Latin America*s Road to Inflation Targeting

advertisement

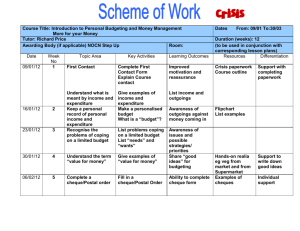

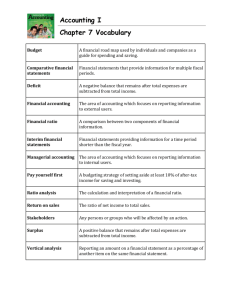

Saving for Growth: New Views on an Old Latin American Debate Augusto de la Torre and Alain Ize Center for Global Development Washington, DC February 2015 Chief Economist Office Latin America and the Caribbean Region The World Bank 1 After seven magnificent years, LAC is back to low growth LAC: Real GDP Growth 2 To address the new reality, LAC will need to save more… We find aggregate demand composition (saving) to matter for growth… Growth is not just about supply (investment prospects, productivity…) Foreign and domestic saving are not perfect substitutes …through three key channels The real exchange (ER) rate channel (external competitiveness effect) The real interest rate (IR) channel (sustainability effect) The endogenous saving (ES) channel (saving-follows-growth effect) These findings, which deviate from the conventional neoclassical view,… That saving matters neither for growth nor for the real exchange rate That growth leads to lower saving …reflect frictions that limit factor (especially capital) mobility and help reconcile macro theory with well established observations Hence, this is essentially a middle income country feature The policy implications are relevant to LAC … but fraught with tensions 3 We are dealing with an old yet largely unsettled debate The correlation between domestic saving and growth is undisputed… Faster growth generally requires higher investment (it is not all TFP…) Higher investment implies higher domestic saving – as per the Feldstein-Horioka puzzle (1980) of observed high correlation of S & I at country level … what is hotly debated is the direction of causality… “… no support for the view that domestic saving is the binding constraint to economic growth…” [saving follows growth] (Rodrik, 2000) “Countries whose productivity falls behind are countries that ‘tax’ saving…” [rationale for the “allocation paradox”] (Gourinchas & Jeanne, 2011) … and how to reconcile theory with observation and policy concerns Consistent with observation (Prasad et al., 2007), policy makers worry that low saving and CA deficits can undermine growth But conventional open-economy growth models treat domestic and foreign savings as perfect substitutes and, hence, capital as perfectly mobile… … contrary to the observed large and persistent productivity dispersion 4 Exploring the links between saving and growth 5 ER channel: works via the current account, external competitiveness, and tradable vs. nontradable production Positive learning externalities bs SD • • • • • • • bg e be be bi I d g Suboptimal saving (excess expenditure over income) appreciates the real exchange rate because T (imports) respond elastically at given world prices while the price of NT rises, given inelastic supply. The real appreciation lasts because frictions limit inter-sectorial and inter-national factor mobility. The real appreciation hinders growth inasmuch as a smaller T sector generates less learning externalities. National saving is suboptimal because externalities are not internalized. NB1: The frictions that limit factor mobility also limit the substitutability between foreign and domestic saving, which is why domestic saving matters for the real exchange rate and, hence, growth. NB2: SD and e reinforce each other (endogeneity and multiplier effect). NB3: Whether the current account deficit widens due to low saving or high investment matters for growth— the difference depends on d. 6 IR channel: works via the capital account, domestic vs. foreign saving, and the sovereign risk rating Positive learning externalities e SD gr ge I gr gi r d g gg Negative crises externalities • • • Ex ante: sub-optimal saving raises the interest rate via BOP deficits and the sovereign risk premium • The risk premium rises as collateral constraints increase default risk, thereby limiting capital mobility • A higher risk premium depresses growth through a higher cost of capital Ex post: sub-optimal saving endangers external debt viability => BOP crisis => negative growth externalities NB1: sub-optimal saving drags down growth even though it depreciates the real exchange rate 7 ES channel: works through the multiplier effect of the responsiveness of domestic saving to growth Positive learning externalities bg e SD be be bi ge gr I gr gi r d g gg Negative crises externalities a • • • Multiplier effect Saving is growth elastic because frictions (e.g., collateral constraints) prevent inter-temporal smoothing. The responsiveness of saving to growth introduces a multiplier effect. 