469 Sp15 Ch1 Slides Intro - Management and Marketing

advertisement

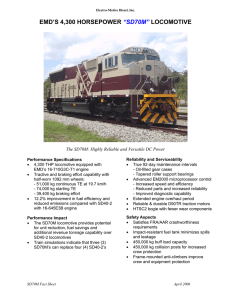

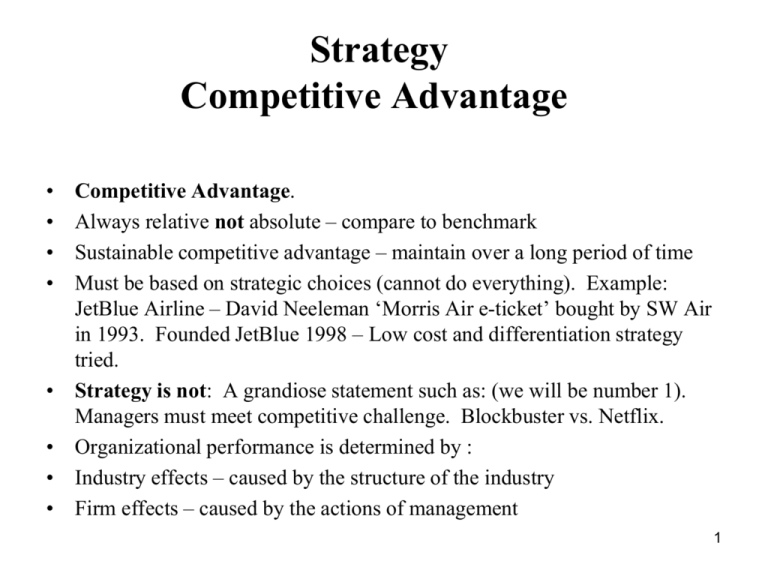

Strategy Competitive Advantage • • • • • • • • Competitive Advantage. Always relative not absolute – compare to benchmark Sustainable competitive advantage – maintain over a long period of time Must be based on strategic choices (cannot do everything). Example: JetBlue Airline – David Neeleman ‘Morris Air e-ticket’ bought by SW Air in 1993. Founded JetBlue 1998 – Low cost and differentiation strategy tried. Strategy is not: A grandiose statement such as: (we will be number 1). Managers must meet competitive challenge. Blockbuster vs. Netflix. Organizational performance is determined by : Industry effects – caused by the structure of the industry Firm effects – caused by the actions of management 1 Strategy Competitive Advantage • Stakeholders and competitive advantage. • Identify what are the interest, opportunities and threats, social issues and concerns for: • Internal – employees, stockholders, managers • External – customers, suppliers, partners, community, government • Analyze, Formulate, and Implement (AFI) framework. SWOT analysis, Level of strategy ( Business, Corporate, Global ). Implement organizational design. • Black-Swan events. The impact of a highly improbable event (Nicholas Taleb). 2 Competitive Forces Shape Strategy How Competitive Forces Shape Strategy: “By being aware of competitive forces, an organization can position itself to be less vulnerable to attack” (Michael E. Porter, 1979) 3 Competitive Forces Shape Strategy Porter’s 5 Forces Model Threat of New Entrants Bargaining Power of Suppliers Industry Competitive Rivalry Bargaining Power of Customers Threat of Substitutes 4 Strategic Planning Model Critical Success Factor: Strategic Innovation Environmental Analysis S trengths W eaknesses O pportunities T hreats Formulation Mission Objectives STRATEGY Organizational Structure Policy Guidelines Implementation Budgets Programs Procedures Execution & Control Monitor Feedback Feedback 5 Life Cycle and Competitive Advantage Introduction R&D Tech change Attention to quality Design change Process change Growth Improve product Econ of scale Process improve Distribution Value added Forecasting Maturity Decline Focus on Cost Control Standardize Reduce capacity Efficiency Cut products Costs cuts Few changes Optimal capacity Creating a Sustainable Competitive Advantage (David A. Aaker, 1989) Stage of the Product Life Cycle, Business Strategy, and Business Performance (Anderson & Zeithaml, 1984) 6 Automobile Industry: Growth to Maturity (1932-2006) I. II. III. IV. Depression to WWII Post WWII 1970s – The Oil Embargo and Competitive Rules Change Today – The Rules are Still Changing * In Maturity, focus on standardization, efficiency and costs* * Grow by capturing existing market share* U.S. Motor Vehicle Sales (Millions of units) Year 1986 … 2000 2001 Units 16.1 17.1 17.5 2002 17.2 2003 16.9 2004 17.3 2005 17.4 2006 17.0 Source: Ward’s Automotive Reports 7 Automobile Industry: 1913-1932 (Growth Phase I) * In Introduction, focus is on R&D, technical and design changes, attention to quality, and process changes* 2000000 1800000 1600000 Units Sold 1400000 1200000 Buick 1000000 Chevrolet Ford 800000 600000 400000 200000 0 1913 1915 1917 1919 1921 1923 1925 1927 1929 1931 Source: U.S. Automobile Production Figure-Wikipedia 8 59 Automotive Industry Clusters 65 20 in Alabama There are more than 383 Automotive Companies and Suppliers in Alabama. 59 20 85 Legend Concentration of Automotive Suppliers Suppliers by Zip Code 65 1 2 3 4-6 10 Source: 2007 EDPA Automotive Database 7 - 11 Strategic Planning The Locomotive Industry The Big Three 1825-1956 American Locomotive (ALCO) Baldwin Locomotive Lima Locomotive 10 Locomotive Industry 1939 General Motors Electro-Motive Division took lead in diesel-electric locomotives Why? Growth Market Strength (R&D, developmental capital, aggressive marketing) Opportunity (Railroads wanted more dieselelectric locomotives) WWII Opportunity offered by history Demand not determined by general market forces 1950s End of Steam 11 Strategic Planning Locomotive Industry Technology Matures Maturity – Focus on standardization, efficiency and costs Strength- Efficiency through standardization Opportunity- Growth of container freight Today – Big Two (EMD and GE) EMD GE 12 Strategy Competitive Advantage Differentiation (RCA used its R&D strength and its organizational structure to market successfully Color TV) Transformation: From ordinary to revolutionary 13 RCA Strategic Advantage Differentiation 14 Strategy Competitive Advantage Low Cost (Southwest Airlines strives to recruit and train the best personnel available, create innovative flight schedules, stress strong customer support, and provide high pay for employees) Transformation: From in-state service to national to? 15 Competitive Advantage Southwest – Low Cost 16 Strategy Competitive Advantage Innovation/Response (FedEx uses a hub-and-spoke system to rapidly respond to request for package shipments worldwide) Transformation: From national letter carrier to global cargo carrier 17 Strategic Advantage FedEx - Response 18 Strategy Competitive Advantage Diversification (Boeing reacts to the maturing airframe market) Transformation: From an airplane builder to a high-tech product and service provider 19 Strategic Advantage Boeing 20 Strategic Advantage Boeing – Delta Rocket 21