Summary profile of the dominant economic characteristics of the

advertisement

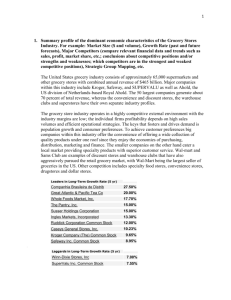

Summary profile of the dominant economic characteristics of the Grocery Stores Industry. For example: Market Size ($ and volume), Growth Rate (past and future forecasts), Major Competitors (compare relevant financial data and trends such as sales, profit, market share, etc.; conclusions about competitive positions and/or strengths and weaknesses; which competitors are in the strongest and weakest competitive positions), Strategic Group Mapping, etc. The United States grocery industry consists of approximately 65,000 supermarkets and other grocery stores with combined annual revenue of $465 billion. Dominant companies within the industry include Kroger, Safeway, and SUPERVALU as well as Ahold, the US division of Netherlands-based Royal Ahold. The 50 largest companies generate about 70 percent of total revenue, whereas the convenience and discount stores, the warehouse clubs and superstores have their own separate industry profiles. The grocery store industry operates in a highly competitive external environment with the industry margins are low; the individual firms profitability depends on high sales volumes and efficient operational strategies. The aspect that foster and drives demand is population growth and consumer preferences. To achieve customer preferences big companies within this industry offer the convenience of offering a wide collection of quality products under one roof since they enjoy the economies of purchasing, distribution, marketing and finance. The smaller companies on the other hand cater the local market providing specialty products with superior customer service. Wal-mart and Sams Club are examples of discount stores and warehouse clubs that have also aggressively pursued the retail grocery market, with Wal-Mart being the largest seller of groceries in the US. Other competition includes specialty food stores, convenience stores, drugstores and dollar stores. For comparative analysis we are going to compare the two top companies making the most revenue, Kroger Company and Safeway Inc. The Kroger Companies primary sources of revenue are the food stores which account for approximately 95% of total company sales. The companies owns 2,470 grocery retail stores in 31 states, operates 779 convenience stores in 18 states. 375 fine jewelry stores under names like Fred Meyer Jewelers, Littman Jewelers, Barclay Jewelers, and Fox's Jewelers. These are high-margin businesses which generates good cash flow. Kroger is the only major U.S. supermarket company to operate an economical three-tier distribution system. Kroger also operates 40 food processing or manufacturing facilities producing high quality private-label products that provide value for customers and enhanced margins for Kroger. Kroger operates 909 supermarket fuel centers, which are a natural addition to their one-stop-shopping strategy. Kroger's 1,963 pharmacies, located within stores, provide high quality services at everyday low prices. Growing market share is an important part of Kroger’s long-term strategy. Market share being the most important part of their long-term strategy allows them to leverage the fixed costs in their business over a wider revenue base thus their fundamental operating philosophy is to maintain and increase market share. According to Nielsen Homescan Data in 2009, Kroger’s overall market share increased approximately 60 basis points, according to. Throughout 2009, Kroger successfully grew identical sales, one of the key objectives of their strategic business model. Identical supermarket sales increased 2.1%, without fuel, compared with the prior year. The business continues to widen the gap between Kroger’s identical sales growth trends and those of most of their competitors. Even in the face of high unemployment, unprecedented deflation, and a weak U.S. economy, Kroger improved its operational performance and continued to focus on creating value for its shareholders (referenceforbusiness.com). Safeway Inc. on the other hand is one of the largest food and drug retailers in North America. As of March 28, 2010, the company operated 1,712 stores in the Western, Southwestern, Rock Mountain, and Mid-Atlantic regions of the United States and in western Canada. In support of its stores, Safeway has an extensive network of distribution manufacturing and food processing facilities. With 8% of the market, Safeway is the second largest traditional supermarket operator in the United States. With its Blackhawk Network subsidiary, Safeway is also the largest distributor and seller of third party gift cards, offering brands such as Barnes & Noble (BKS), iTunes, and Home Depot (HD). Safeway earned $40.8 billion in revenue in 2009, down from $44.1 billion in 2008 (and the latter was reported for 53-weeks). In 2009 Safeway reported a net loss of $1,097 million, as compared to net income of $965 million the previous year. However, the poor result includes accounting for a noncash goodwill impairment charge related to Safeway’s reduced market capitalization and the recession; excluding the charge, Safeway would have posted net income of $720 million. Management blamed the decline in revenues on reduced consumer spending and an increase in bargain shopping, lower fuel prices, and “unprecedented levels” of price deflation for items such as dairy, meat, and produce. The following pie chart illustrates the Strategic Group Mapping within this industry. The Strategic Group Mapping may be explained through the Boston Consulting Group Matrix which divides the players in the market in terms of their market growth and market share. Stars have a high market share and high market growth, Companhia Brasileira de Distributors can be stated as the stars with a revenue of $25.5 B and a growth rate of 27.50%. Cash cows high market share and low growth, Kroger is the cash cow of this industry with a revenue of $78.7 B and growth of 9.65%. Dogs are the companies that have a low share of a low growth market,. Winn-Dixie Stores, Inc with the revenue of $7.2 B and the growth of 7.00%. Question marks are high market share but low growth rate, SuperValu, comes under this category with $39.4 B in revenues in 2009 but a 7.55% growth rate (Wikinvest, 2010). Since the grocery store industry is so competitive with the industry margins very low; the individual firms struggle to keep up their profitability. Each individual firm needs to consider Porters Five Forces Model along with keeping in mind that that their businesses run on customers that are powerful and have low switching cost when giants like Wal-Mart are in business. Leaders in Total Revenue (ttm) 2009 Kroger Company (The) Common Stock $78.7 B Safeway Inc. Common Stock $41.0 B SuperValu Inc. Common Stock $39.4 B Etablissements Delhaize Freres $25.5 B Companhia Brasileira de DistribCBD $16.0 B Whole Foods Market, Inc. $8.7 B Great Atlantic & Pacific Tea Co $8.6 B Winn-Dixie Stores, Inc. $7.2 B The Pantry, Inc. $6.2 B Caseys General Stores, Inc. $4.4 B Leaders in Long-Term Growth Rate (5 yr) Companhia Brasileira de Distrib 27.50% Great Atlantic & Pacific Tea Co 20.00% Whole Foods Market, Inc. 17.70% The Pantry, Inc. 15.00% Susser Holdings Corporation 15.00% Ingles Markets, Incorporated 13.30% Ruddick Corporation 12.00% Caseys General Stores, Inc 10.23% Kroger Company 9.65% Safeway Inc. 8.95% Source: http://www.wikinvest.com/industry/Grocery_Stores WORKS CITED Reference for business. (2010). SIC 5411 Grocery Stores. Retrieved September 24, 2010, from http://www.referenceforbusiness.com/industries/Retail-Trade/Grocery-Stores.html Wikinvest. (2010). Grocery Stores. Retrieved September 24, 2010, from Source: http://www.wikinvest.com/industry/Grocery_Stores Einav, L., Leibtag, E., & Nevo, A. (n.d.). On the Accuracy of Nielsen Homescan DataThe U.S. Department of Agriculture. Retrieved September 24, 2010, from http://www.ers.usda.gov/Publications/ERR69/ERR69.pdf.