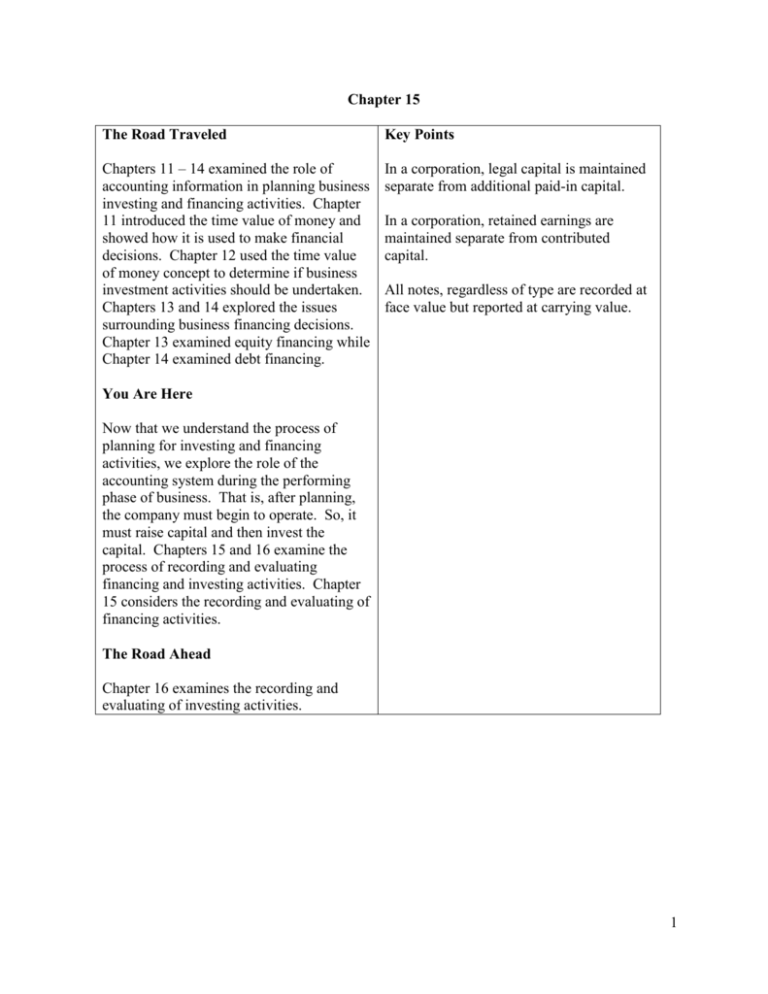

Chapter 15

advertisement

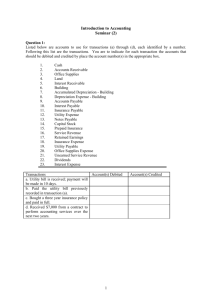

Chapter 15 The Road Traveled Key Points Chapters 11 – 14 examined the role of accounting information in planning business investing and financing activities. Chapter 11 introduced the time value of money and showed how it is used to make financial decisions. Chapter 12 used the time value of money concept to determine if business investment activities should be undertaken. Chapters 13 and 14 explored the issues surrounding business financing decisions. Chapter 13 examined equity financing while Chapter 14 examined debt financing. In a corporation, legal capital is maintained separate from additional paid-in capital. In a corporation, retained earnings are maintained separate from contributed capital. All notes, regardless of type are recorded at face value but reported at carrying value. You Are Here Now that we understand the process of planning for investing and financing activities, we explore the role of the accounting system during the performing phase of business. That is, after planning, the company must begin to operate. So, it must raise capital and then invest the capital. Chapters 15 and 16 examine the process of recording and evaluating financing and investing activities. Chapter 15 considers the recording and evaluating of financing activities. The Road Ahead Chapter 16 examines the recording and evaluating of investing activities. 1 DISCUSSION OUTLINE Chapter 15’s discussion should focus on the different types of accounts used corporations to record equity financing activities. This discussion should tie back to Chapter 13 when we planned corporate ownership. Then we switch gears as we focus on recording and communicating debt financing. This discussion should tie back to Chapter 14 when we planned debt financing activities. In Chapters 13 and 14 we planned financing activities. How does Chapter 15 add to that discussion? Chapter 15 adds another piece to the puzzle as we learn how financing activities are recorded and reported. 2 Lecture Examples 1. XYZ Company is authorized to issue 500,000 shares of $1 par value common stock and 100,000 shares of 8 percent, $10 par value cumulative preferred stock. The events listed below occurred during the first 2 years of the corporation’s life. How are these events recorded and reported? Year 1 Events: Issued 25,000 shares of common stock for $15 each. Issued 1,000 shares of preferred stock for $100 each. Issued 10,000 shares of common stock in exchange for a building valued at $200,000. Earned revenues of $150,000, incurred expenses of $80,000. Declared no dividends. Year 2 Events: Repurchased 2,000 shares of common stock at $15 per share to be held as treasury stock. Earned revenues of $150,000, incurred expenses of $120,000. Declared and then later paid dividends of $5,000 Year 1 Events: Cash 375,000 Common stock Paid-in capital in excess of par value (CS) Cash 100,000 Preferred stock Paid-in capital in excess of par value (PS) Building Common stock Paid-in capital in excess of par value (CS) Revenues Retained earnings Retained earnings Expenses Income Statement: Net income, $70,000 Balance Sheet (owners’ equity): Common stock Preferred stock Paid-in capital in excess of par value (CS) Paid-in capital in excess of par value (PS) Retained earnings Total stockholders’ equity Statement of Cash Flows: Financing cash Cash received from stock issuances 25,000 350,000 10,000 90,000 200,000 10,000 190,000 150,000 150,000 80,000 80,000 $ 35,000 10,000 540,000 90,000 70,000 $745,000 $475,000 3 Year 2 Events: Treasury stock Cash Revenues Retained