Outcomes for 2012-13 - Small Business Development Corporation

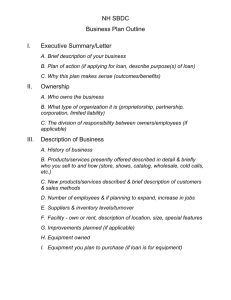

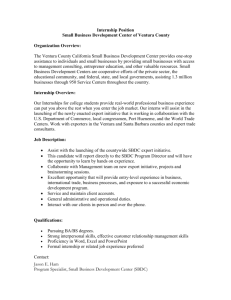

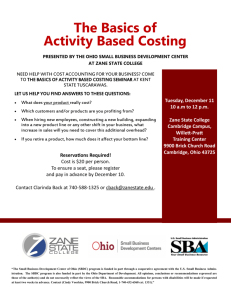

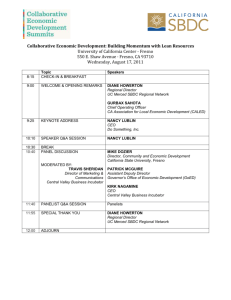

advertisement