Chapter 22 Study Guide 2015

advertisement

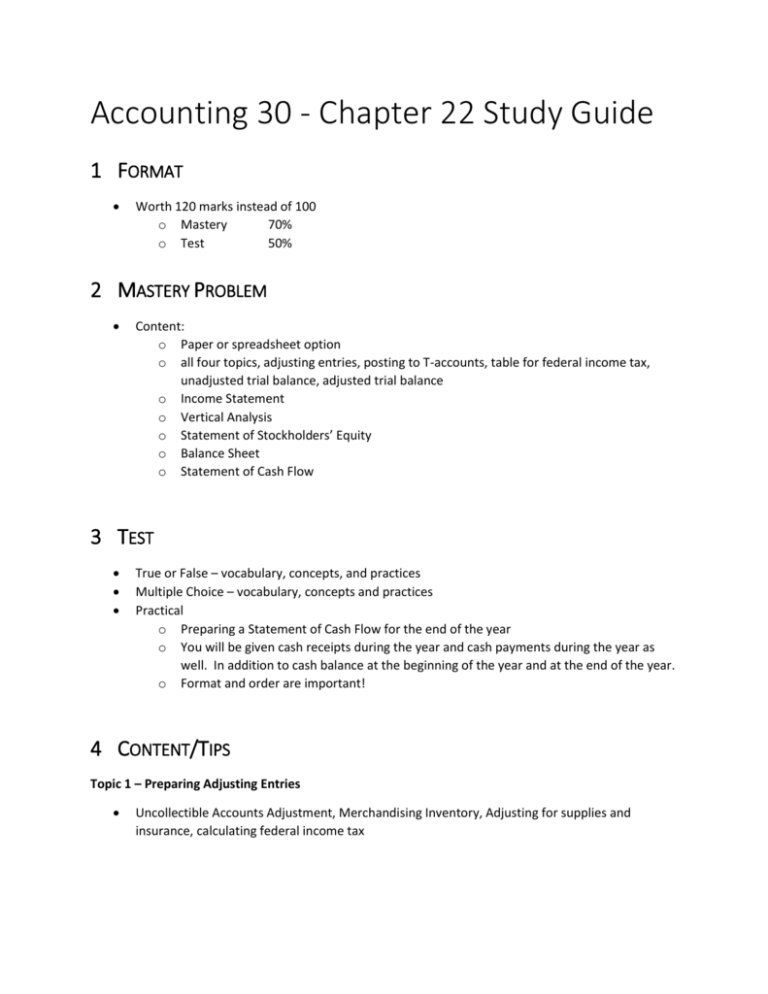

Accounting 30 - Chapter 22 Study Guide 1 FORMAT Worth 120 marks instead of 100 o Mastery 70% o Test 50% 2 MASTERY PROBLEM Content: o Paper or spreadsheet option o all four topics, adjusting entries, posting to T-accounts, table for federal income tax, unadjusted trial balance, adjusted trial balance o Income Statement o Vertical Analysis o Statement of Stockholders’ Equity o Balance Sheet o Statement of Cash Flow 3 TEST True or False – vocabulary, concepts, and practices Multiple Choice – vocabulary, concepts and practices Practical o Preparing a Statement of Cash Flow for the end of the year o You will be given cash receipts during the year and cash payments during the year as well. In addition to cash balance at the beginning of the year and at the end of the year. o Format and order are important! 4 CONTENT/TIPS Topic 1 – Preparing Adjusting Entries Uncollectible Accounts Adjustment, Merchandising Inventory, Adjusting for supplies and insurance, calculating federal income tax Topic 2 – Preparing Income Statement, Statement of Stockholders’ Equity and Balance Sheet Income Statement and % o Sales and sales allowances and returns o COST OF GOODS SOLD/cost of merchandise Beginning inventory, purchases, purchase returns and allowances, ending inventory, cost of merchandise available and then sold o Gross Profit o Other income and expenses Statement of Stockholders’ Equity o Shares – common and preferred o Retained Earnings o Dividends Balance Sheet o Classified Report Form o Stockholders’ Equity Topic 3– Statement of Cash Flow Require this statement which addresses the changes in the business’s cash for the period. The cash receipts and cash payments of a company are called cash flow. A financial statement that summarizes cash receipts and cash payments resulting from business activities during the fiscal period is called a statement of cash flow. IS/Equity/BS – are based on accrual basis of accounting The statement of cash flows is prepared using the cash basis of accounting/only reports the inflows and outflows of cash and excludes business transactions that do not affect cash. Purpose: to provide important information to external parties such as stockholders and creditors. Show cash is acquired and how it is used by a company. Cash Flow from three different activities. o Operating activities o Investing activities o Financing activities o Chart on page 692 is very useful. Topic 4 – Prepare Closing and Reversing Entries (close temporary accounts – 4 steps – revenue, expenses, close res, close drawings) Closing entries for a merchandising business organized as a corporation. Record reversing entries for a merchandising business organized as a corporation. After financial statements are prepared, the adjusted trial balance is used to journalize the closing entries for a corporation. Closing Entries o The IS accounts with credit balances consist of revenue accounts (sales, interest income, rent income, gain on plan assets) and contra cost accounts (purchases discount and purchases returns and allowances). o The IS accounts with debit balances consist of contra revenue accounts (sales discount, sales returns and allowances, the cost (purchases) and all expense accounts. o Cash short and over – depends o Closing Entry to record net income (close income summary and move to retained earnings) o Closing Entry for Dividends (close dividends and move to retained earnings) Reversing Entries o If an adjusting entry creates a balance in an asset or liability account, the adjusting entry should be reversed. o Examples: accrued interest income, interest receivable, interest payable accrued interest expense, federal income tax expense and federal income tax payable. Accounting Cycle for a Merchandising Business Organized as a Corporation o Page 704