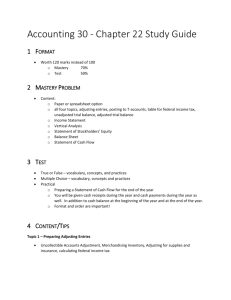

Accounting Conconcepts and Applications

advertisement

CHAPTER 4 Accrual Accounting and Completing the Accounting Cycle CHARACTERISTICS OF THE ACCOUNTING MODEL Periodic Reporting Accrual-Basis Adjusting Closing Accounting Entries Entries PERIODIC REPORTING Time Period Concept--The life of a business is divided into distinct and short time periods so the accounting information can be summarized each period. PERIODIC REPORTING Time Period Concept--The life of a business is divided into distinct and short time periods so the accounting information can be timely. Fiscal Year--An accounting period that lasts 12 months. PERIODIC REPORTING Time Period Concept--The life of a business is divided into distinct and short time periods so the accounting information can be timely. Fiscal Year--An accounting period that lasts 12 months. Calendar Year—A fiscal year that lasts 12 months and ends on December 31. PERIODIC REPORTING Fiscal Year-- For publicly traded companies, the period covered by annual financial statements which are prepared for the public (Annual Report), and the SEC (Form 10K ). PERIODIC REPORTING Time Periods are often further divided into Quarters and Months Quarter--An accounting period that lasts 3 months. For publicly traded companies quarterly financial reports are prepared and sent to the SEC (Form 10Q). Month--May be a calendar month or a series of periods lasting 4 and 5 weeks. LIFE CYCLE OF A Accounting Period 1 BUSINESS ENTITY Accounting Period 2 Inc Statement, Inc Statement, Statement of RE, Statement of RE, Cash Flow Cash Flow Statement Statement Balance Sheet Accounting Period 3 Inc Statement, Statement of RE, Cash Flow Statement Balance Sheet Balance Sheet ACCRUAL ACCOUNTING Accrual-basis accounting is a concept in which revenues and expenses are recorded when earned or incurred, not when cash is received or paid. Revenues and expenses must be assigned to the proper accounting period. “Revenue recognition principle” and the “matching principle” determine the accounting period items are recorded in. REVENUE RECOGNITION Revenue is recognized when two criteria are met: 1. 2. The earning process is “substantially complete.” An exchange has taken place. THE MATCHING PRINCIPLE All expenses incurred to generate revenues must be recognized in the same period as the related revenues. Example: The cost of goods sold for an item must be matched with the sales revenue generated in any time period. DETERMINING ACCRUAL INCOME Recognized Revenues of 2009 - Matched Expenses of 2009 = Net Income for 2009 STEPS 1. 2. 3. 4. 5. 6. 7. 8. 9. IN THE ACCOUNTING CYCLE Analyze transactions and business documents. Journalize transactions. Post journal entries to the general ledger. Determine account balances and prepare a trial balance. Journalize and post adjusting entries. Prepare the adjusted trial balance. Prepare financial statements. Journalize and post the closing entries. Balance the accounts and prepare a postclosing trial balance. STEP 5 - ADJUSTING ENTRIES Adjusting entries are required at the end of each accounting period for accrualbasis accounting, prior to preparing the financial statements. The purpose for adjusting entries are to: 1. Bring Balance Sheet accounts current. 2. Reflect proper amounts of revenues and expenses on the Income Statement. TIPS REGARDING ADJUSTING ENTRIES Analytical Process. You must determine what original entry was made (if any) and what the ending balances should be before you know what adjusting entry to make. You cannot memorize adjusting entries. Adjusting entries always include a Balance Sheet account and an Income Statement account. Adjusting account. entries never involve a CASH 3-STEP PROCESS FOR ADJUSTING ENTRIES 1 Identify the original entries that were made, if any. (Original entries were only made for unearned revenues and prepaid expenses.) 