Furman University

advertisement

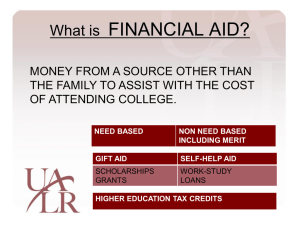

Determining the Cost of College Smart Student Guide to Financial Aid www.finaid.org Includes calculators to help you with the math on loan payments, college cost projections, financial aid estimation forms, reference book resources, videotape resources, information on free booklets by mail, periodicals, lobbying and advocacy groups, and discussion groups. Smart Money for College Planning www.smartmoney.com/college Fast Web www.fastweb.com College Board www.collegeboard.com Cost of Attendance • • • • • Tuition and fees Room and board Books and supplies Transportation Personal Expenses Goals of Financial Aid Process • To assist students in paying for their educational investment • To evaluate the family’s financial ability to pay for educational costs • To distribute limited resources in an equitable manner • To attempt to provide a balance of gift aid and self-help aid Basic Eligibility Requirements for Aid • Demonstrate a financial need • Be a US citizen or eligible non-citizen with a valid Social Security number • Be working toward a degree or certificate in an eligible program • Be qualified to obtain postsecondary education, i.e. be a High School Graduate Sources of Aid • • • • Institutional Private State Federal Types of Financial Aid Gift Aid • Scholarships • Grants Self-help • Loans • Employment Opportunities Gift Aid Grants • Federal – Pell Grant – FSEOG – ACG – SMART • State • Institutional • Private Scholarships • Federal • State (SC) – Palmetto – Life Institutional Private Self-Help Aid Loans Employment • Federal WorkStudy • State Work-Study Programs • Institutional WorkStudy Programs • Federal Perkins Loan • Federal Stafford Loans – Federal Family Education Loan (FFEL) Program – William D. Ford Federal Direct Loan Program • Federal PLUS Loan – GRAD PLUS Loan • State Loans • Institutional and Private Loans Loans vs. Grants Determining Financial Need Cost of Attendance (COA) – Expected Family Contribution (EFC) ______________________________________ = Financial Need Expected Family Contribution (EFC) • The measure of your family’s financial strength • Indicates how much of your and your family’s financial resources should be available to help pay for your education • Calculated according to an established formula EFC Formula The formula takes into account • Your own & your family’s income • Your own & your family’s assets • Your family size • The number of family members who will be attending college Need Varies Based on Cost 1 X 2 Y 3 Cost of Attendance (Variable) Z EFC EFC Expected Family Contribution Need (Constant) (Variable) Examples of Financial Need Institution Private State Technical *COA $30,124 $14,640 $11,350 *EFC $10,000 $10,000 $10,000 ____________________________________________________ Need $20,124 $4,640 $1,350 *COA - Cost of Attendance *EFC - Estimated Family Contribution Free Application for Federal Student Aid (FAFSA) • Family’s personal and financial information required to perform need analysis is collected on FAFSA • Paper versions of FAFSA – “Regular” Paper FAFSA – Renewal FAFSA • Electronic version of FAFSA – FAFSA on the Web at www.fafsa.ed.gov – Obtain PIN at www.pin.ed.gov Avoid ERRORS! Any accidental errors made in completing the FAFSA and/or supplemental forms may cause delays in the aid process and result in the loss of financial aid funds. Please complete all forms carefully! FAFSA • Apply on-line, rather than by paper – Speeds up processing – Catches potential errors • Apply for your PIN before completing FAFSA • Parents Must apply for a PIN also Frequent FAFSA Errors • Enter in Whole Numbers only, – Use 50 vs 50.00 • Do not leave any field blank • Count yourself as one of the people in your family attending college • “You” or “Your” in questions refers to the student’s income or assets, not parents • Pick up the amount from the correct line on the tax return – www.finaid.org provides a map from tax line to FAFSA Frequent FAFSA Errors (cont.) • Use your name exactly as it appears on your Social Security card • Dependent Student Status question is confusing – read it carefully and answer accurately • Make sure worksheets A, B, & C are completed and submitted, if they apply • Self- Employed individuals must complete and additional worksheet • When completing the Form on-line make sure both parent and student input PIN for e-signature Maximizing your Aid Eligibility • Save money in the parent’s name, not the child’s name • Pay off consumer debt, such as credit cards and auto loans • Spend down the student’s income and assets first Maximizing your Aid Eligibility (cont.) • If you feel you have unusual circumstances make an appt with the financial aid administrator to review your case • If absolutely necessary borrow money from retirement funds, rather than withdrawing funds – as the withdrawal is considered income next year • 529 plans should be in the parent or grandparents name, not the students Federal Programs Grants • Four Types Of Federal Student Aid Grants – Federal Pell Grant – Federal Supplemental Educational Opportunity Grant (FSEOG) – Academic Competitiveness Grant (ACG) – National Science & Mathematics Access to Retain Talent Grant (National Smart Grant) Federal Pell Grant Program • Awarded to eligible undergraduates • Portable • Award range: $400 - $4,050 Federal Supplemental Educational Opportunity Grant (FSEOG) • Eligible students – Undergraduates – Awarded first to students with exceptional financial need – Priority to Federal Pell Grant recipients • Annual award amounts – $100 - $4,000 Academic Competitiveness (AC) Grant • In addition to the Federal Pell Grant, first-year AC Grant students may receive up to $750 • Second-year AC Grant students may receive up to $1,300 AC Grant Eligibility • Submit FAFSA and been determined eligible for a Federal Pell Grant; • Be a U.S. citizen; • All AC Grant students must have completed a rigorous high school program of study as designated by their state • For a second-year AC Grant, students must have a cumulative grade point average (GPA) from their first year of at least 3.0 National SMART Grant • National Science and Mathematics Access to Retain Talent (SMART) Grant recipients may receive up to $4,000 each year in addition to the Pell Grant funds SMART Grant Eligibility • Submit FAFSA and been determined eligible for a Federal Pell Grant; • Be a U.S. citizen; • Be enrolled fulltime in their third or fourth year of a four-year degree program; • Pursuing a major in mathematics, science (including physical, life, and computer sciences), technology, engineering, or a critical foreign language, such as Arabic, Chinese, Korean, Japanese and Russian; and • Have a grade point average (GPA) of at least 3.0 Federal Work-Study • Undergraduate or graduate students are eligible • Employment can be on or off campus • Typical award amount is $1,500 • Eligible employers – – – – – School Federal, state, or local public agency Private non-profit organization For-profit organization Community service activities Federal Perkins Loan • Student is the borrower • Eligible students – Undergraduate or graduate students – Priority to exceptional need – Interest subsidized while student is in school • Interest rate: 5% • Repayment begins 9 months after graduation • Deferment and cancellation provisions available • Undergrads can borrow up to $4,000 per year; typical award amount $1,000 - $1,500 Federal Stafford Loan (Subsidized and Unsubsidized) • Student is the borrower • Interest Rate is 6.8% • Repayment begins 6 months after graduation • Annual loan limits – $3,500 (1st year undergraduates) – $4,500 (2nd year undergraduates) – $5,500 (each remaining undergraduate year) – $8,500 (each year of graduate/professional study) • Subsidized Stafford: Must demonstrate “need” • Unsubsidized Stafford: Need is not a consideration Additional Eligibility for Unsubsidized Federal Stafford Additional eligibility for independent undergraduates and for graduate students – $4,000 per year for first and second years of undergraduate study – $5,000 per year for remaining years of undergraduate study – $10,000 per year for graduate and professional students Federal PLUS Loan • Borrowers are parents of dependent undergraduate students • Annual loan limit; cost of attendance minus other aid • Adverse credit history check • Fixed interest rate of 9.0% • Up to 4% origination fee • Repayment begins 60 days after disbursement; • Deferment provisions; only principal is deferred, but interest may be capitalized Who Should Borrow? • Even if parents intend to repay the loans – students should borrow as much as they are eligible for, as the student can borrow at a lower rate and better deferment options Repayment If using a private lender inquire about: • Repayment rewards – ie, lower interest rate or origination fee if you repay through automatic withdrawal – Sallie Mae Upromise offers discount on purchases at major retailers – Credits for paying loan on time • Consolidation plans • Graduated payment options South Carolina Programs SC Commission on Higher Education: www.che.sc.gov Palmetto Fellows • • • • South Carolina residents only (Guidance office at SJCS will notify you if you qualify) Students must attend a four-year private or public institution within South Carolina Eligibility based on high school performance and academic promise Students qualify in one of two ways: 1. Score on SAT of 1200 or higher or a 27 composite score or higher on the ACT at the end of junior year in high school, top 6 percent of the class at the end of either the sophomore or junior year, and a 3.5 GPA. 2. Score at least a 1400 on the SAT or 32 on the ACT through the November test administration and earn a cumulative 4.0 GPA at the end of the junior year without regard to class rank. Palmetto Fellows (cont.) • Renewable first year award of $6700, second, third and fourth year award of $7500 with a 3.0 GPA and 30 hours (cannot count AP/IB hours towards 30 hour requirement) • Two application deadlines: December 14, 2007 June 13, 2008 • Verify that he or she has never been convicted of any felonies and has not been convicted of any alcohol or other drug –related misdemeanor convictions within the