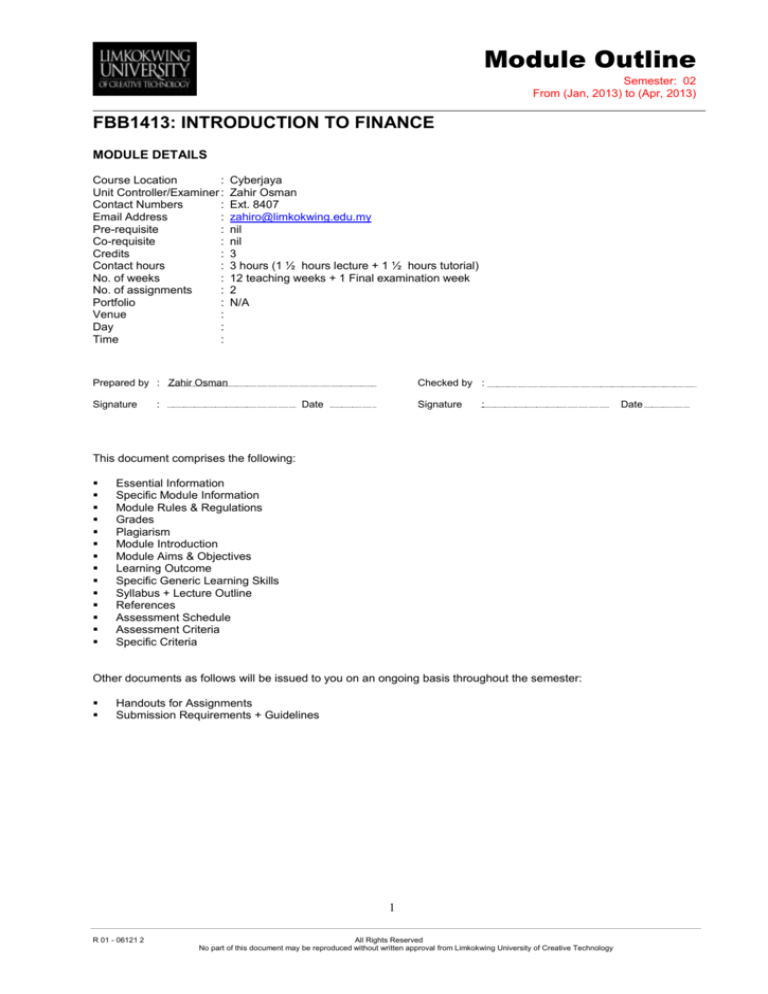

Module Outline

Semester: 02

From (Jan, 2013) to (Apr, 2013)

FBB1413: INTRODUCTION TO FINANCE

MODULE DETAILS

Course Location

:

Unit Controller/Examiner :

Contact Numbers

:

Email Address

:

Pre-requisite

:

Co-requisite

:

Credits

:

Contact hours

:

No. of weeks

:

No. of assignments

:

Portfolio

:

Venue

:

Day

:

Time

:

Cyberjaya

Zahir Osman

Ext. 8407

zahiro@limkokwing.edu.my

nil

nil

3

3 hours (1 ½ hours lecture + 1 ½ hours tutorial)

12 teaching weeks + 1 Final examination week

2

N/A

Prepared by : Zahir Osman

Signature

:

Checked by :

Date

Signature

:

This document comprises the following:

Essential Information

Specific Module Information

Module Rules & Regulations

Grades

Plagiarism

Module Introduction

Module Aims & Objectives

Learning Outcome

Specific Generic Learning Skills

Syllabus + Lecture Outline

References

Assessment Schedule

Assessment Criteria

Specific Criteria

Other documents as follows will be issued to you on an ongoing basis throughout the semester:

Handouts for Assignments

Submission Requirements + Guidelines

1

R 01 - 06121 2

All Rights Reserved

No part of this document may be reproduced without written approval from Limkokwing University of Creative Technology

Date

1.0

2.0

3.0

ESSENTIAL INFORMATION

All modules other than electives are 'significant modules'

As an indicator of workload one credit carries and additional 2 hours of self study per week. For

example, a module worth 3 credits require that the student spends an additional 6 hours per

week, either reading, completing the assignment or doing self directed research for that

module.

Submission of ALL assignment work is compulsory in this module. A student cannot pass this

module without having to submit ALL assignment work by the due date or an approved

extension of that date.

