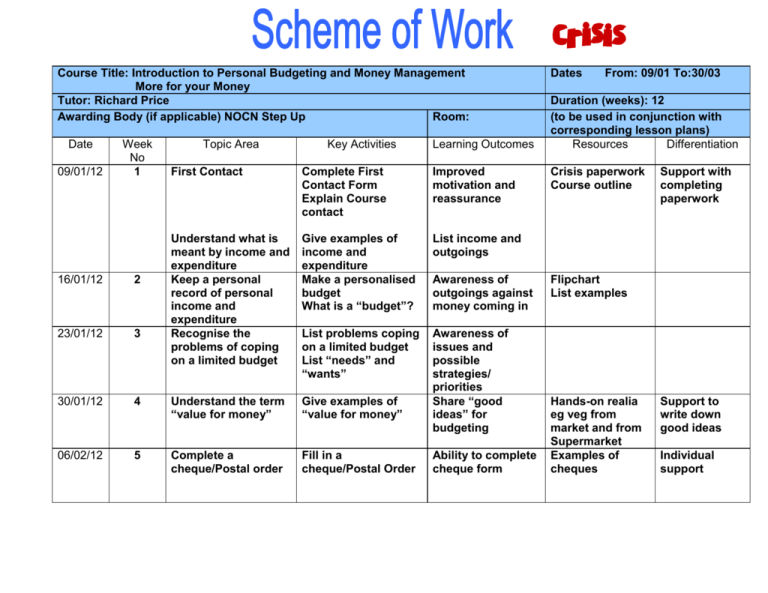

More for your Money

advertisement

Course Title: Introduction to Personal Budgeting and Money Management More for your Money Tutor: Richard Price Awarding Body (if applicable) NOCN Step Up Room: Date 09/01/12 Week No 1 Topic Area Key Activities Learning Outcomes First Contact Complete First Contact Form Explain Course contact Improved motivation and reassurance Understand what is meant by income and expenditure Keep a personal record of personal income and expenditure Recognise the problems of coping on a limited budget Give examples of income and expenditure Make a personalised budget What is a “budget”? List income and outgoings List problems coping on a limited budget List “needs” and “wants” Awareness of issues and possible strategies/ priorities Share “good ideas” for budgeting 16/01/12 2 23/01/12 3 30/01/12 4 Understand the term “value for money” Give examples of “value for money” 06/02/12 5 Complete a cheque/Postal order Fill in a cheque/Postal Order Awareness of outgoings against money coming in Ability to complete cheque form Dates From: 09/01 To:30/03 Duration (weeks): 12 (to be used in conjunction with corresponding lesson plans) Resources Differentiation Crisis paperwork Course outline Support with completing paperwork Flipchart List examples Hands-on realia eg veg from market and from Supermarket Examples of cheques Support to write down good ideas Individual support 13/02/12 6 Recognise the key information on a receipt and pay slip Identify key items on a receipt/pay slip/bill/ financial documents Full knowledge of key information – subtotals, totals Examples of bank Understanding statements/ of individual Receipts/bills receipts for personal use 20/02/12 7 Understand what saving means Encouragement to start saving Details of saving accounts from banks/PO etc Individual savings plan 27/02/12 8 Produce a simple budget plan State what saving means Give two examples of saving schemes How could make savings? Produce a simple and realistic personal budget for the future Keep a record of personal spending Produce a budget and use it everyday Outlines of budgets Individual budget plan tailored to individuals 05/03/12 9 Accessing and Managing a bank a/c List different types of bank accounts Decide which a/c would suit needs Advertising from banks/financial institutions Help understanding official documentation /terms 12/03/12 10 Understanding and accessing benefits Access government website/Jobcentre Benefit Agency 19/03/12 11 Complete folders