Financial Literacy - ROI

advertisement

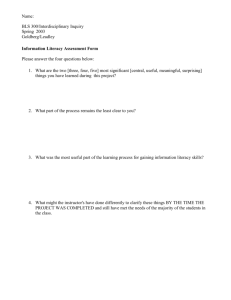

Financial Literacy “ROI” Constructing Measurable Financial Literacy Initiatives Sailing away the winter blues with ISFAA … 2015 Winter Conference Contact Info Michele Wedel, Adjunct Instructor Kelley School of Business, IUPUI (317) 306-1769 mwedel@iupui.edu Sara Wilson, USA Funds (317) 806-0140 Sara.Wilson@usafunds.org 2 Agenda • Building The Program • Evaluating The Program • Discussion/Question & Answer 3 Session Outcomes • By the end of the this session, you will be able to: – Cite the importance of involving all stakeholders in the planning and implementation processes – List the top financial literacy topics for the student audience – Describe how to make financial literacy sessions interesting and relevant for students – Use national datasets to develop an assessment plan to measure the impact of the financial literacy initiatives 4 Why is financial literacy needed • Student loan debt over $1.1 trillion. Compared to: – Credit card debt = $854 billion. – Auto loan debt = $877 billion. • Average student loan debt is approx. $30,000. • Financial stress is one of the top reasons for students leaving college prior to completing their education. • CDR change from 2-year rate to a 3-year rate. 5 BUILDING THE PROGRAM Who needs to Be Involved • Implementing alone can be difficult • Identify the key stakeholders – Who/what areas benefit from financial education • Or suffer from a lack of it – Stakeholders will vary from campus to campus • Look for overlapping areas – the sweet spot Student Loan Indebtedness Students Financial Aid Office 7 Alumni Office Potential key stakeholders • Admissions • Enrollment/Retention • Orientation/First-Year Experience • Financial Aid • Academics/Academic Services – Course curriculum, academic advising, Higher Education Opportunity Programs, summer bridge 8 • Career Development/Services • Administration – President’s office, business office • Support Services – TRIO, Upward Bound, EOPS • Alumni Services • Accrediting Organizations What is needed on my campus • Ways to determine the most important financial literacy issues on your campus – Check with student-led organizations – Talk with other departments like financial aid, housing, advising, alumni and retention – Survey students directly 9 Create a Hub or Single Point of Contact • For example, IUPUI Financial Wellness Committee – Led by Marvin Smith, Director of Student Financial Services – Representation by numerous stakeholder offices • • • • • • • Financial aid Student advising Student housing Student government Undergraduate and graduate programs Faculty Office of Financial Literacy – Significantly reduces silos/stovepipes; the barriers to communicating across the institution 10 Start Small, Build Up • Focus on the most important outcome(s) • Focus on what will impact the most number of stakeholders Student Loan Indebtedness Students Financial Aid Office 11 Alumni Office How can I apply this? • Assess the need – all stakeholders, instructional need • Clearly and specifically define the goals and objectives of the lesson, course, presentation… – Start with goals, then assessment and finally methods • Remember the learners’ perspective – What is driving them, make it relevant • Design, implement, evaluate, repeat…. 12 Classes, Workshops, Forums, Oh My! • Biggest lesson learned – Just because you build it, doesn’t mean they’ll come. • Choose delivery methods that work best for you and your students. • Variety is key – Meets the needs of different types of learners 13 Classes, Workshops, Forums, Oh My! • Formal admissions process • Freshman orientation programs • First year experience courses • Individual course work/ assignments • Incorporated into program of study • Financial aid application process 14 • SAP appeals • Peer mentor programs • Electronic newsletter/ targeted emails • Group presentations/ workshops • Summer bridge programs for high school students • Student Success Programs Classes, Workshops, Forums, Oh My! • Office of Financial Literacy – Phil Schuman, Director – Money$marts web site • FWC & SFS Leadership • For credit class – Hybrid & Online – Same design • Except for in-class portion – – – – – Pre/post-Tests End of course survey Launched Fall 2013 FWC key to promoting 306 so far, 88 started 1/12/15 • Silos reduced or removed! 15 SLO’s for F151 • Upon successful completion of this course students will be able to: – Identify the benefits of using personal financial planning techniques to manage finances. – Measure risk and return and explain the trade-off between risk and return in personal finance decisions – Describe how to establish and maintain good credit – Establish a strategy for monitoring and defending their financial identity – Identify and evaluate the components of a financial aid package to make informed decisions regarding the acceptance of financial aid and the taking out of student loans. 