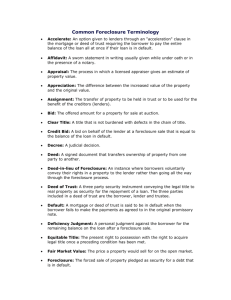

Section 2 – Non-Judicial Foreclosure Procedures

advertisement

Allison Tanner Swanson Midgley, LLC 4600 Madison, Suite 1100 Kansas City, MO 64112 816 886-4809 atanner@swansonmidgley.com www.swansonmidgley.com THE MISSOURI FORECLOSURE PROCESS – for Lenders’ and Borrowers’ attorneys THE FORECLOSURE PROCESS IN MISSOURI Section 1 – Judicial Foreclosure Section 2 – Non-Judicial Foreclosure Procedures Section 3 – Statutory Requirements for Foreclosure of a Junior Deed of Trust Section 4 – Trustee Responsibilities Section 5 – Taxes Section 6 – Post Foreclosure Sale Issues Section 7 – FAQ Section 8 – Case Law and Legislative Update Section 1 – Judicial Foreclosure JUDICIAL FORECLOSURE Judicial Foreclosure is authorized pursuant to RSMO § 443.190. This statute authorizes any lender to commence the action by filing a petition in the circuit court in the county in which the real property is located. Once the lender has obtained judgment, a writ of execution is issued and the sheriff is authorized to conduct a foreclosure sale (rather than the trustee). JUDICIAL FORECLOSURE Any purchaser takes the real property subject to the interests of any entities or persons who were not parties to the case. This type of foreclosure is almost never used because the non-judicial process is quicker and cheaper, but it might be useful when there are possible defects in the deed of trust (such as a deed of trust which failed to include the power of sale language). EQUITABLE JUDICIAL FORECLOSURE Equitable judicial foreclosure is authorized pursuant to RSMO § 443.280. This type of foreclosure is used when a lender needs preliminary equitable relief, such as a need to set aside a cancellation of record of a deed of trust or where the legal description in the deed of trust must be corrected. Then the parties would proceed to judicial foreclosure. See, Louis v. Andrea, 338 S. W. 2d 96 (Mo. 1960). Section 2 – Non-Judicial Foreclosure Procedures Non-judicial foreclosure (foreclosure by the trustee of a deed of trust) is by far the most common method of foreclosure in Missouri, authorized pursuant to Chapter 443, RSMO. It is almost completely a statutory-driven process. NON-JUDICIAL FORECLOSURE PROCEDURES If you represent the lender, close attention must be paid to each statutory requirement to ensure that a foreclosure is conducted in accordance with such statutory requirements. If you represent the borrower and are trying to fight a wrongful foreclosure sale, the trustee’s compliance with such statutory requirements should be closely examined. NON-JUDICIAL FORECLOSURE PROCEDURES Subject to any notice and cure periods required by the loan documents, the foreclosure process should normally take 4560 days from the lender’s authorization to the trustee to proceed with foreclosure. For a lender, this is good and means the process does not take long to get the property back. NON-JUDICIAL FORECLOSURE PROCEDURES For a borrower, this is bad and means there is not much time to fight the process. NON-JUDICIAL FORECLOSURE PROCEDURES Process for a Lender’s Attorney / Trustee: 30 to 40 Days Prior to Sale Date: Attorney should receive authorization from lender to proceed with foreclosure. Lender should also send copies to attorney of all loan documents and confirm that it has the original note. NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney or trustee should also confirm with lender that borrower is actually in default under the terms of the loan documents, which should include review of the notice(s) sent to borrower to confirm that any applicable requirements have been satisfied. NON-JUDICIAL FORECLOSURE PROCEDURES Trustee should also confirm that lender is real party in interest (true holder of the debt), to ensure that the foreclosing entity has the original note or is the true holder of the debt and has standing to foreclose (to be discussed in the Ibanez and MERS cases). NON-JUDICIAL FORECLOSURE PROCEDURES Ammunition for a borrower’s attorney – does foreclosing lender have the original note? Were proper statutory and loan document notices requirements complied with? Is lender true holder of debt so that it has standing to foreclose? NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney / trustee should immediately order foreclosure report from title company. Search should include: federal and state tax liens probate records for any indication that the borrower is deceased, incapacitated or disabled NON-JUDICIAL FORECLOSURE PROCEDURES court records regarding whether any decree of dissolution of marriage has been entered judgment liens notice of bankruptcy proceedings mechanics’ liens status of real estate taxes. NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should send default and demand letter(s), and acceleration letter(s) if necessary. See form of default letter and form of acceleration letter included in your materials. – Any party requesting notice at least 40 days prior to sale, in compliance with RSMO § 443.325. – Owners of record 40 days prior to sale. NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should check with local municipality regarding registration requirements for foreclosing properties. (New vacant property registration requirements have been enacted by municipalities – to be