2 Determine what the correct balances should be at this point in time. 3 Make the adjustments needed to correct the balances. MOST COMMON ADJUSTING ENTRIES Prepaid Expenses--Expenses that have been recorded (paid) but not yet incurred. Unearned Revenues--Revenues that have been recorded (received) but not yet earned. Accrued Revenues--Revenues that have been earned but not yet recorded. Accrued Expenses--Expenses that have been incurred but not yet recorded. EXAMPLE: PREPAID EXPENSES On July 1, 2008 XYZ Company pays $3,600 for one year’s rent in advance, covering July 1, 2008 to June 30, 2009. On December 31, 2008, an adjustment will be needed. What is the adjusting entry? EXAMPLE: PREPAID EXPENSES On July 1, 2008 XYZ Company pays $3,600 for one year’s rent in advance, covering July 1, 2008 to June 30, 2009. On December 31, 2008, an adjustment will be needed. What is the adjusting entry? Prepaid Rent Original Entry 3,600 Correct Balances1,800 Cash Rent Expense 3,600 1,800 EXAMPLE: PREPAID EXPENSES On July 1, 2008 XYZ Company pays $3,600 for one year’s rent in advance, covering July 1, 2008 to June 30, 2009. On December 31, 2008, an adjustment will be needed. What is the adjusting entry? Prepaid Rent Original Entry 3,600 Adjusting Entry Cash 3,600 1,800 Correct Balances1,800 Adjusting Entry: 12/31 Rent Expense 1,800 1,800 Rent Expense Prepaid Rent 1,800 1,800 PREPAID EXPENSES On July 1, 2008, XYZ Company pays $3,600 for one year’s rent in advance, covering July 1, 2008, to June 30, 2009. On December 31, 2008, an adjustment will be needed. What is the adjusting entry using the expense approach? PREPAID EXPENSES On July 1, 2008, XYZ Company pays $3,600 for one year’s rent in advance, covering July 1, 2008, to June 30, 2009. On December 31, 2008, an adjustment will be needed. What is the adjusting entry using the expense approach? Prepaid Rent Original Entry Correct Balances1,800 Rent Expense Cash 3,600 3,600 1,800 PREPAID EXPENSES On July 1, 2008, XYZ Company pays $3,600 for one year’s rent in advance, covering July 1, 2008, to June 30, 2009. On December 31, 2008, an adjustment will be needed. What is the adjusting entry using the expense approach? Prepaid Rent Original Entry Rent Expense Cash 3,600 3,600 •Adjusting Entry 1,800 1,800 Correct Balances1,800 1,800 Adjusting Entry: 12/31 Prepaid Rent Rent Expense 1,800 1,800 EXAMPLE: UNEARNED REVENUE On July 1 XYZ Company receives $5,000 for season tickets to a trade show they will put on every month for the next 12 months. On December 31 an adjustment will be needed. What is it? EXAMPLE: UNEARNED REVENUE On July 1 XYZ Company receives $5,000 for season tickets to a trade show they will put on every month for the next 12 months. On December 31 an adjustment will be needed. What is it? Unearned Rev Original Entry 5,000 Correct Balances 2,500 Cash Show Rev 5,000 2,500 EXAMPLE: UNEARNED REVENUE On July 1 XYZ Company receives $5,000 for season tickets to a trade show they will put on every month for the next 12 months. On December 31 an adjustment will be needed. What is it? Unearned Rev Original Entry 5,000 •Adjusting Entry 2,500 Cash Show Rev 5,000 Correct Balances 2,500 Adjusting Entry: 12/31 Unearned Rev Show Rev 2,500 2,500 2,500 2,500 EXAMPLE: ACCRUED REVENUE The XYZ Company earns a rent revenue of $500 in 2008 but did not send out an invoice nor receive the payment until January 3, 2009. An adjustment will be needed. What is the adjusting entry? EXAMPLE: ACCRUED REVENUE The XYZ Company earns a rent revenue of $500 in 2008 but did not send out an invoice nor receive the payment until January 3, 2009. An adjustment will be needed. What is the adjusting entry? Rent Receivable Rent Revenue Original Entry none none Correct Balances 500 500 EXAMPLE: ACCRUED REVENUE The XYZ Company earns a rent revenue of $500 in 2008 but did not send out an invoice or receive the payment until January 3, 2009. An adjustment will be needed. What is the adjusting entry? Rent Receivable Rent Revenue Original Entry none none Correct Balances 500 500 Adjusting Entry: 12/31 Rent Receivable 500 Rent Revenue 500 EXAMPLE: ACCRUED EXPENSE The XYZ Company is assessed property taxes of $1,000 for 2008, but will not make this payment until January 5, 2009. An adjustment will be needed. What is the adjusting entry? EXAMPLE: ACCRUED EXPENSE The XYZ Company is assessed property taxes of $1,000 for 2008, but will not make this payment until January 5, 2009. An adjustment will be