All assignments are to be handed on time on the due date. Students will be penalised 10

percent for the first day and 5 percent per day thereafter for late submission (a weekend or a

public holiday counts as one day). Late submission, after the date Board of Studies meeting

will not be accepted.

Due dates, compulsory assignment requirements and submission requirements may only be

altered with the consent of the majority of students enrolled in this module at the

beginning/early in the program.

Extensions of time for submission of assignment work may be granted if the application for

extension is accompanied by a medical certificate.

Overseas travel is not an acceptable reason for seeking a change in the examination schedule.

Only the Head of School can grant approval for extension of submission beyond the

assignment deadline.

Re-submission of work can only receive a 50% maximum pass rate.

Supplementary exams can only be granted if the level of work is satisfactory AND the semester

work has been completed.

Harvard referencing and plagiarism policy will apply on all written assignments.

SPECIFIC MODULE INFORMATION

Attendance rate of 80% is mandatory for passing module.

All grades are subject to attendance and participation.

Absenteeism at any scheduled presentations will result in zero mark for that presentation.

Visual presentation work in drawn and model form must be the original work of the student.

The attached semester program is subject to change at short notice.

MODULE RULES AND REGULATIONS:

Assessment procedure:

These rules and regulations are to be read in conjunction with the UNIT AIMS AND

OBJECTIVES

All assignments/projects must be completed and presented for marking by the due date.

Marks will be deducted for late work and invalid reasons.

All assignments must be delivered by the student in person to the lecturer concerned. No other

lecturer is allowed to accept students’ assignments.

All tests/examinations are compulsory.

2

R01 – 061212

All Rights Reserved

No part of this document may be reproduced without written approval from Limkokwing University of Creative Technology

4.0

Students must sit the test/examination on the notified date.

Students are expected to familiarise themselves with the test/examination timetable.

Students who miss a test/examination will not be allowed to pass.

Any scheduling of tutorials, both during or after lecture hours, is TOTALLY the responsibility of

each student. Appointments are to be proposed, arranged, confirmed, and kept, by each

student. Failure to do so in a professional manner may result in penalty of grades. Tutorials

WITHOUT appointments will also NOT be entertained.

Note that every assignment is given an ample time frame for completion. This, together with

advanced information pertaining deadlines gives you NO EXCUSE not to submit assignments

on time.

GRADES

All modules and assessable projects will be graded according to the following system. With respect

to those units that are designated 'Approved for Pass/Fail' the grade will be either PA or F:

80 – 100

Grade

A

Numeric Grade

4.00

75 – 79

A-

3.67

70 – 74

B+

3.33

65 – 69

B

3.00

60 – 64

B-

2.67

55 – 59

C+

2.33

50 – 54

C

2.00

45 – 49

C-

1.67

40 – 44

D

1.00

0 – 39

F

Pass0.00

EXP

Description

Pass with Distinction

Pass with Merit

Pass

Fail

Exempted

PX

Pass after extra work is given and passed

X

Ineligible for assessment due to unsatisfactory attendance

D

Deferred

W

Withdraw

DNA

Did Not Attend Module

DNC

Did Not Complete Module

3

R01 – 061212

All Rights Reserved

No part of this document may be reproduced without written approval from Limkokwing University of Creative Technology

5.0

PLAGIARISM, COPYRIGHT, PATENTS, OWNERSHIP OF

PROJECT, THESES & WORKS

WORK:

STUDENT

MAJOR

See LIMKOKWING, HIGH FLYERS HANDOUT, Page 10.

6.0

MODULE INTRODUCTION

This is an introductory module in which students obtain very basic knowledge on subjects related to

financial management including financial markets, interest rates, return and risk in investments,

bond and stock valuation, cost of capital, and capital budgeting. Students are expected to attain a

clear and basic understanding of the essentials of financial decision making. Emphasis is laid on

the factors to be considered on cash flow estimation and the mechanics of discounting those cash

flows in valuing certain financial assets or projects, before choosing alternatives or arriving at a

feasible decision.

MODULE AIMS AND OBJECTIVES

Upon the completion of this module, students will:

Be able to develop an understanding of both theory and practice in finance

Be able to provide students with practices on evaluating certain financial assets and simple

projects.

Be able to deal with the fundamentals of finance and its effects on business decisionmaking.

LEARNING OUTCOME

Upon the completion of the module, Students should be able to demonstrate:

9.0

Thorough understanding of the financial environment, including equity and debt markets,

financial institutions, and interest rates.

