The Federal Home Loan Bank System: The Lender of Next-to

advertisement

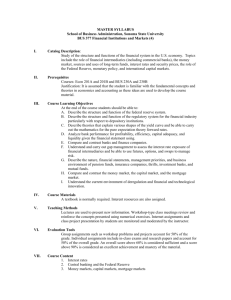

Federal Home Loan Bank System Lender of Next to Last Resort? Ashcraft, Bech and Frame 45th Annual Conference on Bank Structure and Competition Chicago, May 2009 The views expressed in the presentation are those of the author and are not necessarily reflective of views at the Federal Reserve Bank of New York, Federal Reserve Bank of Atlanta or the Federal Reserve System. • Why this paper? • Is the Federal Reserve not the Lender of last resort? • True! … and the Fed has been most creative • “Need teaches naked women how to spin” –Then: Discount Window –Now: Alphabet soup: TAF, TSLF, PDCF, AMLF, CPFF, MMIFF, TALF … 2,500 2,000 $Billions 1,500 1,000 500 0 Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Traditional Assets Liquidity Programs for Financial Firms Support for Specific Institutions Direct Lending to Borrowers and Investors Purchases of High-Quality Assets The Stigma of the Discount Window Fed tried to make DW attractive: • “Penalty” cut to 50 bps • Term extended to 30 days • Teleconference: sign of strength ? ? ? ? ? ? The Term Auction Facility 1.4% 1.7% 1.6% 1.4% 1.8% 1.6% • Maximum bid size 10% of amount offered • Attractive minimum bid (Overnight Index Swap/ IOR) 1.2% • Liquidity crisis but no LoLR-lending! –LoLR effect not measured in only $ –Stigma • But … there was another game in town • A lender that said yes when everybody else were saying no! • … this lender was cheaper • Your neighborhood Federal Home Loan.. Federal Reserve and FHLB Its purpose is to establish a series of discount banks for home mortgages, performing a function for homeowners somewhat similar to that performed in the commercial field by Federal Reserve banks through their discount facilities. President Herbert Hoover - July 22, 1932 John T. Woolley and Gerhard Peters, The American Presidency Project [online]. Santa Barbara, CA: University of California (hosted), Gerhard Peters (database). Available from World Wide Web: http://www.presidency.ucsb.edu/ws/?pid=23176. Federal Home Loan Bank System • • • • • • • • • • • • • A GSE Created in 1932 12 FHLBs + Office of Finance Federal Housing Finance Agency (FHFA) Coops with 8000+ members - Open to banks after S&L crisis Elected + public interest directors Member: 10%+ of portfolio in residential mortgage related assets (incl. MBS) Mission: Housing financing … and “a reliable source of liquidity for its membership” Severally and Jointly Liable Advances (Collateralized Loans) and other … Capital: Membership and activity requirements Super Lien on other assets of borrower Stricter haircuts than Discount Window Never a credit loss on advances bu tts rg h Ci k Yo r a co nt go Ch ica Pi Ne w la At cis Fr an nc in na ti Bo st on Se at tle Da lla s To pe In ka di an ap ol De is s M oi ne s Sa n $ Billion The 12 FHLBs FHLBank Assets 350 300 30-Jun-07 30-Sep-07 250 200 150 100 50 0 FHLB System Combined Balance Sheet as of EOY ‘07 Amount ($ Billions) Share of Assets (%) Assets Advances $875.1 68.7 Cash & Investments 299.0 23.4 Mortgage Loans (Net) $91.6 7.2 $8.8 0.7 $1,274.5 100.0 $1,178.9 92.5 Other Liabilities $42.0 3.3 Membership Capital Stock $50.3 3.9 $3.7 0.3 ($0.4) 0.0 $1,274.5 100.0 Other Assets Total Assets Liabilities and Capital: Consolidated Obligations (Net) Retained Earnings Other Comprehensive Income Total Liabilities and Capital Source: Federal Home Loan Banks 2007 Combined Financial Report, authors’ calculations Concentration Risk for Advances Q4 2007 Concentration of Advances for FHLB SF Citibank, N.A. 30% 42% Concentration of Advances for FHLB Seattle 26% B of A OR 31% WaMu Bank Merrill Lynch Bank World Savings Bank, FSB WaMu Bank, FSB Other Other 10% 22% 21% 18% Concentration of Advances for FHLB Atlanta Concentration of Advances for FHLB Boston B of A RI 35% 37% 38% Citizens Bank New Alliance Bank 50% Other Other 7% 4% 23% Source: Call and Thrift Financial Reports, FHLBs 10-Q Countrywide Bank, FSB SunTrust Bank, Atlanta E*Trade Bank 6% Prior August 2007 240 24 200 20 $Billions 16 $Billions 160 