Corporations

Chapter 13 - Corporations: Organization, Stock Transactions, and Dividends

After studying this chapter, you should be able to:

1.

2.

3.

Describe the nature of the corporate form of organization.

Describe the two main sources of stockholders’ equity.

Describe and illustrate the characteristics of stock, classes of stock, and entries for issuing stock.

4.

Journalize the entries for cash dividends and stock dividends.

5.

6.

7.

Journalize the entries for treasury stock transactions.

Describe and illustrate the reporting of stockholders’ equity.

Describe the effect of stock splits on corporate financial statements.

1

Objective 1

Describe the nature of the corporate form of organization.

13-1 A

corporation

is a legal entity, distinct and separate from the individuals who create and operate it. As a legal entity, a corporation may acquire, own, and dispose of property in its own name.

The

stockholders

or

shareholders

who own the stock own the corporation. Corporations whose shares of stock are traded in public markets are called

public corporations

.

2

Corporations whose shares are not traded publicly are usually owned by a small group of investors and are called

nonpublic

or

private corporations

. The stockholders of all corporation have

limited liability

.

13-1 The stockholders control a corporation by electing a

board of directors

. The board meets periodically to establish corporate policy. It also selects the chief executive officer (CEO) and other major officers.

3

Exhibit 1 Organizational Structure of a Corporation

Stockholders Board of Directors Officers Employees 13-1

4

Advantages of the Corporate Form

A corporation exists separately from its owners.

A corporation’s life is separate from its owners; 13-1 therefore, it exists indefinitely.

The corporate form is suited for raising large amounts of money from stockholders.

A corporation sells shares of ownership, called stock. Stockholders can transfer their shares of stock to other stockholders.

A corporation’s creditors usually may not go beyond the assets of the corporation to satisfy their claims.

5

Disadvantages of the Corporate Form

Stockholders control management through a board of directors.

As a separate legal entity, the corporation is subject to taxation. Thus, net income distributed as dividends will be taxed at both the corporate and individual levels.

Corporations must satisfy many regulatory requirements.

13-1

6

Organization Structure of a Corporation

Costs may be incurred in organizing a corporation. The recording of a corporation’s organizing costs of $8,500 on January 5 is shown below: 8 500 00 Jan. 5 Organizational Expense Cash Paid costs of organizing the corporation.

8 500 00 13-1

7

Objective 2

13-2

Describe the two main sources of stockholders’ equity.

The owner’s equity in a corporation is called

stockholders’ equity

,

shareholders’ equity

,

shareholders’ investment

, or

capital

.

The two sources of capital found in the Stockholders’ Equity section of a balance sheet are

paid-in capital

or

contributed capital

(capital contributed to the corporation by stockholders and others) and

retained earnings

(net income retained in the business).

8

Stockholders’ Equity Section of a Corporate Balance Sheet

13-2

Stockholders’ Equity

Paid-in capital: Common stock Retained earnings Total stockholders’ equity $330,000 80,000 $410,000 If there is only one class of stock, the account is entitled

Common Stock

or

Capital Stock

.

A debit balance in

Retained Earnings

is called a

deficit

. Such a balance results from accumulated net losses.

9

Objective 3

13-3

Describe and illustrate the characteristics of stock, classes of stock, and entries for issuing stock.

The number of shares of stock that a corporation is

authorized

to issue is stated in the charter. A corporation may reacquire some of the stock that has been issued. The stock remaining in the hands of stockholders is then called

outstanding stock

.

Shares of stock are often assigned a monetary amount, called

par

. Corporations may issue

stock certificates

to stockholders to document their ownership. Some corporations have stopped issuing stock certificates except on special request.

Stock issued without a par is called

no-par stock

. Some states require the board of directors to assign a

stated value

to no-par stock.

10

Major Rights That Accompany Ownership of a Share of Stock

13-3 1.

2.

3.

The right to vote in matters concerning the corporation.

The right to share in distributions of earnings.

