Institute of Finance and Banking

R856500 auditing(審計學)

Spring 2009

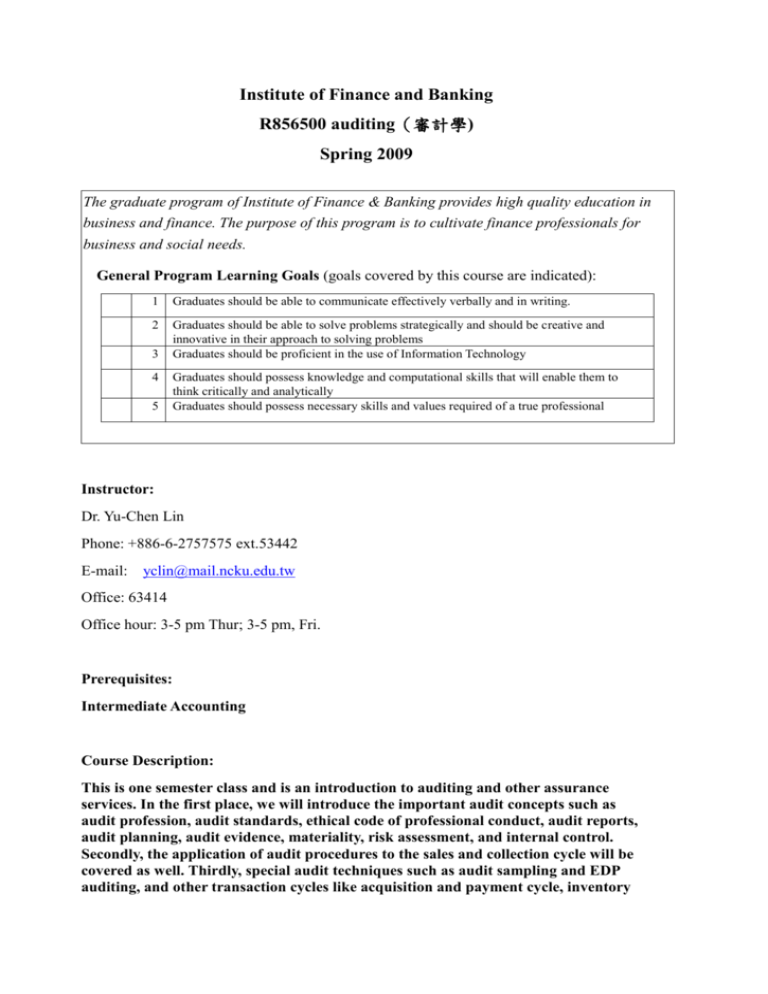

The graduate program of Institute of Finance & Banking provides high quality education in

business and finance. The purpose of this program is to cultivate finance professionals for

business and social needs.

General Program Learning Goals (goals covered by this course are indicated):

1

Graduates should be able to communicate effectively verbally and in writing.

2

Graduates should be able to solve problems strategically and should be creative and

innovative in their approach to solving problems

Graduates should be proficient in the use of Information Technology

3

4

5

Graduates should possess knowledge and computational skills that will enable them to

think critically and analytically

Graduates should possess necessary skills and values required of a true professional

