Sport Obermeyer

advertisement

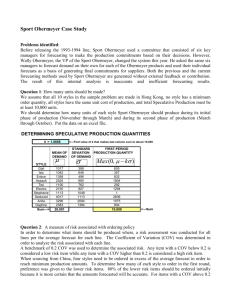

Sport Obermeyer What to order? What are the issues? A Sample Problem Commit 10,000 units before show Commit 10,000 units after show Minimum of 600 units A First Approach Ignore differences in Profit margins Salvage values Ignore minimum lot sizes Consider only first order cycle Sample Problem Style Mean Forecast Std Deviation in Demand Gail 1,017 388 Isis 1,042 646 Entice 1,358 496 Assault 2,525 680 Teri 1,100 762 Electra 2,150 807 Stephanie 1,113 1,048 Seduced 4,017 1,113 Anita 3,296 2,094 Daphne 2,383 1,394 Normal Distribution 0.45 0.4 0.35 0.3 0.25 0.2 0.15 Std Dev.s 0.1 0.05 0 -5 -4 -3 -2 -1 0 1 2 3 4 5 Idea 1 Make all products equally likely to sell out Choose a single std dev. To set production quotas for all products What should the Std. Dev. Be? Style Gail Isis Entice Assault Teri Electra Stephanie Seduced Anita Daphne Mean Forecast 1,017 1,042 1,358 2,525 1,100 2,150 1,113 4,017 3,296 2,383 Std Deviation in Demand 388 646 496 680 762 807 1,048 1,113 2,094 1,394 Total Production Order Amount 1,017 1,042 1,358 2,525 1,100 2,150 1,113 4,017 3,296 2,383 20,001 Std. Devs 0 0 0 0 0 0 0 0 0 0 0 Probability of Sell out Probability of Sell Out 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.50 Number of Standard Deviations 50% Normal Distribution 0.45 Set order Qty to this many std. devs 0.4 Probability we stock out = Probability demand exceeds over qty = 0.86 0.35 Probability we discount last item = 0.3 0.25 Probability demand is smaller than order quantity = 0.2 0.15 Std Dev.s 0.1 0.05 0.14 0 -5 -4 -3 -2 -1 0 1 2 3 4 5 What’s Wrong with This? What else should we be looking at? Still just worried about Order up to 10,000 One order cycle No minimum order qty. A Second Idea Look at 1 Product How to trade off risks of overstock (discounting) vs risks of understock (lost sales)? If we order Q The last item faces what risk of being discounted? Probability Demand < Q = F(Q) The last item faces what risk of selling out Probability Demand > Q = 1 - F(Q) We want to be indifferent We want two to be equal Expected loss from Overstock = CO*F(Q) Expected loss from Lost Sale = CL*(1-F(Q)) A little Algebra: F(Q) = CL/(CO+CL) Example Oversimplification Lost Sale: CL = Selling Price - Cost Discount: CO = Cost - Salvage Value Electra: Selling Price $173 Cost $ 50 Salvage $ 0 Lost Sale: CL = $123 Discount: CO = 50 Want Probability of Discount = F(Q) = 123/173 = 0.71 Balancing Risks Style Gail Isis Entice Assault Teri Electra Stephanie Seduced Anita Daphne Mean Forecast 1,017 1,042 1,358 2,525 1,100 2,150 1,113 4,017 3,296 2,383 Probability of Style Sell Out Gail 0.86 Isis 0.86 Entice 0.86 