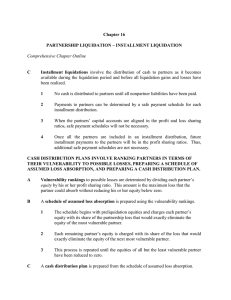

ASSIGNMENT QUESTIONS 1. Who is an “Insolvent Partner”? 2. What do you understand by Garner Vs. Murray rule? 3. How do you prepare realization account when all partners are insolvent? 4. How do you close the accounts of credtors when all partners are insolvent? 5. Explain the meaning of proportionate capital. 6. What do you understand by maximum possible loss? 7. Explain in detail the rule laid down in Garner Vs Murray case 8. Explain the accounting treatment in case all partners of a firm are insolvent. 9. What do you accounting treatment in case all partners of a firm are insolvent. 10. What do you understand by piece meal distribution ? explain the methods of making such distribution? 11. Vikram of Chennai owes the following sums : Income Tax Rs.4000 Corporation Tax Rs.600 Wages to 2 servants Rs.500 Salaries to 4 Clerks Rs.2700 Rent to Landlord for 3 months – Rs. 3000 Determine the amount payable by him as preferential creditors and unsecured secured creditors if he becomes insolvent. 12. From the following distribute cash under proportionate capital method : Capital of Partners : A: Rs. 20,000 B : Rs.10,000 Profit sharing ratio : 3: 2 I Instalment (cash) Rs.5000 II Instalment (cash) Rs.2000 III Instalment (cash) Rs.1000 13. Show the accounting treated when all partners become insolvent