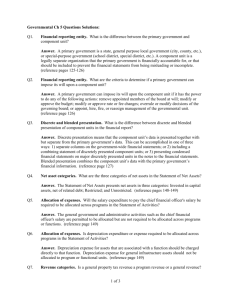

The Financial Statements of Proprietary Funds

advertisement

Learning Objective 7 Understand and explain the financial reporting of proprietary funds. 13-1 The Financial Statements of Proprietary Funds Financial statements for the proprietary funds Can be major funds If a governmental entity has more than one enterprise fund, each must be individually assessed Must meet either the 10 percent criterion or the 5 percent criterion. 13-2 The Financial Statements of Proprietary Funds The financial statements for proprietary funds are very similar to those for commercial entities 1. The statement of net assets (balance sheet) 2. The statement of revenues, expenses, and changes in fund net assets (income statement) 3. The statement of cash flows Budgeting in the proprietary funds also has the same role as in commercial entities 13-3 The Financial Statements of Proprietary Funds Statement of net assets Proprietary funds report their own fixed assets, investments, and long-term liabilities GASB 34 specifies that the net assets section be separated into three components: 1. Invested in capital assets, net of related debt 2. Restricted because of restrictions beyond the government’s control 3. Unrestricted 13-4 The Financial Statements of Proprietary Funds Statement of Revenues, Expenses, and Changes A separation of operating and nonoperating revenues and expenses is made to provide more information value regarding the operations of the proprietary funds. 13-5 The Financial Statements of Proprietary Funds Statement of Cash Flows Because of the large number of capital asset acquisition and financing transactions, the GASB specified four sections: 1. Cash flows from operating activities 2. Cash flows from noncapital financing activities 3. Cash flows from capital and related financing activities 4. Cash flows from investing activities 13-6 Practice Quiz Question #7 Which of the following statements is true about the financial reporting of proprietary funds? a. The financial statements are identical to those of the general fund. b. Proprietary funds do not need to meet the 10% or 5% tests to be major funds . c. Enterprise funds are always major funds. d. Internal service funds are not required to provide a statement of cash flows. e. Proprietary funds provide financial statements very similar to those of commercial businesses. 13-7 Learning Objective 8 Make calculations and record journal entries for internal service funds. 13-8 The Proprietary Funds: Internal Service Funds Purpose: to account for activities that provide services solely to other departments. These services are not available to the general public, making it different from the enterprise fund. Accounting like business accounting. Measurement focus on all economic resources and the accrual basis of accounting. Report fixed assets, which are depreciated, and long-term debt. 13-9 Practice Quiz Question #8 Which of the following an example of an activity that would be accounted for in an internal service fund? a. A public swimming pool. b. A municipal golf course with a club house used for weddings and other public gatherings. c. A maintenance department that provides services to various government offices. d. A state beach or park. e. A city recreation center with weight rooms, a workout facility, and a pool available to citizens of the community. 13-10 Learning Objective 9 Make calculations and record journal entries for trust funds. 13-11 The Fiduciary Funds Two categories (four types of funds) Trust Funds Pension (and other employee benefit) Trust Funds Investment Trust Funds Private-Purpose Trust Funds Agency Funds 13-12 The Fiduciary Funds: Trust Funds Purpose: to account for the investing and using of money in accordance with stipulated provisions of trust indenture agreements or statutes. Pension (and other employee benefit) Trust Funds Investment Trust Funds (created by GAS 31) Private-Purpose Trust Funds 13-13 The Fiduciary Funds: Trust Funds Private-purpose Trust Funds account for property held under trust arrangements which benefit: Individuals Private organizations Other governments 13-14 The Fiduciary Funds: Trust Funds Trust funds use the accrual basis of accounting. Financial statements required: The statement of fiduciary net assets includes all trusts and agency funds the statement of changes in fiduciary net assets. includes only the trust funds because agency funds do not have a net asset balance. 13-15 Practice Quiz Question #9 Which of the following is NOT true trust funds? a. Trust funds use the accrual basis of accounting. b. Trust funds can account for money that belongs to employees. c. Trust funds are not required to provide financial statements. d. Pension funds are an example of a trust fund. 13-16 Learning Objective 10 Make calculations and record journal entries for agency funds. 13-17 The Fiduciary Funds: Agency Funds Agency Funds serve as conduits for the transfer of money. This role is purely custodial in nature. Since the assets belong to someone else, assets always equal liabilities. A = L The following items do not exist for agency funds: A fund balance/equity An operating statement 13-18 The Fiduciary Funds: Agency Funds Agency funds account for resources held by a governmental unit as a custodial agent for individuals, private organizations, other funds, or other governmental units. Agency funds use the accrual basis of accounting. The financial statement for agency funds is the statement of fiduciary net assets. 13-19 Practice Quiz Question #10 Which of the following is a good example of an activity that would be accounted for in an agency fund? a. A public parking lot available to all citizens that charges a fixed daily or monthly rate. b. A county tax assessment agency that collects property taxes for all cities in the county. c. A county owned ski resort that is available to both county residents and nonresidents. d. A public water utility providing services to all residents of the county. 