US Depression

advertisement

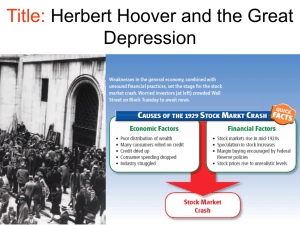

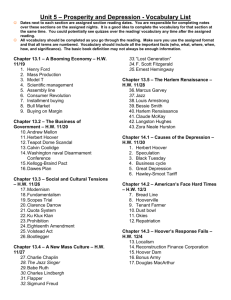

Causes of Great Depression Tariffs and war debt policies that cut down the foreign market for American goods The farmer crisis The availability of easy credit An unequal distribution of income These factors led to fall in the demand for consumer goods By keeping interest rates low, it was easy to borrow money and build up large debts Threats to Economic Prosperity As the 1920s advanced, serious problems threatened economic prosperity 1. Income gap increased 2. Consumers and farmers were going deep into dept Farms suffered losses with new machinery, they were producing more food than needed and this drove down food prices (remember: war created a need for bulk of food supply; after war, need went down) 3. Superficial prosperity- idea that prosperity would go on forever (businesses expanded, chain stores, installment plan) Signaled the onset of the Great Depression Industries in Trouble Railroad Replaced by other types of transformation (cars, trucks, buses) Mining and Lumber No longer in high demand after the war Coal mining New forms of energy Housing Starts Housing starts fall, led to loss of jobs in industries such as furniture manufacturing and lumbering (beginning construction of a new home) Agriculture WWI- international demand for wheat and corn Prices soared After the war, the demand fell and crop prices fell 40% Farmers boosted production Idea: producing more= selling more Affect: caused prices to go further down Hard time getting out of dept Congress support- McNary-Haugen bill Federal price-support for key products: wheat, tobacco, corn Buy surplus at a guaranteed price and sell them on the world market Consumers- late 1920s What is a consumer? By the late 1920s Americans were buying less Rising prices Stagnant wages Unbalanced distribution of income Overbuying on credit Production expanded faster than wages Credit During the 1920s- it seemed Americans were prosperous BUT they were living beyond their means Credit- consumers agree to buy now and pay later for purchases (monthly payments with interest) Many people had trouble paying off their debt and this caused consumers to cut back on spending Uneven Distribution of Income During the 1920s, the rich got richer and poor got poorer $2500- the minimum amount needed for a decent standard of living 70% of families made less than $2500 per year Unequal distribution of income meant that most Americans could not participate fully in the economic advancements in the 1920s Many people did not have the funds to purchase the new goods or goods being produced Wealth distribution 1920- The wealthiest Americans made up 1% of the population By 1929, the income for the 1% rose 75%. For the rest of the American’s, their income rose 9%. 1% vs Rest of Nation Income distribution 1% Rest of Nation 75% increase 9% increase 1% Wealthy/ Rest of Nation US Wealth Distribution in 1920s 75% Income Increase Wealthiest 1% of population Everyone Else 9% Income Increase Reflection Who helps the poor? What have we previously discussed that encouraged the government helping the people (the poor)? How does the 1920s prove that history repeats itself? How does the economy in the 1920s relate to the term gilded? Election of 1928 Herbert Hoover (R) vs Alfred Smith (D) Hoover, “We in America are nearer to the final triumph over poverty than ever before.” Nation has the attitude of national prosperity but we know that it was actually gilded Hoover has overwhelming support because Americans saw that the previous republican presidents (Harding and Coolidge) were successful with economic prosperity, and majority of the public believed Hoover’s statement. HOOVER WINS!! By 1929, some economists had warned about the economy, but most Americans had full confidence in the nation’s economic health. Stock Market Symbol of prosperous American economy Dow Jones Industrial Average- barometer of the stock market’s health Measure based on the stock prices of 30 representative large firms trading on the New York Stock Exchange Based on points 1920s- stock prices rose steadily (reached 381 points) 300 points higher than 5 years earlier “bull market”- period of rising stock prices Americans rushed to buy stocks 1929-4 million Americans (3% of nation) owned stock Many were already wealthy but others were Average Americans who hoped to strike rich