Chapter 1

advertisement

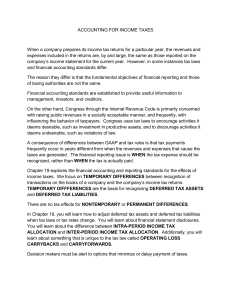

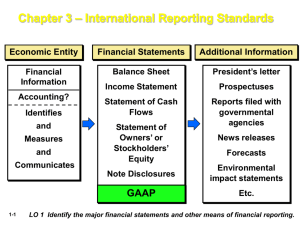

Chapter 1 Financial Accounting Standards 1 Standard Setters Securities and Exchange Commission (SEC). Formed to administer the Securities Act of 1934. Oversees the development of Generally Accepted Accounting Principles (GAAP). Encouraged the development of the first “private” standard-setting body, the CAP (next slide). SEC sits on FASB’s (Slide 4) Emerging Issues Task Force (EITF). 2 Standard Setters American Institute of Certified Public Accountants (AICPA) – Committee on Accounting Procedure (CAP), 1939-1959; issued Accounting Research Bulletins (ARB). – Accounting Principles Board (APB), 1959-1973; issued APB Opinions (APBO). 3 Standard Setters Financial Accounting Standards Board (FASB), 1973 to present. – Funded by Financial Accounting Foundation (FAF). – Benefits: smaller Board; full-time, paid members; independent; broader representation. – Wheat Committee (1972) recommended an independent standard-setting structure. 4 FASB Codification FASB issues a number of pronouncements containing GAAP: Standards, Interpretations, Technical Bulletins, Implementation Guides, EITF Statements. To organize GAAP, FASB developed the Accounting Standards Codification (ASC). All GAAP pronouncements are organized by topic and subtopic, and make it easier to research GAAP issues. 5 FASB Codification FASB issues a number of pronouncements containing GAAP: Standards, Interpretations, Technical Bulletins, Implementation Guides. To organize GAAP, FASB developed the Accounting Standards Codification (ASC). All GAAP pronouncements are organized by topic and subtopic, and make it easier to research GAAP issues. You will research several issues this semester using the Codification. 6 International Accounting Standards Board (IASB) The IASB issues International Financial Reporting Standards (IFRS). The predecessor to the IASB was the International Accounting Standards Committee (IASC); the IASC issued International Accounting Standards (IAS). Over 115 countries currently use IFRS as their primary financial reporting standard. The U.S., through the FASB and the SEC, has been working with the IASB on a number of issues, with the goal of achieving convergence with IFRS by 2015. 7 Professional Reputation and Ethics Ethical behavior is in the long-run interest of managers, stockholders, and auditors. Many companies, universities, and professional organizations have enacted increased emphasis on ethics. Auditors’ reputations are integral to their ability to perform their duties. High ethical conduct is imperative to their continued success. A number of companies, and their auditors, have been exposed in recent years for their fraudulent financial reporting. Some of these ethical failures will be discussed this semester. 8