Whole Foods - SWOT-Internal Analysis

advertisement

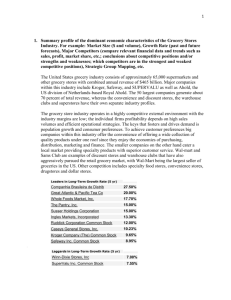

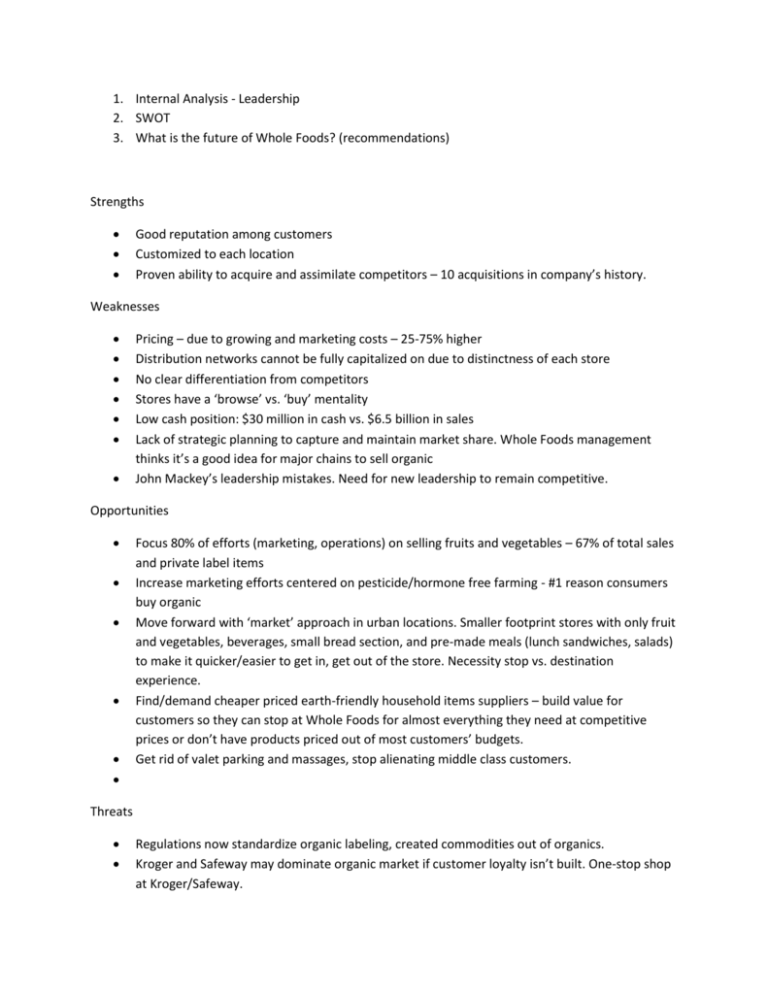

1. Internal Analysis - Leadership 2. SWOT 3. What is the future of Whole Foods? (recommendations) Strengths Good reputation among customers Customized to each location Proven ability to acquire and assimilate competitors – 10 acquisitions in company’s history. Weaknesses Pricing – due to growing and marketing costs – 25-75% higher Distribution networks cannot be fully capitalized on due to distinctness of each store No clear differentiation from competitors Stores have a ‘browse’ vs. ‘buy’ mentality Low cash position: $30 million in cash vs. $6.5 billion in sales Lack of strategic planning to capture and maintain market share. Whole Foods management thinks it’s a good idea for major chains to sell organic John Mackey’s leadership mistakes. Need for new leadership to remain competitive. Opportunities Focus 80% of efforts (marketing, operations) on selling fruits and vegetables – 67% of total sales and private label items Increase marketing efforts centered on pesticide/hormone free farming - #1 reason consumers buy organic Move forward with ‘market’ approach in urban locations. Smaller footprint stores with only fruit and vegetables, beverages, small bread section, and pre-made meals (lunch sandwiches, salads) to make it quicker/easier to get in, get out of the store. Necessity stop vs. destination experience. Find/demand cheaper priced earth-friendly household items suppliers – build value for customers so they can stop at Whole Foods for almost everything they need at competitive prices or don’t have products priced out of most customers’ budgets. Get rid of valet parking and massages, stop alienating middle class customers. Threats Regulations now standardize organic labeling, created commodities out of organics. Kroger and Safeway may dominate organic market if customer loyalty isn’t built. One-stop shop at Kroger/Safeway. Down economy shifts demand to conventional food items – income elasticity of demand. Internal Analysis Affordability is a key Weakness – WF must build value with every customer interaction. o Email recipes, establish newsletter, personalized services once customer is in the store, free organic cooking classes, partner with local farmers in advertising Value Chain Analysis o Logistics seem to be streamlined o Operations – opportunity to be more efficient, appeal to more customers/increase average spending Focus more on perishables (fruit and vegetables) – reduce waste and spoilage in biggest section of the store Eliminate external (?) services – valet parking, massages Develop budget that allows chefs to teach organic cooking classes to customers at no cost. Continue to invest in customer service associates. Their interactions can help build brand loyalty. o Marketing – severely underfunded, develop new marketing campaign in current markets to reach more middle/upper income families. Focus on pesticide/hormone free and benefits to the earth – capitalize on green/healthy trends. o Management/Administration – board should remove John Mackey and replace him with a leader with experience in grocery or organics. Proven inability to lead at this level. Doesn’t have the vision to make the changes necessary right now. Stage of Industry Evolution is key – Emergence, Growth, Maturity, Decline o Currently in Growth Stage. To remain competitive WF must: Appeal to a greater segment of the population – increased demand. Provide outstanding quality in every customer interaction. Customers have more options in growth stage vs. emergence stage. Differentiation must include building brand value (marketing) and value-added services (cooking classes, personalized customer service throughout the store).