needed. What is the adjusting entry? Property Tax Expense Property Tax Payable Original Entry none none Correct Balances 1,000 1,000 EXAMPLE: ACCRUED EXPENSE The XYZ Company is assessed property taxes of $1,000 for 2008, but will not make this payment until January 5, 2009. An adjustment will be needed. What is the adjusting entry? Property Tax Expense Property Tax Payable Original Entry none none Correct Balances 1,000 1,000 Adjusting Entry: 12/31 Property Tax Expense 1,000 Property Tax Payable 1,000 Accrued EXPENSE •Which of the following is not a True statement? a) Accumulated depreciation is a contraasset. b) Depreciation expense is a contra-expense. c) Accumulated depreciation has a normal credit balance. d) Depreciation expense has a normal debit balance. There are 9 steps in the Accounting Cycle. List them in order. (Hint: Three of them contain the words “Trial Balance”) 1. 2. 3. 4. 5. 6. 7. 8. 9. __________________________ __________________________ __________________________ __________________________ __________________________ __________________________ __________________________ __________________________ __________________________ STEPS 1. 2. 3. 4. 5. 6. 7. 8. 9. IN THE ACCOUNTING CYCLE Analyze transactions and business documents. Journalize transactions. Post journal entries to the general ledger. Determine account balances and prepare a trial balance. Journalize and post adjusting entries. Prepare the adjusted trial balance. Prepare financial statements. Journalize and post the closing entries. Balance the accounts and prepare a postclosing trial balance. Step 7 Preparing Financial Statements • After all transactions have been recorded, a trial balance prepared, and adjusting entries made . . . the financial statements can be prepared. Record Transactions Prepare Trial Balance Make Adjusting Entries Prepare Financial Statements STEP 8 THE CLOSING PROCESS Nominal Accounts (temporary accounts) are closed to a zero balance at the end of each accounting period. Real Accounts (permanent accounts) are not closed to a zero balance at the end of the accounting period. These accounts are carried forward to the next period. Closing Entries reduce all nominal accounts to a zero balance. Examples Real Accounts Assets Liabilities Owners’ Equity (Balance Sheet Accounts) Examples Real Accounts Nominal Accounts Assets Revenues Liabilities Expenses Owners’ Equity (Balance Sheet Accounts) Dividends (Income Statement Accounts) CLOSING ENTRIES The Goal: Move all Revenue and Expense items (Net Income) into Retained Earnings. Dec 31 Sales Revenue....................... 1,500 Rent Revenue........................ 100 Cost of Goods Sold............ 1,100 Salaries Expense............... 200 Other Expenses................. 150 Retained Earnings............. 150 CLOSING ENTRIES Closing the books ALWAYS requires 4 closing entries CLOSING ENTRIES Closing Entry 1. Close all revenue accounts by debiting them. Dr. Cr. Sales Revenue............ 13,000 Rent Revenue………... 2,000 Income Summary... 15,000 The Closing Process Revenues xxx Income Summary Bal. xxx xxx Revenues Since the revenue account is a nominal account, it is closed at the end of the period to Income Summary. The Closing Process Closing Entry 2. Close all expense accounts by crediting them. Dr. Cr. Income Summary…............. 13,600 Cost of Goods Sold….... 12,800 Insurance Expense........ 500 Supplies Expense.......... 300 The Closing Process Income Summary xxx Rev. Exp. YYY Expenses Bal. YYY YYY The expense accounts are credited in order to close the account at the end of the period. The Closing Process Closing Entry 3. Close Income Summary. Dr. Cr. Income Summary…............. 1,400 Retained Earnings.….... 1,400 The Closing Process Retained Earnings Income Summary xxx Rev. Exp. YYY Net Income Net Income The Income Summary account is closed with a debit or credit depending on its balance. The Closing Process Closing Entry 4. Close Dividends (if any). Dr. Retained Earnings…............ Dividends………….