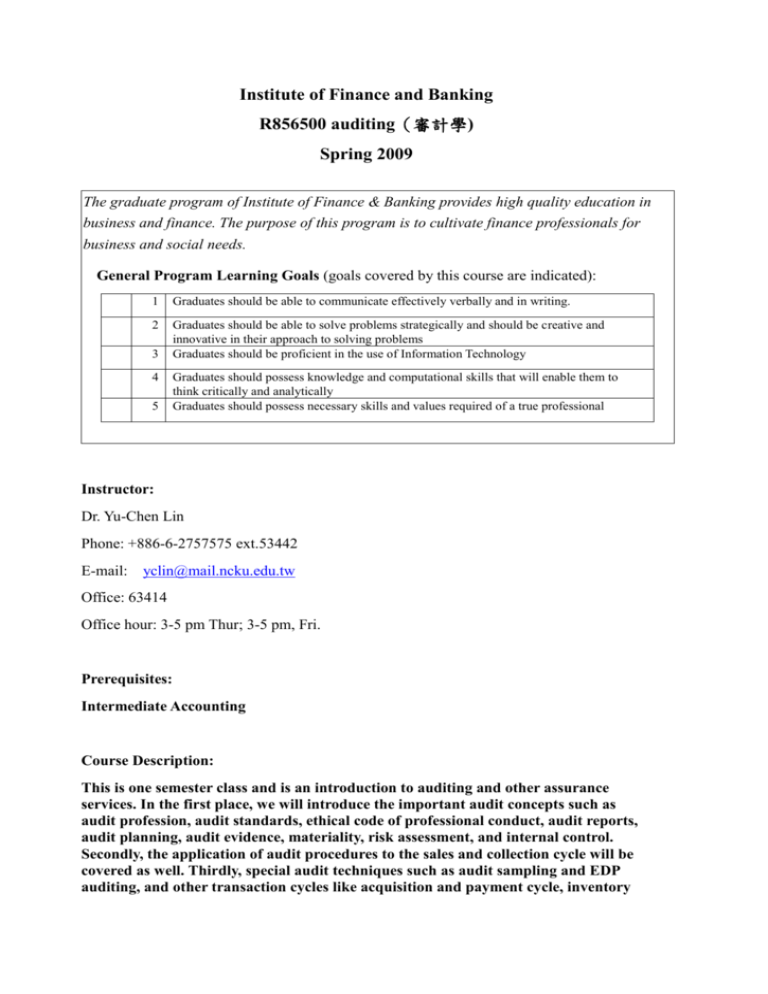

Instructor:

Dr. Yu-Chen Lin

Phone: +886-6-2757575 ext.53442

E-mail:

yclin@mail.ncku.edu.tw

Office: 63414

Office hour: 3-5 pm Thur; 3-5 pm, Fri.

Prerequisites:

Intermediate Accounting

Course Description:

This is one semester class and is an introduction to auditing and other assurance

services. In the first place, we will introduce the important audit concepts such as

audit profession, audit standards, ethical code of professional conduct, audit reports,

audit planning, audit evidence, materiality, risk assessment, and internal control.

Secondly, the application of audit procedures to the sales and collection cycle will be

covered as well. Thirdly, special audit techniques such as audit sampling and EDP

auditing, and other transaction cycles like acquisition and payment cycle, inventory

and warehousing, capital acquisition and repayment cycle, etc. In the end, this course

will discuss every types of audit report, auditor legal liability, and other assurance and

nonassurance services.

Course Objectives:

The objective of the auditing course is to introduce the nature of audit and demand

for audit and other types of assurance services offered by CPAs in the changing

business environments. This course is also devoted to understand the underlying

concepts and the procedures utilized in performing audits. This course will help each

student obtain the skill, knowledge, and personal characteristics necessary to practice

successfully as an auditor.

Content Summary:

Class Schedule

WEEK

NO.

1

CONTENTS

CORRESPONDING

CHAPTER IN TEXT

Introduction

Introduction

2

The demand for audit and other assurance services

The CPA profession

Overview of reporting

Chapter 1

Chapter 2

Chapter 3

3

Professional ethics

Legal liability

Chapter 4

Chapter 5

4

Audit responsibilities and objectives

Audit evidence

Chapter 6

Chapter 7

5

Audit planning and analytical procedures

Materiality and risk

Chapter 8

Chapter 9

6

Materiality and risk (cont.)

Chapter 9

7

No Class

8

Midterm examination#1

Midterm #1

Sec. 404 audits of internal control and control risk

Chapter 10

Fraud auditing

Chapter 11

9

WEEK

NO.

10

11

CONTENTS

CORRESPONDING

CHAPTER IN TEXT

The impact of information technology on the audit

process

Overall audit plan and audit program

Chapter 12

Chapter 13

Audit of the sales and collection cycle: tests of

controls and substantive tests of transactions

Accounts receivable: tests of details of balances

Chapter 14

Chapter 16

Audit sampling for tests of controls and

12

substantive tests of transactions

Audit sampling for tests of details of balances

Chapter 15

Chapter 17

Chapter 17

13

Audit sampling for tests of details of

balances (cont.)

14

Midterm examination #2

Midterm #2

15

Audit of the acquisition and payment cycle

Chapter 19

Chapter 20

16

Audit of cash balances

Completing the audit

Chapter 23

Chapter 24

17

Audit reporting-completion and other assurance

services reports

Chapter 3

Chapter 25

18

Internal and governmental financial auditing and

operational auditing

Chapter 26

19

Final Exam

Final Exam

The schedule is subjective to change, which will be announced by the instructor.

Textbook:

Elder, Beasley, and Arens, 2008, Auditing and Assurance Services: An Integrated Approach,

12th ed. Pearson Prentice Hall. (華泰: 02-2162-1217)

Recommended references:

Statement of Auditing Standards, Accounting Research and Development Foundation

(R.O.C.) http://www.ardf.org.tw/html/center3.htm#審計準則公報

Code of Professional Ethics, National Federation of Public Accountants Association

(R.O.C.) http://www.roccpa.org.tw/Download.php

Rittenberg and Schwieger, 2005, Auditing: Concepts for a Changing Environment,

Thomson Southwestern. (滄海:04-2708-8787)

審計新論,李宗黎、林蕙真著,第四版,正業會審專業叢書

Course Requirement:

Since we have to finish 26 chapters within this class, the time schedule is tight. Therefore, we may

not cover everything that is important. All students must have read the text materials before class,

and try to take the initiative to raise questions on materials that you do not understand. In addition,

I will give you the quizzes and case discussions in class. You may not pass these if you have not

previewed.

Grading policy:

Participation and Quizzes

Case Study and Group Project

Exams

10%

30%

60%