budget

advertisement

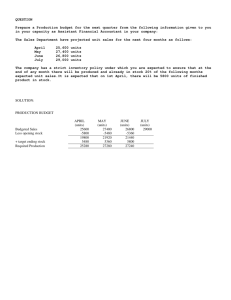

Module 20 Budgeting and Profit Planning (omit pp: 20-1 to 20-6) 1 What is a Budget? • A budget is a detailed plan for the acquisition and use of financial and other resources over a specified period of time. Good budgeting practice should provide facilitate planning, operating and control activities. • Planning - developing objectives and preparing various budgets to achieve these objectives. • Operating - daily decisions facilitated by a budget. • Control - the steps taken by management to increase the likelihood that the objectives set down at the planning stage are attained, and to ensure that all parts of the organization function in a manner consistent with organizational policies (budgeting for control in Chapter 21). 2 The Master Budget • Master budget - a financial plan of an organization for the coming year or other planning period. It generally culminates in a cash budget, a budgeted income statement, and a budgeted balance sheet. • The master budget is also called the static budget. • The master budget reflects the sales levels, cost levels, income and cash flows anticipated for the coming year. • Developing a master budget is a dynamic process that ties together goals, plans, decision making, and performance evaluation. 3 Advantages and Disadvantages of Budgeting • Advantages: – forces managers to focus on the planning aspects of the business. – helps management – provides benchmarks against which performance can be evaluated. – promotes communication and coordination within the organization. • Disadvantages: – consumes a good deal of time. – may lead to excessive reliance on extrapolation of current trends. – may promote a “slash and burn” mentality in tough times. – may lead to budget slack if used for performance evaluation. 4 Steps in Preparing the Budget 1. 2. 3. 4. 5. 6. 7. Sales budget. Purchases budget. Selling and administrative expense budget. Cash receipts budget. Cash disbursements budget. Summary cash budget. Budgeted (pro forma) financial statements – Budgeted income statement. – Budgeted balance sheet. – Budgeted statement of cash flows. Note: manufacturing budgets are complicated by the need for raw materials as an input to the manufacturing activity. 5 Sales Budget • The sales budget is the basis for all other budget components. • Units to be sold are a function of the forecasted selling price. • The budget requires a forecast of sales, typically involving sales staff and market research. Various statistical techniques may also be used. Sales will be forecasted in units and in dollars. • Budgeted revenues are computed as: Forecasted sales (in units) x Forecasted selling price. Budgeted revenues are used to calculate expected cash collections for cash budget, and any A/R that might exist at the end of the period. 6 Inventory Purchases • We use the following relationship to forecast inventory purchase requirements: In Units: BI + Purchases - EI = Units Sold or: Purchases = Sales +/- change in inv. • Beginning and ending inventory levels in units are estimated using some inventory model (e.g., percentage of next month’s sales). • Multiplication of each component by the forecasted cost per unit converts these amounts to dollars. • Payment schedules are applied, and the cash outflow is included in the cash disbursements budget. • Any estimated unpaid amounts at the end of the period are reflected in Accounts Payable. 7 Selling and Administrative Costs • The budgeting objective is to estimate the amount of selling and administrative costs required to: – operate the organization at its projected level of sales and production. – achieve long-term company goals. • These estimates are often based on prior period expenditures or planned expenditures, but adjusted for inflation, changes in operations, etc. • Note: some costs, such as depreciation, are included for the budgeted income statement, but excluded when calculating cash disbursements. 8 Cash Budget Cash budget - a statement of cash on hand at the start of the budget period, expected cash receipts, expected cash disbursements, and the resulting cash balance at the end of the period. • Cash disbursements - amounts required to pay for purchases, operating expenses, taxes, interest, dividends, etc. • Cash receipts - collections from accounts receivable, cash sales, sales of assets, borrowing, issuing stock, etc. • The cash budget requires that all revenues, costs, expenses, and other transactions be examined in terms of their effects on cash. 9 Budgeted Income Statement • The budgeted income statement is easily generated using information from the previous budgets. • To complete the computation of net income, an estimate must be made of tax expense. • The computed net income is then incorporated into the calculation of budgeted retained earnings. 10 Budgeted Balance Sheet • Budgeted balance sheet - a statement of budgeted financial position. • The ending balance in a given account equals the beginning balance plus any estimated change. • The cash budget provides the ending cash balance on the balance sheet. • The ending inventory for the period is reported on the balance sheet. • Ending accounts receivable/accounts payable are derived from the cash budgets (the amount of payment or receipt that is yet to happen). 11 Budgeted Statement of Cash Flows • The budgeted statement of cash flows explains the difference between estimated cash at the beginning of the period and that at the end of the period. The change in cash is explained as arising from operating activities, investing activities, and financing activities. • Can be created from the other financial statements using the indirect method, or with the detail from the cash budget • Operating section starts with net income, then backs out the non-cash activity and the changes in the related assets and liabilities (usually the current assets and liabilities). • Represents the operating, investing, and financing activity that the company has undertaken. • Different form and different information than the 12 Cash Budget.