Everything You Wanted to Know about Financial Statements

Everything You Wanted to Know about Financial Statements but were Afraid to Ask

Julie A. Jakubec, CPA

O’Hara Township Manager

You and Me

• Stop me at anytime for a question

• No question is silly

• If I go too fast let me know

• You should know this stuff is not easy, even

I get confused at times

What is the most important department/function in a

Municipality?

Think hard!

Why

• The entire function of the Township is dependent on the finance department/function

• You can’t have a police department without having someone to pay them

• The super heroes in government are the finance folks!

First Step for Financial

Statements

• Usually the Municipality Board appoints external auditors – normally through a request for proposal process

• Should be a CPA Firm that specializes in governmental clients

• Elected auditors are a thing of the past

Specialize in Governments?

• Governments are ruled by the

Governmental Accounting Standards Board

• The rules are totally different from the private sector – you have to audit governments to understand governments

• Everyone remembers the infamous/famous

GASB 34

• Now we’re up to GASB 52

Auditors

• Ask you to sign an engagement letter

Let’s look at an example

• Do the voodoo they do

• Verify the numbers that

YOU have presented to them are free of material misstatement

• These tested (audited) numbers are what are used to prepare the financial statements

The Financial Statements

Basic Make up of Financial Statements-

• Auditor’s Report

• Management Discussion and Analysis

• Basic Financial Statements – sounds simple but…..

• Footnotes

• Required Supplementary Information

• Combining Schedules

Auditor’s Report

• The report card on the Township’s financial statements

• Are in the simplest forms–

Unqualified – great

Qualified – not that great

Adverse – bad

Disclaimer – VERY, VERY BAD

Unqualified Opinion

• States the opinion that the financial statements present fairly, in all material respects, the financial position, results of operations and cash flows of the entity in conformity with generally accepted accounting principles

• This is a text book definition - really

• Let’s look at an example

Qualified Opinion

• States that , except for the effects of the matter(s) to which the qualification relates, the financial statements present fairly, in all material respects, the financial position, results of operation, and cash flows of the entity in conformity with GAAP

• Can be qualified for various reasons – usually not material to the financial statements

• Let’s look at some examples

Adverse Opinion

• States that the financial statements do not present the financial position, results of operations, or cash flows of the entity in conformity with GAAP

• Means material misstatements

• If you get one of these - WORRY

• Let’s look at an example

Disclaimer of Opinion

• States that the auditor does not express an opinion on the financial statements

• This is REALLY NOT GOOD

• Means records are basically unauditable

• If you get one of these you have serious issues

• I have never seen one issued

• Let’s look at an example

What is Materiality?

• The concept of materiality recognizes that some matters, either individually or in aggregate, are important for the fair presentation of the financial statements

• Would the matter change my opinion of the financial statements – reasonable person

• Materiality is based on audit units – really technical stuff

• See me after the class if you want more information and I can get you more information

Management’s Discussion and Analysis

• Was part of GASB 34

• Narrative of key points of the financial statements

• Very specific reporting requirements

• Must disclose the good, the bad and the ugly

• Lots of charts and graphs

• Reader should get a basic understanding of your financial position from reading

• Must be prepared by management – auditor should not prepare this for you and it’s not audited

• Let’s look at an example – mine

Government-wide Financial

Statements

• Creation of GASB 34

• Statement of Net Assets

• Statement of Activities

First Things First

Governments have three main fund types

• Governmental – general fund, special revenue funds and capital project funds

• Proprietary Funds – sewer funds, water funds – driven by user charges

• Fiduciary Funds – pension funds

Government-wide Financial

Statements

All activities in the government-wide statements are measured and reported utilizing the economic resources measurement focus and the accrual basis of accounting

• Different for governmental funds

• Same old for proprietary funds

Key

The government-wide financial statements are designed to demonstrate operational accountability

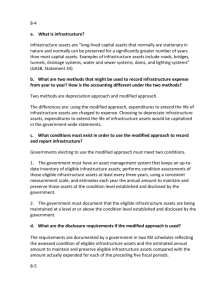

Statement of Net Asset

Let’s look at mine

Everything rolled up into one

Key areas of interest – fixed assets and net assets

Statement of Activities

• Focus on functions and programs first, not fund types

• Is the function or program pulling its own weight? – usually the answer is no, except for user charge driven functions or programs

• Let’s look at mine

Points of Interest

• No fiduciary funds are presented – monies not available for operations

• Cash flow is not required

Julie’s Opinion

The government-wide statements are interesting and have some interesting information, but most governments focus on and utilize the fund financial statements

Focus of Fund Financial

Statements

Focuses on major funds – these funds meet a specific criteria that qualifies them as major funds. General fund is always a major fund, but others may or may not be

Measurement Focus

The measurement focus for governmental fund types is different in the fund financial statements vs. the government-wide. Use the current financial resources measurement focus and the modified accrual basis of accounting to measure and report their activities. Emphasizes the near-term inflows and outflows of expendable resources. This is consistent with our annual budgets

Proprietary funds same as government-wide

What?