16 Make It Relevant • Topics of interest according to research – Saving and investing for the future – Getting ahead financially after graduation – Avoiding credit problems and ID theft – Budgeting income and expenses – Financial aid and student loans 17 Make It Relevant • Find ways to relate training to topics that matter to students – Ways to save money on campus – Skills needed to make financial decisions students are being asked to make • loans, food, housing, transportation • Teach the concept, show an example and then have the students apply – Exercises can be simple and still teach life long financial management and problem solving skills 18 EVALUATING THE PROGRAM/IMPACT Why Measure • Track progress towards goal(s) identified when building the program • Assess effectiveness of program and make improvements • Challenges: – “Doing no harm” does not equal “doing good” – Difficult to prove scientifically (attribution vs. contribution) • Solution: look for leading indicators — knowledge, attitudes and behaviors 20 What to Measure • What have others done? — Use national datasets – Numerous school and program specific research studies – Some nationwide research on the state of financial literacy – Very few nationwide research on effectiveness • What can you do? — Learning value chain – – – – – 21 Input: volume and exposure Reaction: satisfaction Learning: knowledge and ability Attitude: planned actions Application: changes in behavior Kirkpatrick’s Four Levels of Evaluation 22 Kirkpatrick, D. L. & James D. Kirkpatrick. (2006). Evaluating training programs: The four levels, 3rd ed. San Franciso: Berrett-Koehler The Learning Value Chain - Simplified Level Measurement Focus Key Questions Input - 0 Volume and exposure to materials How many participants? What topics were presented? Reaction - 1 Satisfaction with program Was the program relevant, important and useful at this time? Learning - 2 Knowledge and ability to apply newly learned skills Did participants increase or enhance knowledge, skills or perceptions and have confidence to use them? Attitude and Planned Action - 2 Participant planned actions What’s one thing you plan to do differently related to managing your finances after receiving this training? Application - 3 Changes in behavior What did you do differently after related to managing your finances after receiving the training? Impact - 4 Impact Did it impact the bottom line? Did you meet your ultimate goal? 23 What to Measure • Leading indicator examples: – Number of borrowers and borrowed amounts. • Indiana University – 12% decrease in borrowing from 201213 to 2013-14. – Number of SAP appeals (repeat vs. new). – Number of students retained from year to year. • Discussion – What data might you have at your disposal that contains leading indicators? – What new data could you collect? Remember to make it measurable! 24 How to Measure • Again, review the SLO’s identified when building the program – Implement assessment methods that will measure whether or not the SLO’s were met • Pre-test and post-test • End of course survey – Self reported data, but is still a good way to measure • Student surveys at set times after the course, workshop or other training/teaching event • Grades – Information can also be used to fine tune the instructional methods 25 I would recommend this course to other students. Hybrid (26) Online (39) 25 25 20 20 15 15 10 10 5 5 0 0 Because of this course I am better able to manage my personal finances. Hybrid (26) 14 12 10 8 6 4 2 0 Online (39) 25 20 15 10 5 0 I can develop and use a budget to plan for and keep track of my income vs. expenses. Hybrid (26) 16 14 12 10 8 6 4 2 0 Online (39) 25 20 15 10 5 0 I understand my student loan repayment options and how to select one that fits my financial situation. Hybrid (26) 16 14 12 10 8 6 4 2 0 Online (39) 20 18 16 14 12 10 8 6 4 2 0 Example Results: Life Skills • Nearly 728,000 courses completed by more than 214,000 students. • Average post-course assessment score: 88% • Immediate post-course survey (approx. 104,000 surveys): – Average student rating for usability, relevance and satisfaction: 4.2 out of 5 – Average knowledge before: 3.4 – Average knowledge after: 4.4 – Intent to change behavior: 94% 30 Example Results: Life Skills • Follow-up survey (approx. 13,300 surveys): – 90% reported making a positive change in behavior • Top behavior changes reported: – I consider if an item is a need or want before purchasing it and spend less on wants. – I established educational, financial and/or career goals. – I researched and understand the requirements to complete my program of study. – I avoid taking on additional debt unless I am sure I can afford the payments. – I spend more time on activities that help me achieve my educational, financial and career goals. 31 DISCUSSION/Q&A Contact Info Michele Wedel, Adjunct Instructor Kelley School of Business, IUPUI (317) 306-1769 mwedel@iupui.edu Sara Wilson, USA Funds (317) 806-0140 Sara.Wilson@usafunds.org 33