Stock- the ups and downs Seeds of trouble taking root! People engaging in Speculation- buying stocks on the chance of a quick profit while ignoring the risk Many began buying on margin paying a small percentage of a stock’s price as a down payment and borrowing the rest If stock value declined, people who bought on margin had no way to pay off loan. The stock market rose quickly and the rising prices did not reflect companies worth. Stock- the crash September 1929, stock prices peaked and then fell Confidence in the market declined- investors quickly sold stock and pulled out October 24, 1929 the stock market plunged By mid November, investors had lost about $30 billion, an amount equal to how much America spent in World War I. Black Tuesday October 29- the bottom fell out of the stock market Signal of the Great Depression (1929-1940)-period of time when the economy plummeted and unemployment skyrocketed The crash did NOT cause the depression alone, but it accelerated the collapse of the economy and made the depression more severe The Dow Jones Industrial Average (DJIA)© index climbed to an all-time high on Sep. 3,1929 (Close: 381.17). 34 months later Oct. 7, 1932 the DJIA© was at 41.22 (89.19%) Bank Failure Run on the Bank After the crash, many people panicked and withdrew their money from the bank Banks invested in the stock so some could not get their money 1929- 600 banks closed 1933- 11,000 of the 25,000 banks had failed Because the government did not protect or insure bank accounts, millions of people lost their savings ** What protects banks today? Business failure Approximately 90,000 businesses went bankrupt Millions of workers lost their jobs Unemployment: 1929- 3% 1933- 25% 1 out of every 4 workers was out of a job Those who were fortunate to keep their job still faced pay cuts and reduced hours Global effects of the depression The depression affected Europe US investors withdrew their money from European markets To keep US dollars in America, the government raised tariffs on goods Hawley-Smoot Tariff- worlds largest protective tariff Designed to protect American farmers and manufactures from foreign competition Hawley-Smoot Tariff Reverse effect reduced flow of goods prevented other countries from collecting American currency to buy American goods unemployment in US industries who depended on exports to Europe many countries retaliated by raising their own tariffs World trade fell more than 40% Depression Devastation People lost jobs, homes Some slept in parks, sewer pipes wrapping themselves in newspapers to keep warm Makeshift shack- a place to live that was made out of scrap materials Old rusted car parts, orange crates, piano box Shantytowns- little towns consisting of shacks Soup Kitchen- free or low cost food Bread lines- lines of people waiting to receive food provided by charities African Americans- faced racial violence because competing with whites for similar jobs Mexican Americans- faced deportation (even if born in US) Farmers- advantage, able to grow food; disadvantage, thousands lost land through foreclosure- process by which a mortgage holder (loan company) takes back property if an occupant has not made payments. Resulted to tenant farming Mississippi River Flood 1927 April 21, 1927 levy broke 20 miles north of Greenville (mounds landing) April 22, 10 ft of water 30,000 African Americans “farm hands”, “convicts” worked to stop levees from breaking (worked at gun point) Tons of houses destroyed African Americans were gathered to stay on Greenville levy waters rose, AA were left stranded for days without food or drinking water, while white women and children were hauled to safety. MS River Flood, 1927 William Percy- wants to evacuate 13k AA Planters say no- do not want to loose the labor President Coolidge at the time appoints Hoover to head up relief effort (colored advisory commission) Does not fulfill his duties for the AA once president Migration to the north (Chicago) Political party switch Followed republicans (Lincoln’s party) Switched to democrat When the Levee Breaks 1971 http://www.youtube.com/watch?v=Lvh c0WvTJfE 1929 Dust Bowl 1930s- a drought hit the Great Plains, destroying crops, leaving the earth dry and cracked Then came the deadly dust storms Drought and winds lasted for more than 7 years Farmers methods of plowing during the 1920s removed the protective layer of prairie grass thus the soil was depleted. Wind scattered