Notes for Chapter 9

advertisement

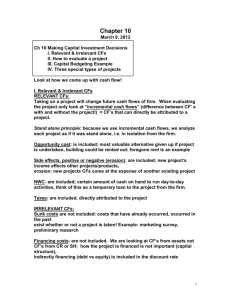

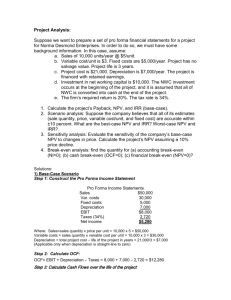

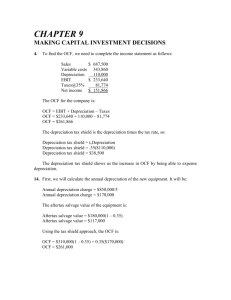

Making Capital Investment Decisions Project Analysis FIN 301: Chapter 9 Topics • Projected Cash Flows & Incremental Cash Flows • Pro Forma Financial Statements & Projected Cash Flows • How Cash Flow is impacted by Networking Capital and Depreciation adjustments • Three Alternatives for deriving Operating Cash Flow (OCF) • Special Cases of Discounted Cash Flow Analysis • Scenario and Sensitivity Analysis Barton College 2 Project Cash Flows Barton College 3 Project Cash Flows • Relevant Cash Flows – Are Incremental cash flows that occur only if the project is accepted – The stand-alone principle allows us to analyze each project in isolation from the firm simply by focusing on incremental cash flows • Stand-Alone Principle – Projects stand alone and have their on cash flows, costs, assets – They are not part of another project (mutually exclusive) to avoid duplicated revenue streams, etc. – Allows the company to manage the projects that are accepted and or rejected, and thus manage overall risk. – “Mini Firms” or a portfolio of projects/firms as stated by the author… – Having “Mini Firms” allows the company to hedge risk by selecting a diversified portfolio of projects. Barton College 4 Make sure the Cash Flow is Incremental….. • Do not include the cash flow if it would occur without the project, i.e., it must be incremental or in addition to existing firm cash flows. – E.g., Building a new student center may increase enrollment, but how many would come otherwise? • You should always ask yourself “Will this cash flow occur ONLY if we accept the project?” – If the answer is “yes”, it should be included in the analysis because it is incremental – If the answer is “no”, it should not be included in the analysis because it will occur anyway – If the answer is “part of it”, then we should include the part that occurs because of the project • • Barton College This may require a forecast or statistical estimate (i.e., forecast of the number of students when the student center is built) 5 Issues Impacting Incremental Cash Flows • Sunk Costs – Cost already incurred and cannot be considered in an investment decision(s). • Opportunity Cost – The forgone opportunity we give up for using a resource for one thing but not another. • Side Effects – Product Erosion (People buy the new Altima instead of the Maxima, etc.) – Product Tie-ins (Wilson Tennis Rackets promotes the Wilson Tennis Balls) – Gillette Razors is a good example (dual blade triple blade quad blade) • Shaving cream • Networking Capital – The short term demands of most projects require an investment in networking capital (inventories, cash, other expenses, etc.) • Financing Cost – Are not considered when looking at incremental cash flow. They are looked at separately and should not be confused with the generation of cash from the asset…. It is already included in the discount rate… • Others… – We must always consider the tax implications of cash flow Barton College – Always use after tax cash flows 6 See Notes…. Pro-Forma Statements Barton College 7 Pro Forma Statements • We must first develop a future set of financial projections. From these projections we can then determine incremental cash flows from a project. • The Pro Forma Income Statement is used considerably in projecting future-year Revenues. • Don’t include interest; as stated earlier it’s already in the discount rate. • Major items to include (mainly income statement related): – Change in NWC (increase at the beginning and decrease at the end of a project) – Salvage value of the asset – Initial Cost (capital) – Additional Costs (variable and fixed) – Sales – We do not include interest expense (this is a financing cost…. not an operating cost) Barton College 8 OCF Review • Computing cash flows – refresher – Operating Cash Flow (OCF) = EBIT + Depreciation – Taxes – OCF = Net income + (Depreciation when there is no interest expense) – Cash Flow From Assets (CFFA) = OCF – net capital spending (NCS) – changes in NWC $ OCF – change NWC True Cash Flow From Operations Barton College $ Assets (Firm) $ Creditors Cash flow of the Firm Stockholders (Owners) NCS 9 Review A few Relationships • Variable Cost = VC = Q * V – V = cost per unit – Q = number of units • FC = Fixed Cost • Total Cost = TC = FC + VC • Sales (S) = Revenue = P * Q – P = Price per unit • Operating Profit = Sales – TC • Depreciation = D • Operating Profit = EBIT • Operational Cash Flow = OCF = EBIT + D - Taxes • We know that: – – – – OCF = EBIT + D – Tax OCF = (S - VC - FC) - D) + D – Tax OCF = S – VC – FC – Tax OCF = (PxQ) – (VxQ) – FC - Tax Barton College Marketing & Sales Manufacturing, Control & Supply Chain 10 Pro Forma Example • Get estimates for Net Income, NWC and capital spending for the Project – – – – Sales, fixed and variable Cost Depreciation Taxes (At Marginal Tax Rate) NWC & Capital request OCF = EBIT + depreciation – taxes = 