8 If the multiplier effect is large enough (ad >1) => growth would self-propel and SD policy would not matter Empirical results: growth effects of saving are stronger for middle-income countries with BOP deficits Strong fit for MICs, weaker fit for HICs and LICs Saving matters more at middle income stages of development Significant asymmetries CA deficits matter more for e and r than surpluses Saving for growth implies avoiding chronic CA deficits Sizable impacts under IV estimates + 10 pp SD => 1.5 pp higher g Should be even higher for CA < 0! Structural Form High Income Middle Income 0.0387** 0.0283** Low Income 0.00788 IV CA>0 0.07** 0.107*** 0.0567+ 1.05 0.0296 -0.349** -0.781 -0.4+ -0.328*** -0.0332 -0.320*** 0.0330 (-0.3) -1.411*** -1.411*** -1.645* -1.286* 0.146 -1.4+ γr 0.0222 -0.0913*** -0.0367 -0.121*** 0.0257 (0) γe 0.218*** 0.218*** 0.388*** 0.137* 0.143 (0) γI 0.266*** 0.266*** 0.167 0.270*** 0.305+ (0) γg 1.049*** 1.049*** 2.174+ 0.884* 0.836 2.8** δ 3.114*** 3.114*** 1.482** 3.256*** 2.237* (3.1) 0.08 0.15 0.04 0.19 0.00 1.54 α CA>0 0.0227** CA<0 0.0227** βe 0.0804+ 0.182*** 0.0119 βS -0.379*** -0.379*** βI -0.328*** βg Impact *** p<0.01, ** p<0.05, * p<0.1, + p<0.2 Notes: Statistical significance is reported for country clustering. The standard deviations for the IV estimation are calculated using the suest and nlcom Stata routines. Impact measures the growth respnse (in percentage points) to a 10 percent of GDP increase in the saving ratio. 9 On average, the world as a whole follows an ER pattern, but deviations likely reflect an IR pattern Domestic Saving and Real Exchange Rate Gaps, 1981-2011 10 ER pattern: high savers are undervalued and grow faster Under-saving Saving Gap Over-saving Average Gaps by Quadrant for the Whole Sample (1981-2011) Undervalued Overvalued Real Exchange Rate Gap 11 IR pattern: under-savers with BOP sustainability problems (as proxied by the country ratings) are undervalued Under-saving Saving Gap Over-saving Average Gaps by Quadrant for the Whole Sample (1981-2011) Undervalued Overvalued Real Exchange Rate Gap 12 Undervaluation is good for growth, overvaluation is not Under-saving Saving Gap Over-saving Average Gaps by Quadrant for the Whole Sample (1981-2011) Undervalued Overvalued Real Exchange Rate Gap 13 Saving also matters for future growth (investment) Under-saving Saving Gap Over-saving Average Gaps by Quadrant for the Whole Sample (1981-2011) Undervalued Overvalued Real Exchange Rate Gap 14 Where is LAC? 15 LAC stayed for a long time under the IR spell (under-saver – undervalued)… Domestic Saving and Real Exchange Rate Gaps, 1981-2011 2 1 National Saving EAP ECAMNA 0 HI LAC1 SSA LAC2 -1 -2 -1 -0.5 0 Real Exchange Rate 0.5 1 ●LAC1 Countries per Period ♦LAC1 1990-2011 Average ●LAC2 Countries per Period ♦LAC2 1990-2011 Average ♦Other groups of countries 1990-2011 Average ●Other countries per Period 16 …which reflected LAC’s past history of low sovereign ratings and chronic macro-financial problems Domestic Saving and Sovereign Rating Gaps, 1981-2011 2 1 National Saving EAP ECA MNA 0 SSA LAC1 HI LAC2 -1 -2 -1 -0.5 0 Country Rating 0.5 1 ●LAC1 Countries per Period ♦LAC1 1990-2011 Average ●LAC2 Countries per Period ♦LAC2 1990-2011 Average ♦Other groups of countries 1990-2011 Average ●Other countries per Period 17 Thus, LAC grew slowly despite competitive exchange rates… Real Exchange Rate and Growth Gaps, 1981-2011 10 GDP per capita Growth 5 ECA EAP LAC1 0 MNA SSA LAC2 HI -5 -10 -1 -0.5 0 Real Exchange Rate 0.5 1 ●LAC1 Countries per Period ♦LAC1 1990-2011 Average ●LAC2 Countries per Period ♦LAC2 1990-2011 Average ●Other countries per Period ♦Other groups of countries 1990-2011 Average 18 … but there was substantial heterogeneity within LAC… Saving and Real Exchange Rate Gaps for LAC1 Countries, 1990-2011 Averages 0.5 VEN ER/HS CHL IR/HS PAN ARG MEX PER 0 ER / LS National Saving ECU URY IR/LS COL BAH BRA TTO -0.5 BAR ER/LS CRI -1 -0.4 -0.2 0 0.2 Real Exchange Rate 19 …resulting in contrasting macroeconomic performances of the ER low and high savers, matching the ER priors Policy-Adjusted Gaps for High and Low Saver LAC1 Countries, 1981-2011 Panel A. National Saving Gaps Panel C. Real Exchange Rate Gaps Panel G. GDP per capita Growth Gaps Panel D. Country Rating Gaps 20 LAC moved to the ER pattern in the last decade, reflecting large real appreciations and improved country ratings Saving and Exchange Rate Gaps for LAC1 Countries, 2004-2011 Averages 0.5 ARG VEN PAN TTO 0 CRI National Saving PER CHL ECU MEX BAH URY COL BRA -0.5 -1 BAR -1.5 -0.5 0 Real Exchange Rate 0.5 21 Final thoughts 22 A saving mobilization agenda should make sense for many LAC countries Demand appears to also matter for growth, but not in the Keynesian way LAC countries with substantial, recurrent CA deficits should save more to grow faster… … which should in now way distract from sorely needed supply-side and enabling environment (rule of law) reforms Raising saving is within the reach of policy… It can be done via fiscal, financial, and safety net reforms 23 However, it won’t be easy It will take time, requiring perseverance Difficult tensions will need to be managed Macro conflict between short-term and long-term growth objectives • Switch towards a “tighter fiscal looser monetary” policy mix • Tilt public investment in favor of investment Distributional conflict – who will consume less? Current weak world demand and easy liquidity make things even trickier The combination of higher country ratings in LAC and markets willing to finance CA deficits can boost the adverse impacts of the ER channel 24 Thank you 25