discussed) NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should confirm with lender that borrower is alive, and is not a member of the armed forces. If borrower has died or if there is any indication that borrower is a member of the armed forces, the trustee must comply with special statutory provisions (to be discussed). NON-JUDICIAL FORECLOSURE PROCEDURES – If borrower has died, see RSMO § 443.300 (foreclosure stayed by 6 months) – If borrower is a member of the armed forces, trustee must comply with the Servicemembers’ Civil Relief Act of 2003 (to be discussed). No foreclosure against such a protected person can be undertaken without consent of a court. NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should: Have a CERCLA search performed. Perform state and local UCC searches. Perform federal tax lien search (do NOT depend on the title company) NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should prepare Appointment of Successor Trustee, if necessary. Successor trustee must be a person who lives in Missouri or is a Missouri corporation. See Form of Appointment of Successor Trustee included in your materials. – – Send to client for signing. Record. NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should work with lender to choose Sale Date and prepare Notice of Trustee's Sale. See form of Notice of Trustee’s Sale included in your materials. Confirm with the trustee that he or she will be available on that date prior to publication. NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should Fax or mail notice of Trustee’s sale to publisher. Review proof of publication. Check first publication (21 days before sale). Update foreclosure report and confirm that no parties have filed a “Notice of Sale” pursuant to RSMO § 443.325. NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should be aware that publication requirements vary with the location of the land to be sold. RSMo.§ 443.320 requires notice to be inserted at least 20 times and continued to the date of the sale in some daily newspaper in counties having cities of 50,000 or more. In all other counties, or in any county of the first class not having a charter form of government, or in any county of the second class, and containing a portion of a city with a population over 350,000 notice must be published in a weekly newspaper for 4 successive issues, with the last publication being not more than 1 week prior to the sale date. NON-JUDICIAL FORECLOSURE PROCEDURES 20 to 25 days prior to sale date: Lender’s attorney should send Notice letters or combined acceleration/notice letters (certified mail, return receipt requested) at least 20 days prior to sale date to (and see form of notice letter to junior creditor or other interested party included in your materials) to: NON-JUDICIAL FORECLOSURE PROCEDURES Grantors in deed of trust (if different from owners of record), Any other interested party (e.g., guarantors, subordinate lien holders), IRS (notice must be sent at least 25 days prior to sale date). If an IRS lien exists and no notice is sent to the IRS, the foreclosed property will be subject to the IRS lien (1954 I.R.C. § 7425). NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should Collect certified mail slips (white) and save to be attached to Trustees' Deed. Collect green receipt cards to keep in the file. NON-JUDICIAL FORECLOSURE PROCEDURES 5 Days Prior to Sale Date: Lender’s attorney should prepare Trustee's Deed(s). See Form of Trustee’s deed included in your materials. Prepare Foreclosure Dialogue. See Form of Foreclosure Sale Dialogue included in your materials. NON-JUDICIAL FORECLOSURE PROCEDURES Lender’s attorney should; Prepare any necessary corporate resolutions for anticipated buyer. Work with lender to determine bid amount. Obtain signed bid instructions from lender, if it intends to bid. Obtain original Note and Deed of Trust (if not already received). Prepare closing letter to title company. NON-JUDICIAL FORECLOSURE PROCEDURES Day of Sale, Lender’s attorney should: Check bankruptcy court records on day of sale; PACER system is at https://pacer.psc.uscourts.gov/index.html (registration is required) Note that lender’s attorney should also check on bankruptcy of any co-debtor or guarantor Acquire Affidavit of Publication from publisher and take original to the foreclosure sale. NON-JUDICIAL FORECLOSURE PROCEDURES Cry foreclosure sale. Adjourn to title company or law office to close the foreclosure sale (complete and deliver Trustee's Deed, deliver certified mail slips and original Note and Deed of Trust). Section 3 – Statutory Requirements for Foreclosure of a Junior Deed of Trust Pursuant to § 408.551-408.562, Certain additional statutory requirements may apply to foreclosure of a junior deed of trust: – If it is a “second mortgage loan,” defined in RSMO §408.231 as a loan secured in whole or in part by a lien or residential real estate that is already subject to at least one prior mortgage loan; and – If it is a loan on which the interest rate charged is to be calculated at the rate allowed by RSMO § 408.232. STATUTORY REQUIREMENTS FOR FORECLOSURE OF JUNIOR DEED OF TRUST If the loan qualifies as a “second mortgage loan”, then: – – The lender may not take steps to enforce its interest until 30 days after notice of the borrower’s right to cure. Such notice cannot be