Homework week 1 Exercise 2-3 1. Activities of a general purpose

advertisement

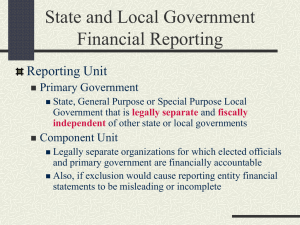

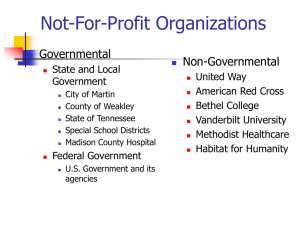

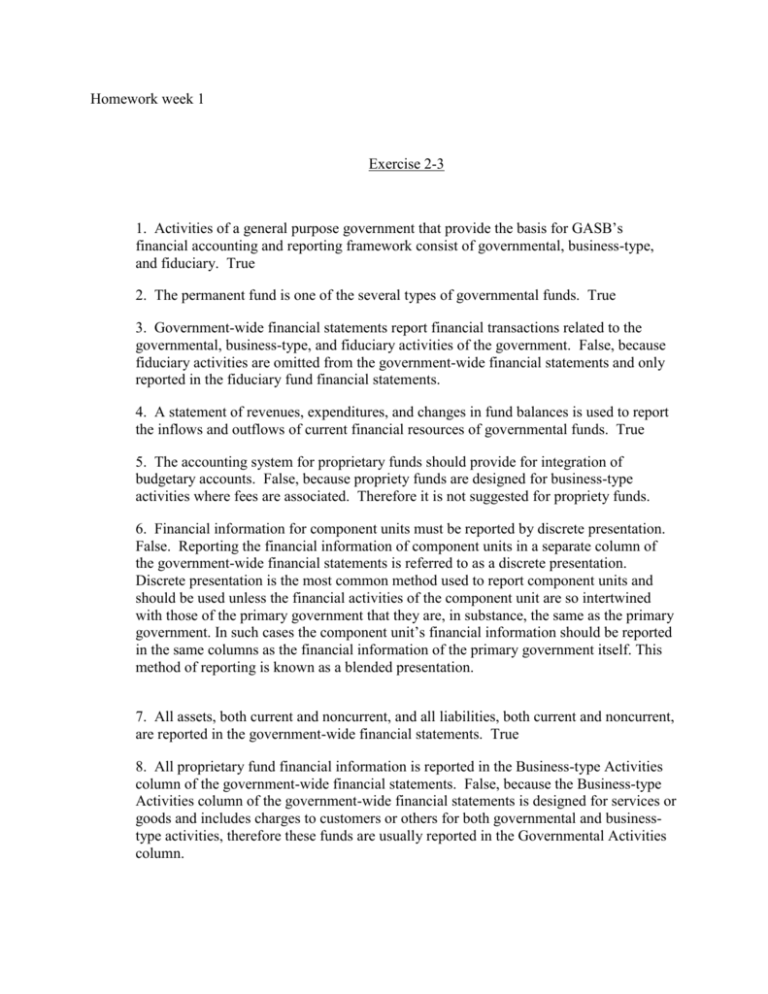

Homework week 1 Exercise 2-3 1. Activities of a general purpose government that provide the basis for GASB’s financial accounting and reporting framework consist of governmental, business-type, and fiduciary. True 2. The permanent fund is one of the several types of governmental funds. True 3. Government-wide financial statements report financial transactions related to the governmental, business-type, and fiduciary activities of the government. False, because fiduciary activities are omitted from the government-wide financial statements and only reported in the fiduciary fund financial statements. 4. A statement of revenues, expenditures, and changes in fund balances is used to report the inflows and outflows of current financial resources of governmental funds. True 5. The accounting system for proprietary funds should provide for integration of budgetary accounts. False, because propriety funds are designed for business-type activities where fees are associated. Therefore it is not suggested for propriety funds. 6. Financial information for component units must be reported by discrete presentation. False. Reporting the financial information of component units in a separate column of the government-wide financial statements is referred to as a discrete presentation. Discrete presentation is the most common method used to report component units and should be used unless the financial activities of the component unit are so intertwined with those of the primary government that they are, in substance, the same as the primary government. In such cases the component unit’s financial information should be reported in the same columns as the financial information of the primary government itself. This method of reporting is known as a blended presentation. 7. All assets, both current and noncurrent, and all liabilities, both current and noncurrent, are reported in the government-wide financial statements. True 8. All proprietary fund financial information is reported in the Business-type Activities column of the government-wide financial statements. False, because the Business-type Activities column of the government-wide financial statements is designed for services or goods and includes charges to customers or others for both governmental and businesstype activities, therefore these funds are usually reported in the Governmental Activities column. 9. Depreciation should be reported in the financial statements of the General Fund for general capital assets accounted for in the General Fund. False. Depreciation of general capital assets should be reported in the government activities column of the governmentwide financial statements. 10. In addition to the General Fund, in governmental and proprietary fund financial statements, the only individual funds for which financial information is reported in separate columns are major funds. True Exercise 2-5 a. Construction of highways, bridges, or parks – 2 – Capital projects b. Administrative expenses of the city manager’s office – 5 - General c. Gifts in which the principal must be invested and preserved but the investment earnings must be used to provide scholarships to children of police officers who died in the line of duty – 10 – Private-purpose trust d. Costs of a central purchasing and warehouse function – 6 – Internal service e. Assets held for external government participants in the government’s investment pool for the purpose of earning investment income – 7 – Investment trust f. Gifts in which the principal must be invested and preserved but the investment earrings can be used for public purposes – 9- permanent g. Costs of operating a municipal swimming pool – 4 - Enterprise h. Grant revenues restricted for particular operating purposes – 11 – Special revenue i. Assets held in trust to provide retirement benefits for municipal workers – 8 – Pension trust j. Principal and interest payments on general long-term debt – 3 – Debt service k. Taxes collected on behalf of another governmental unit – 1 - Agency