Budgeted Income Statement

advertisement

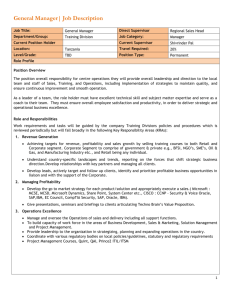

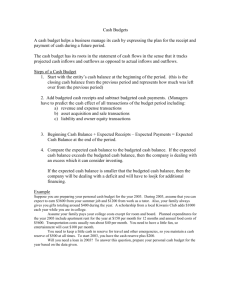

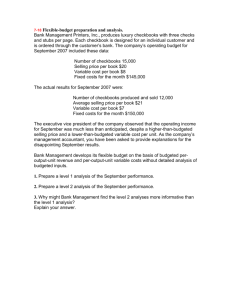

Running head: BUDGETED INCOME STATEMENT Budgeted Income Statement Christopher D. Holes Bellevue University FBUS 345 1 BUDGETED INCOME STATEMENT 2 Abstract Preparing financial statements requires attention to detail that will allow the reader to easily read and comprehend a significant amount of information. Budgets create a way for users to compare expectations to results. When using budgeted income statements, these provide the same data as a typical income statement, with the exception of the information being budgeted rather than historical. This information can be utilized to assess if changes to the budget will need to be executed. Keywords: budgeted income statement, budgeting, profits, assets, revenues BUDGETED INCOME STATEMENT 3 Budgeted Income Statement The Vice-President of Sales has predicted a half percent increase in sales for the coming year. Also increasing will be the cost of raw materials, by 3.75% according to the VP of Purchasing. Depreciation will decrease by ten percent over the coming year, and deferred taxes will decrease by 15% from the previous year. Dividends paid to common stock holders will be reduced by ten percent from the amount paid the previous year. Questions 1. The budgeted income statement indicates a negative change to the Gross Profits for 2013. This change was -.3%, as a result of the rise of the cost of production being more than revenues. 2. The budgeted income statement indicates changes in net operating income for 2013. The statement shows a .75% increase due to the decision to cut more expenses, such as reducing dividends. 3. Changes in net income shown on the budgeted income statement for 2013 was a 1% increase achieved by lowering expenses and achieving more revenue for the year. 4. The earnings per share in the 2013 budgeted income statement was $3.35 which was a 1.2% increase from the previous year. 5. According to the budgeted income statement, the retained earnings were $235.33 thousand dollars which shows an increase of $15.33 thousand dollars. 6. There are several external factors to consider when preparing a budget or forecast. First, taxes can play a very large role in the fluctuations that can occur in a company’s budget. Second, the economy can influence an organization’s budget in a large way, including price per product and supply and demand. Last, technological advances can BUDGETED INCOME STATEMENT 4 be important factors in the effectiveness of your budget; when new products are introduced that reduce or enhance your own products this can lead to a need for budgetary adjustments. XYZ COMPANY Income Statement for the Year Ended December 31, 2013 Total Operating Revenues Less Cost of Goods Sold Gross Profits Less: Operating Expenses Selling Expenses General and Administrative Expenses Depreciation Expenses Fixed Expenses Total Operating Expenses Net Operating Income Other Income Earnings Before Interest and Taxes Less: Interest Expense Interest on Short-Term Notes Interest on Long-Term Notes Total Interest Expense Pretax Earnings Less: Taxes Current Taxes Deferred Taxes Total Taxes (rate=35%) Net Income (Earnings after Taxes, EAT) Less: Preferred Stock Dividends Net Earnings Available for Common Stock EPS 100,000 shares outstanding Retained Earnings 2587.88 1167.25 1420.63 275 225 90 75 665 755.63 0 755.63 10 50 60 695.63 160 105.4 265.4 430.23 95 335.23 3.35 235 100 BUDGETED INCOME STATEMENT 5 References What external influences are there on a business budget? (n.d.). Retrieved January 31, 2016, from Finance Info and Money website: http://businessknowledgesource.com/finance/what_external_influences_are_there_on_a_ business_budget_024401.html