Day 2 in the pm

advertisement

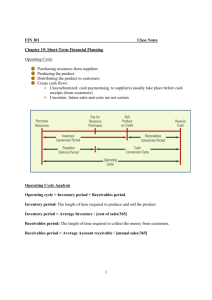

International Corporate Finance (ICF) Jim Cook Cook-Hauptman Associates, Inc. (USA) Agenda Thursday – (Sessions am: 8:30-12:00, pm: 1:30-5:00) am: Structures, Statements, Value, Analysis, Currency pm: Time & Currency Discounting/Trading of Money Friday – (Sessions am: 8:30-12:00, pm: 1:30-5:00) am: Workshop on Evaluating Financials. Discussion of the RMB pm: Internal Operations: Cash Management & Project Evaluation Saturday – (Sessions am: 8:30-12:00, pm: 1:30-5:00) am: Workshop on Financial Projections and Raising Capital pm: External Operations: Markets’ instruments and practices Sunday – (Sessions am: 8:30-12:00, pm: 1:30-5:00) am: Workshop on Mini-Cases: Process, Discrete, Software, eBay pm: Reviewing important points. Final Exam. On the Internet at: International Corporate Finance http://cha4mot.com/ICF0411 Day 2 in the pm # 2 / 34 The Operating Cycle Operating cycle – time between purchasing the inventory and collecting the cash Inventory period – time required to purchase and sell the inventory Accounts receivable period – time to collect on credit sales Operating cycle = inventory period + accounts receivable period International Corporate Finance Day 2 in the pm # 3 / 34 Cash Cycle Cash cycle time period for which we need to finance our inventory Difference between when we receive cash from the sale and when we have to pay for the inventory Accounts payable period – time between purchase of inventory and payment for the inventory Cash cycle = Operating cycle – accounts payable period International Corporate Finance Day 2 in the pm # 4 / 34 Operating Cycle Chart Inventory purchased Inventory sold Time Cash paid for Inventory Cash received Operating Cycle The operating cycle is the time period from inventory purchase until the receipt of cash. (The Operating cycle may not include the time from placement of the order until arrival of the stock. The cash cycle is the time period from when cash is paid out to when cash is received. International Corporate Finance Day 2 in the pm # 5 / 34 Example Information Inventory: Beginning = 5000 Ending = 6000 Accounts Receivable: Beginning = 4000 Ending = 5000 Accounts Payable: Beginning = 2200 Ending = 3500 Net sales = 30,000 Cost of Goods sold = 12,000 International Corporate Finance Day 2 in the pm # 6 / 34 Example – Operating Cycle Inventory period Average inventory = (5000 + 6000)/2 = 5500 Inventory turnover = 12,000 / 5500 = 2.18 times Inventory period = 365 / 2.18 = 167 days\ Receivables period Average receivables = (4000 + 5000)/2 = 4500 Receivables turnover = 30,000/4500 = 6.67 times Receivables period = 365 / 6.67 = 55 day Operating cycle = 167 + 55 = 222 days International Corporate Finance Day 2 in the pm # 7 / 34 Example – Cash Cycle Payables Period Average payables = (2200 + 3500)/2 = 2850 Payables turnover = 12,000/2850 = 4.21 Payables period = 365 / 4.21 = 87 days Cash Cycle = 222 – 87 = 135 days We have to finance our inventory for 135 days We need to be looking more carefully at our receivables and our payables periods – they both seem extensive International Corporate Finance Day 2 in the pm # 8 / 34 Credit Management: Key Issues Granting credit increases sales Costs of granting credit Chance that customers won’t pay Financing receivables Credit management examines the tradeoff between increased sales and the costs of granting credit International Corporate Finance Day 2 in the pm # 9 / 34 Components of Credit Policy Terms of sale Credit period Cash discount and discount period Type of credit instrument Credit analysis – distinguishing between “good” customers that will pay and “bad” customers that will default Collection policy – effort expended on collecting on receivables International Corporate Finance Day 2 in the pm # 10 / 34 Cash Flows from Granting Credit Credit Sale Check Mailed Check Deposited Cash Available Cash Collection Accounts Receivable International Corporate Finance Day 2 in the pm # 11 / 34 Terms of Sale Basic Form: 2/10 net 45 2% discount if paid in 10 days Total amount due in 45 days if discount not taken Buy $500 worth of merchandise with the credit terms given above Pay $500(1 - .02) = $490 if you pay in 10 days Pay $500 if you pay in 45 days International Corporate Finance Day 2 in the pm # 12 / 34 Example: Cash Discounts Finding the implied interest rate when customers do not take the discount Credit terms of 2/10 net 45 and $500 loan $10 interest (.02*500) Period rate = 10 / 490 = 2.0408% Period = (45 – 10) = 35 days 365 / 35 = 10.4286 periods per year EAR = (1.020408)10.4286 – 1 = 23.45% The company benefits when customers choose to forego discounts International Corporate Finance Day 2 in the pm # 13 / 34 Credit Policy Effects Revenue Effects Delay in receiving cash from sale May be able to increase price May increase total sales Cost Effects Cost of sale is still incurred even though the cash from the sale has not been received Cost of debt – must