given until after an event of default. STATUTORY REQUIREMENTS FOR FORECLOSURE OF JUNIOR DEED OF TRUST – – If the borrower cures the default, all borrower’s rights are restored unless there is a third default. After the 3rd default, the borrower has no cure rights. Section 4 – Trustee Responsibilities A Trustee is considered to be in a fiduciary relationship with both the borrower and the lender. A Trustee cannot make any statements or representations regarding the state of the property or title which might have the effect of “chilling” the bidding. Requiring bidders to prove that they are financially capable of purchasing the property does not “chill” the bidding. TRUSTEE RESPONSIBILITIES Trustee may not “self deal” or act in his or her own best interests. It looks very suspicious for a trustee to purchase the property at the sale. TRUSTEE RESPONSIBILITIES A Trustee can accept (and announce at the sale) a bid made in writing before the sale. A good practice tip for Trustees to minimize exposure is to bring another person (such as an attorney or paralegal) to offer any bid on behalf of the lender. TRUSTEE RESPONSIBILITIES Trustee must personally conduct the sale, not someone designated by the Trustee. The Trustee has the option to continue the sale one time without the need to advertise or send new notices. The new sale date must be within 7 days of the originally set sale date. The continuance must have been announced at the original time, place and date of the sale. TRUSTEE RESPONSIBILITIES The Trustee should offer the property both in parcels and in bulk. This will ensure that the Trustee has fulfilled his or her fiduciary obligation to both borrower and lender to obtain the best possible price for the property. TRUSTEE RESPONSIBILITIES Trustees have the ability to recess the sale for a short period of time to confirm a purchaser’s ability to pay the purchase price in accordance with the requirements set forth in the notice. TRUSTEE RESPONSIBILITIES Ammunition for borrower’s attorneys: Trustee did not fulfill its fiduciary duties to Borrower Trustee “chilled” the bidding or self-dealt Trustee did not actually conduct the sale Trustee conducted the sale improperly and did not obtain the best price for the property Section 5 – Taxes STATE TAXES RSMO § 144.150 allows a lender to make written request to the Director of Revenue for a statement of the status of sales taxes which might be owed by the borrower. If no response is received within 15 business days, the parties can proceed with the sale with the assumption that no state taxes are due. STATE TAXES If state sales tax liens are filed subsequent to the deed of trust, a foreclosure sale will wipe them out. REAL ESTATE TAXES The amounts due to the government for real estate taxes take priority over any Deed of Trust, so all outstanding real estate taxes create a cloud on the title to foreclosed property whether the taxes were due prior or after the recording of the Deed of Trust. The lender could pay the taxes and include any such amounts as part of its debt, or it could choose not to pay them and any third party purchaser at the sale would become liable. FEDERAL TAXES IRS Redemption Rights. If there is an IRS lien on the property, the IRS has the right to redeem the property for a period of 120 days from the date of the sale by paying to the successful bidder the purchase price plus interest from the sale date. Section 6 – Post Foreclosure Sale Issues Redemption New Notice Requirements Obtaining Possession following Foreclosure Deficiency REDEMPTION RIGHTS Can the borrower redeem? Equitable redemption Statutory redemption REDEMPTION RIGHTS Equitable Redemption. Equitable redemption is allowed in Missouri when the borrower seeks relief because of fraud or other defect in the sale. Damage to the borrower is usually proven by evidence that the property sold for inadequate consideration; but inadequate consideration alone is not enough for equitable relief. REDEMPTION RIGHTS Statutory Redemption. A statutory redemption right exists in Missouri pursuant to RSMO § 443.410, but it is very cumbersome and, as a result, infrequently used. Right applies only if purchaser is the holder of the debt. Available only to original borrower, his heirs, devisees, executors, administrators, grantees or assigns. REDEMPTION RIGHTS Statutory procedure must be followed: – – – Borrower must give written notice to trustee within 10 days prior to the sale or at the sale that borrower intends to redeem the property. Borrower must file a bond and a motion for its approval within 20 days after the sale, in the circuit clerk’s office. Borrower must also give notice to the purchaser at the sale. REDEMPTION RIGHTS – – Bond must be approved by the court within 20 days after the date of the sale. Bond must be executed by the borrower and at least one good surety. Amount of the bond must be sufficient to cover: – – Interest on the debt for 1 year following the date of the sale; Legal charges and costs of the sale; REDEMPTION RIGHTS – – – – Interest accrued before the sale date on any prior encumbrance that is past due and that was paid by the purchaser plus interest on such prior encumbrance that will accrue for 1 year following the sale date; taxes and assessments accrued or accruing during the period of 1 year from the sale; interest