• Now have a reconciliation of fund financial statements to government-wide to tie them together

Balance Sheet Governmental

Funds

• Gives a snapshot of the assets, liabilities and fund balance of the major governmental funds. Non-major funds grouped into one column

Let’s look at an example and see what we can figure out from it, then we can run a few different scenarios

What We Can Figure Out

• How is the Municipality’s cash position

• What is the tax receivables balance

• Do they owe a lot of money

• How much revenue is expected to be collected in the distant future

• What is the undesignated fund balance number – this is the number we all live and die by

Statement of Revenues,

Expenditures and Changes in

Fund Balance – Gov. Funds

• Shows revenues and expenditures for the year – not expenses as in government-wide

• Major funds shown individually and nonmajor grouped into one column

• Shows gain or loss for the year

• Let’s look at an example and run a few scenarios

Statement of Revenues,

Expenditures and Changes in Fund

Balances - Budget and Actual

This is a really neat financial statement. Shows how the fund performed vs. the final budget and shows the effects of any budget amendments or adjustments

You can really get a feel for how the government is performing from this statement

Let’s look at an example and run a few scenarios

Things to Watch

• Is the budget always exceeded or not met – may have to change the way you budget

• If scanning the original vs. final budget shows lots of changes may need to ask why

– any budget amendment should be passed by the board in ordinance form. I always include reasons as to why there is an adjustment needed

Statement of Fund Net Assets

• Proprietary Funds focus on net assets, not retained earnings or fund balance

• Can have one or many proprietary funds

• Remember presentation is the same as the government-wide financial statements – full accrual

• Let’s look at an example

Statement of Revenues, Expenses and Changes in Fund Net Assets

• Focus on operating and non-operating

• Expenses and not expenditures

• Can have one or multiple proprietary funds

• Let’s look at an example

What Can We Learn?

• Is the proprietary fund self supporting? Not a good idea for the general fund to support a proprietary fund – may need user charge increase

• My pet peeve – If I do not use the swimming pool why should my tax dollars support it? – We could talk an hour just on this issue

Time for Cash Flows

• Shows the cash in and out for the proprietary funds

• Not presented in the government-wide

• Even I hate the cash flows

• Let’s look at an example

Statement of Fiduciary Net

Assets

• Relates to pensions

• Not presented in the government-wide

• Let’s look at an example

Statement of Changes in

Fiduciary Net Assets

• Similar to an income statement

• Shows additions and deductions

• Let’s look at an example

Footnotes

• Lots of good information

• Basically is the detail of key financial statement numbers

• You can glean a lot of good information from the footnotes

• Certain footnotes are required for GAAP financial statements

Quick Quiz on Summary of

Accounting Policies

• Does O’Hara have any joint ventures?

• What are the Township’s major funds?

• Why do we have reserved fund balance?

• What are our infrastructure capitalization thresholds?

• What is the maximum sick days a police officer can accrue?

This is information you can learn from one footnote

Footnotes

• Let’s look through mine and see what we could learn and glean you would be surprised what you can learn from a quick read of your footnotes

Required Supplementary

Information

• Tables related to pensions

• Can get quick information on Municipal required contributions to fully fund the actuarial accrued liability and funding ratio

• Let’s look at an example

Combining and Individual Fund

Statements and Schedules

I know you have been worrying about the non-major funds that we talked about earlier and how you get detailed information on them – no need to worry any longer

Combining statements are presented for these funds to get any necessary detailed information

Let’s look at examples

SAS 112 Letter

Utilized to communicate in writing significant and material internal control deficiencies noted during the audit

Reports material weaknesses and significant deficiencies

Significant Deficiency

A control deficiency or combination of control deficiencies that adversely affects the entity’s ability to initiate, authorize, record, process, or report financial data reliably in accordance with generally accepted accounting principles such that there is a remote likelihood that a misstatement of the financial statements that is more than inconsequential will not be prevented or detected

- SAS 112 definition

Material Weakness

• A significant deficiency, or combination of significant deficiencies, that results in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected – SAS 112 definition

What Does This Mean

• Your auditors will communicate internal control issues to you in writing by their severity

• This is a public document – make sure you read it and have the finance folks correct the problems

• Let’s look at possible issues

My Final Thoughts

I believe that it is imperative for managers, board members and department heads to understand financial statements and their impact on the municipality. The finance department and their related reports are the gatekeepers to the success or failure of a government

One thing you never want to be wrong about is a tax increase

How do I Learn More?

• www.GFOA.org has a great series for the elected official on various financial issues – the price is not too steep

• Read your municipality’ financial statements and ask questions

• Call me (412) 782-1400