Statement of Cash Flows

advertisement

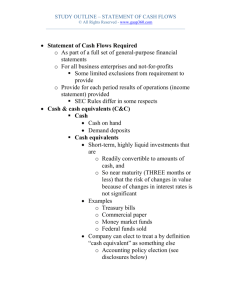

Statement of Cash Flows --Part 1 Overview • Purpose of the statements of cash flows • Classification of cash flows • Preparation of Statement of Cash Flows Terminology • Cash? Cash on Hand Demand Deposits Cash Equivalents: short-term, highly liquid investments. • Cash Flow? Cash flows are inflows and outflows of cash and cash equivalents. The purpose of the Statement of Cash Flows • The Statement of Cash Flows provides information about cash receipts, cash payments and the net change in cash • It helps to answer the following questions: Where has the entity spent the cash? Where did it receive cash from during the period? What has been the change in the cash balances? What can the entity generate in terms of future cash flow? Cash Sources (Inflows) Uses (Outflows) 1.Receive Revenue 1.Pay Expenses Operating Activities 2.Sale of long-term assets 2.Purchse of long term assets Investing Activities 3.Investment by the owners 3.Withdraw by the owners/Dividends 4.Long-term borrowing 4.Repayment of long-term debts Financing Activities Classification of Cash Flows Cash flows from operating activities Cash flows arising from providing goods and services and that are not classified as financing or investing activities (NZ IAS 7.6). The cash flows generally arise from transactions affecting the Income Statement. Examples include: Cash receipts from the sale of goods and services, the payment to suppliers for goods and services, payment to employees (wages). Classification of Cash Flows Cash flows from investing activities Cash flows arising from the purchase and sale of long-term assets and other investments (not included in cash equivalents) (NZ IAS 7.6.). Examples include: cash receipt (payments) from the sale (purchase) of property plant and equipment. Classification of Cash Flows Cash flows from financing activities Cash flows arising from the activities relating to owners contributed equity and borrowings. (NZ IAS 7.6). Examples include: Cash received from obtaining a loan ; Cash paid to repayment of a loan; Obtaining cash from shareholders; Paying dividends. Exercise For each of the following transactions indicate: (a) in the first column if the transaction is a receipt or payment of cash, and (b) in the second column, classify the cash transaction as operating, investing or financing. Transaction Wages paid Received interest Advertising expense paid Paid dividends Cash sales Paid commission Interest paid on loan Increased loan Issued shares for cash Sold goods on credit Paid for shop fittings Owner took goods for own use Paid creditors Cash purchases Credit purchases Owner invested cash Sold delivery van Loss on sale of delivery van Credit sales Received payment on account Bad debts Depreciation expense Cash drawings Receipt / Payment Operating / Investing / Financing Classification of interest , dividends paid and received • Interest paid can be classified as cash outflow from operating activities because it is included in the determination of the income statement OR it can be treated as financing cash flows because interest is a cost of obtaining funds ( NZIAS 7. 33). • Interest and dividends received can be classified as cash inflow from operating activities because they are included in the determination of the income statement OR they can be treated as cash inflow from investing activities because they are returns on investments ( NZIAS 7. 33). • • Dividends paid can be treated as cash outflows from financing activities because they are party of the cost of obtaining funds for the business. However, IAS 7.34 also allows dividends paid to be classified as operating cash flows as they enable users to assess the ability of the entity to pay dividends out of cash flows from operations. Classification of interest , dividends paid and received • Interest paid and received – operating activities • Dividends received – operating activities • Dividend paid – financing activities Format of Cash Flow Statement Cash flow from operating activities – Cash receipts – Cash payments Net cash flow from operating activities Cash flow from investing activities – Cash receipts – Cash payments Net cash flow from investing activities Cash flow from financing activities – Cash receipts – Cash payments Net cash flow from financing activities Net increases (decrease) in cash Cash at beginning of period Cash at end of period Preparation of Cash Flow Statement • Information required • A balance sheet for two consecutive accounting periods so that changes in asset, liability and equity accounts can be identified. • The income statement covered between the two balance sheet periods • Additional data relating to particular transactions. The steps to undertake in preparing the Statement of Cash Flow Step 1 Determine the net increase /decrease in cash for the period. Step 2 Determine cash flows from operating activities. Step 3 Determine cash flows from investing activities Step 4 Determine cash flows from financial activities Step 5 Complete the Statement of Cash Flows Cash flow from operations Cash flow from operations can be determined using two methods: 1. Direct Method This method requires reporting the major classes of operating cash receipts – such as cash from customers; and major classes of operating payments such as payments to suppliers, to employees and the government for tax. The direct method is shown above. 