at the rate of 6% on all sums paid by the purchaser at the sale; damages for all waste committed or suffered by the borrower during the period of 1 year from the sale date. REDEMPTION RIGHTS Within 1 year from the date of the sale, the borrower must pay the following in order to complete the redemption: – – Full amount of the debt secured by the deed of trust and interest to the date of payment; Full amount paid by the purchaser for interest and principal on any prior encumbrance on the property; REDEMPTION RIGHTS – – Taxes and assessments paid by the purchaser; Legal charges and costs of foreclosure sale. Possession After Foreclosure Unlawful Detainer The only issue is the right to possession. Owner is entitled to file suit by filing a petition, verified by affidavit, in the court where the property is located. Petition should state: (1) the defendant has held over after he no longer has the right to possess the property, (2) plaintiff’s entitlement to possession and the date of such entitlement (usually the date of the Trustee’s Deed), Unlawful Detainer (3) written demand was made and (4) the reasonable rental value of the property. Demand for possession is made by (a) delivering written demand to the occupant, (b) leaving a copy with someone over the age of 15 who resides or is present at the property, or (c) posting a copy of the demand on the property. Unlawful Detainer Summonses are served the same as in other civil actions No counterclaims are allowed in Unlawful Detainer actions as the only issue is the right to possession. New Post Sale Notice Requirements The federal “Protecting Tenants at Foreclosure Act of 2009” requires that owners must give 90 days notice to vacate or quit to residential tenants, unless the tenant has a “bona fide” lease in which case the lease must be honored (to be discussed in more depth). New Post Sale Notice Requirements RSMO § 534.030 (amended effective 8/28/09) requires 10 business days notice to a residential tenant before a new owner can commence an action for unlawful detainer. The exact language that must be included in the notice is included in the statute. A copy is included in your materials. Deficiency If the lender is unable to recover all of its losses at the foreclosure sale, it is entitled to a deficiency judgment. As a practical matter, unless the lender knows that the borrower has other substantial assets, it will probably not pursue a deficiency judgment. If lender thinks borrower has assets, it may be a different story. Deficiency If a lender sues for a deficiency, the likely responses will be: Chapter 7 bankruptcy by borrower Offer to settle for little or nothing Default judgment, but no ability to collect OR the borrower will hire an attorney to mount a vigorous defense and the foreclosure sale will be scrutinized to see if there were any technical problems that could vacate the sale. Section 7 – Frequently Asked Questions FAQ ABOUT EFFECT OF FORECLOSURE What does a foreclosure wipe out? A trustee’s sale of a senior deed of trust wipes out junior encumbrances, including junior deeds of trust. FAQ ABOUT EFFECT OF FORECLOSURE How are the funds obtained from a foreclosure sale to be applied? Pursuant to Missouri case law, (In re Lacy, 112 S.W.2d 594 (Mo .App. E.D. 1937) and Farris v. Hendrichs, 413 S.W.2d 185 (Mo. 1967)), the funds must be applied as follows: FAQ ABOUT EFFECT OF FORECLOSURE A. to pay expenses of the sale B. then to pay the balance due on the debt secured by the deed of trust being foreclosed (assuming the lender was not the high bidder) C. then to pay the balance to the borrower or the borrower’s successors in interest. FAQ ABOUT EFFECT OF FORECLOSURE If there is any question about how the funds should be applied, an interpleader action in state court should be considered. See Lick Creek Sewer Systems, Inc. v. Bank of Bourbon, 747 S.W. 2d 317 ( Mo. App. S. D. 1988) for questions about foreclosure of second deed of trust and payment of surplus. Section 8 -- Case Law and Legislative Update Federal Laws that affect foreclosure State and Local Laws that affect foreclosure Recent Case Law that affects foreclosure Federal Laws Bankruptcy (Title 11, USC) Service Members Civil Relief Act of 2003 (updated 1940 Soldiers and Sailors Relief Act) (50 USC §§ 501-596) Fair Debt Collection Practices Act (15 USC § 1601, et seq.) Hope for Homeowners program Protecting Tenants at Foreclosure Act Bankruptcy If a borrower files for bankruptcy it stops the foreclosure process. If you represent the lender, check the bankruptcy records prior to crying the sale to ensure that no bankruptcy has been filed: PACER system is at https://pacer.psc.uscourts.gov/index.html (registration is required) If you represent the borrower – discuss the pros and cons of bankruptcy to stop the foreclosure process. Bankruptcy Co-debtor stay – in a bankruptcy, a creditor may NOT pursue against a co-debtor or guarantor who has not filed for bankruptcy if the debt is a “consumer debt”. “Consumer debt” means a debt incurred by an individual primarily for personal, family or household purposes. Service Members Civil Relief Act of 2003 If borrower is a member of the armed forces, foreclosing trustee must comply with the Service Members Civil Relief Act of 2003. A sale, foreclosure or seizure of property shall not be valid