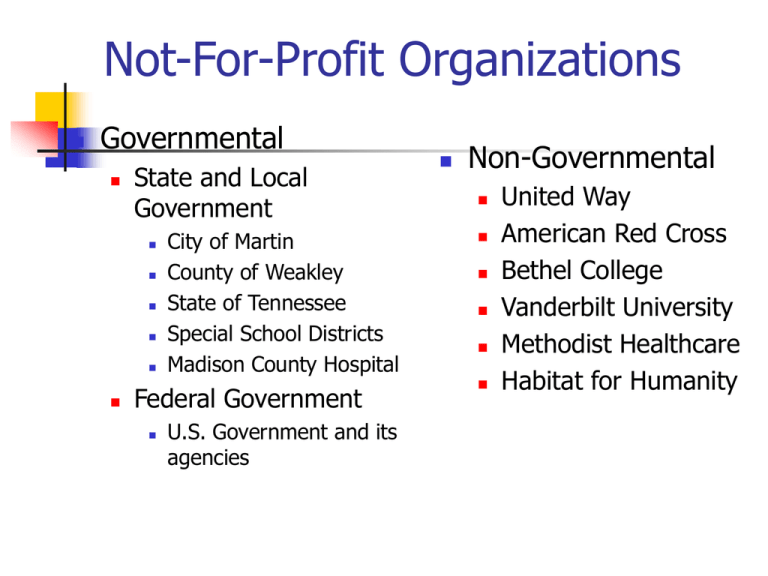

Not-For-Profit Organizations Governmental Non-Governmental

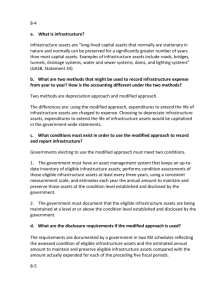

advertisement

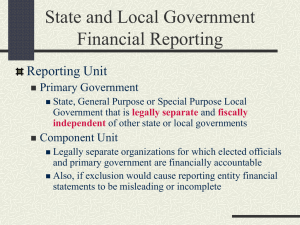

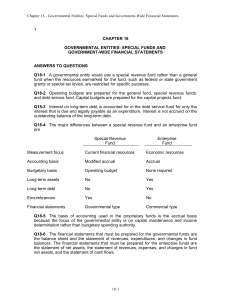

Not-For-Profit Organizations Governmental State and Local Government City of Martin County of Weakley State of Tennessee Special School Districts Madison County Hospital Federal Government U.S. Government and its agencies Non-Governmental United Way American Red Cross Bethel College Vanderbilt University Methodist Healthcare Habitat for Humanity Definition of a Government Popular election or appointment by popular elected officials Potential for unilateral dissolution by government Power to tax Power of Issuance of tax exempt debt directly Financial Reporting-NFPs Governmental State and Local Objectives GAAP Hierarchy (pp. 4-5) GASB is King (Queen) Federal Objectives GAAP Hierarchy (pp. 4-5) FASAB is King (Queen) Non-Governmental Objectives (p. 6) GAAP Hierarchy (pp. 4-5) FASB is King (Queen) Recent FASB Activity Little until middle 1990s SFAS 116, 117, 118, 121 changed this inactivity State and Local Government Financial Reporting User considerations are much more diverse Investors and creditors Legislative and oversight officials Political and social decisions as well as economic Measurement Focus Economic resources Flow of current financial resources State and Local Government Basis of Accounting Accrual Modified Accrual Method of Reporting Comprehensive Annual Financial Report Sections of CAFR Introductory Financial Statistical Exchange and Non-exchange Transactions Exchange Each party receives and gives up equal values City cleans up privately owned property and bills the owner for the service Non-Exchange One party does not receive proportionate value for value given up Property tax revenue Financial Statements Government-Wide Accrual basis of accounting Economic resources measurement focus Statement of Net Assets Statement of Activities Fund: A fiscal and accounting entity Modified accrual basis of accounting Flow of current financial resources measurement focus Each fund is a self-balancing set of accounts Fund Financial Statements Governmental Funds Balance Sheet Statement of Revenue, Expenditures, and Changes in Fund Balances Proprietary Funds Statement of Net Assets Statement of Revenue, Expenses, and Changes in Fund Net Assets Statement of Cash Flows Fund Financial Statements Fiduciary Funds Statement of Fiduciary Net Assets Statement of Changes in Net Fiduciary Assets Special Considerations Differences in measurement focus and basis of accounting between Government-Wide and Fund Financial Statements require reconciliation schedules Fiduciary Fund Statements are not included in the Government-Wide financial statements Types of Governmental Funds Governmental General Special Revenue Capital Projects Debt Service Permanent Proprietary Funds Enterprise Internal Service Fiduciary Funds Agency Pension Trust Investment Trust Private-Purpose Trust Governmental Funds and Budgeting Required for governmental type funds Optional for proprietary type funds Adopted by the legislative body Entered into the accounting records in reverse debit/credit approach A part of appropriate financial statements and/or schedules Accounting for Capital Assets and Infrastructure Long-lived assets All (except collections of works of art and historical treasures) must be capitalized and depreciated on government-wide and proprietary fund financial statements Capital assets and related depreciation expense do not appear on governmental type fund financial statements More elaborate discussion in next chapter Long-Term Debt Payable more than one year from Statement of Net Assets Date All entity long-term debt must be reported on the Statement of Net Assets (GW) Governmental type funds do not report long-term debt on financial statements (Flow of current financial resources measurement focus)