finance receivables Probability of nonpayment – some percentage customers will not pay for products purchased Cash discount – some customers will pay early and pay less than the full sales price International Corporate Finance Day 2 in the pm # 14 / 34 Short-Term Financial Policy Size of investments in current assets Flexible policy – maintain a high ratio of current assets to sales Restrictive policy – maintain a low ratio of current assets to sales Financing of current assets Flexible policy – less short-term debt and more long-term debt Restrictive policy – more short-term debt and less long-term debt International Corporate Finance Day 2 in the pm # 15 / 34 Carrying vs. Shortage Costs Managing short-term assets involves a tradeoff between carrying costs and shortage costs Carrying costs – increase with increased levels of current assets, the costs to store and finance the assets Shortage costs – decrease with increased levels of current assets, the costs to replenish assets Trading or order costs Costs related to safety reserves, i.e., lost sales and customers and production stoppages International Corporate Finance Day 2 in the pm # 16 / 34 Understanding Float Float – difference between cash balance recorded in cash account and cash balance recorded at the bank Disbursement float Generated when a firm writes checks Available balance at bank – book balance > 0 Collection float Checks received increase book balance before the bank credits the account Available balance at bank – book balance < 0 Net float = disbursement float + collection float International Corporate Finance Day 2 in the pm # 17 / 34 Example: Types of Float You have $3000 in your checking account. You just deposited $2000 and wrote a check for $2500. What is the disbursement float? What is the collection float? What is the net float? What is your book balance? What is your available balance? International Corporate Finance Day 2 in the pm # 18 / 34 Example: Measuring Float Size of float depends on the dollar amount and the time delay Delay = mailing time + processing delay + availability delay Suppose you mail a check for $1000 and it takes 3 days to reach its destination, 1 day to process and 1 day before the bank will make the cash available What is the average daily float (assuming 30 day months)? Method 1: (3+1+1)(1000)/30 = 166.67 Method 2: (5/30)(1000) + (25/30)(0) = 166.67 International Corporate Finance Day 2 in the pm # 19 / 34 Example: Cost of Float Cost of float – opportunity cost of not being able to use the money Suppose the average daily float is $3 million with a weighted average delay of 5 days. What is the total amount unavailable to earn interest? 5*3 million = 15 million What is the NPV of a project that could reduce the delay by 3 days if the cost is $8 million? Immediate cash inflow = 3*3 million = 9 million NPV = 9 – 8 = $1 million International Corporate Finance Day 2 in the pm # 20 / 34 Choosing the Best Policy Cash reserves Pros – firms will be less likely to experience financial distress and are better able to handle emergencies or take advantage of unexpected opportunities Cons – cash and marketable securities earn a lower return and are zero NPV investments Maturity hedging Try to match financing maturities with asset maturities Finance temporary current assets with short-term debt Finance permanent current assets and fixed assets with long-term debt and equity Interest Rates Short-term rates are normally lower than long-term rates, so it may be cheaper to finance with short-term debt Firms can get into trouble if rates increase quickly or if it begins to have difficulty making payments – may not be able to refinance the short-term loans Have to consider all these factors and determine a compromise policy that fits the needs of your firm International Corporate Finance Day 2 in the pm # 21 / 34 Capital Budgeting Foundations For good selections, there must be good possibilities Have clear long term goals and specific direction Engage everyone to contribute ideas and improvements Research the emerging markets, competition, and technologies For good outcomes, there must be clear structures Divide Capital Budgeting into Acquisitions and Projects Be sure that Buy versus Make is always considered Appoint a Process Master for Acquisitions and one for Projects Acquisitions may be centered in Purchasing or Finance, whereas Projects may be centered in Engineering or Manufacturing. Have an Investment Decision Council for integrating approvals For Project Priortization, consider the Gartner Program (which follows immediately) as a starting reference International Corporate Finance Day 2 in the pm # 22 / 34 Classification of Projects 1. New products or expansion of existing products 2. Purchase or Renovation of equipment or buildings 3. Research and Development 4. Exploration 5. Other 6. Mandated key requirement: greater than one year! International Corporate Finance Day 2 in the pm # 23 / 34 Prioritization Success Factors 