The right to share in assets on liquidation.

Two Primary Classes of Paid-In Capital

The two primary classes of paid-in capital are

common stock

and

preferred stock

. The primary attractiveness of preferred stocks is that they are preferred over common as to dividends.

11

E.g. A corporation has 1,000 shares of $4 preferred stock and 4,000 shares of common stock outstanding. The net income, amount of earnings retained, and the amount of earnings distributed are as follows: Net income Amount retained Amount distributed

2006

$20,000 10,000 $10,000

2007

$9,000 6,000 $3,000

2008

$62,000 40,000 $22,000 13-3

12

Issuing Stock

13-3 A corporation is authorized to issue 10,000 shares of preferred stock, $100 par, and 100,000 shares of common stock, $20 par. One-half of each class of authorized shares is issued at par for cash.

1,500 000 00 Cash Preferred Stock Common Stock Issued preferred stock and common stock at par for cash.

500 000 00 1,000 000 00

13

13-3 When a stock is issued for a price that is more than its par, the stock has sold at a

premium

. When stock is issued for a price that is less than its par, the stock has sold at a

discount

.

Premium on Stock

Caldwell Company issues 2,000 shares of $50 par preferred stock for cash at $55.

110 000 00 Cash Preferred Stock Paid-in Capital in Excess of Par—Preferred Stock Issued $50 par preferred stock at $55.

100 000 00 10 000 00

14

13-3 A corporation acquired land for which the fair market value cannot be determined. The corporation issued 10,000 shares of $10 par common that has a current market value of $12 in exchange for the land. 120 000 00 Land Common Stock Paid-in Capital in Excess of Par Issued $10 par common stock valued at $12 per share, for land. 100 000 00 20 000 00

15

No-Par Stock

13-3 A corporation issues 10,000 shares of no par common stock at $40 a share. Cash Common Stock Issued 10,000 shares of no par common stock at $40.

400 000 00 400 000 00

16

Objective 4

Journalize the entries for cash dividends and stock dividends.

13-4

Cash Dividends

A cash distribution of earnings by a corporation to its stockholders is called a

cash dividend

. There are usually three conditions that a corporation must meet to pay a cash dividend.

1.

Sufficient retained earnings 2.

Sufficient cash 3.

Formal action by the board of directors

17

Three Important Dividend Dates

13-4 First is the

date of declaration

. Assume that on December 1, Hiber Corporation declares a $42,500 dividend ($12,500 to the 5,000 preferred stockholders and $30,000 to the 100,000 common stockholders. Heber Corporation records the $42,500 liability on the declaration date.

Dec. 1 Cash Dividends Cash Dividends Payable Declared cash dividend.

42 500 00 42 500 00

18

Three Important Dividend Dates

The second important date is the

date of record

. For Hiber Corporation this would be December 10. No entry is required since this date merely determines which stockholders will receive the dividend. 13-4

19

Three Important Dividend Dates

The third important date is the

date of payment.

On January 2, Hiber issues dividend checks.

13-4 Jan. 2 Cash Dividends Payable Cash Paid cash dividend.

42 500 00 42 500 00

20

Stock Dividends

13-4

A distribution of dividends to stockholders in the form of the firm’s own shares is called a

stock dividend

.

On December 15, the board of directors of Hendrix Corporation declares a 5% stock dividend of 100,000 shares (2,000,000 shares x 5%) to be issued on January 10 to stockholders of record on December 31. The market price on the declaration date is $31 a share.

21

13-4 The entry to record the declaration of the 5 percent stock dividend is as follows: Dec. 15 Stock Dividend (100,000 x $31 market) Stock Dividend Distributable Paid-in Capital in Excess of Par—Common Stock Declared 5% (100,000 share) stock dividend on $20 par common stock with a market value of $31 per share.

3,100 000 00 2,000 000 00 1,100 000 00

22

13-4 On January 10, the number of shares out standing is increased by 100,000. The following entry records the issue of the stock: Jan. 10 Stock Dividends Distributable Common Stock Issued stock for the stock dividend.