if made during or within 90 days after the period of the servicemember’s military service, except upon court order. Check military service status at: https://www.dmdc.osd.mil/appj/scra/scraHome.do FDCPA Fair Debt Collection Practices Act is often raised as a defense. Courts have generally held that an attorney or lender foreclosing on a mortgage is NOT debt collection activity for purposes of FDCPA. FDCPA But, see, McDaniel v. South & Associates, P.C., 325 F. Supp. 1210 (D. Kan. 2004) holding: The filing of a foreclosure petition which also seeks a personal judgment is a debt collection activity under the FDCPA; If borrower request verification under the FDCPA, the foreclosure action must be stayed until the verification is sent; Attorney can file a lawsuit within the 30 day verification period without violating the FDCPA as long as the attorney immediately stays the foreclosure action while the verification process is ongoing. Hope for Homeowners Act New program for borrowers at risk of default. See materials for some basic facts about the Hope for Homeowners program and the Housing and Economic Recovery Act of 2009 Voluntary program for lenders with no requirement of principal reduction, so it has helped a fraction of the homeowners anticipated. Protecting Tenants at Foreclosure Act All tenants must receive a 90 day notice before being evicted as the result of a residential foreclosure. With some exceptions, existing leases for renters must be honored to the end of the term of their leases. The stated exceptions are for tenants without a lease, tenants with a lease terminable at will under state law, or where the owner acquiring the property will occupy it as a primary residence. In these cases, the tenants must have 90 days to vacate the property. Protecting Tenants at Foreclosure Act This changes the nature of evictions on foreclosed properties and preempts state law, unless state law gives longer notice requirements. Text is included in your materials. State law update Chapter 443 generally governs foreclosures of deeds of trust in Missouri. Only current statutory change which effects foreclosure is RSMO § 534.030 (amended effective 8/28/09) which requires 10 business days notice to a residential tenant before a new owner can commence an action for unlawful detainer. The exact language that must be included in the notice is included in the statute. A copy is included in your materials. This is likely preempted by the 90 day notice required by the Protecting Tenants at Foreclosure Act, but we recommend giving both notices. Local Laws Check with local municipality regarding registration requirements for foreclosing properties. As of May 1, 2009, KCMO requires that all “owners” register vacant and/or properties in the process of being foreclosed within 14 days of initiation of the foreclosure process. Numerous municipalities in the Kansas City Metropolitan area and across the state of Missouri have adopted or are adopting variations on these types of requirements. Foreclosing lenders will need to check with each municipality regarding registration requirements. Local Laws See copy of ordinances that have been passed in Kansas City, Missouri, Lee’s Summit, Gladstone, Belton, Raymore and St. Louis (as of March 12) Case Law Update Foreclosure actions are being thrown out of court, particularly in the bankruptcy context, because the courts are finding that the servicers who are bringing the foreclosure actions are not real parties in interest and do not have proper standing to foreclose. Holder To enforce, the entity must be in possession of the instrument. The original holder and subsequent transferees are “holders” and if a transferee takes with no notice of default, he is a “holder in due course.” Payment to a party entitled to enforce is sufficient to extinguish the obligation. Therefore only a holder of a note endorsed to it or holder of bearer paper may enforce it. Holder Article 3 of the UCC governs negotiable instruments (notes and drafts). Defines a negotiable instrument as “an unconditional promise or order to pay a fixed amount of money, with or without interest . . .” Negotiable instruments are transferred from the original payor by negotiation. Order paper must be endorsed (such as a check drawn on a bank). Bearer paper must be delivered. Real Party in Interest (F.R. Civ. Pro 17) Pursuant to Federal Rule of Civil Procedure 17, an action must be prosecuted in the name of the real party in interest. Typical problems arise in a motion for relief from stay in a bankruptcy proceeding. Real Party in Interest (F.R. Civ. Pro 17) The real party in interest in a federal action to enforce a note is the holder of the note. In a securitization it would be the trustee for the certificate holders. Unless the name of the actual note holder is stated, the pleadings are defective. Standing Servicing agent may be a party in interest, but may not have standing. Federal Courts have power authorized by Article III of the Constitution and statutes enacted by Congress. A plaintiff must have constitutional standing for a federal court to have jurisdiction. Servicing agent would only have standing if it can show that it has agency status and that its principal is the holder of the note. Standing Also see Deutsche Bank National Trust Co. v. McRae, 2010 Westlaw 