The Great Depression

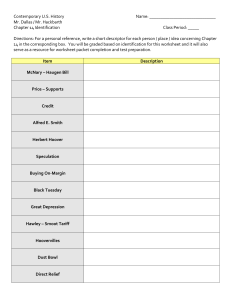

advertisement

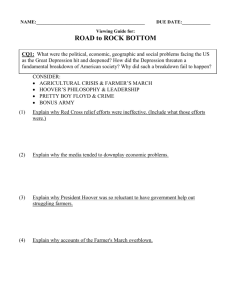

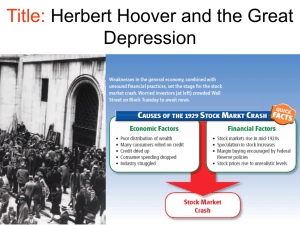

Potential economic problems in U. S. apparent in 1920s Textile, steel & railroad industries in trouble. Railroads lost business to new forms of transportation. Textile mills faced competition from mills in Japan, India, China, and South America that used cheaper labor to sell at cheaper prices Coal mining hit especially hard due to competition from new forms of energy: fuel oil, hydroelectric power,and natural gas. 1930s, these new sources supplied more than half the power once provided by coal. New house construction fell steadily after peaking in 1925 The decline caused other businesses dependent on construction to decline also. Furniture, and household appliances Agriculture suffers in 1920s World War I: demand for wheat, corn, etc. soared Prices rose Farmers planted more Took out loans for more land and equipment After war, demand fell— prices declined by 50% or more Agriculture suffers in 1920s Because of low prices, farmers could not repay loans Banks foreclosed and seized farms and equipment as payment Agriculture suffers in 1920s McNary-Haugen Bill in Congress Proposed federal price supports for key products • Government would buy surplus crops at guaranteed prices higher than market rate • Government would then sell crops on world market for lower prices • To compensate for losses, taxed domestic food sales. Agriculture suffers in 1920s McNary-Haugen Bill in Congress Cost passed to consumers Coolidge twice vetoed Farmers began to experience severe financial difficulties. The economy of the late 1920s: People: less disposable income Farms and factories continued to produce more People bought less creating a surplus that caused farmers and businesses to go further into debt. The economy of the late 1920s: Many Americans lived beyond their means Bought goods on credit Distribution of wealth very uneven Rich got richer; poor got poorer 1928 election: Republicans: Herbert Hoover Iowa, engineer, had not previously run for elective office “A chicken in every pot; 2 cars in every garage.” Democrats: Alfred Smith Brooklyn, New York; Catholic; career politician. 1928 election: Hoover won an overwhelming victory. People liked the Republican message: “The poorhouse is vanishing among us.” 1928 election: The Stock Market Many Americans invested in stocks and bonds A “bull market”—rising prices 1929—4 million Americans (3%) owned stocks Many investors engaged in speculation—short term ownership of particular stocks—ignored risks to make quick profits. The Stock Market Unrestrained buying and selling Prices rose—paper wealth Stock prices often became far greater than the real worth of the companies represented by particular stocks. The Stock Market Many investors bought on margin—borrowed on the value of the stock. Company X=$10.00 per share Buy 400 shares: $4,000.00 Pay 25% down: $1,000.00 Borrow 75% from Stockbrokers: $3,000.00 As prices rose and investors sold, paid off debt and kept profits The Stock Market September 1929: stock prices peaked; began to decline due to surpluses and increasing business and farm debt. October 24, 1929: stocks plunged. October 29, 1929: Black Tuesday Prices spiraled downward People sold frantically to cut their losses 16 million shares dumped The Great Depression The Great Depression: Five factors Lack of economic diversification Misdistribution of purchasing power, weakness in consumer demand Credit structure: farmers too deeply in debt Decline in European demand for U. S. goods International debt structure The Great Depression Begun by Stock Market crash Other causes: Old/decaying industrial base Farm products crisis Availability of easy credit Unequal distribution of income Low interest rates encouraged more borrowing; greater debts The Great Depression People panicked; withdrew their money from banks (runs on) Many banks lost a lot of money in stock market crash Could not cover those losses plus withdrawals of individual accounts 1929—259 banks closed By 1933, 6,000 banks (25%) had failed 9-million individual savings accts. wiped out by 1933 The Great Depression Millions of Americans lost their jobs Unemployment: 1929: 3% ( 1.6 million) 1933: 25% (13 million) The 2005 film Cinderella Man depicted the hard times of the Great Depression The Dust Bowl The Dust Bowl The Dust Bowl The Dust Bowl John Steinbeck & The Grapes of Wrath The Scottsboro Case Gracie Allen and George Burns Jack Benny Orson Welles Hollywood Moguls Louis B. Mayer MGM Jack Warner Warner Brothers Frank Capra It Happened One Night It’s A Wonderful Life Walt Disney Snow Wight and the Seven Dwarfs (1937) The Wizard of Oz Gone With the Wind Margaret Mitchell The Marx Brothers Greta Garbo President Hoover tried to reassure