the topsoil, dust traveled hundreds of miles The region that was hardest hit came to be known as the Dust Bowl KA, OK, TX, NM, CO Thousands in this area migrated west along route 66 to California The thick clouds of dust would force businesses and schools to close as residents sought shelter. People got dust in their eyes and noses and grit between their teeth. Dust piled up like snow against houses and fences. People would hang wet sheets in windows and doorways to catch the dust. Housecleaning after a storm involved removing buckets of dirt. Baking in the oven was preferable to cooking on the stovetop, because the oven offered better protection from dust. Meals were eaten immediately after preparation; otherwise dust would cover them. The storms were especially hard on farm animals. Range cattle died in the fields with two inches of dirt lining their stomachs. Chickens were smothered in henhouses. Black Sunday The worst of all the dust storms descended on Kansas on April 14, 1935. Severe storms had been blowing for weeks, destroying millions of acres of wheat in Kansas and Nebraska. But the sun had broken out in Kansas on Sunday, April 14, and people ventured out for church and other activities. Then with sudden fury a black cloud appeared on the horizon. It descended with terrifying energy—sixty- to seventy-mile-per-hour winds—and total blackness. Though few people died from this or other such dust storms, many suffered serious lung ailments, commonly called dust pneumonia. This storm, and other major dust storms, also caused substantial economic hardship for farmers and rural communities due to the major loss of topsoil and damaged houses and farm property. The April 14 storm literally buried farm equipment and partially covered houses in dust dunes created within hours. The day became known as "Black Sunday." Effects of Depression on the Family Men- used to working and supporting the family, some left the family and became hoboes Women- canned food and sewed clothes, helped families survive, managed household budgets, many worked outside home many resented if women (esp married woman) had jobs. They had no right to work when men were unemployed Some cities refused to hire married women as schoolteachers Children-malnutrition, lack of health care, schools closed, teens traveled nation in hope for work, adventure (dangerous) Hoovervilles Hoover blankets Hoover flags Hoover struggles The nation is in a depression, Hoover is president, After the stock crashed, Hoover tried to reassure nation that the economy was strong “remain optimistic and go about your business as usual” Hoover- “government’s role is to encourage and facilitate cooperation, not to control it” Opposed federal welfare or direct-relief for the needy His answer- individuals, charities, and local organizations chip in to help each other Federal handouts would weaken people’s self- respect Hoover tries to help Federal farm board- raise crop prices by helping members buy crops and keep them off the market temporarily until prices rose Federal home Loan Bank Act- lowered mortgage rates for homeowners and allowed farmers to refinance their farm loans and avoid foreclosure Reconstruction Finance Corporation (RFC)authorized $2 billion for emergency financing for banks, life insurance companies, railroads, and other large businesses. Hoover believed money would trickle down to the average citizen through higher wages (would not directly help the poor) Hoover and his dam Hoover administers the Boulder Dam (Hoover Dam) on the Colorado River Use profits from sales of the electric power to finance dam’s construction World’s tallest dam Provide: electricity, flood control, regular water supply Help CA agricultural economy Today: water for LA and Vegas Boulder City- town to house workers Recreation- harsh summers, rugged landscape In 1931, Nevada legalized gambling Las Vegas started to develop 25 miles from dam Today- Vegas provides employment for 1000s and taxes on gaming prove a substantial amount of money for the state Another strike against Hoover WWI Veterans want compensation Patman Bill 1924- pay $500 by 1945 to compensate Vets want compensation now March on Washington Shantytowns near Capitol General Douglas MacArthur sent in to disband veterans Tear gas Burned shacks Two people shot Many injured 11 month old died and 8 year old blinded Election 3 months away http://www.youtube.com/watch?v=dWvCCxOUsM8