12 120 80 40 8 0 2006M01 2006M07 2007M01 2007M07 4 Net advances since July 2007 Federal Reserve lending and institutions support 0 2006M01 2007M01 Net advances since July 2007 Federal Reserve lending and institutions support Source: Federal Reserve H.4.1 statistical release and Federal Home Loan Banks financial statements 2007H2 240 200 $Billions 160 120 80 40 0 2006M01 2007M01 Net advances since July 2007 Federal Reserve lending and institutions support Source: Federal Reserve H.4.1 statistical release and Federal Home Loan Banks financial statements 2008Q1 300 250 $Billions 200 150 100 50 0 2006M01 2007M01 2008M01 Net advances since July 2007 Federal Reserve lending and institutions support Source: Federal Reserve H.4.1 statistical release and Federal Home Loan Banks financial statements 2008Q2 350 350 350 300 300 300 $Billions 300 250 250 250 250 200 200 200 150 150 150 150 100 50 100 100 100 50 50 50 00 06M01 2006M01 0 2006M01 0 2006M01 06M07 07M01 2007M01 07M07 08M01 2008M01 2006M07 2007M01 2007M07 2008M01 Net advances since July 2007 support Federal Reserve lending and institutions institution support Net advances since July 2007 Federal Reserve lending and institutions support 2007M01 2008M01 Net advances since July 2007 Federal Reserve lending and institution support 2008Q3 700 700 600 600 500 $Billions 500 400 400 300 200 300 100 200 100 0 2006M01 0 06M01 06M07 07M01 07M07 08M01 08M07 Net advances since July 2007 Federal Reserve lending and institutions support 2007M01 2008M01 Net advances since July 2007 Federal Reserve lending and institution support Source: Federal Reserve H.4.1 statistical release and Federal Home Loan Banks financial statements 2008Q4 2,000 2,000 1,600 1,600 1,200 $Billions 1,200 800 800 400 400 0 06M01 06M07 07M01 07M07 08M01 08M07 Net advances since July 2007 Federal Reserve lending and institutions support 0 2006M01 2007M01 2008M01 Net advances since July 2007 Federal Reserve lending and institution support Source: Federal Reserve H.4.1 statistical release and Federal Home Loan Banks financial statements April 2009 2,000 2,000 1,600 1,600 1,200 $Billions 1,200 800 800 400 0 400 2006 2007 2008 Net advances since July 2007 Federal Reserve lending and institutions support 0 2006M01 2007M01 2008M01 2009M01 Net advances since July 2007 Federal Reserve lending and institution support Source: Federal Reserve H.4.1 statistical release and Federal Home Loan Banks financial statements From illiquidity to insolvency Increases in Advances by FHLB Members: 2007:Q2 to Q4 Change in Advances Q2 - Q4 2007 Advances Q4 2007 Assets Q4 2007 $ Billions Washington Mutual Advances/Assets Q2 2007 Q4 2007 Percent 42.4 63.9 325.8 6.9 19.6 25.5 57.2 1,667.4 2.2 3.4 Countrywide, FSB 18.9 47.7 121.1 28.9 39.4 Merrill Lynch 11.7 11.7 115.8 - 10.1 Wachovia Corp. 11.3 41.9 740.8 4.5 5.7 11.1 11.3 529.8 0.0 2.1 8.3 102.0 1,351.3 7.6 7.6 7.3 8.7 131.2 1.2 6.6 5.9 6.8 132.3 0.7 5.2 5.7 17.2 238.4 5.1 7.2 148.1 368.3 5,354.0 4.6 6.9 TARPx2 Bank of America TARP Wells Fargo & Co TARPx2 Citigroup TARP PNC TARP Capital One TARP US Bank Total/Average ULLP: Unusual Large Loss Protection Note: Merill Lynch = Merrill Lynch Bank USA and Merrill Lynch Bank & Trust Co., FSBSource: Call and Thrift reports ULLP ULLP • Three points! –Ultimate LoLR is the U.S. Treasury –The Fed is not the sole LoLR • Treasury – Credit lines to GSEs • Central Liquidity Facility for credit unions • Federal Home Loan Banks ? –LoLR part of the regulatory framework • Supervision, deposit insurance • Complex, convoluted and dates back to 30s LoLR Framework in the US $$$ Credit Lines U.S. Treasury 12 x Capital Credit Line from Federal Financing Bank Federal Reserve Swap w. ECB + SNB FHLB NCUA CIF Credit Unions Life Insurance Thrifts Banks Branches & Subs of.. Foreign Banks Non-banks DW + TAF Securities firms Fannie & Freddie Sec. 13(13) $$$ Credit Line + Implicit Government Guarantee 120 120 100 80 80 40 60 0 40 -40 20 -80 0 -120 2006 2007 2008 Primary Credit to Depository Institutions Spread in all-in cost bwt. FHLB NY and Discount Window (right axis) Basis Points $Billions Final Slide