Americans that the American economy was on solid ground in late October 1929. “Any lack of confidence in the economic future. . . is foolish.” Americans had experienced previous depressions. Felt they were normal parts of the business cycle. Many experts believed that the best course of action in late 1929-early 1930: do nothing Secretary of the Treasury Andrew Mellon: “Let the slump liquidate itself.” Hoover: minimal government intervention in the economy; but government should play some role in solving problems. Hoover: Logic combined with humanitarianism Hard time making political compromises— too inflexible Difficulty adjusting his attitudes to changing desperate circumstances of the nation. Government’s role: encourage and facilitate cooperation; not control it. Believed in “rugged individualism”—people should succeed through their own efforts; they should not depend on the government to bail them out. Believed individuals, charities, and local organizations should pitch in and care for less fortunate. Federal government: direct relief measures, but not through a bureaucracy. Cautious approach Called together business, banking and labor leaders, urging them to work together to find solutions to the nation’s economic problems. Hoover asked employers not to cut wages or lay off workers; asked labor leaders not to demand higher wages or strike. None of his urgings did any good. Unemployment rose More companies & banks went out of business Increasing numbers of breadlines, soup kitchens, shantytowns, and hoboes. The “nice guy,” laissez faire (let business do it) approach did not work. The Great Depression American imports severely reduced Further stress on European economies Difficult to sell U. S. products abroad 1930 Congress passed the Smoot-Hawley Tariff Act Highest protective tariff in U. S. history Designed to protect U. S. farmers Reduced flow of goods into U. S. The Great Depression 1930 Congress passed the Smoot-Hawley Tariff Act European “pay back”—raised their own tariffs Limited U. S. exports Increased U. S. unemployment World-wide affect World trade fell by > 40% World-wide crisis 1930 off year elections: Democrats win control of the House of Representatives Republicans only control Senate by 1 vote People very displeased with Hoover and the Republican Party (GOP) Americans outwardly expressed anger with Hoover Farmers burned corn and wheat, dumped milk on roads (rather than sell it at a loss), and blocked roads to prevent food from getting to market. Americans outwardly expressed anger with Hoover Shantytowns: Hoovervilles Americans outwardly expressed anger with Hoover Newspaper blankets: Hoover blankets Hoover flags People started thinking of Hoover as cold and heartless Still, he refused to consider direct relief from the government or any form of federal welfare. By 1930, Hoover did take a more activist approach to stimulating the economy. Genuine sensitivity to people’s suffering. Began to listen to others. Initiated public-works projects Roads, dams, bridges Approved $800 million for projects Effort to stimulate business and provide jobs Most famous federal project: Boulder (now Hoover) Dam. Other local, with some federal assistance, projects included: Golden Gate and Transbay Bridges over S. F. Bay Other efforts by Hoover to help the U. S. out of the Depression: Creation of the Federal Farm Board— designed to keep crop prices high 1933—Glass-Steagall Banking Act— increased bank reserves for easier loans Federal Home Loan Bank Act—lower mortgage rates and money for farmers to refinance farm loans Other efforts by Hoover: 1932—Reconstruction Finance Corporation Emergency financing to banks, life insurance companies, railroads, and other large businesses Hoover’s theory: money would trickle down to average citizen through job growth and higher wages. The Bonus Army 1932: 10,000-20,000 World War I veterans and families arrived in Washington, D. C. Bonus to World War I veterans who had not been paid adequately for wartime service Congress passed the bonus in 1924 to be paid in 1945 as a life insurance policy. The Bonus Army Patman Bill Congressman Wright Patman of Texas Patman believed the bonus should be paid immediately Hoover provided food and supplies so the veterans could erect a shantytown in sight of the capitol The Bonus Army June 17, 1932—Congress voted down the Patman Bill Hoover asked the veterans to leave; all but about 2000 did. They marched on the capitol. Hoover calls out the Army to disband the Bonus Army. Army, led by General Douglas MacArthur, assisted by future generals George Patton and Dwight D. Eisenhower, The Bonus Army . . . uses tear gas, bayonets, and the “flats” of cavalry swords to disband the Bonus Army. 11-month-old baby killed, 8-year-old partially blinded 2 people shot American people outraged and blame Hoover for the incident.