Uncertain Tax Positions – FIN 48 Example

advertisement

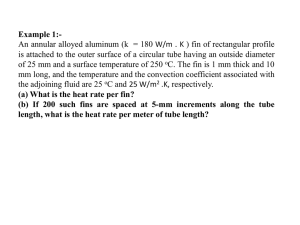

FIN 48 – Accounting for Uncertainty in Tax Positions May 12, 2008 McGladrey & Pullen LLP is a member firm of RSM International – an affiliation of separate and independent legal entities. Course Outline • • • • • Background/Basic Concepts Recognition and Measurement Special Rules Examples Financial Statement Disclosures FIN 48 – Basic Concepts McGladrey & Pullen LLP is a member firm of RSM International – an affiliation of separate and independent legal entities. Uncertain Tax Positions – FIN 48 Why the Change? • Diversity in practice of how tax positions were recognized in financial statements – FAS 109 did not address this issue • Some of the practices included: – Recording a “cushion” for the estimated liability resulting from final resolution of the uncertainty – Increasing the valuation allowance to reduce deferred tax assets for the estimated effect of the uncertainty – Establishing a confidence threshold for recognizing tax benefits and applying the FAS 5 “probable” threshold for recording contingent losses associated with those positions Uncertain Tax Positions – FIN 48 Effective Date and Transition • FIN 48 is effective for fiscal year beginning after December 15, 2007 – Early adoption permitted if company has not issued interim financial statements for the year • These rules must be applied to all open tax positions upon initial adoption • The cumulative effect of adopting FIN 48 is recognized as an adjustment to beginning retained earnings • SAB 74 disclosures regarding estimated future impact is required for all financial statements issued by public companies before adoption of FIN 48 Uncertain Tax Positions – FIN 48 What is a Tax Position? • FIN 48 applies to all tax positions accounted for under FAS 109, including (but not limited to): – Position in a previously filed tax return or expected filing position that effects current or deferred tax assets or liabilities for interim or annual period – A decision whether or not to file a tax return – A decision to exclude reporting income in a tax return – Characterization of gains or losses as capital or ordinary – Allocations of income between taxing jurisdictions – Decisions to classify transactions or entities as tax exempt Uncertain Tax Positions – FIN 48 Scope • FIN 48 applies to income taxes only and does not apply to nonincome taxes such as property taxes, sales & use taxes, franchise taxes based on capital, etc. – On the other hand, FIN 48 has heightened the awareness as to liabilities for these other taxes which are still subject to FAS 5 • FIN 48 applies to any entity that is potentially subject to income taxes, including: – Nonprofit organizations – Flow-through entities (i.e., partnerships, S corporations, LLCs) – Pass-through entities with 100% credit for dividends paid such as REITs and RICs FIN 48 – Recognition and Measurement McGladrey & Pullen LLP is a member firm of RSM International – an affiliation of separate and independent legal entities. Uncertain Tax Positions – FIN 48 Step #1 - Recognition • Criteria for financial statement recognition of a tax position: – More likely than not (more than 50%) the position will be sustained upon examination (including appeals or litigation required to settle the matter) – Based on the technical merits of the position – Presume examination by relevant taxing authorities that have full knowledge of all relevant information (i.e., no “audit lottery”) – Evaluate each position without offset or aggregation Uncertain Tax Positions – FIN 48 Step #1 - Recognition • Technical merits are based on: – Application of sources of tax law authority to facts and circumstances • Includes legislation and statutes, legislative intent, regulations, rulings and case law • Highly recommended that auditors utilize tax professionals to examine and evaluate technical merits of tax positions – May rely on widely understood administrative practices and precedents of taxing authority in dealing with similar businesses • (e.g., fixed asset capitalization threshold) • This exception should only be used when there is compelling evidence the taxing authority will accept the position Uncertain Tax Positions – FIN 48 Step #1 - Recognition • Unit of account must be used to determine if more likely than not (“MLTN”) threshold is met – – – – Based on how taxpayer prepares and supports tax return Based on the approach anticipated to be taken by examining tax authorities The unit of account can change based on a change in facts and circumstances Example: unit of account for R&D credit may be projects or departments Uncertain Tax Positions – FIN 48 Step - #2 - Measurement • Measurement = determining the largest amount of tax benefit greater than 50% likely to be realized upon settlement – Based on expected negotiated settlement with taxing authority that has access to all relevant facts – Based on management’s best judgment given the facts, circumstances and information available at the time Uncertain Tax Positions – FIN 48 Measurement • Example: Possible