13-20 Learning Objective 11 Understand and explain the preparation of government-wide financial statements. 13-21 The Government Reporting Model GASB 34 specifies the reporting model What organizations comprise the reporting entity? The primary government A component unit for which the primary government is financially accountable Any organization that has a significant relationship with the primary government 13-22 The Government Reporting Model What constitutes financial accountability? Financial accountability is evidenced when the primary government appoints a majority of the organization’s governing board. Financial accountability may also exist if the organization has a separately elected or appointed board but fiscally depends on the primary government for the financial resources required to operate. 13-23 The Government Reporting Model What other organizations should be included in the reporting entity? GASB 14 specifies a third category of organizations to be evaluated to determine if they are part of the reporting entity with the primary government. These are legally separate, tax-exempt entities for which the primary government is not financially accountable. 13-24 The Government Reporting Model How should the financial results of the component units be reported? A choice between two methods: Discrete presentation in a separate column of the primary government’s financial statements Blended presentation by combining the organization’s results into the primary government’s financial results 13-25 The Government Reporting Model The Comprehensive Annual Financial Report (CAFR) The CAFR Government-wide statements (2) Fund-based statements (7) 13-26 The Government Reporting Model Two government-wide statements: The Statement of Net Assets includes all GCA and GLTL. The Statement of Activities includes depreciation expense. Presented on the accrual basis. Measure the flow of economic resources Like statements for a commercial enterprise. These two statements are presented in addition to the 7 Fund-Based Financial Statements. 13-27 The Government Reporting Model The two government-wide statements must distinguish between: 1. Governmental activities and 2. Business-type activities. The total primary government must be discretely presented in addition to the component units reported in separate columns. Fiduciary activities are excluded from the government-wide statements if their resources are not available to finance the government’s programs. 13-28 The Government Reporting Model Important features of the government-wide Statement of Net Assets: Reports all “general capital assets”—including infrastructure. Reports all debt—including GLTL. Reports net assets in 3 categories: 1. Invested in capital assets, net of related debt 2. Restricted 3. Unrestricted In general, interfund balances (loans, advances, and due to and due from accounts) are eliminated. 13-29 The Comprehensive Annual Financial Report 13-30 Government-wide Statement of Net Assets 13-31 Government-wide Statement of Activities 13-32 Practice Quiz Question #11 Which of the following is NOT true about the CAFR? a. Government-wide financial statements are similar to the balance sheet and income statement disclosed by businesses. b. Government-wide financial statements are based on the modified accrual basis of accounting. c. Since governments provide the two government-wide financial statements, they are not required to provide fund statements. d. Governmental reporting requires a government-wide statement of cash flows. 13-33 Learning Objective 12 Understand and explain the additional disclosures that accompany government-wide financial statements. 13-34 The Government Reporting Model Reconciliation schedules Required to reconcile the net change in the total amounts reported on the governmental funds statements with the amounts reported on the government-wide statements Reconciliation schedule for Statement of Net Assets Reconciliation schedule for Statement of Activities Budgetary comparison schedule This should be presented as required supplementary information for the general fund and for each special revenue fund that has a legally adopted annual budget. 13-35 The Government Reporting Model Management’s Discussion and Analysis MD&A should be included in the required supplementary information of the governmentwide financial statements to provide an analytical overview of the government’s financial and operating activities. Notes to the government-wide financial statements GASB 34 specified a number of required note disclosures. 13-36 The Government Reporting Model Interim reporting Governmental entities generally are not required to publish interim reports, although many prepare monthly or quarterly reports Internal management control instrument Auditing governmental entities Most entities are audited annually Different from the audit of a commercial entity Single Audit Act of 1984 13-37 Additional Considerations Special-purpose governmental entities Financial reporting for pensions and OPEB plans Employer accounting for pensions and OPEB plan benefits Accounting for termination benefits 13-38 Practice Quiz Question #12 Which of the following is true about required supplemental disclosures of governmental entities? a. Governments are autonomous and need not provide any specific disclosures. b. The CAFR must include management discussion and analysis. c. No one reads governmental financial reports, so it doesn’t really matter what is disclosed. d. Governments must provide quarterly interim reports as part of the CAFR. 13-39