Fin403 HW 06 (Annual Equivalent Costs)

advertisement

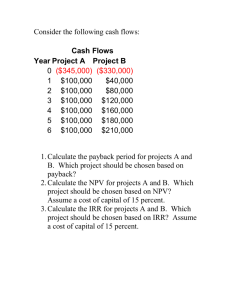

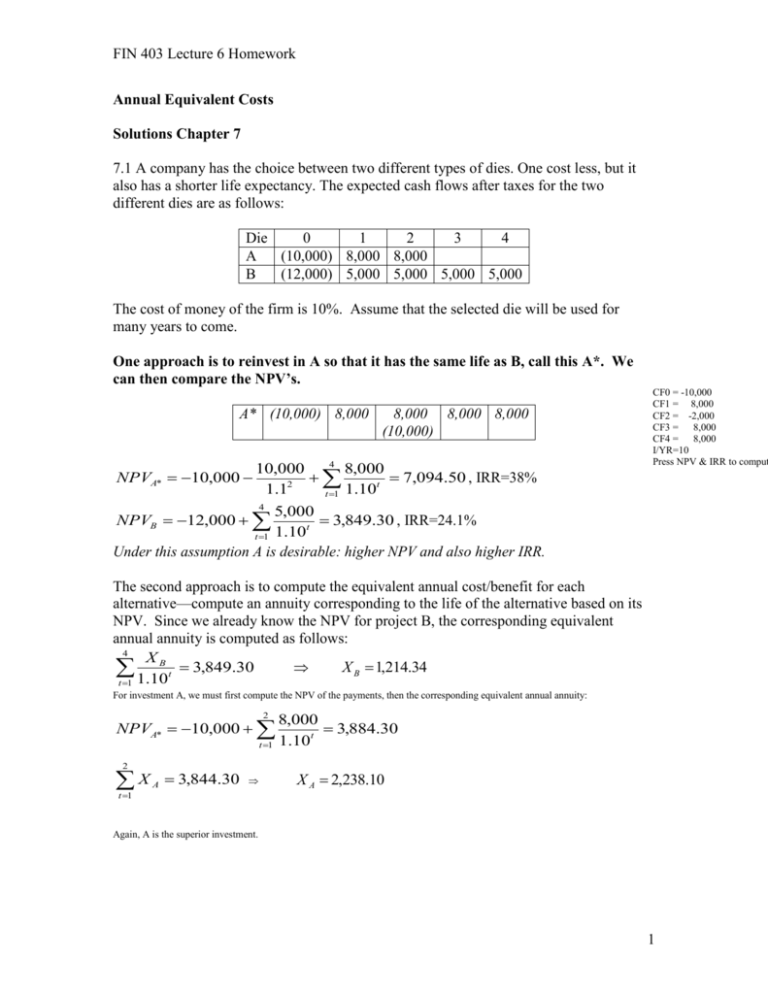

FIN 403 Lecture 6 Homework Annual Equivalent Costs Solutions Chapter 7 7.1 A company has the choice between two different types of dies. One cost less, but it also has a shorter life expectancy. The expected cash flows after taxes for the two different dies are as follows: Die 0 1 2 3 4 A (10,000) 8,000 8,000 B (12,000) 5,000 5,000 5,000 5,000 The cost of money of the firm is 10%. Assume that the selected die will be used for many years to come. One approach is to reinvest in A so that it has the same life as B, call this A*. We can then compare the NPV’s. A* (10,000) 8,000 8,000 8,000 8,000 (10,000) 4 10,000 8,000 7,094.50 , IRR=38% 2 t 1.1 t 1 1.10 4 5,000 NPVB 12,000 3,849.30 , IRR=24.1% t t 1 1.10 Under this assumption A is desirable: higher NPV and also higher IRR. CF0 = -10,000 CF1 = 8,000 CF2 = -2,000 CF3 = 8,000 CF4 = 8,000 I/YR=10 Press NPV & IRR to comput NPVA* 10,000 The second approach is to compute the equivalent annual cost/benefit for each alternative—compute an annuity corresponding to the life of the alternative based on its NPV. Since we already know the NPV for project B, the corresponding equivalent annual annuity is computed as follows: 4 XB 3,849.30 X B 1,214.34 t t 1 1.10 For investment A, we must first compute the NPV of the payments, then the corresponding equivalent annual annuity: 2 NPVA* 10,000 t 1 2 X t 1 A 3,844.30 8,000 3,884.30 1.10t X A 2,238.10 Again, A is the superior investment. 1 FIN 403 Lecture 6 Homework 7.2 Assume that there are two mutually exclusive investments that have the following cash flows: Investment 0 1 IRR A (10,000) 12,000 20 B (5,000) 6,100 22 Assume that either investment will require modification to the basic building structure, which will cost $1,000 and that this amount is not included in the preceding computations. The cost of money is 10%. a) Compute the actual internal rates of return of the investments. Solution: 12,000 90.90 , IRR=9.1% 1.1 6,100 NPVB 5,000 1,000 454.50 , IRR=1.7% 1.1 The reason the NPV’s are negative is that both investments are returning less than the firm’s cost of money—10%. NPVA 10,000 1,000 b) Does the additional $1,000 alter the ranking of the two investments? Explain. Solution: 12,000 909.10 , IRR=20% 1.1 6,100 NPVA 5,000 545.50 , IRR=22% 1.1 The IRR ranking changes, not NPV. Note: the reason for the reversal in ranking is that B is a smaller investment than A, and therefore, more sensitive to the additional $1,000 cost. NPVA 10,000 2 FIN 403 Lecture 6 Homework 7.12 State Electric wants to decide whether to repair or replace electric meters when they break down. A new meter cost $30 and, on the average, will operate for 12 years without repair. It costs $18 to repair a meter, and a repaired meter will, on average, operate for 8 years before it again needs a repair. Repairs can be made repeatedly to meters because they