past academic year • Must certify that he/she has not defaulted and does not owe refunds on any Federal or State financial aid South Carolina LIFE Scholarship • South Carolina residents only, or a high school graduate of South Carolina resident parents • Students must attend an eligible institution, including fouryear private or public institutions, two year public and private institutions and technical colleges within South Carolina • Eligibility based on high school performance and academic promise (colleges will notify you if you are eligible) SC LIFE Scholarship (cont.) • Must meet 2 of 3 criteria: – A 3.0 cumulative grade point average (GPA) on a 4.0 scale – A score of 1100 (not including the writing subsection) on the SAT or an equivalent ACT score of 24 – Rank in the top 30% of the graduating class • Verify that he or she has never been convicted of any felonies and has not been convicted of any alcohol or other drug –related misdemeanor convictions within the past academic year • Must certify that he/she has not defaulted and does not owe refunds on any Federal or State financial aid SC LIFE Scholarship (cont.) LIFE award amounts: – 4 year Public and Private Institutions • Cost of tuition plus a $300 book allowance not to exceed $4,700 – Technical Schools • Cost of tuition plus a $300 book allowance – 2 year Public/Private Institutions • up to cost of tuition at USC Regional campus plus a $300 book allowance – Renewable if student earns 30 credit hours and maintains a 3.00 cumulative LIFE GPA (can count AP/IB hours towards 30 hour requirement) – Half disbursed for Fall and half disbursed for Spring – No application required. “LIFE GPA” Formula Grade Points × Attempted Credit Hours = LIFE GPA Total Attempted Credit Hours All college level work during any term from an accredited college/university is used to determine the cumulative LIFE GPA at the end of each academic year. Life Scholarship Enhancement • Must meet all of the requirements of a Life Scholar, plus be enrolled as a math or science major • Awarded for second, third and fourth years of school • Minimum credit hour requirements in math and science courses • Additional $2500 in aid awarded South Carolina HOPE Scholarship • Must be a U.S. citizen or permanent resident • South Carolina residents only, or a high school graduate of South Carolina resident parents • Must have earned a 3.0 cumulative grade point average (GPA) on a 4.0 scale • Must be enrolled full-time as a degree-seeking undergraduate student in an eligible four-year public institution or four-year independent institution • Verify that he or she has never been convicted of any felonies and has not been convicted of any alcohol or other drug –related misdemeanor convictions within the past academic year • Must certify that he/she has not defaulted and does not owe refunds on any Federal or State financial aid SC HOPE Scholarship (cont.) • Students receiving a SC Hope Scholarship are not eligible for a LIFE or Palmetto Fellows Scholarship • Only eligible to receive scholarship funds during the first year of attendance • Documents required for determining SC Hope Scholarship eligibility must be submitted to the institution by their established deadlines • Award amount is $2,800 (includes a $300 book allowance) South Carolina Need-based Grant • Must be a needy student as determined through completion of the FAFSA • Must be a legal resident of South Carolina • Must be enrolled for at least part time • Must certify that he or she has not been convicted of any felonies and has not been convicted of any alcohol or drug-related misdemeanor offenses within the past academic year South Carolina Need-based Grant cont. • Must certify that he or she does not owe a refund or repayment on a State Grant, Pell Grant, or a SEOG Grant and is not in default on a loan (Perkins or Stafford) • Student may receive up to $2,500 annually if enrolled full-time and up to $1,250 annually if enrolled part-time • The Office of Financial Aid will determine the exact amount of the award • The grant must be directly applied towards the cost of attendance South Carolina Tuition Grants • • • • • South Carolina residents only Students must attend a private college within South Carolina Award varies dependent upon the private school you attend Eligibility based on parent’s prior year income and assets Estimated maximum award for the 2007-2008 academic year is $3100. • To apply the student and parent must complete the FAFSA prior to June 30 • Upperclassmen must complete a minimum of 24 semester hours per academic year for renewal • Freshmen must rank in the top 75% of graduating class or score at least a 900 on the SAT. South Carolina Teacher Fellows • South Carolina Center for Teacher Recruitment awards $5,700 renewable scholarships with a $300 summer stipend • Recipients agree to teach in South Carolina one year for every year they receive the fellowship • Awards are renewed provided the recipient maintains a 2.75 cumulative GPA and completes 30 academic hours per year while completing a degree leading to teacher certification • Toll free in SC 1-800-476-2387