Outcome Ind. Probability % Cumulative Prob. % $100 5 5 80 25 30 60 25 55 50 20 75 40 20 95 20 5 100 Uncertain Tax Positions – FIN 48 Subsequent Recognition/Derecognition • If MLTN threshold not initially met, tax benefit recognized in first interim period that meets one of these conditions: – The MLTN threshold is met – The tax matter is resolved through settlement or litigation – The statute of limitations has expired • A previously recognized tax position is derecognized when it is no longer more likely than not that the position will be sustained – Use of valuation allowance is not permitted for this purpose Uncertain Tax Positions – FIN 48 Change in Judgment • Change in judgment based on new information can result in recognition, derecognition or change in measurement – Recognized as a discrete item in earnings in the period in which the change occurs and does not affect the estimated annual effective tax rate – If change occurs in different interim period of the same fiscal year as initial recognition, then it is reflected in the estimated annual effective tax rate FIN 48 – Other Special Rules McGladrey & Pullen LLP is a member firm of RSM International – an affiliation of separate and independent legal entities. Uncertain Tax Positions – FIN 48 Interest and Penalties • Interest on underpayments should be recorded in the first interim period that interest would begin accruing by applying the statutory interest rate to the difference between tax position recognized in the financial statements and the amount claimed on the tax return. • If a tax position does not meet the minimum threshold to avoid penalties, an expense must be recognized in the period the company expects to claim the position in the tax return. Uncertain Tax Positions – FIN 48 Deferred Tax Impact • FIN 48 applies to temporary differences as well as permanent differences – Computation of temporary differences are based upon tax effect of MLTN tax basis versus financial statement basis of assets and liabilities – The tax effect of difference between MLTN tax basis and “as filed” tax basis should be recorded as a reserve in income taxes payable Uncertain Tax Positions – FIN 48 Classification of Liability • Liabilities arising from the difference between the tax treatment and the financial statement measurement of the tax benefit is recorded based upon expected cash payment – Payable within one year or operating cycle - current tax payable – Payable in excess of one year - non-current tax payable Uncertain Tax Positions – FIN 48 Classification of Liability • Interest and penalties may be classified as either income tax expense or interest expense based on accounting policy elected by management • If interest is classified as income tax expense, the interest will need to be recorded net of the tax benefit, since the interest is tax deductible FIN 48 - Examples McGladrey & Pullen LLP is a member firm of RSM International – an affiliation of separate and independent legal entities. Uncertain Tax Positions – FIN 48 Example – Permanent Difference • Research credit claimed on return = $1,000,000 • Unit of account = 4 projects at $250,000 each • Projects 1,2,3 meet MLTN threshold, project 4 does not – Potential recognition = $250,000 x 3 = $750,000 • Largest settlement more than 50% likely is $250,000 for project 1 and $200,000 each for projects 2 and 3 – Initial measurement $250,000+$200,000+$200,000 = $650,000 Uncertain Tax Positions – FIN 48 Example – Permanent Difference • Journal entry to record uncertain tax position benefit: – Current tax receivable $1,000,000 Current income tax expense Non-current income tax payable $650,000 350,000 • Assume the credit is later settled at $700,000, the entry would be as follows: – Non-current income tax payable Current income tax expense Cash (payment to IRS) $350,000 $50,000 300,000 Uncertain Tax Positions – FIN 48 Example – Taxable Temporary Difference • Acquired intangible asset of $150,000 – Indefinite book life – Tax return filing position – entire cost deductible in year 1 – 40% likely to sustain immediate deduction; 60% likely to obtain sec 197 15 year amortization • Largest settlement more than 50% is 15 year amortization – Initial measurement in Year 1 = $150,000 / 15 = $10,000 x 40% = $4,000 – Additional benefits in years 2-15 of $4,000 per year Uncertain Tax Positions – FIN 48 Example – Taxable Temporary Difference • At end of Year 1 record deferred tax liability for difference between book basis and the MLTN recognized tax basis ($150,000 – $10,000 = $140,000) – $150,000 – $140,000 = $10,000 x 40% = $4,000 • The company will still claim a $150,000 deduction on the tax return, so they will need to record a current tax receivable of $60,000 • Where does the difference of $56,000 go to balance the entry? Uncertain Tax Positions – FIN 48 Example – Taxable Temporary Difference • Journal entry to record uncertain tax position benefit: – Current taxes receivable Deferred tax expense Non- Current tax liability Deferred tax liability Current tax benefit • $60,000 4,000 $56,000 4,000 4,000 In year two, the entries would be