309105 (N. J. Supp. 1/25/10). In this case, the foreclosure defendant did not appear and did not file any response but the court raised the standing issue itself independently and dismissed after it determined that the filings did not support the verified complaint stating that the plaintiff was the owner of the note and mortgage. To Enforce Note It is the holder of the note by transfer with all necessary transfer documentation It had possession of the note before it was lost If lost, must be prepared to post a bond If person seeking to enforce is an agent, it must show its agency status and prove that its principal is the holder of the note. Case Law Update See In re Hwang, 396 B. R. 757 (C. D. Ca., 2008) in which court held, among other things, that the motion for relief from stay to enforce mortgage note could not be pursued by bank that had previously assigned its rights under note to another entity, and that at most retained only loan servicing rights, without joinder of party that owned the note following the assignment. Court also noted that bank to which mortgage note was payable and which was in physical possession of the note qualified as the “holder” of the note, even though it had assigned its rights under the note to another entity, which had further sold the note as part of a securitization transaction. Case Law Update See, also, In re Vargas, 396 B. R. 511 (C. D. Ca., 2008); In re Hayes, 393 B. R. 259 (D. Mass. 2008); Deutsche Bank Nat’l Trust Co. v. Steele, 2008 WL 111227 (S. D. Ohio 2008); In Re Foreclosure Cases, 2007 WL 3232430 (N. D. Ohio 2007); In Re Foreclosure Cases, 521 F. Supp. 2d 650 (S. D. Ohio 2007) and In re Jones (2008 WL 4539486 (Bkrtcy. D. Mass) (which is also a great example of how complicated the assignment and servicing issues can be to sort out). Case Law Update Further, see, Nosek v. Ameriquest Mortgage Company, 386 B. R. 374 (Bankr D. Mass. 2008), in which court noted that during the five years during which the Chapter 13 proceeding was pending, Ameriquest had represented itself to be the holder of the note and mortgage, and only later did Ameriquest notify the court that it was merely the servicer. Case Law Update During part of the pendency of the Chapter 13 proceeding, Ameriquest had not even been assigned servicing rights. The court imposed fairly dramatic sanctions, some of which have been affirmed on appeal and some of which were vacated. See 406 B.R. 434 (D. Mass. 2009). Case Law Update See In re Jacobson, 2009 WL 567188 (Bkrtcy. W.D. Wash.), in which court held that the entity that claimed to be only a servicer for deed of trust note, and that it neither asserted any beneficial interest in note nor claimed it could enforce note in its own right, was not a real party in interest in whose name motion for relief from stay to foreclose on property which secured note could be prosecuted; and alleged servicing agent failed to establish that it had standing to pursue motion for relief from stay in order to enforce deed of trust. Case Law Update U.S. Bank National Association v. Ibanez, Misc 384283 and 386755 (Trial Court, Land Court Department of Commonwealth of Massachusetts 2009). Mortgage foreclosure sales (there were several) were noticed up and conducted by an entity without any recorded interest in the mortgage at the time of the notice and sale. Because foreclosing entity (the plaintiff) was unable to get title insurance, it brought the actions to obtain judgment on two issues: (1) whether the notices were valid, having been published in the Boston Globe, and (2) whether the plaintiff had the right to foreclose the mortgage since the assignment was not executed or recorded until after the exercise of the power of sale. Ibanez The court held that the publication in the Boston Globe was valid. The “present holder of the mortgage” issue was decided against the plaintiffs. Plaintiffs appealed, arguing that (i) the “present holder of the mortgage” issue came as a surprise to them and shouldn’t have been decided, (ii) had plaintiffs known that issue was going to be addressed they would have pled the case differently, (iii) since the defendant homeowners had defaulted, it was inappropriate for judgment to be entered against the plaintiffs, Ibanez (iv) based on new evidence, plaintiffs were the “present holder of the mortgage” because they had the note (endorsed in blank) and assignment in blank without an identified assignee, and a contractual right to obtain the mortgage at those times and (v) if the note and mortgage endorsed in blank weren’t enough, the foreclosure sale was valid anyway because the plaintiffs were authorized by the last record holder of the mortgage and the plaintiffs were acting as its agent. Ibanez The Land Court held that the foreclosing agent did not have the right to foreclose on the property since the assignment of the mortgage did not occur (either executed or recorded) until well after the foreclosure sale. The court stated as follows: “The plaintiffs cannot credibly claim surprise at the judgment that was entered and, having asked for (and received) a declaration on issues they chose and on the facts exactly as they pled them, they have no right to a “do-over” because the declaration was not entirely as they wished.” Ibanez The court continued: “Moreover, their newly presented facts