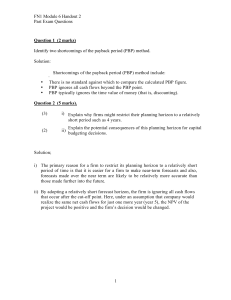

February 3 Handout Solution

advertisement

ACG 2071 – Take Home Problem SOLUTION DRAFT Problem 1. Gill’s Towing Service is considering the purchase of an additional tow truck with a cost of $65,000. Gill estimates the tow truck could be sold for $15,000 at the end of its 4-year estimated life. Gill has a required rate of return of 6.2% and a cost of capital of 4.1%. This purchase would allow Gill to tow 1,200 more per vehicles per year at $55 each. Gill would have to hire one additional driver with a salary of $32,000 per year. Maintenance, fuel and insurance operating costs for the truck would be $14,000 per year. The income tax rate is 30%. Gill uses straight line depreciation. Calculate each of the following. Interpret the outcome of each capital budgeting method. A. B. C. D. E. Incremental annual operating cash flows IRR NPV ARR Payback period Incremental revenue (1,200*$55) Incremental driver Maintenance, fuel, insurance Depreciation (($65,000 - $15,000)/4) Income before taxes Income taxes expense Net income Add depreciation Operating cash flows CF0 C01 C02 C03 C04 17750 17750 17750 32750 $ 66,000 (32,000 (14,000) (12,500) 7,500 (2,250) 5,250 12,500 $ 17,750 ` (65000) IRR = 10.97% The investment will generate around 11% cash return each year. NPV = $8,017 The investment will generate a cash return that exceeds the company’s minimum required return of 6.2% each year. ARR = $5,250 / [(65,000 + 15,000) / 2] = 13.13% The investment will generate around a 13% return on profit each year. PBP = $65,000/$17,750 = 3.66 years The entire cash investment will be recovered in 3.66 years. Problem 2. Cutler Cleaners wants to purchase of a new dry cleaning machine with a cost of $48,800. The company has a cost of capital of 4.3% and a required rate of return of 6.4%. Its income tax rate is 32%. The acquisition is proposed for January 1, 2010. Cutler expects it can sell the dry cleaner for $10,000 at end of its useful life of 4 years. Amounts estimated by Cutler estimates the following incremental amounts to be generated by the machine: Year 1 Year 2 Net income $10,200 $8,600 Operating cash flows 19,900 18,300 Perform calculations for each of the capital budgeting methods. CF0 C01 C02 C03 C04 19,900 18,300 18,800 28,500 Year 3 $9,100 18,800 ` (48800) IRR = 25.14% NPV = $23,912.31 ARR = [($10,200 + $8,600 + $9,100 + $8,800)/4] / [($48,800 + $10,000) / 2] = 31.21% PBP = To recover Year 1 Year 2 Balance to collect year 3 Year 3: $10,600/$18,800 PBP = 2.56 years $48,800 (19,900) (18,300) $10,600 0.56 Year 4 $8,800 18,500