earnings Retained earnings Expenses Retained earnings Dividends payable (PS) Dividends payable (CS) (PS: 1,000 * $10 * .08 * 2) (CS: $50,000 - $16,000) Dividends payable (PS) Dividends payable (CS) Cash 30,000 30,000 150,000 150,000 120,000 120,000 5,000 1,600 3,400 1,600 3,400 5,000 Income Statement: Net income, $30,000 Balance Sheet (owners’ equity): Common stock $ 35,000 Preferred stock 10,000 Paid-in capital in excess of par value (CS) 540,000 Paid-in capital in excess of par value (PS) 90,000 Retained earnings 95,000* Less: Treasury stock (30,000) Total stockholders’ equity $740,000 *$70,000 + $150,000 - $120,000 - $5,000 = $95,000 Statement of Cash Flows: Financing cash Cash paid for treasury stock $ 30,000 Cash paid for dividends 5,000 4 2. Periodic Payment Note (see amortization table). Assume a December 31 Year-End On October 1, your company borrows $100,000 cash at 12 percent interest for 5 years. You will make monthly payments of interest and principal. Make journal entries for the first year and indicate how these events affect the financial statements. PV = 100,000, FV = 0, r = 12, c = 12, n =60, PMT = $2,224.44 10-1 Cash Installment note payable 11-1 Interest expense Installment note payable Cash 12-1 Interest expense Installment note payable Cash 12-31 Interest expense Installment note payable Cash* *Payment made 1 day early 100,000.00 100,000.00 1,000.00 1,224.44 2,224.44 987.76 1,236.68 2,224.44 975.39 1,249.05 2,224.44 Income Statement: Interest expense, $2,963.15 Balance Sheet: Installment note payable, $96,289.83 Statement of Cash Flows: Financing cash, + $100,000; - $3,710.17; Operating cash, - $2,963.15 5 3. End Lump-sum Payment Note (see amortization schedule). Assume December 31 Year- On April 1, your company issues a 5-year noninterest-bearing note payable with a face value of $200,000. The market rate of interest is 9 percent. Make journal entries for the first year and indicate how these events affect the financial statements. FV= 200,000, PMT = 0, r = 9, c= 1, n = 5, PV = $129,986.28 4-1 Cash Discount on notes payable Noninterest-bearing note payable 12-31 Interest expense (11,698.77 *9/12) Discount on notes payable 129,986.28 70,013.72 200,000.00 8,774.07 8,774.07 Income Statement: Interest expense, $8,774.07 Balance Sheet: Noninterest-bearing note payable, $138,760.35 Statement of Cash Flows: Financing cash, + $129,986.28 Note: Entry on 12-31-Y2 Interest expense Discount on notes payable 12,488.43 12,488.43 ($11,698.77 * 3/12 = $2,924.69 and $12,751.65 * 9/12 = $9,563.74; $2,924.69 + $9,563.74 = $12,488.43) 6 4. Bonds (see amortization schedule). Assume December 31 Year-End Your company issues 20-year bonds with a face value of $200,000 on April 1. The face rate of interest of 12 percent is paid semiannually on April 1 and October 1. The market rate of interest is 10 percent when the bonds are issued. Make journal entries for the first year and indicate how these events affect the financial statements. PMT = 200,000 * .12 * ½ = 12,000, FV = 200,000, c = 2, r = 10, n = 40, PV = $234,318.17 4-1 Cash 10-1 Premium on bonds payable Bonds payable Interest expense Premium on bonds payable Cash 234,318.17 34,318.17 200,000.00 11,715.91 284.09 12,000.00 12-31 Interest expense (11,701.70 * 3/6) 5,850.85 Premium on bonds payable 149.15 Interest payable Income Statement: Interest expense, $17,566.76 Balance Sheet: Interest payable, $6,000.00 Bonds payable, $233,884.93 Statement of Cash Flows: Financing cash, + $234,318.17 Operating cash, - $12,000.00 6,000.00 Note: Entry on 4-1-Y2 Interest expense Interest payable Premium on bonds payable Cash 5,850.85 6,000.00 149.15 12,000.00 7