Corps Revision Lecture - Monash Law Students' Society

advertisement

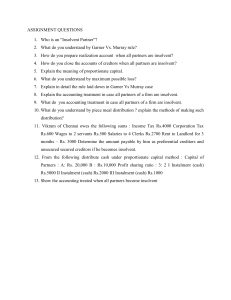

Corps Revision Lecture LSS Tutorials Overview Intro: Formation/Types of Company/Corporate veil/BoD/GM Directors’ duties: Related party transactions Financial assistance Consequences of breach/relief from liability Remedies DCSD Insolvent trading BF/GF/proper purpose Director must not fetter discretions Conflicts Derivative/personal actions Oppression Continuous disclosure requirements 3P/company Directors Remedies Piercing corporate veil s180-DCSDbusiness judgment rule-reliancedelegation SDA s236/s237 Insolvent trading s588v-g S181-GF/proper purpose-collateral purposes? Oppression s232/233 Financial assistance s260A Conflicts s9, s182/183/191/195, member approval, financial benefit s229 Injunction Corporate contracting Related party s228/50AA Winding up Problem Solving Who are the parties and in what capacity can we advise them? 1. 1. 2. 3. 4. 5. Director, officer, shareholder, corporation, holding co, ASIC, creditors, liquidator, employees What is their complaint? Legal issue: breach? Resolve Remedies Intro SLP – Salomon Corporate Groups BoD/GM Calling a meeting – SH rights Directors’ duties questions Intro 1. 1. 2. 2. 3. 4. 5. Parties? Grievance? Breach of directors duties (analysis) Defences/presumptions Consequences of breach/relief from liability Remedies Duty of DCSD s180(1) CL/equity/statute? S180(1) X as a director or other officer, must exercise their powers and discharge their duties with the degree of care and diligence that RP would exercise if they What would a RP in [D’s] position with [D’s] knowledge and experience, exercising [D’s] responsibility, in that type of company, have done? Daniels; Wheeler (objective test) Were a director or officer of a corp in the corp’s circumstances; and Occupied the office held by, and had the same responsibilities within the corp as X Size of company? What experience and skills did the director hold himself out to have? The court in Daniels discussed the following factors: Continuing obligation to keep informed about the company’s business Must generally monitor corporate affairs, policies Familiar with financial status Attend company meetings; bring informed independent judgment to bear on matters Can’t hide behind duty of confidentiality to one company to avoid obligations to another DCSD: defences/presumptions Delegation of powers s190 Reliance on information and advice from others s189 s198D allows director to delegate powers Director responsible for exercise of power by delegate s190(1) Director not liable if reasonably believed delegate reliable/ competent s190(2) Santow J in Adler factors Reliance presumed reasonable if matter relied upon is within professional competence; in good faith; Director made independent assessment Statutory business judgment rule s180(2), (3) Charterbridge Corp v Lloyds Bank Business judgment: any decision to take or not take action in respect of a matter relevant to the business operations of the corporation s180(3) S180(2) DCSD: policy? AWA case p181 Diligence and reliance Executive vs non-executive directors Rogers CJ Clarke & Sheller JJA Duty to prevent insolvent trading Holding co liability Duty holding company to prevent subsidiary company trading while insolvent Div 5 s588V Director liability Duty directors to prevent insolvent trading Div 3 s588G Insolvent trading Does the applicant have standing? 1. 1. 2. 3. 2. 3. Unsecured creditor ASIC Liquidator Unsecured creditor – personal claim for debt – is there a HC/SUB relationship s588V? If no HC/SUB relationship – can we find a director liable? s588G Holding co liability for insolvent trading X can seek compensation from holding co if can prove company (holding co) contravened s588V 1. Corporation is a holding co of subsidiary Subsidiary is insolvent/becomes insolvent by incurring a debt 2. 3. s46 s95A definition insolvent not being able to pay debts as they fall due Reasonable grounds to suspect the subsidiary is or would be insolvent Director liability for insolvent trading 1. 2. 3. 4. Directors of co may be liable for debts of co if they permit co to trade while insolvent s588G Director will be liable for debts of co if: Person is director (or shadow director) at the time the debt incurred AND Co trades while insolvent AND There were reasonable grounds for questioning co solvency or that it would become insolvent when the debt was incurred AND Director was aware that there were grounds for suspecting or a reasonable person in the position of the director would have been aware of insolvency under test s95A 1. 2. Defences s588H 1. 2. 3. 4. QLD Bacon v Rees ASIC v Plymin Expect solvency Reasonable reliance Illness Director took all reasonable steps to prevent co incurring debt Consequences of breach Insolvent trading: policy? Deterring directors from taking business risks Creditor protection Balance between protecting creditors vs entrepreneurial activity by directors P.61-62 Boros & Duns Duty of good faith/proper purpose Equity/statutory duty S181(1) a director or other officer must exercise powers and discharge duties: In good faith in the best interests of the corp; and For a proper purpose Company’s best interests = shareholders’ best interests EXCEPT: when company is approaching insolvency creditors best interests (Kinsela) Does not include individual SH interests EXCEPT if it’s a special fact fiduciary relationship (Coleman v Myers) No special obligation to consider employees (Parke v Daily News) Corporate group s187? Duty of good faith/proper purpose cont. Proper purpose? 2 step test: (Howard Smith) What is the legal purpose of the company giving the director the power? (question of law) What is the actual reason that the directors exercised the power? (question of fact) 1. 2. List potential purposes Courts have 2 different tests (do both): 1. 2. Substantial purpose test (Howard Smith) ‘But for’ test (Whitehouse) Director must not fetter discretions Director retains discretion if makes decision based on his own judgment and what’s in the best interests of the co Breach: if director promises always to follow the directions of another person Thorby Duty to prevent conflict s182, 183 Duty not to profit from the [position/use of information] s182/183 Statute broader than fiduciary/equity as it applies to all employees Advantage extends beyond gains made by the officer to gains made by 3P Use of position s182 Officer must not improperly use their position to Gain advantage for themselves or someone else; or Cause detriment to the corp Use of information s183 person who obtains info because they are or have been an officer must not improperly use information to Gain advantage for themselves or someone else; or Cause detriment to the corp Related party transactions (public co only) s207/208 Member approval is required for decisions to give financial benefits to related parties that could endanger SH interests 1. Is the entity a related party? Note: broad definition of related entity 2. Is there a financial benefit? S229 3. Does it fall under an exempt transaction? S210-216 4. If no exceptions apply, must seek member approval… 5. Disclosure 6. Consequences: civil penalties Financial assistance s260A ASIC v Adler – Santow J – focus on prejudicial impact on creditors/SH Consequences of breach/relief from liability Civil penalty s1317E Criminal penalty Relief/indemnification of directors Relief by court s1317S, s1318 Ratification at GM Full and frank disclosure of all material facts to GM + approval 75%: Winthrop Investments v Winns Indemnification s199A Insurance s199B Remedies SDA Injunction Oppression Winding up Continuous disclosure Chapter 6CA ss674 – 678 ASX LR 3.1 (public/listed) Non listed s675 Any questions – email me emboo2@student.monash.edu.au