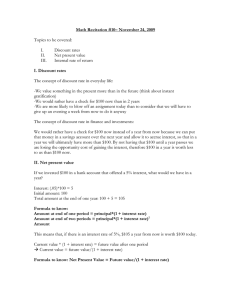

IRR = A + [(B-A) x NA NA –NB ] A B A NA NA IRR = A +

advertisement

![IRR = A + [(B-A) x NA NA –NB ] A B A NA NA IRR = A +](http://s2.studylib.net/store/data/018456319_1-4faaa9a471b68ef839761e9ccad4e453-768x994.png)

IRR Internal Rate of Return The rate of return which equates the Net Present Value (NPV) of the cash flows to zero. Remember: the NPV calculation discounts future cash flows for the time value of money. To help you remember this, think of a banana, just remember there’s an NB at the end. N A IRR = A + [(B-A) x NA – NB ] A B A NA NA NB A = Lower discount rate B = Higher discount rate Step 1 NA = NPV at lower discount rate NB = NPV at higher discount rate Find out what your investment cash flows are.* *Remember that cash outflows are Year 0 1 2 3 negative and that any cashflows happening today are in year 0. Step 2 Year 0 1 2 3 Cash flow (1000) 210 260 720 Take your first discount rate, either given in the question or an arbitrary one, say 10%, and discount your cash flows. Cash flow (1000) 210 260 720 r=10% 1 0.9091 0.8264 0.7513 Your year 0 discount factor is 1 – we don’t discount today’s money. PV @ 10% (1000) 191 215 541 (53) If you are struggling with this step, revisit your notes on Net Present Value (TC Finance module 3). Note: If you have a NPV = 0 you’re done. Your discount factor is your IRR. Step 3 Choose and apply your second discount factor. Q How do I know which rate to use? A We use educated guesswork. Picture a basic line graph and work out where your first discount factor and NPV fall: NPV We want to find where NPV=0, i.e., where the line crosses the x axis. ? 5% 10% The IRR formula works best with one negative and one positive NPV* so in this case to get a bigger, positive NPV we need a smaller discount factor, e.g., 5%. DF -53 Year 0 1 2 3 Cash flow (1000) 210 260 720 Step 4 r=10% 1 0.9091 0.8264 0.7513 PV @ 10% (1000) 191 215 541 (53) r=5% 1 0.9524 0.9070 0.8638 PV @ 5% (1000) 200 236 622 58 *At TPS you can get away with two signs the same, as long as the choice of discount rate moves in the right direction. Substitute your results into the formula. N A IRR = A + [(B-A) x NA – NB ] 58 = 0.05 + [(0.1-0.05) x ] 58 + 53 = 0.0761 Watch out for a double negative turning positive Step 5 Conclude. Compare the IRR you have calculated to the required rate of return. IRR > RRoR [Equivalent to a POSITIVE NPV] ACCEPT THE PROJECT IRR < RRoR [Equivalent to a NEGATIVE NPV] REJECT THE PROJECT