Assault 0.86 Teri 0.86 Electra 0.86 Stephanie 0.86 Seduced 0.86 Anita 0.86 Daphne 0.86 Std Deviation in Demand 388 646 496 680 762 807 1,048 1,113 2,094 1,394 Total Production Expect Cost of Lost Sale $ 51.33 $ 41.92 $ 25.67 $ 34.22 $ 62.45 $ 105.23 $ 71.01 $ 19.68 $ 36.79 $ 83.84 Order Amount Std. Devs 606 (1.06) 357 (1.06) 832 (1.06) 1,804 (1.06) 292 (1.06) 1,294 (1.06) 2 (1.06) 2,837 (1.06) 1,075 (1.06) 905 (1.06) 10,003 -1.0605 Probability of Sell out Probability Last Item is Discounted 0.14 0.14 0.14 0.14 0.14 0.14 0.14 0.14 0.14 0.14 Expect Cost of Discount $ 7.22 $ 7.22 $ 7.22 $ 7.22 $ 7.22 $ 7.22 $ 7.22 $ 7.22 $ 7.22 $ 7.22 Salvage Price Cost Value $ 110 $ 50 $ $ 99 $ 50 $ $ 80 $ 50 $ $ 90 $ 50 $ $ 123 $ 50 $ $ 173 $ 50 $ $ 133 $ 50 $ $ 73 $ 50 $ $ 93 $ 50 $ $ 148 $ 50 $ Number of Standard Deviations 86% Ratio Rec. Ord. Q 0.55 1,061.30 0.49 1,033.82 0.38 1,199.95 0.44 2,430.00 0.59 1,280.25 0.71 2,598.90 0.62 1,444.34 0.32 3,481.05 0.46 3,098.17 0.66 2,966.21 20,593.99 Expect Probability Assoc. Std Probability Cost of Last Item is Dev of Sell Out Lost Sale Discounted 0.11 0.45 $ 27.27 0.55 (0.01) 0.51 $ 24.75 0.49 (0.32) 0.62 $ 18.75 0.38 (0.14) 0.56 $ 22.22 0.44 0.24 0.41 $ 29.67 0.59 0.56 0.29 $ 35.55 0.71 0.32 0.38 $ 31.20 0.62 (0.48) 0.68 $ 15.75 0.32 (0.09) 0.54 $ 23.12 0.46 0.42 0.34 $ 33.11 0.66 Expect Cost of Discount $ 27.27 $ 24.75 $ 18.75 $ 22.22 $ 29.67 $ 35.55 $ 31.20 $ 15.75 $ 23.12 $ 33.11 Additional Thoughts What’s the derivative of the cost as a function of order quantity? Expected Cost of Discounting Last Item (increases with order size) - Expected Cost of Stocking Out (decreases with order size) Decrease Order with largest estimated derivative Estimated Derivative Style Gail Isis Entice Assault Teri Electra Stephanie Seduced Anita Daphne Mean Forecast 1,017 1,042 1,358 2,525 1,100 2,150 1,113 4,017 3,296 2,383 Std Deviation in Demand 388 646 496 680 762 807 1,048 1,113 2,094 1,394 Total Production Order Amount 1,060 1,033 1,199 2,429 1,279 2,598 1,443 3,480 3,097 2,965 20,584 Probability of Sell Out 0.46 0.51 0.63 0.56 0.41 0.29 0.38 0.69 0.54 0.34 Expect Cost of Lost Sale $ 27.33 $ 24.78 $ 18.77 $ 22.25 $ 29.71 $ 35.60 $ 31.23 $ 15.76 $ 23.13 $ 33.13 Probability Last Item is Discounted 0.54 0.49 0.37 0.44 0.59 0.71 0.62 0.31 0.46 0.66 Expect Cost of Discount $ 27.22 $ 24.72 $ 18.71 $ 22.19 $ 29.65 $ 35.53 $ 31.18 $ 15.74 $ 23.11 $ 33.10 Estimated Derivative $ (0.11) $ (0.06) $ (0.06) $ (0.05) $ (0.06) $ (0.07) $ (0.05) $ (0.02) $ (0.02) $ (0.04) 2-Rounds What additional Issues? What rules of thumb? Only order late Surely order early Differences in Suppliers Hong Kong Higher Cost Smaller Minimums Faster What rules of Thumb?