are essentially rebuilt each time they are repaired. It costs $6 to take out and reinstall a meter. The time value of money is 0.05. Should the company repair old meters or buy new meters? New (A) Cost ($30) Take out and reinstall cost ($ 6) Horizon 12 years Old (B) ($18) ($ 6) 8 years Solution: First note that you have to pay the cost of removal and installation/reinstallation under both options. But, we cannot eliminate this cost from the analysis because, under the first option, we incur it every twelve years, and under the second, every eight years. The simplest way to approach this problem is to compute that annual equivalent cost of each. The first step is to compute the NPV for each option, the second, the corresponding annuity. 12 XA $36 X A $4.06 t t 1 1.05 8 XB $24 X B $3.71 t t 1 1.05 Option B is superior because it has lower annual costs. A more messy way is to repeat both options—reinvest—until the lives are equal, then compare the NPV’s. We must repeat A twice, and B three times. $36 $56.05 1.0512 ($24) ($24) B $24 51.24 1.058 1.0516 Same result. The lifecycle cost of A for 24 years is greater than B. A $36 3 FIN 403 Lecture 6 Homework 7.20 A new piece of equipment being considered cost $75,816 and has a useful life of five years. It will cost $10,000 in out-of-pocket expenses per year to operate. The cost of money is 10%. An alternative to the equipment is to use a labor-intensive process that would cost $38,000 per year. This $38,000 includes $15,000 of depreciation expense for the currently used machine (the machine has no other use but does have a replacement cost of $25,000). The tax rate is zero. A B Initial cost ($75,816) ($25,000) Expense/year ($10,000) ($38,000) Depreciation (add-back) $15,000 Horizon 5 years 5 years If we have no tax, the effect of depreciation has no significance and should be excluded in our analysis. Remember, depreciation is not a real expense; the sole purpose of depreciation expense is to reduce the tax burden. a) Prepare an analysis of the alternatives. What should the firm do? 5 $10,000 $113,723.9 1.10t t 1 5 ($38,000 $15,000) PVOld $25,000 $112,188.1 1.10t t 1 The old machine should be retained because it yields a lower cost. PVNew $75,816 b) If the equipment will make 1,000 units of product per year, what will be the cost per unit if the new equipment is purchased? This is a tricky question and somewhat unclear. You could simply divide the $10,000 per year marginal cost of production by 1000. But that would fail to acknowledge the cost of the machine. You could also divide the cost of the machine by 1000 and add it to the marginal costs of production, but that would fail to address the time value of money. The proper way to compute this is to take the PV that you computed above, compute a corresponding annual annuity, and divide that by 1000: 1 1.15 X New $30,000 X New $113,723.9 0.1 Thus, the cost of production is $30 per unit. 4 FIN 403 Lecture 6 Homework 5 FIN 403 Lecture 6 Homework 6