2,000 000 00 2,000 000 00

23

13-5

Objective 5

Journalize the entries for treasury stock transactions.

Treasury Stock Transactions

Occasionally, a corporation buys back its own stock to provide shares for resale to employees, for reissuing as a bonus to employees, or for supporting the market price of the stock. This stock is referred to as

treasury stock

.

24

13-5 On January 5, a firm purchased 1,000 shares of treasury stock (common stock, $25 par) at $45 per share. The

cost method

for accounting for treasury stock is used.

45 000 00 Treasury Stock Cash Purchased 1,000 shares of treasury stock at $45.

45 000 00

25

13-5 Later, 200 shares of treasury stock were sold for $60 per share.

12 000 00 Cash Treasury Stock* Paid-in Capital from Sale of Treasury Stock Sold 200 of treasury stock at $60.

9 000 00 3 000 00

26

13-5 Sold 200 shares of treasury stock at $40 per share.

8 000 00 Cash Paid-in Capital from Sale of Treasury Stock Treasury Stock Sold 200 of treasury stock at $40.

1 000 00 9 000 00

27

Objective 6

Describe and illustrate the reporting of stockholders’ equity.

13-6

Stockholders’ Equity Section of a Balance Sheet 28

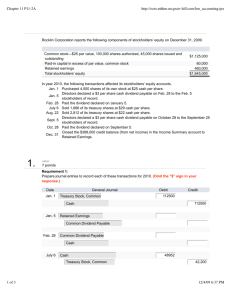

Example Exercise 13-6 Using the following accounts and balances, prepare the Stockholders’ Equity section of the balance sheet. Forty thousand shares of common stock are authorized and 5,000 shares have been reacquired.

Common Stock, $50 par Paid-in Capital in Excess of Par Paid-in Capital from Sale of Treasury Stock Retained Earnings Treasury Stock $1,500,000 160,000 44,000 4,395,000 120,000 13-6

29

Follow My Example 13-6 Stockholders’ Equity Paid-in capital: Common stock, $50 par (40,000 shares authorized, 30,000 shares issued) Excess of issue price over par From sale of treasury stock Total paid-in capital Retained earnings Total Deduct treasury stock (5,000 shares at cost) Total stockholders’ equity $1,500,000 160,000 $1,660,000 44,000 $1,704,000 4,395,000 $6,099,000 120,000 $5,979,000 13-6

30

Retained Earnings Statement

13-6

31

7 Statement of Stockholders’ Equity

13-6

32

Example Exercise 13-7 Dry Creek Camera Inc. reported the following results for the year ending March 31, 2008: Retained earnings, April 1, 2007 Net income Cash dividends declared Stock dividends declared $3,338,500 461,500 80,000 120,000 Prepare a retained earnings statement for the fiscal year ended March 31, 2008.

13-6

33

Follow My Example 13-7 DRY CREEK CAMERAS INC.

RETAINED EARNINGS STATEMENT For the Year Ended March 31, 2008 $3,338,500 Retained earnings, April 1, 2007 Net income Less dividends declared Increase in retained earnings Retained earnings, March 31, 2008 $461,500 200,000 261,500 $3,600,000 13-6 For Practice: PE 13-6A, PE 13-6B

34

Objective 7

Describe the effect of stock splits on corporate financial statements.

13-7

Stock Splits

A corporation sometimes reduces the par or stated value of their common stock and issues a proportionate number of additional shares. This process is called a

stock split

.

35

Rojek Corporation has 10,000 shares of $100 par common stock outstanding with a current market price of $150 per share. The board of directors declares a 5-for-1 stock split.

13-7

BEFORE STOCK SPLIT 4 shares, $100 par AFTER 5:1 STOCK SPLIT 20 shares, $20 par $400 total par value $400 total par value

It is not recorded by a journal entry

36