Lab 11 (I Think This Is The 11th Lab)

advertisement

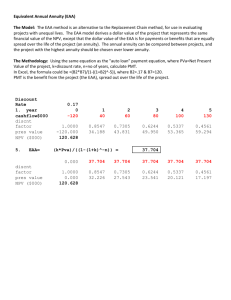

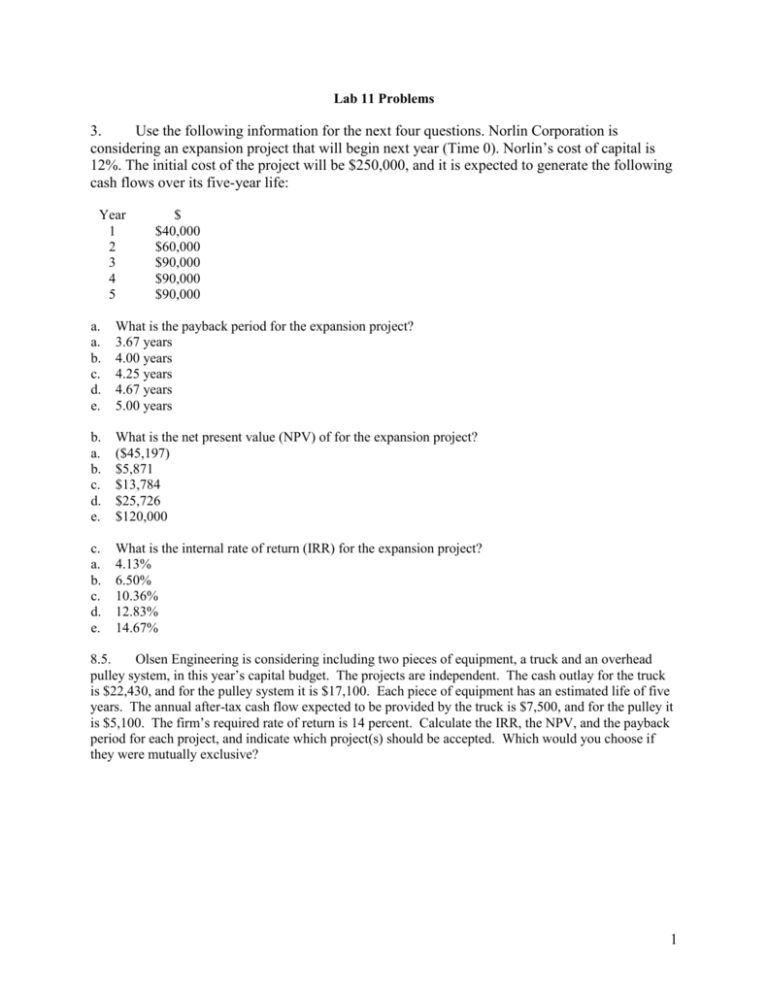

Lab 11 Problems 3. Use the following information for the next four questions. Norlin Corporation is considering an expansion project that will begin next year (Time 0). Norlin’s cost of capital is 12%. The initial cost of the project will be $250,000, and it is expected to generate the following cash flows over its five-year life: Year 1 2 3 4 5 $ $40,000 $60,000 $90,000 $90,000 $90,000 a. a. b. c. d. e. What is the payback period for the expansion project? 3.67 years 4.00 years 4.25 years 4.67 years 5.00 years b. a. b. c. d. e. What is the net present value (NPV) of for the expansion project? ($45,197) $5,871 $13,784 $25,726 $120,000 c. a. b. c. d. e. What is the internal rate of return (IRR) for the expansion project? 4.13% 6.50% 10.36% 12.83% 14.67% 8.5. Olsen Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $22,430, and for the pulley system it is $17,100. Each piece of equipment has an estimated life of five years. The annual after-tax cash flow expected to be provided by the truck is $7,500, and for the pulley it is $5,100. The firm’s required rate of return is 14 percent. Calculate the IRR, the NPV, and the payback period for each project, and indicate which project(s) should be accepted. Which would you choose if they were mutually exclusive? 1 8.7. Project S costs $15,000 and is expected to produce benefits (cash flows) of $4,500 per year for five years. Project L costs $37,500 and is expected to produce cash flows of $11,100 per year for five years. a. Calculate the NPV, IRR, and payback period for each project, assuming a required rate of return of 14 percent. b. If the projects are independent, which project(s) should be selected? If they are mutually exclusive projects, which project actually should be selected? 8.8. The Cordell Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating cost and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The required rate of return for the plant is nine percent, and the projects’ expected net costs are listed in the following table: Expected Net Cash Flows Conveyor Forklift $(300,000) $(120,000) $ (66,000) $ ( 96,000) $ (66,000) $ ( 96,000) $ (66,000) $ (96,000) $ (66,000) $ (96,000) $ (66,000) $ (96,000) Year 0 1 2 3 4 5 a. b. What is the present value of costs for each alternative? Which method should be chosen? What is the IRR for each alternative? 98. What is the Equivalent Annual Annuity (EAA) of a project that has an initial outlay of $2,500 followed by cash inflows of $1,000, $3,000 and $5,000 in years 1,2 & 3 respectively? Assume a cost of capital of 11%. (Round to nearest $) a. b. c. d. $1,256 $1,591 $1,838 $2,141 100. You are considering the following 2 mutually exclusive projects. Using the equivalent annual annuity method and a cost of capital of 10%, which project should be selected? (Round to nearest $) Year 0 1 2 3 4 a. b. c. d. Project A Cash Flow (20,000) 15,000 20,000 Project B Cash Flow (20,000) 5,000 10,000 15,000 50,000 Project B because of an EAA of $12,060 Project A because of an EAA of $5,857 Project B because of an EAA of $38,320 Project A because of an EAA of $10,165 2 97. The projected cash flows for two mutually exclusive projects are as follows: Year Project A Project B 0 ($150,000) ($200,000) 1 80,000 40,000 2 60,000 50,000 3 50,000 50,000 4 60,000 5 50,000 6 53,000 If the firm’s cost of capital is 10% and the equivalent annual annuity method is used to eliminate the disparity between the projects’ lives, which project should be undertaken? a. A b. B c. either because the difference in lives makes a comparison meaningless d. A but the EAAs are so close that either is probably ok The next problem is from chapter 11 and we may not have time in this lab to do