do not lead to a different result. Instead they show that the plaintiffs themselves recognized that they needed mortgage assignments in recordable form explicitly to them (not in blank) prior to their initiation of the foreclosure process. . . They also show that the problem the plaintiffs face (the present title defect) is entirely of their own making as a result of their failure to comply with the statute and the directives in their own securitization documents.” Ibanez In the conclusions, the Ibanez court stated: “The issues in this case are not merely problems with paperwork or a matter of dotting i’s and crossing t’s. Instead they lie at the heart of the protections given to homeowners and borrowers by the Massachusetts legislature. To accept the plaintiff’s argument is to allow them to take someone’s home without any demonstrable right to do so, based upon the assumption that they ultimately will be able to show that they have that right and the further assumption Ibanez that the potential bidders will be undeterred by the lack of a demonstrable legal foundation for the sale and will nonetheless bid full value in the expectation that that foundation will ultimately be produced, even if it takes a year or more. The law recognizes the troubling nature of these assumptions, the harm caused if those assumptions prove erroneous, and commands otherwise.” Ibanez Although just a trial court level case, there has been some discussion in the legal community that the Land Court is a specialized court designed to hear cases involving real property and so other courts will likely defer to its expertise, so it will likely become established case law. A copy of the Memorandum and Order are included in your materials. Case Law Update / MERS Mortgage Electronic Registration Systems, Inc. (“MERS”) is a national electronic registration and tracking system that was designed to simplify tracking of mortgage loan ownership and servicing rights. Once MERS becomes the beneficiary of record of a lender, it remains the beneficiary when the ownership or servicing rights are transferred. MERS MERS was designed to eliminate the need to prepare and record assignments when trading mortgage loans for ease in securitizing such loans. However, MERS does not have legal title to the mortgages registered on its database and the underlying notes have never been transferred to it. Now the situation is arising where MERS is attempting to foreclose on property. Cases are coming out which are deciding whether MERS has standing and is the real party in interest entitled to foreclose on real property. MERS In these cases, courts have found that MERS does not have standing and is not the real party in interest to be entitled to foreclose on real property. See In Re Hawkins, 2009 WL 901766 (Bkrtcy. D. Nev.); In Re Sheridan, 2009 WL 631355 (Bkrtcy. D. Idaho); Novastar Mortgage, Inc. v. Snyder, 2008 WL 4560794 (N. D. Ohio); MERS v. Lisa Marie Chong, Lenard E. Schwartzer, Bankruptcy Trustee, et al., Dist. Ct. Case No. 2:09-CV-00661-KJD-LRL. MERS Landmark National Bank v. Kesler, 192 P. 3d 177 (Kan. App. 2008), affirmed by 216 P. 3d 158 (Kan. 2009) is a Kansas case in which Landmark National Bank brought a suit to foreclose its mortgage against the borrower and joined Millenia Mortgage Corp as a defendant because it had a second mortgage against the property. Neither Borrower nor Millenia responded, so the court entered a default judgment for Landmark. Millenia had sold the mortgage to Sovereign Bank. Sovereign and MERS filed a motion to set aside the judgment, as MERS asserted that it now held legal title to the mortgage on behalf of Sovereign as successor to Millenia. MERS Sovereign and MERS claimed that MERS was a necessary party and the judgment should be set aside because MERS wasn’t included in the lawsuit. The court refused to set aside the judgment and found that MERS was not a contingently necessary party in Landmark’s foreclosure action. MERS There has been some discussion in the legal community that this is not a good decision, and any reasonable attorney should not foreclose a mortgage senior to MERS without naming MERS as a necessary party. MERS The Minnesota Supreme Court just decided Jackson, et al v. MERS as of 8/13/09. Several Minnesota homeowners filed suit against MERS alleging that MERS violated Minnesota state law by foreclosing without following two requirements: (i) to identify all assignees of the mortgage in the county land records, and (ii) to list those assignees in the published foreclosure notice. MERS MERS argued that it should be able to foreclose in its own name without identifying the successive owners of the loan which are tracked on its private system. The court ruled 6-1 that MERS did not violate Minnesota law by failing to disclose which lenders actually owned a homeowner’s mortgage. A copy of the decision is included in the materials. MERS In Bellistri v. Ocwen Loan Servicing, LLC, 2009 WL 531057 (Mo. App. E.D.), Bellistri purchased property at a tax foreclosure sale and then brought a quiet title action. The original borrower had executed a promissory note to BNC Mortgage Inc., but the beneficiary under the Deed of Trust was MERS. The Missouri Court of Appeals held that MERS never held the promissory note and thus its assignment of the Deed of Trust