Able to grasp the concept of the time value of money including present value and future value

analyses of annuities and uneven cash-flows over time.

Able to compute bond and stock values including coupon rates, coupon payments, yields,

risk, bond ratings, price discounts, and premiums.

Able to grasp the concept of a business’ cost of capital and the sources for small and large

firms.

Able to assess basic projects by applying capital budgeting for evaluation of long-term fixed

asset investments including both independent and mutually exclusive decisions.

SPECIFIC GENERIC LEARNING SKILLS

Upon the completion of this module, students should be able to identify the right investment

opportunities and be able to make the risk-return assessments.

4

R01 – 061212

All Rights Reserved

No part of this document may be reproduced without written approval from Limkokwing University of Creative Technology

UNIT SYLLABUS + LECTURE OUTLINE:

Week:

LECTURE 1:

Lecture Synopsis:

1

AN OVERVIEW OF FINANCIAL MANAGEMENT

Goals of the firm, legal forms of business organisation, principles that form financial

management, finance and multinational firms.

Tutorial:

Week:

LECTURE 2:

Lecture Synopsis:

Tutorial:

2

UNDERSTANDING FINANCIAL STATEMENTS AND CASH FLOWS

Income statement, balance sheet, cash flows.

Week:

LECTURE 3:

Lecture Synopsis:

3 RATIO ANALYSIS

Purpose of financial analysis, measuring key financial relationships, limitations of financial

ratios

Tutorial:

Week:

LECTURE 4:

Lecture Synopsis:

Tutorial:

4 TIME VALUE OF MONEY CONCEPTS

Week:

LECTURE 5:

Lecture Synopsis:

Tutorial:

5 TIME VALUE OF MONEY CONCEPTS

Week:

6

. Present Value & Future Value concepts, Investment Decision Making in Practice

Present Value & Future Value concepts, Investment Decision Making in Practice

MID TERM BREAK

Week:

7

Week:

LECTURE 6:

8 BOND VALUATION

Lecture synopsis:

Expected return, measurement of risk and return, risk and diversification, investors

required rate of return.

Tutorial:

Week:

LECTURE 7:

Lecture synopsis:

Tutorial:

Week:

LECTURE 8:

Lecture Synopsis:

MID-TERM EXAM

9 BOND VALUATION

Expected return, measurement of risk and return, risk and diversification, investors

required rate of return.

10

CAPITAL BUDGETING CONCEPTS

Finding profitable projects, capital budgeting decision criteria, capital rationing, ethics in

capital budgeting, cash flows in capital budgeting

Tutorial:

Week:

11 REVISION

5

R01 – 061212

All Rights Reserved

No part of this document may be reproduced without written approval from Limkokwing University of Creative Technology

LECTURE 9:

Lecture Synopsis:

Week:

12

REVISION

Week:

13

FINAL EXAMINATION WEEK

11.0 ESSENTIAL TEXT

Arthur J. Keown, John d. Martin, J, William Petty, Foundations of Finance, 7th edition, 2010.

11.1 ADDITIONAL TEXT FOR REFERENCE

Brigham & Houston, Fundamentals of Financial Management, 10th Edition, Thomson, 2007

Brigham & Ehrhardt, Financial Management, Theory & Practice, 11th Edition, South-Western, 2005

Moyer, McGuigan & Rao, Fundamentals of Contemporary Financial Management, 2nd Edition, 2007

12.0 ASSESSMENT SCHEDULE

Assessment Description

Issue Date

Due Date

%

Individual Assignment

Week 8

10%

Group Assignment

Week 11

30%

Mid-Term Exam

Week 7

20%

Final Exam

Week 13

40%

Total

100%

13.0 ASSESSMENT CRITERIA

Process of grading and criteria used to determine the grades, passes and high distinctions.

14.0 SPECIFIC CRITERIA

Each assignment will be handed out with the project brief and will vary, depending on the

teaching and learning objectives of the specific assignment.

Each student will receive a completed assessment sheet back with their marks, thereby giving

student feedback on each set criterion and the project as a whole.

Marks for each project will be posted on the Bulletin Board with student number within 2 weeks

of hand-in date.

6

R01 – 061212

All Rights Reserved

No part of this document may be reproduced without written approval from Limkokwing University of Creative Technology

7

R01 – 061212

All Rights Reserved

No part of this document may be reproduced without written approval from Limkokwing University of Creative Technology