2. Indirect Method This method takes operating profit after tax which has been determined on an accrual basis and makes adjustments for non-cash items such as deprecation and movements in working capital items to determine cash flow form operations. IAS 7.20.1 requires the Statement of Cash Flows to be prepared by the direct method. However, the indirect method is used to reconcile net profit or loss with cash flows from operating activities which is required by IAS 7.. Step 2 cash flows from operating activities Cash receipts from operations Cash payments from operations For sale of goods and services to customers For supplies Interest and dividends from investments For employees For operating expenses For interest For taxes Cash from Customers Accounts Receivable Date Particulars Opening balance (incl GST) Credit Sales (incl GST) Amount Date Particulars Sales returns (incl GST) Bad Debts (incl GST) Discount Allowed (incl GST) Receipts from customers (incl GST) Closing balance Cash Received from Credit Customers + Cash Received From Cash Customers = Total Cash Received From Customers Amount QUESTIONS For each of the following, calculate the cash receipts from customers. (a) Accounts Receivable Sales (all credit) Bad debts Year 2 17,000 325,000 1,500 Year 1 14,500 Accounts Receivable Sales (cash) Sales (credit) Year 2 9,845 108,000 143,000 Year 1 10,770 Accounts Receivable Sales (cash) Sales (credit) Bad debts Discount allowed Year 2 11,230 200,450 123,560 3,240 6,480 Year 1 10,900 (b) (c) Cash paid to suppliers Cost of Goods Sold Plus: Ending Inventory Less: Opening Inventory = Purchases from Suppliers Add: Opening Accounts Payable Less : Closing Accounts Payable = Cash payments TO SUPPLIERS • QUESTIONS Calculate the payments to suppliers: Cost of sales - $429,800 Opening inventory - $39,200 Closing inventory - $25,600 Accounts Payable at beginning - $42,600 Accounts Payable at end - $21,000 Cash payments for expenses: adjusting for prepaid expenses Expense from Income Statement Less: Opening Prepayments Plus: Closing Prepayments = Cash payment for EXPENSE Cash payments for expenses: adjusting for accrued expenses Expense from Income Statement Plus: Opening Accrued Expense Less: Closing Accrued Expense QUESTIONS (a) Total operating expenses as shown in the Income Statement for the year ended 31 March 2005 were $130,500. Prepaid expenses at the beginning and at the end of the year were $20,000 and $35,000 respectively. Accrued expenses at the end of the year were $8,350. Work out the payments for operating expenses for the year ended 31 March 2005. (b) Calculate the tax payments for the year, based on the information provided below: Tax expense $22,000 Tax Payable: Beginning balance $16,000 Ending balance $19,000 Step 3 Determine cash flows from investing activities • One of the main investing activities is the purchase and sale of property plant and equipment. The relevant cash flows are the cash paid to acquire the asset and the cash proceeds from selling an asset. This will require reconstructing the PPE asset and Accumulated Deprecation accounts. QUESTIONS (a) Modern Enterprises had the following balance sheet amounts: Plant and Equipment Accumulated Depreciation 31 March 2004 $550,000 64,000 31 March 2005 $640,000 79,000 During the year ended 31 March 2005, the depreciation charge relating to plant and equipment was $20,000. Plant that cost $60,000 and had been depreciated by $5,000 was sold for $42,000. Required: 1. Determine the profit or loss on sale of the plant. 2. Determine the amount paid for new plant. (b) Calculate the cash received on disposal of plant and machinery, based on the following information: Plant and Machinery, at cost - opening balance $800,000 - closing balance $1,100,000 Accumulated depreciation: - opening balance $400,000 - closing balance $470,000 Gain on sale of Machinery - $8,000 New machinery purchased during the year - $370,000 Depreciation charge for Plant and Machinery for current year - $120,000 Step 4 Determine cash flows from financial activities QUESTIONS The following balances were taken from the books of Allendale Ltd: Bank Loan Capital Retained Earnings 31 Dec 2004 $50,000 90,000 115,000 31 Dec 2003 $100,000 70,000 82,000 Profit for the year ended 31 December 2004 was $95,000. Required: 1. Determine the dividend paid during the year. 2. Prepare an extract from the Cash Flow Statement to show cash flows from financing activities. Cash flow from financing activities Cash was provided from: Issue of shares $20,000 Cash was applied to: Repayment of bank loan ($50,000) Payment of Dividend (62,000) 112,000 Net cash outflow from financing activities ($92,000) Step 5 Complete the Statement of Cash Flows This step requires completing the cash flow statement ensuring the net increase in cash plus the opening position equals the closing cash position.