1. Establish governance and clear accountabilities 2. Allocate sufficient resources to support the process 3. Ensure the process is disciplined and sustained 4. Develop an objective prioritization framework 5. Support decision-making with tools 6. Maintain communication and education programs Source: Getting Priorities Straight, Gartner Group, 2002.10 International Corporate Finance Day 2 in the pm # 24 / 34 Organizing the Prioritization Assign a process owner to oversee the process implementation and execution Create a qualified support team Review investments on an ongoing basis Disciplined process ensures all project proposals go though the same screening End-to-end process manages portfolio proactively through entire project life cycle Review the portfolio periodically to adjust both the process and the portfolio to changing conditions Integrate with the project management process to track project status at major decision points International Corporate Finance Day 2 in the pm # 25 / 34 Project Portfolio Management Leading enterprises are adopting portfolio management techniques to gain benefits Project portfolio management (PPM) is a 5-step process for prioritizing and managing initiatives Define initiatives Evaluate initiatives Prioritize & balance Match resources Manage portfolio Process is not sequential, but has feedback loops International Corporate Finance Day 2 in the pm # 26 / 34 Prioritization Framework International Corporate Finance Day 2 in the pm # 27 / 34 Prioritize the Initiatives Investment categories can be used to group initiatives with similar characteristics Scoring model should reflect management objectives Weightings define the relative importance of each criterion Combine financial/non-financial measures into single score Force rank initiatives based on overall weighted scores Evaluation criterion Score Weight % Weighted score Return on investment 8 50 40 Strategic fit 7 30 21 Probability of success 5 20 10 Project Score International Corporate Finance 71 Day 2 in the pm # 28 / 34 Notes on the Scoring Model 1) 2) 3) 4) 5) 6) 7) 8) Should closely match the Prioritization Framework No need for weightings to sum to 100, for example, a fantastic flexibility capability should not lose out, nor should something of significant possibilities Fatal items should be multiplied, not summed, for example, confidence (if near zero, don’t do it!) Some visibility should be given to buy versus make ALL, projects are interdependent; they constitute the company! Maps can be a great help to justifying the right projects; maps of technology, of capability, and of opportunity – often, in the real world, you must do three (or so) suboptimal projects to have a platform of substantial consequence. Some provision should be made for learning from and improving the management processes Ask often, what do I wish we had funded and why didn’t we? International Corporate Finance Day 2 in the pm # 29 / 34 Financial Analysis But, how to do the Financial Analysis? Every Capital Budget Request must have a projected Cash Flow of revenue recognition and direct costs (Finance can put in the overhead, taxes, but not interest or depreciation!) The revenue recognition should be “signed off” by someone responsible for getting those revenues (or savings) The resolution should be by month and should be CASH, not bookings, or even sales. Key events and key contingencies should be highlighted There must be a “champion” who will go as the project goes International Corporate Finance Day 2 in the pm # 30 / 34 Incremental Cash Flows Initial cash outflow -- the initial net cash investment. Interim incremental net cash flows -- those net cash flows occurring after the initial cash investment but not including the final period’s cash flow. Terminal-year incremental net cash flows -- the final period’s net cash flow. International Corporate Finance Day 2 in the pm # 31 / 34 Cash Flow Rules 1) Include Cash, but not accounting income (don’t include depreciation, for example) 2) Operating flows, but not financing flows (no interest charges) 3) Include all other cash flows (that includes tax effects) 4) Just the incremental flows (attributable to project) 5) Include opportunity costs & side effects 6) Ignore sunk costs and allocated overhead costs (neither are incremental) 7) Include project-driven changes in working capital net of spontaneous changes in current liabilities 8) Include effects of inflation/deflation as can best be determined International Corporate Finance Day 2 in the pm # 32 / 34 Analytical Issues What Technique and Metrics should be used? Net Present Value Internal Rate Return (hurdle rate) Average Accounting Return Payback Period ROA, RONA, ROE (The Dupont Method) International Corporate Finance Day 2 in the pm # 33 / 34 Concluding Remarks Questions and Answers Thank you, again. You can find a copy of this lecture (450 KB) on the Internet at: http://cha4mot.com/ICF0411 International Corporate Finance Day 2 in the pm # 34 / 34