Name FASB Paper ACC 497 Week 1 The idea of keeping good

advertisement

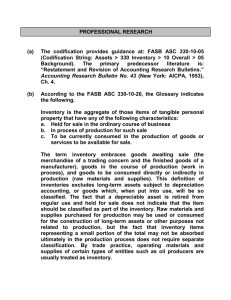

Name FASB Paper ACC 497 Week 1 The idea of keeping good records of finances, property, or materials date back to just some of the earliest societies and branches over various different civilizations and generations. The history and evolution of accounting is strictly routed through that of society. Thus, each society has their specific need of accounting, which closely indicates the methods and structure of the system followed. Ultimately, due to the development of corporate business, there is a need to establish a formal method which arose from the modern accounting system which is active today. Over time, the Financial Accounting Standards Board or FASB became relative to accounting standards. However, the FASB is not the primary group which has the responsibility to declare or clarify accounting standards; coincidentally, the confusion leads to attempting to comply with generally accepted accounting principles. Nevertheless, in order to simplify the process and bring order, the FASB established an Accounting Standards Codification. The FASB ASC is an overhaul of accounting and reporting standards designed to simplify user access to select US authorities which are generally accepted accounting principles (GAAP). Furthermore, they are provided with the authoritative literature with a typically organized structure. In summary, the FASB ASC has an authoritative and complete source on GAAP. The purpose of ASC is basically to simplify the user access to all authoritative US GAAP´s within one spot. Furthermore, the ASC makes an effort to provide updated information on the GAAP. Through a simplified and updated research system, the FASB ASC is able to improve their accuracy with accounting practices. The accounting standards codification in itself are composed of nine sections, including accounting principles, presentation, assets, liabilities, equity, revenue, expenses, broad transactions, and industry. Primarily, accounting principles were generally accepted as an overview of the GAAP. Second of all, the presentation presented itself as a section which regards to the general presentation of financial statements. Finally, the assets section, which normally covers cash, cash equivalents, inventory, and various other assets. Basically, each of the sections gave the audience guidance on the related field of accounting. The final two sections include a broad transaction and industry, which is where the topics primarily fall under simple concepts from the previous sections and other transactions from other industries. Accounting in general has evolved naturally along with society´s evolution based on the need for record keeping so the difficulties apply of accounting rules and regulations. Through various groups there is a founded facilitation which provides structure and unification in practice, and the overall outcome was an overwhelming amount of publication from multiple sources. Normally, along with evolution, the need presents a solution so yielding the FASB ASC, which served to once more regulate accounting by establishing an up to date codification of US generally accepted accounting principles. References American Institute of CPAs. (2010). FASB accounting standards codification. Retrieved from http://www.aicpa.org/InterestAreas/AccountingAndAuditing/Resources/ AcctgFinRptg/AcctgFinRptgGuidance/Pages/FASBAccountingStandards Codification.aspx Schroeder, R. G. (2011). The deveolpment of accounting theory. In Financial accounting theory and analysis (pp. 1-30). Retrieved from https://ecampus.phoenix.edu/content/eBookLibrary2/content/TOC.aspx ?assetdataid=5e1c71fc-6f96-4807-97c9029d18e362ac&assetmetaid=ce9325f9-d0aa-4005-bcff-61f723a936f1