it. 9.1. You have been asked by the president of your company to evaluate the proposed acquisition of a spectrometer for the firm’s R&D department. The equipment’s base price is $140,000, and it would cost another $30,000 to modify it for special use by your firm. The spectrometer, which falls into the MACRS three-year class, would be sold after three years for $60,000. (3-year MACRS recovery allowance percentages are 33%, 45%, 15%, and 7% in years 1-4 respectively.) Use of the equipment would require an increase in net working capital (spare parts inventory) of $8,000. The spectrometer would have no effect on revenues, but it is expected to save the firm $50,000 per year in before-tax operating costs, mainly labor. The firm’s marginal tax rate is 40 percent. a. What is the initial investment outlay associated with this project? (That is, what is the Year 0 net cash flow?) b. What are the incremental operating cash flows in Years 1, 2, and 3? c. What is the terminal cash flow in Year 3?) d. If the project’s required rate of return is 12 percent, should the spectrometer be purchased? 3 Key Lab 11 Problems 3. a. b. c. a 250 - 40 - 60 – 90 = 60. Need three years of cash flow + 60/90 of the 4th year = 3+60/90= 3.67 years b (CF0 = –250; CF1 = 40; CF2 = 60; CF3 through CF5 = 90; I/Y = 12%; NPV = 5,871) d Inputs same as above; IRR = 12.83% 8-5 Pulley versus Truck Pulley system: CF0 = -17100 CF1-CF5 = 5100 I = 14 compute NPV = $408.71 compute IRR = 14.99% Since the cash flow is an annuity: Payback = 17100/5100 = 3.35 years Accept the project because NPV > $0 Truck system: CF0 = -22430 CF1-CF5 = 7500 I = 14 compute NPV = 3318.11 compute IRR = 20% Since the cash flow is an annuity: Payback = 22430/7500 = 2.99 years Accept the project because NPV > $0 If the projects were mutually exclusive you would pick the project with the highest NPV, which is the truck. 8-7. a. Use a financial calculator For project S: CFo = -15000 CF1-CF5 = 4500 I/Y= 14 Compute NPV=$448.86 Compute IRR = 15.24% Since the cash flow is an annuity: PB = 15000/4500 = 3.3 years For project L: CFo = -37500 CF1-CF5 = 11100 I/Y= 14 Compute NPV=$607.2 Compute IRR = 14.67% Since the cash flow is an annuity: PB = 37500/11000 = 3.4 years b. If the projects are independent, then both are acceptable because both NPVs are positive. If the projects are mutually exclusive, then accept project L because it has the higher NPV. 8-8 Conveyor versus Forklift Conveyor: CF0 = -300000 CF1-CF5 = -66000 I=9 compute NPV = ($ 556717) or the Net Present Cost is $556717 compute IRR = no solution. You can't get an IRR with only negative cash flows (with just costs) Forklift: CF0 = -120000 CF1-CF5 = -96000 I=9 compute NPV = -493407. or the present value of cost is $493407 compute IRR = no solution. Same reason as above 4 Thus the forklift has a lower Net Present Cost by the following amount: $5556717-$493407=$63310. To calculate an IRR the cash flows must include the inflows (returns) to the project as well as the costs. 98. ANS: C Calculator Steps –2500 1000 3000 5000 11 CFo CF1 CF2 CF3 I/Y NPV = 4,491.73 Then: –4,491.73 PV, 3 n, 11 I/Y; Solve for PMT = $1,838 = EAA 100. ANS: Calculator Steps: A Project A –20,000 CFo 15,000 CF1 20,000 CF2 10 I/Y NPV = 10,165 –20,000 5,000 10,000 15,000 50,000 10 Project B CFo CF1 CF2 CF3 CF4 I/Y NPV = 38,230 EAA: –10,165 PV 2 n 10 I/Y PMT = $5,857 = EAA –38,230 PV 4 n 10 I/Y PMT = 12,060 = EAA 97. ANS: D Calculator steps ($000): A: NPV: CF0 = –150, CF1 = 80, CF2 = 60, CF3 = 50; NPV: I = 10 NPV = $9.880 EAA: PV = 9.880, N = 3, I/Y = 10; solve for PMT = $3.973 = EAA B: NPV: CF0 = –200, CF1 = 40, CF2 = 50, CF3 = 50; CF4 = 60, CF5 = 50, CF6 = 53, NPV: I = 10 NPV = $17.196 EAA: PV = 17.196, N = 6, I/Y = 10; solve for PMT = $3.948 = EAA Project A has the higher EAA, but only by $3973 – $3948 = $25 9-1. See spreadsheet key 5