to Ocwen had no force. Therefore Ocwen does not have an interest in the property and lacks standing to seek relief. MERS The holding in Bellistri was affirmed in Bellistri v. Ocwen Loan Servicing, LLC, 284 S.W. 3rd 619 (Mo. App. E.D. 2009). The court noted that if the note and the deed of trust are split, the note becomes unsecured which makes it impossible for the holder of the note to foreclose unless the holder of the deed of trust is the agent of the note holder. MERS As MERS never held the note, its assignment of the deed of trust, separate from the note, to Ocwen had no force. Thus Ocwen lacks a cognizable interest in the case and lacks standing to seek relief. MERS Questions: Since MERS claims no interest in the note and is merely the servicer/tracker of the mortgage assignment, how does MERS claim standing as “real party in interest” to foreclose? How can a servicer defend a lawsuit and have legal standing to oppose contractual issues of the loan it is servicing if it does not name and defend the suit in the name of its principal? Case Law Update See also the following articles (included in your materials): “Where’s the Note, Who’s the Holder: Enforcement of Promissory Note Secured by Real Estate” by Hon. Samuel L. Bufford, United States Bankruptcy Judge, Central District of California, Los Angeles, CA and (Formerly Hon.) R. Glen Ayers, Langley & Banack, San Antonio, TX, presented at the American Bankruptcy Institute, April 3, 2009, Washington, D.C. Case Law Update The Concept of Securitization, by Kenneth S. Jannette, Esq. “Show Me the Original Note and I Will Show You the Money” by O. Max Gardner III Foreclosure, Subprime Mortgage Lending, and the Mortgage Electronic Registration System, by Christopher L. Peterson (which is somewhat inflammatory and apparently still in draft form – see http://ssrn.com/abstract=1469749). Case Law Update Amicus Brief filed in Nevada District Court Case, MERS v. Chong, Case No. 2:09-CV-00661-KJD-LRL Arizona Legal Studies Discussion Paper No. 09-35 “Underwater and Not Walking Away: Shame, Fear and the Social Management of the Housing Crisis” by Brent T. White, James E. Rogers College of Law at the University of Arizona. Short Sales A short sale means a lender will accept a payoff of less than the balance due on the loan. Short Sale Issues The IRS may consider debt forgiveness income. Lender may not release its right to pursue the borrower for the difference between what is owed and what it received in the short sale. Difficult to discuss or negotiate with a lender. Negative effect on borrower’s credit rating. Short Sales Issues Length of time to complete the process Borrower must prove hardship beyond that it is underwater. Loan Modifications A loan modification is just a change in the terms of a loan. With some loans, lender may want to have a “pre-negotiation agreement” with borrower stating conditions under which modification will be considered, deadlines and confidentiality requirements. Loan Modification Issues Any material modification of a loan that would adversely affect the holder of a subordinate lien or encumbrance can lose priority if entered into without the consent of the junior lienholder. (Either complete loss of priority or loss to the extent prejudiced). A “material modification” can include an increase in the interest rate or increase in principal. Loan Modification Issues If a lender requires additional security without advancing additional funds, and the borrower files bankruptcy within 90 days thereafter, the receipt of such additional security may be considered a preferential transfer which could be set aside by the bankruptcy trustee. Loan Modification Issues Because of the possibility of prejudicing junior lienholders, lenders should get new title work to make sure they work out agreements with all junior lienholders so they do not lose priority. Loan Modification Issues If all borrowers, guarantors or other sureties are not required to either execute the loan modification agreement or re-affirm the modification agreement, they might be released from personal liability. Loan Modification Issues Principal forgiveness may be considered a taxable event by the IRS. Because of the prevalence of loan securitizations, make sure that borrower is negotiating with the correct entity (request documentation trail). Loan Modification Issues Lender will need to get a loan title policy modification endorsement because a modification of the loan is a “post-policy event” that would be excluded from coverage. Some lenders require a “waiver of automatic stay” provision in the modification agreement. May or may not be enforceable. Tips for Negotiations Maintain thorough records system in a professional business-like file Make reasonable deadlines and stick to them Use objectivity when evaluating legal and business risks Maintain professional relationships and act reasonably and consistently Tips for Negotiations Communication and responsiveness are key Establish a preferred method of communication and stick with it. Email is not a secure method of communication, but it is a really good way of communicating status or questions to a lot of people simultaneously. Allison Tanner Swanson Midgley, LLC 4600 Madison, Suite 1100 Kansas City, MO 64112 816 886-4809 atanner@swansonmidgley.com www.swansonmidgley.com