3. Industry leaders consider the niche too costly or difficult to meet 4. The industry has many different niches and segments 5. Few, if any, other rivals are attempting to specialize in the same target segment Means for Achieving Strategies 1 Joint Venture/Partnering Two or more companies form a temporary partnership or consortium for purpose of capitalizing on some opportunity Means for Achieving Strategies Joint Ventures are effective when • A privately owned organization forms one with a public organization. • A domestic organization works with a foreign company. • The distinct competencies of the firms complement each other especially well. • Some project is potentially profitable but requires much risk. • Two or more smaller firms wish to compete against a larger firm. • There is a need to introduce a new technology quickly. Consider what guidelines should be considered before a joint venture in Russia Means for Achieving Strategies 2 Mergers and Acquisitions; • A merger occurs when two organizations of about equal size unite to form one enterprise. • An acquisition occurs when a large organization purchases (acquires) a smaller firm or vice versa. Means for Achieving Strategies Reasons for considering Mergers & Acquisitions Provide improved capacity utilization Better use of existing sales force Reduce managerial staff Gain economies of scale Smooth out seasonal trends in sales Gain new technology Access to new suppliers, distributors, customers, products, creditors Recent Mergers Acquiring Firm IBM Philip Morris Acquired Firm Ascential Software PT Hanjaya Mandala Samp National Steel Corp PeopleSoft Brookstone U.S. Steel Oracle OSIM International Ltd Adobe Systems Macromedia US Airways American West United Parcel Service Overnight Corp. Outsourcing Companies taking over the functional operations for other firms Less expensive Allows firm to focus on core business Enables firm to provide better services Questions • Discuss three different types of strategies, not including porter’s three strategies, firms can adopt and discuss how to achieve these strategies. • Discuss integrative, intensive and diversification strategies and their relationship to Porter’s strategies: low-cost, differentiation and focus. • Discuss the type of strategy: integration, intensive, diversification or defensive, which you would consider to be most appropriate for a the D.I.T. • Discuss the different means of achieving a strategy and propose which one an organisation of your choice may use in order to pursue a strategy of their choice.