as follows: – Non-current tax liability (reserve) Deferred tax expense Current tax benefit Deferred tax liability $4,000 4,000 $4,000 4,000 Uncertain Tax Positions – FIN 48 Example – Taxable Temporary Difference • Assume the issue is settled with the IRS after Year Five and the IRS prevails and requires 15 year amortization • Cumulative balances should be as follows: – Deferred tax liability – Non-current tax payable (reserve) $20,000 $40,000 • Since the taxpayer deducted $150,000 and should have only amortized $50,000; the payment owed to the IRS is $40,000 ($100,000 x 40%) Uncertain Tax Positions – FIN 48 Example – Taxable Temporary Difference • The entry to record the settlement would be as follows: – Noncurrent income tax payable Cash (payment to IRS) $40,000 $40,000 • In future years, there should be a current amortization deduction taken in the provision and the return, so the entry each year in the future will be as follows: – Current income tax receivable Deferred tax expense Current tax benefit Deferred tax liability $4,000 4,000 $4,000 4,000 Uncertain Tax Positions – FIN 48 Examples – Temporary Difference • The preceding example did not take into account: – Interest and penalties – Any financial statement impairment or write-down of the intangible – The fact that a deferred tax liability related to an indefinite lived asset cannot be offset against any deferred tax assets for purposes of determining valuation allowance Uncertain Tax Positions – Fin 48 Temporary Differences • Another way to look at this is to maintain two parallel sets of deferred tax roll-forwards – Roll-forward #1 will track the differences between the book basis and the “as filed” tax basis; in other words, what FAS 109 already requires, pre-FIN 48 – Roll-forward #2 will track the differences between the book basis and the “more likely than not” tax basis that may be recorded under FIN 48 • The difference between deferred taxes computed under Rollforward #1 and Rollforward #2 will be the reserve in current or non-current income taxes payable Uncertain Tax Positions – Fin 48 Temporary Differences • The Parallel Rollforward method has several advantages – – – – Easier to track differences and maintain integrity of deferred tax computations Enables provision to return reconciliation more easily Better SOX 404 controls Entries recorded on a gross basis; making it easier to reconcile tax accounts Uncertain Tax Positions – Fin 48 Temporary Differences • For example, the initial entry in the taxable temporary difference example under the parallel rollforward approach would be as follows: – Current tax receivable $60,000 Deferred tax expense 60,000 Deferred tax liability Current tax expense (benefit) To record as-filed tax benefit of acquired intangible – Deferred tax liability $56,000 Current tax expense (benefit) 56,000 Non-current tax payable (reserve) Deferred tax expense To record reserve for uncertain tax position $60,000 60,000 $56,000 56,000 FIN 48 – Financial Statement Disclosures McGladrey & Pullen LLP is a member firm of RSM International – an affiliation of separate and independent legal entities. Uncertain Tax Positions – FIN 48 Required Disclosures • The accounting policy regarding classification of interest and penalties • Tabular reconciliation of unrecognized tax benefits, including: – – – – – – – Beginning balance Gross additions/reductions to UTP liability from prior period tax positions Gross additions/reductions to UTP liability from current period tax positions Decreases resulting from settlements with tax authorities Decreases resulting from the lapse of the statute of limitations Changes in interest and penalties, if classified as income taxes Ending balance Uncertain Tax Positions – FIN 48 Required Disclosures • The total of uncertain tax positions that, if recognized, would impact the effective tax rate • For items where it is reasonably possible the estimate of the realized tax benefit will materially change in the next 12 months: – Nature of the uncertainty – Nature of the event that could cause the change – Estimated range of reasonably possible change Uncertain Tax Positions – FIN 48 Required Disclosures • The amount of interest and penalties recorded in the income statement and balance sheet • A list of open tax years by major jurisdiction • In the fiscal year of adoption, the cumulative effect of the change recorded as an adjustment to retained earnings Uncertain Tax Positions – FIN 48 Sample Disclosures • See FIN 48, ¶ A33 for narrative disclosure discussing tax jurisdictions filed in, open years under the statute of limitations, IRS audit status including the range of anticipated payments and interest and penalties accrued • The example lists transfer pricing and state nexus as the tax positions with the greatest uncertainty and that adverse settlements would significantly impact the effective tax rate • The example also shows a sample reconciliation of the liability (reserve) for uncertain tax positions Questions? Call to speak with one of the local RSM Tax Professionals at 619.280.3022 E-mail me: Erica.Costanzo@rsmi.com