….... Cr. 500 500 ABOUT DIVIDENDS Dividends are not expenses. They are distributions to stockholders of part of the corporation’s earnings. Dividends reduce Retained Earnings. For example: If a company earns $1,400 of Net Income, paying dividends to shareholders does not change Income. EXAMPLE: DIVIDENDS Declaration of Dividends: Dividends...................... Dividends Payable.... 500 500 EXAMPLE: DIVIDENDS Declaration of Dividends: Dividends...................... Dividends Payable.... 500 Payment of Dividends: Dividends Payable......... Cash........................ 500 500 500 EXAMPLE: DIVIDENDS Declaration of Dividends: Dividends...................... Dividends Payable.... 500 Payment of Dividends: Dividends Payable......... Cash........................ 500 Closing Entry for Dividends: Retained Earnings......... Dividends................. 500 500 500 500 The Closing Process Retained Earnings The dividends account, which is also nominal, is credited to close out the balance. Net Inc. Div. ddd Dividends Bal. ddd ddd The Closing Process Retained Earnings is a real account and always carries a balance. Net Income for the period is added by these two entries. Retained Earnings Beg. Bal. BBB Rev. Exp. Div. End. Bal. EEE STEP 8. POST-CLOSING TRIAL BALANCE Provides a listing of all real account balances at the end of the closing balance. The Trial Balance assures that total debits equal total credits prior to the beginning of the new accounting period. Revenues and expenses will not appear because they have no balances. Only real accounts will have a balance at this time. Post Closing Trial Balance Example Jim Brewster, Inc. Post-Closing Trial Balance as of December 31, 2008 Cash Accounts Receivable Inventory Supplies Accounts Payable Capital Stock Retained Earnings Totals Debits $ 8,200 4,000 3,000 1,000 _____ _ $16,200 Credits $ 5,000 10,000 1,200 $16,200 STEPS 1. 2. 3. 4. 5. 6. 7. 8. 9. IN THE ACCOUNTING CYCLE Analyze transactions and business documents. Journalize transactions. Post journal entries to the general ledger. Determine account balances and prepare a trial balance. Journalize and post adjusting entries. Prepare the adjusted trial balance. Prepare financial statements. Journalize and post the closing entries. Balance the accounts and prepare a postclosing trial balance. CASH-BASIS ACCOUNTING Revenue and expenses are recognized only when cash is received or payments are made. Mainly Not used by small businesses. an accurate picture of true profitability. Example: Accrual vs. Cash-Basis Brewster Enterprises billed their client for $48,000 during the year. On December 31 they had received $41,000, with the remaining $7,000 to be received in the next year. Total expenses during the year amounted to $31,000 with $3,000 of these costs not yet paid for at December 31. Example: Accrual vs. Cash-Basis Brewster Enterprises billed their client for $48,000 during the year. On December 31 they had received $41,000, with the remaining $7,000 to be received in the next year. Total expenses during the year amounted to $31,000 with $3,000 of these costs not yet paid for at December 31. Brewster Enterprises Reported Income for 20XX Cash-Basis Accounting Cash Receipts $41,000 Cash Disbursement 28,000 Income $13,000 Example: Accrual vs. Cash-Basis Brewster Enterprises billed their client for $48,000 during the year. On December 31 they had received $41,000, with the remaining $7,000 to be received in the next year. Total expenses during the year amounted to $31,000 with $3,000 of these costs not yet paid for at December 31. Brewster Enterprises Reported Income for 20XX Cash-Basis Accounting Cash Receipts $41,000 Cash Disbursement 28,000 Income $13,000 Accrual Basis Accounting Revenues Earned $48,000 Expenses Incurred 31,000 Income $17,000 CASH BASIS IS NOT GAAP APPENDIX -- WORKSHEETS May be useful for you to review to clarify the Adjusting Entry process and the surrounding Trial Balances. Worksheets are used to simplify the process of preparing financial statements. Worksheets are also used to analyze end-of-period adjustments. Most accountants use a spreadsheet to prepare the worksheet electronically. Trial balances are used to test whether total debits equal total credits. ADJUSTING ENTRIES – USING A WORKSHEET (APPENDIX) •Illustration 4A-1 •Form and procedure for a worksheet THE END