33,000 + 30,000 – 11,220 = 51,780 or • Cash Flows: OCF = NI + depreciation = 21,780 + 30,000 = 51,780 Project Cash Flow = Project Operating Cash Flow - Project change in NWC- Project capital spending Barton College 11 Total Cash Flows • Calculate Total Project Cash flow by summing the year-overyear cash inflows against the cash outflows. In this case Total Cash Flow = FCF = OCF – NWC - CS • Now that we have the cash flows, we can apply the techniques that we learned in chapter 8 • Enter the cash flows into the calculator and compute NPV and IRR – CF0 = -110,000; C01 = 51,780; F01 = 2; C02 = 71,780 – NPV; I = 20; CPT NPV = 10,648 – CPT IRR = 25.8% • Should we accept or reject the project? Barton College You can also use Excel To compute the NPV and IRR 12 Closer Look at NWC • By including the change in NWC, we are essentially adjusting the accrual accounting income to reflect noncash changes. Barton College See Notes Page 13 Depreciation • Depreciation impacts cash flows and taxes in two ways – Impacts OCF by reducing taxable income – Impacts the book value of an asset. The difference between the book value and market value when the asset is sold has tax implications; if sold over book value tax must be paid on the difference – Provides a tax shield equal on income = (Depreciation x tax rate) Modified Accelerated Cost Recovery System (MACRS) Barton College 14 Project Evaluation Two Examples Project Evaluation using DCF Pappy's Potato Barton College 15 Other Methods for deriving OCF • Bottom-Up Approach – Works only when there is no interest expense – OCF = NI + depreciation – OCF = $21,780 + $30,000 = $51,780 • Top-Down Approach – OCF = Sales – Costs – Taxes – OCF = $200,000 - $137,000 - $11,200 = $51,780 – Don’t subtract non-cash deductions • Tax Shield Approach – OCF = (Sales – Costs)(1 – T) + Depreciation*T – OCF = ($200,000 - $137,000)(1-.34) + ($30,000 x .34) = $51,780 Barton College 16 Can we Trust our NPV Calculation????? • From previous chapters we can now compute NPV, but can we trust the answer? • Question: – Was our sales estimates correct? – Was our cost estimates correct? – Our analysis is still “Projected Cash Flows” not actual • Remember we are doing a “Pro-Forma” analysis – Timing of cash flows, bad unit sales estimates, cost overruns, Macro and or Micro events can change our original analysis. These all create the possibility of FORECASTING ERRORS • Positive NPV is usually not common in a competitive business environment? If so, opportunist will ultimately exploit the opportunity eliminating the positive NPV. Companies that can continuously generate positive NPV projects usually have certain competitive advantages: – – – – – – Economies of Scale ……. (Wal-Mart) Product differentiation ……. (Nike) Mineral rights...…………. (Potash …. Fertilizer Company) Access to distribution channels …. (FedEx) Favorable governmental policy …..(Boeing or Lockheed Martin) Rackspace (RAX)…………….. (First to market with Innovative product) Barton College 17 Scenario Analysis • What happens to the NPV under different cash flows scenarios? • At the very least look at: – Best case – revenues are high and costs are low • High revenues, lowest cost, highest unit volume, etc. – Worst case – revenues are low and costs are high • Lowest revenue, highest, cost, lowest volume, etc. – Measure of the range of possible outcomes – Ranges are determined partly by intuition, analysis and experience….. • Best case and worst case are not necessarily probable, they can still be possible (earthquake devours production plant or a competitor just decides to quick competing and sell of all their assets would be considered extreme cases) • Pappy's Potato Barton College 18 Sensitivity Analysis • What variable of the NPV process should we focus on (Sales, Cost, Units sold, discount rate, etc…) • Focus on those variables that impact NPV the most….. or have the highest degree of sensitivity to overall NPV for the project. These are your more risky variables • Computers are used almost exclusively for this purpose….. Excel for example. • Pappy's Potato Barton College 19 Additional Managerial Considerations for Capital Budgeting • Managerial or Real Options – Contingency Planning (All the options we could possibly take….) – Expand – If the project succeeds are we ready to expand – Wait – Negative NPV • • Discount rates may drop, Revenue conditions may improve, etc. Book Example Euro Disney – Abandon – discontinue the project or possibly scale back parts of the operation. – Strategic Options • Barton College R&D, Pilot studies, Pharma and drug development 20 Capital Rationing • Soft Rationing – Fixed allocated capital budgets to business units – If more capital is required, then more can be granted to the business unit – Business unit would need to justify the increase with higher NPV, PI, etc. • Hard Rationing – Capital is scarce and not available for positive NPV projects. – For example if a company is close to bankruptcy, it may be hard to raise capital, not matter the NPV of a project. Barton College 21